African startups make their exits, South Africa’s bad hair, Zimbabwe’s mining U-turn

Hi, Quartz Africa readers!

Hi, Quartz Africa readers!

Paying up

In May, near the peak of the pandemic-triggered emergency measures put in place across Africa, the UN Economic Commission for Africa estimated a one-month full lockdown would cost the continent about 2.5% of its annual GDP or about $65.7 billion a month. This number didn’t even take into account the much wider impact on everything from lower commodity prices and demand to a drop in foreign direct investment.

Even though most African countries have either fully or partly opened up their economies things are still incredibly tough.

The lack of revenue for a region of the world with many low and low middle income countries was at first primarily a discussion about humanitarian concerns including supplementing health systems during the pandemic and resolving food security issues. But that soon changed. It quickly became about how governments were going to be able to meet their basic domestic obligations to citizens while having major external debt obligations which had grown rapidly in the last decade.

Talk of debt forgiveness or cancellation was mostly dismissed or discouraged by debt holders and by the African countries themselves who are loathe to damage their creditworthiness. The big hope was that the G20 countries’ Debt Service Suspension Initiative proposed back in April would help ease the burden and allow countries to focus on healthcare and other priorities. The idea was that wealthy countries, members of the Paris Club along with China and key multi-laterals including the World Bank, would suspend up to $12 billion in debt payments this year.

But analysts have been disappointed by the initiative so far given only $4 billion has been deployed to date.

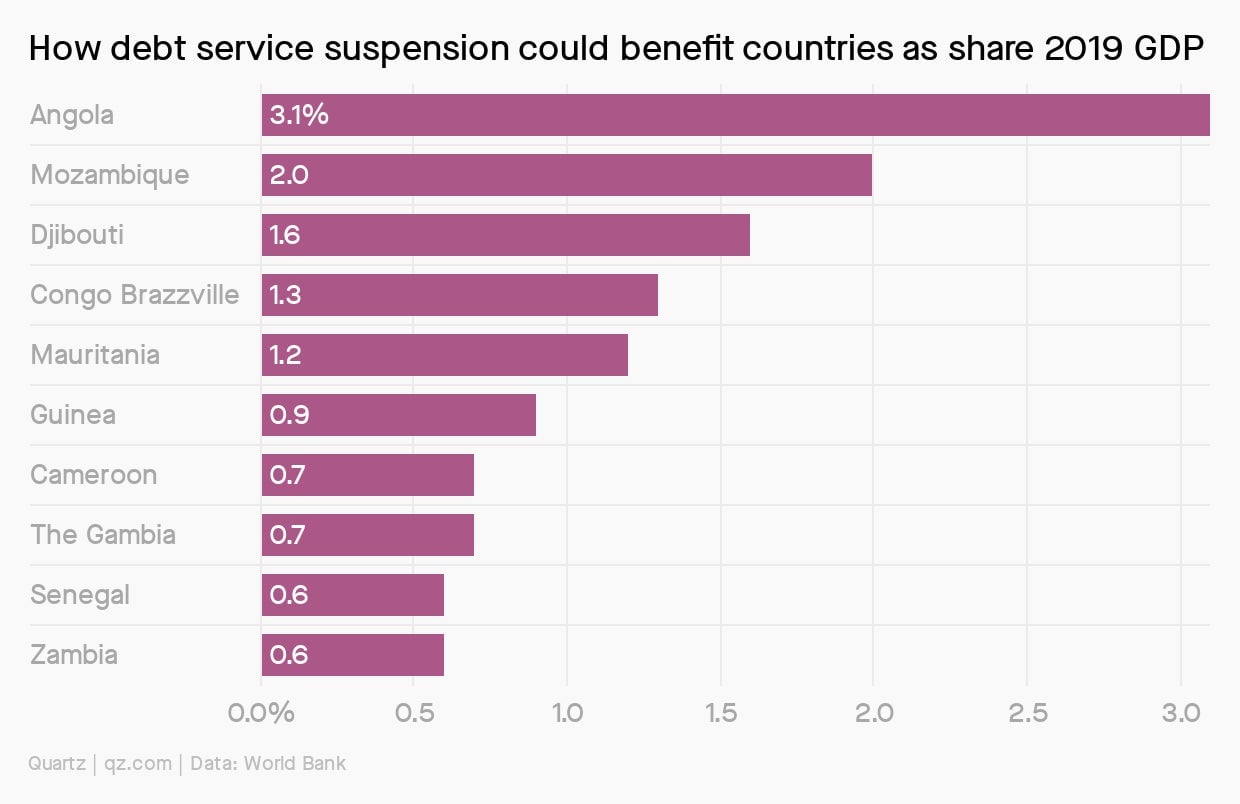

If it was fully implemented DSSI is expected to enable liquidity at an average value of 0.6% of GDP per country. One of the few relatively large economies to take advantage of DSSI has been Angola, which is expected to make a forbearance saving equivalent to 3.1% of its 2019 GDP.

Angola has about $50 billion in external government debt on its books, a staggering amount racked up over the last decade even while being sub-Saharan Africa’s No.2 oil producer.

This is why it was big news on Aug. 31 when Paris Club said it would freeze payments for Angola. Fitch Ratings, estimates Angola will have around $2.5 billion of its debt “reprofiled” because it expects China, which holds some 40% of Angola’s external debt, to reach a similar suspension agreement. That remains to be seen as China prepares mostly for bilateral talks, rather than a broad “Africa’s a country” deal with multiple countries.

But then there are also the negotiations to be had with private investors who are not directly part of the DSSI talks. There’s a lot going on. In the mean time Fitch has downgraded Angola’s debt to “CCC”.

— Yinka Adegoke, Quartz Africa editor

Five stories from Quartz Africa

Nigeria is trying to bridge internet inequality and boost access by cutting expensive red tape. Internet service providers will find it much cheaper to install fiber optic cables in parts of Nigeria over the next 15 months after a temporary policy change. However, as Nigeria’s federal government aims to boost internet penetration, the biggest stumbling block will come from states that still charge exorbitant rates.

An offensive haircare advert shows Black South Africans still have to fight apartheid’s race battles. A leading South African beauty retailer published an advert to promote hair-care products by a major Unilever brand—but the move spectacularly backfired. As Norma Young writes from Johannesburg, the ad sparked protests for the way it appeared to denigrate the hair of Black people while describing white people’s hair as “normal”.

African tech startups are beating the pandemic’s odds and racking up multimillion-dollar exits. As African countries began instituting lockdown measures in response to local coronavirus outbreaks earlier this year, the pervasive fear across tech ecosystems was a sharp drop in dealmaking. Yet, in defiance of economic uncertainty as a result of the pandemic, African startups are increasingly notching multi-million dollar exits, Yomi Kazeem explains.

Zimbabwe is making a sharp U-turn on mining in national parks. Zimbabwe is walking back its plan to allow a Chinese coal mine to be built in its largest national park or indeed any national park in the wake of recent public criticism. But as Tawanda Karombo reports from Harare, environmental experts are pushing for the new position policy to be passed into law.

A “null and void” regional election in Ethiopia has raised the stakes for its federal system. Since Ethiopia’s prime minister Abiy came to office in 2018 he has had to balance being self-described political reformer and economic liberalizer with keeping all sides happy in a fragile federal system. Samuel Getachew reports from Mekelle, Tigray on how the outcome of a regional election is set to severely test Abiy’s government.

Dealmaker

The Trump administration is investing in African e-commerce startups. The US International Development Finance Corporation (DFC) backed two East African e-commerce startups including a $5 million equity investment in Copia Global, a Kenya-based e-commerce and logistics startup. It also made a $1 million investment in Kasha, a women-focused e-commerce player operating in Kenya and Uganda.

•Yellow, a South African solar energy startup, raised $3.3 million in a Series A funding round led by Platform Investment Partners, Ruby Rock Investment and existing investor LBOS.

•Solarise, a Kenya-based clean energy company, raised $10 million in Series B funding round which saw participation from existing investors Energy Access Ventures, ElectriFI, and Proparco.

Quartz Gems: Improving how you make decisions

Of all the errors in human judgment, overconfidence may be the most damaging. Psychologists Don Moore, of the University of California, Berkeley, and Max Bazerman of Harvard, call it “the mother of all biases” in their textbook on decision making.

Overconfidence comes in many forms, but “it is overprecision that I think is the most consistent and pernicious,” says Moore, the author of Perfectly Confident: How to Calibrate Your Decisions Wisely.

Overprecision involves being too sure of the accuracy of your own beliefs, and, inspired by a test in Moore’s book, Quartz created a tool for you to identify and work around overconfidence, which can lead to costly errors when making decisions. Try it out—it’s part of our field guide on the topic.

✦ We’re just the right amount of confident that you’ll enjoy a Quartz membership. You can access our full library of guides—and enjoy a paywall-free experience site-wide—by joining today.

Other things we liked

CFA vs eco: A new currency with old power. There has been much expectation that West Africa’s regional body ECOWAS’ plans to introduce the eco as a common currency for the region would see the end of France’s influence via the CFA. But it’s not quite that simple, write Lisa Ossenbrink and Urooba Jamal for ZAM magazine. “France needs West Africa more than it is willing to admit.”

The African hunger strikers protesting indefinite detention by US immigration in Louisiana. Normally, an average stay for an asylum-seeker held at Pine Prairie detention center in Louisiana by US immigration would be 45 days, but the detentions of many of the African migrants seeking refugee status now range from 11 months to two years. This has led to several group protests and hunger strikes to raise awareness of human rights abuses, learns Joe Penney for the New York Review of Books.

Mozambique can’t contain its insurgency alone. For Foreign Policy, Tonderayi Mukeredzi argues last month’s capture of Mocímboa da Praia, the gateway to Mozambique’s $20 billion offshore liquified natural gas project in the province of Cabo Delgado, shows the an Islamist insurgency is growing in size and sophistication and “mutating into a force that may be difficult to contain.” The government had long denied the existence of these extremists until it was too late.

When it comes to soft power, China is already outpacing the US. For the most part discussions about the competition between the US and China is often about the narrowing the gap between the economic and the”hard” advantage with military might. But China-Africa scholar Howard W. French argues in World Politics Review that the US has seen a “sharp recent erosion of another important traditional competitive advantage: its advocacy of values that many consider universal, like human rights, democratic governance, and the impartial rule of law.”

ICYMI

Shell Postgraduate Research Internship. An opportunity for Nigerian postgraduate students to “gain industry-related work experience and carry out topical research.” (Sept. 22)

Tholoana Enterprise Program. A two-year business support program offering seed-funding and access to market assistance to 60 South African entrepreneurs annually.

Keep an eye on

•Jumia is presenting at the RMB Morgan Stanley Virtual Big Five Conference (Sept. 15)

*This brief was produced while listening to There’s Music in the air by Letta Mbulu (South Africa).

**For our readers who missed the Quartz Africa mid-2020 anti-Covid Spotify playlist

Our best wishes for a productive and ideas-filled week ahead. Please send any news, comments, suggestions, ideas to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.