Hi Quartz Africa members!

As African startups took off over the past decade, local entrepreneurs were able to innovate their way past problems facing the continent, often more quickly than legacy companies. That innovation requires a significant amount of capital. So western venture capitalists—buoyed by low interest rates and fear of missing out on the next big thing—bought in at a frenetic pace, alongside investors from Asia and the Middle East.

But one key player is still largely missing: The local investment scene in Africa is not as mature as the tech industry itself, and the gap leaves startups with global ambitions to look abroad for funding.

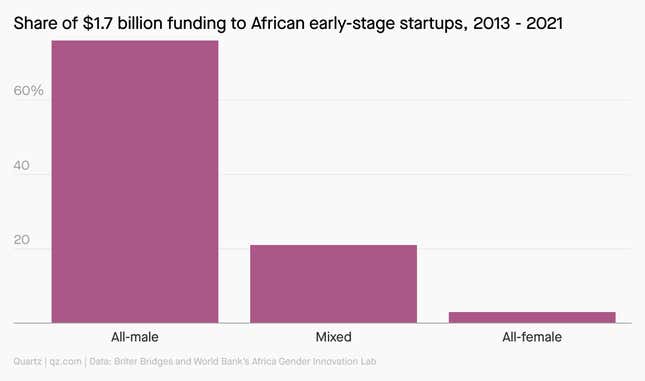

While that dynamic may not seem like much a limitation—after all, four African startups hit valuations of more than $1 billion last year, and a half-dozen raised more than $100 million—local investors are crucial for startups that are not yet making headlines. Before the eye-popping later fundraising rounds, it’s local investors who typically make bold bets on entrepreneurs with checks of $25,000 to $50,000. Sometimes, local funds back those who would otherwise be left behind: FirstCheck Africa, launched last January, funds companies (“ridiculously early”) that are founded or co-founded by women. Just 3% of VC funds to African companies currently goes to female-founded startups.

Western financiers with piles of cash are typically unwilling to back African startups in those early stages, when the future—and the potential to scale—remain uncertain. But for entrepreneurs, those early checks make a huge difference, giving earliest-stage startups room to breathe as they navigate perhaps the most difficult period of any company’s life. In other words: Getting a leg-up from a local funder could be the difference between packing up shop or growing big enough to attract the kind of funding that makes headlines.

Cheat sheet

💡 The opportunity: New startups spring up daily in Africa. Backing them early is a chance to get in on the ground floor; one big success could make up for other investments that turn sour.

🤔 The challenge: Socioeconomic factors mean there are not enough local investors in Africa, and local bigwigs often prefer to put their money in traditional industries like oil and gas and real estate before backing startups they see as risky.

🌍 The road map: The enormous success of companies like Paystack and Flutterwave is indicative of what African startups are capable of if they receive backing. Investors should make bolder bets in companies solving key problems in Africa.

💰 The stakeholders: Prominent African investors include Microtraction, Ingressive Capital, EchoVC, Grindstone Ventures, and Ventures Platforms.

By the digits

53%: Share of African companies funded in 2021 that were started in the past three years.

38%: Share of startups funded in 2021 that took part in an accelerator or incubator program.

121: Startups funded in 2021 with women in their founding team, out of a total of 568 announced deals.

The case study

Name: Ingressive Capital

HQ: Nigeria

Founder: Maya Horgan Famodu

Fund size: $10 million

Ingressive Capital was founded in 2017 to fund tech-enabled businesses in Africa. On average, the company provides between $200,000 and $400,000 in equity funding, and often targets 10% ownership in its startups. Its highlight reel includes Paystack, the payments processor that was acquired by Stripe for more than $200 million in 2020, and 54gene, a company that collects African genetic code for drug development and health research.

Ingressive founder Maya Horgan Famodu has said that spending time in Madagascar as a college student partly informed her decision to launch her own fund: She found that western nonprofit initiatives in local communities created less value without local participation. Horgan Famodu launched Ingressive at age 25; today, the fund is focused on leveling the playing field for female entrepreneurs: About 40% of its portfolio companies are founded or co-founded by women.

In 2020, Ingressive doubled its fund to $10 million, with backers that include Nigeria’s sovereign wealth fund (pdf), Michael Seibel of Y Combinator, Techstars, and others.

The competitive landscape

By funding early-stage companies, Ingressive is part of a growing cohort of local investors on the continent who are providing the financial foundations for innovative ideas to flourish. Those funders fall into two main categories:

- Corporations. In South Africa, big companies like Naspers, Nedbank, and Standard Bank are investing in startups, bucking the trend of other established players in the local ecosystem who do not fund startups.

- Other startup founders. Startup founders have themselves become investors, sometimes funding other startups as individuals or as part of institutions they founded. This is a sign of the growing maturity of African startups—that successful African founders are now backing companies themselves—but it’s also a testament to these funders’ optimism about the sector. Paystack’s Shola Akinlade, mPharma’s Gregory Rockson, and Flutterwave’s Olugbenga Agboola are some of the founders now investing in young African companies themselves.

VC funds to 👀

South Africa’s Alitheia IDF fund, which focuses on small to medium businesses with high-growth potential, is a $100 million private equity fund that invests in women-centered companies across Nigeria, South Africa, Ghana, Zambia, Zimbabwe, and Lesotho. It invests in businesses that “engage a significant percentage of women, either as entrepreneurs, producers, distributors or consumers.”

FirstCheck Africa, launched in 2020, backs early-stage companies founded or co-founded by women with a $25,000 check.

In 2020, Janngo Capital, founded by Senegalese entrepreneur Fatoumata Ba, committed 50% of the €60 million ($82 million) it had raised to startups founded, co-founded, or benefiting women.

Future Africa, a co-investment VC firm founded by Nigerian serial entrepreneur Iyin Aboyeji, announced in 2021 that it would invest up to $1 million in women-led startups.

More from Quartz Africa

👭🏽 Quartz Africa Innovators 2021: Female innovators lead the way

📊 Only 3% of funding goes to female-led African startups

⚡ What boosting local funding could mean for Africa’s startup ambitions

🚢 Female entrepreneurs are tackling Africa’s logistics problems

🧗♀️ The biggest thing getting in the way of Africa’s female founders

💸 Africa’s e-commerce gender gap is costing billions of dollars

🎵 This brief was produced while listening to “Superwoman” by Tanzanian Women All Stars (Tanzania). 🎵

Have a highly motivated rest of your week,

— Aanu Adeoye, London-based contributor

One 🌍 thing

For all the progress African startups have made over the past decade, funding opportunities are still largely skewed in favor of companies based in four countries. Of the more than $2 billion raised by 568 African startups in 2021, 92.1% of the investment went to companies in Nigeria, Egypt, South Africa, and Kenya. Startups based elsewhere are increasingly getting attention, but still not nearly enough.