Hi Quartz Africa members,

In advertising for Africa-focused payment firms, you’ll often find stories of diaspora populations sending money home—putting smiles on their families’ faces as the cash they dispense is used to take care of various expenses.

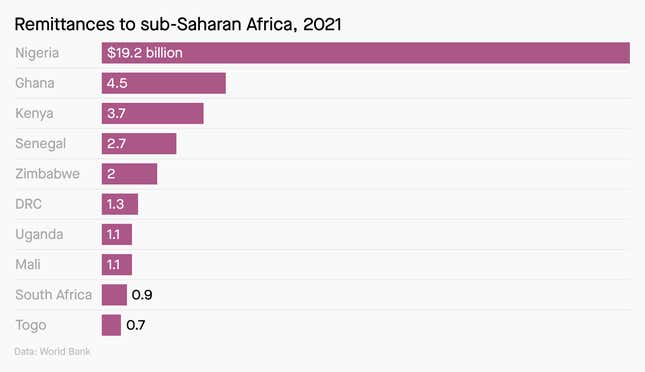

It’s a familiar narrative: As external financing sources go, inflows from African countries’ large and vibrant diaspora populations have become as important as Foreign Direct Investment (FDI) and Overseas Development Assistance (ODA). Last year, remittance inflows to sub-Saharan Africa grew 14%, hitting $49 billion (pdf).

That’s despite the fact that sub-Saharan Africa is also the most expensive region in the world to send money to. Aggregate regional remittance costs averaged 7.8% in the fourth quarter of 2021 (pdf) compared with the global average of 6%. (South Asia is the cheapest region to send money to, at 4.3%.) This is based on the cost of sending $200; the UN Sustainable Development Goals( SDG) has set a target of 3% by 2030.

The role of technology can be transformative in the remittances sector, as shifting from banks and traditionally offline services to digital channels cuts down on costs.

As economies recover from the pandemic’s effects and remittances increase, the sector’s next battlefield will be affordability and accessibility. This is where startups can play a huge role.

Cheat sheet

💡 The opportunity: Africa’s large diaspora population sends money home for important bills and investments, but cross-border payments in Africa are expensive and cheaper digital channels are still inaccessible to many.

🤔 The challenge: The international transfers space in Africa is still dominated by traditional offline services, including banks and other over-the-counter services. For perspective, Western Union and MoneyGram have a combined market share of 50% of remittances in three-quarters of countries in sub-Saharan Africa.

🌍 The roadmap: It is much cheaper to use digital channels for cash transfers from the diaspora to Africa. Startups are now tasked with accelerating the shift to digital payment channels for current users of the dominant traditional offline services—a trend that picked up during the pandemic.

💰 The stakeholders: Businesses in the remittances space must work with mobile money operators, banks, and other fintech services in Africa, as integration is key to ensuring accessibility. Regulators must also be onboard for a conducive operating environment.

By the digits

$49 billion: Remittance inflows to sub-Saharan Africa in 2021, up 14% from pandemic-ravaged 2020

7.8%: Average cost of remittances to sub-Saharan Africa in the fourth quarter of 2021, the highest in the world

800,000: Estimated size of Nigeria’s migrant population, primarily in the UK (220,000) and US (375,000). Nigeria consistently records the highest remittance inflows on the continent.

6.7%: Cost of remitting money from the US to Kenya in 2021

80%: Sub-Saharan Africa’s share of the $12.7 billion in international remittances sent and received via mobile devices in 2020

The case study

Name: Nala

HQ: London, but doing business in Tanzania

Founder: Benjamin Fernandes

Valuation: $38-$58 million according to Dealroom.com estimates

Founded by Benjamin Fernandes, Nala was the first Tanzanian startup to graduate from Y Combinator in 2019. When it raised a seven-figure pre-seed round from investors led by Accel Ventures the same year, the company was still an offline, no-frills mobile money service intended to make transactions simpler. The app served as a user-friendly interface on top of the unstructured supplementary service data (USSD) layer, and therefore required only a one-time download for use. USSD is a protocol that is used to send text messages, allowing users with feature phones to access different types of digital products.

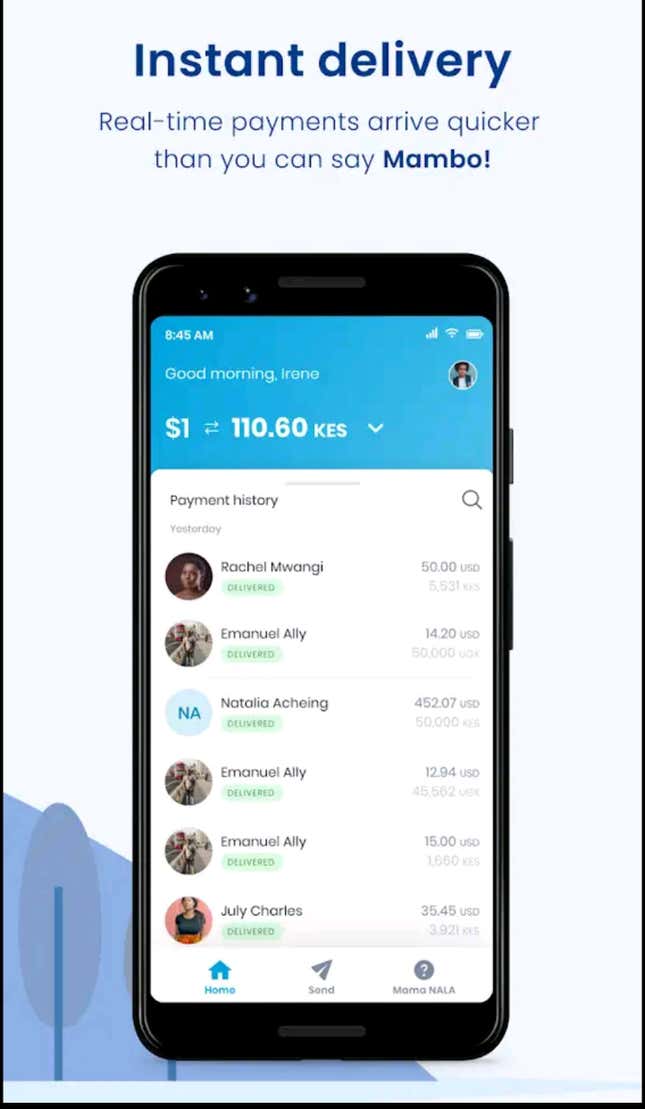

Within a year, more than 250,000 users across east Africa signed up for Nala’s mobile money service. According to the company, in August 2020 it began testing cross-border payments from the UK to the countries it was operating in—Kenya, Tanzania, and Uganda—after noticing that one in seven users wanted to receive money sent from across borders.

Nala officially began its pivot by introducing remittance services in March 2021. In January 2022, it raised $10 million in a seed round from backers that include Amplo, Accel, and Bessemer Partners, and emphasized its goal to conquer remittances even as it plans to offer more diverse financial services in the future.

Today, Nala is available in Kenya, Tanzania, Uganda, Rwanda, Ghana, and South Africa. It plans to be in 12 African countries by the end of the year, including Nigeria, which receives the highest remittance inflows on the continent. And while Nala’s core user base lives in the UK, the startup is moving to expand that reach, too. It officially launched in the US in April, and is looking to the EU next. The pitch is simple: Money transfers from the US, UK, and EU to Africa are cheaper with Nala compared to existing traditional and digital channels.

Nala says remittances are only the beginning—it’s also working on outbound cross-border payments between African countries, piloting “Nala for Business” to enable payments to Africa by businesses abroad and testing multi-currency accounts. The company is also partnering with Citi Bank Global to manage Nala’s FX and fast-track growth across different regions.

In the meantime, Nala has been especially exciting for the tech community in Tanzania, whose tech startups aren’t as likely to secure funding as those in Nigeria, Kenya, Egypt, and South Africa.

In conversation with

Benjamin Fernandes founded Nala in 2018 with a mission to increase economic opportunity on the African continent, and for its diaspora around the world. Here are some choice quotes from our conversation:

↔️ On venturing into remittances:

“Ninety percent of the money sent to Africa is done informally, with physical cash. The remaining 10% is done via digital channels, but is subject to multiple layers of fees and paperwork. In 2018 alone, $48 billion was sent from overseas to family and friends in sub-Saharan Africa, but $3.3 billion was lost in fees, making Africa the most expensive continent to send money to. As well as covering basic needs, contributions from friends and family overseas provide a launchpad to save, invest, and grow.”

✨ On being more than a remittances company:

“We aren’t a remittance company. Those who box us in that category don’t know what we are building. We are building African payment rails that will enable us to increase economic opportunity for Africans globally. In Africa, innovation is created by necessity—payments in Africa are 1% built, and we have a lot of work to do.”

🔭 On being a forerunner in Tanzania:

“Regulation in Tanzania for financial technology is evolving. I would like to see Tanzania be a leading central bank in Africa and setting examples for other central banks in Africa to follow.”

Remittance deals to 👀

Africa’s most valuable unicorn Flutterwave in February 2022 raised $250 million at a $3 billion valuation. Founded in 2016 in Nigeria, the San Francisco-headquartered fintech says it has processed more than 200 million transactions valued at over $16 billion across 34 countries in Africa.

Chipper Cash in November 2021 raised $150 million in a Series C extension round led by Sam Bankman-Fried’s cryptocurrency exchange platform FTX. The raise brought the African cross-border payments startup’s valuation to just above $2 billion.

Y Combinator-backed Nigerian startup Lemonade Finance raised $725,000 in a pre-seed funding round in November 2021. Positioning itself as a faster, more efficient remittance platform, it allows Africans abroad to send and receive money from their home countries and hold their balances in different currencies.

More from Quartz Africa

🇸🇴 Somalis changed the face of money transfers worldwide

🤔 How economic sanctions drove money transfers in west Africa underground

🤗 Lemonade Finance is doing what PayPal has failed to do for Africa’s diaspora

🎵 This Member Brief was prepared while listening to Good Morning Afrika by Ajay of Buruklyn Boyz and Wakadinali’s SewerSydaa.

Have a highly motivated rest of your week,

—Martin Siele, Nairobi based Quartz contributor

One 🤑 thing

One of Nala’s early backers is Accel Ventures, which was among the earliest investors in WorldRemit. Co-founded by Ismail Ahmed—who was once a Somali student in England facing the challenge of sending money home—WorldRemit currently boasts over 8 million customers and is reportedly planning an IPO this year at a $6 billion valuation.