African genomics, Central Bank digital currencies, China DRC suspensions

Hi Quartz Africa readers!

Hi Quartz Africa readers!

As the world embraces digital payments, and cryptocurrencies and stablecoins rise in popularity, cash faces an uncertain future. Central banks around the world are considering adopting their own digital currencies as a result. And Africa is taking a leading role in these discussions.

Central bank digital currencies, or CBDCs, are the virtual format of a country’s or region’s base currency. They are also a sign of governments’ acknowledgment that the appetite for digital currencies will only keep rising—even under unfavorable policies, as evidenced by the recent Nigerian bitcoin ban.

This month, the Basel-based Bank for International Settlements (BIS) announced that South Africa’s central bank and those of Australia, Singapore, and Malaysia would trial CBDCs for cross-border payments. The move could motivate other financial institutions around the world to adopt the technology.

The BIS said it’s leading the project, which will enable financial institutions to transact directly with each other in the digital currencies issued by central banks. It will also eliminate the need for intermediaries, and reduce the time and cost of transactions. As the continent moves to implement the African Continental Free Trade Agreement (AfCFTA), this could be a gamechanger.

While the BIS trial is a multi-country initiative, nine other African countries are also looking at the viability of the technology, with most at the research stage, according to a tracker by the Atlantic Council think tank. Ghana and Nigeria have already announced plans to pilot their own CBDCs.

CBDCs are expected to ease the implementation of fiscal and monetary policy. In Africa, they could promote financial inclusion by bringing the unbanked into the financial system. They could play a major role in the continent’s huge remittance market—the most expensive in the world—by reducing transaction costs.

But digitizing currencies is not an easy proposition, as it raises questions around accessibility, privacy, and what architecture to use.

Trials such as the one in South Africa will help the world better understand how to best make use of the technology and could boost a sector that currently operates on shaky and shifting ground. —Carlos Mureithi, east Africa correspondent

Quartz Africa Innovators 2021: Female entrepreneurs lead the way

Quartz Africa Innovators 2021 is the sixth edition of a series that identifies some of the most ambitious and imaginative minds on the continent. This year’s list focuses on female artists, activists, investors, and entrepreneurs whose innovations are helping their communities, countries, and the continent through a challenging period.

The more than two dozen women, representing 18 countries and a diverse range of sectors, exemplify the dynamism, entrepreneurial drive, and resilience of millions on the continent. Their innovations show the potential that can be unleashed when women with bold ideas and decisive actions take the lead.

🎙 Quartz Africa editor Ciku Kimeria spoke to the World Economic Forum’s Radio Davos podcast about the list, and how female innovators on the continent are contributing to sustainable development and combatting climate change.

✉️ On Sept. 22, subscribers to the Africa Weekly Brief will be introduced to this year’s list. Know someone who might want to learn about the amazing work of Quartz Africa Innovators 2021? Tell them to sign up here.

Stories this week

China to punish its own companies. Following the Democratic Republic of the Congo’s suspension of Chinese companies over illegal activities, Beijing has announced it will impose sanctions on the businesses if they are found guilty. Carlos Mureithi writes on this rare move for China in condemning the activities of its own companies in Africa and elsewhere.

Africa’s big pharma future. African genomes are the oldest and most diverse in the history of humanity, but little African data are used in genomic and pharmaceutical research. US and Nigeria-based startup 54gene, which has just secured $25 million in funding, is one of the continent’s ambitious answers to that challenge, writes Alexander Onukwue.

Missing a second shot. More than 90,000 people in Kenya haven’t gotten their second Covid-19 vaccine dose, with the government suspecting they skipped the doses because they want to get vaccines that they believe have higher efficacy. Carlos Mureithi reports on how the government is using its Covid-19 vaccination platform, health volunteers, and a community policing system to get people to their second shot.

Refining Nigeria’s palm oil industry. Vegetable oil is used industrially in paints, soaps, biofuels, and lubricants, but Nigerian manufacturers have a hard time sourcing it directly from smallholder farmers. Alexander Onukwue explores how Releaf, which recently raised $4 million, plans to solve the problem with a “smart” factory.

AfCFTA gets an assist from the Brits. The UK officially committed to making Africa’s landmark trade agreement a success, writes Alexander Onukwue, after its minister for Africa signed a memorandum of understanding with the secretary-general of the AfCFTA secretariat.

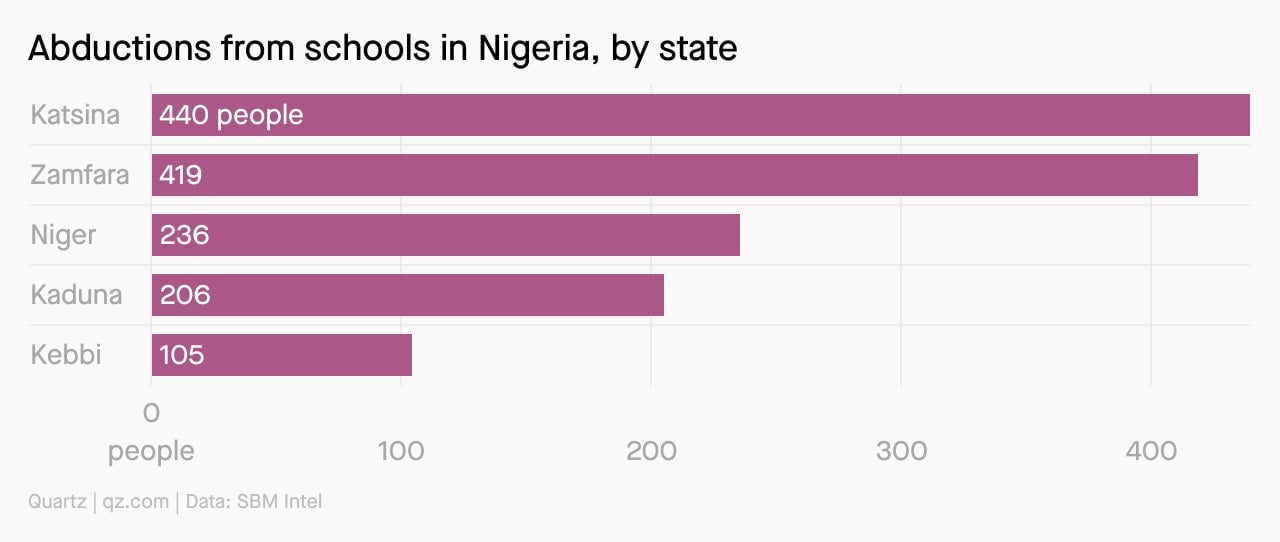

Charting Nigeria’s kidnapping problem

In two states in northern Nigeria, telecoms services have been shut down as part of a scramble by security agencies to combat escalating criminal activity. Katsina, where president Muhammadu Buhari comes from, has experienced Nigeria’s highest incidence of abduction of students and teachers from schools in the last year.

“Telecoms companies will take a huge revenue hit” from the action, and small businesses have been crippled too, says Confidence MacHarry, lead security analyst at SBM Intel. But as Alexander Onukwue explains, some residents welcome the trade-off if they can have peace.

Dealmaker

CDC Group, the UK’s development finance institution, invested $60 million in two African funds: $30 million in a fund managed by South Africa-based Vantage Capital, and $30 million in BluePeak, an asset management firm in Tunisia. The commitment is under CDC Group’s African Private Credit Fund Strategy which, among other things, aims to attract more commercial investors to African markets.

Capiter, an Egyptian e-commerce company, raised $33 million in a Series A round. The deal was led by Quona Capital and MSA Capital, with the participation of Savola, Shorooq Partners, Foundation Ventures, Accion Venture Lab, and Derayah Ventures. Capiter says it has over 50,000 merchants on its platform and wants to reach $1 billion in annualized revenue in 2022.

While we’re talking e-commerce, Nigeria-based OurPass raised $1 million. The startup’s current focus is designing checkout experiences that lead customers to complete purchases, as opposed to adding to cart and logging off. Its pre-seed money came from Tekedia Capital and angel investors from Fortune 500 companies.

Quotable

“We wish to reiterate that the Bank has not contemplated, and will never contemplate, any such line of action. The speculation is a completely false narrative aimed at triggering panic in the foreign exchange market.”

A recent statement by the Nigerian Central Bank addressed rumors that it would force anyone holding dollar bank accounts in Nigeria to convert them to naira. Alexander Onukwue reports on the troubled recent history of the naira, and why Nigerians would be quick to believe such rumors.

Quartz gems

As employers around the globe settle into distance work (or claw their way back to the office), Quartz is honoring companies that already embrace the distributed future—places where remote work is treated not as a stopgap, but as a business priority.

Support Quartz’s journalism by becoming a member—get 40% off with the code QZEMAIL40.

One big number

820,000

That’s the number of Togolese people—around 12% of the country’s population—who have benefitted from a cash transfer project that was initiated by the government during Covid. Annalisa Merelli explores the various ways that Covid-19 has spurred a digital cash revolution in developing countries.

Other things we liked

Sept. 11’s legacy in Africa. After the terrorist attacks 20 years ago, African governments took advantage of a global counter-terrorism awakening to pass laws that restricted civil society and crushed opposition voices, report Kgalalelo Gaebee and David Kode in African Arguments. One example: a new Senegalese “anti-terrorist” law against “seriously disturbing public order.”

The queen of Afrobeats claims her time. Cheers for the global spread of Afrobeats in the last decade often fail to include women who lend diversity and energy to the genre. Nigerian singer Tiwa Savage set high standards for the industry long before her recent hit with Brandy, or her 2019 deal with Universal Music. But as Joey Akan writes in a review of her latest EP for his Afrobeats Intelligence newsletter, Tiwa is setting a new direction for her art.

Secret Cold War maneuvers in the Congo. In a Guardian article about a new book by author Susan Williams, Jason Burke recounts how jazz musician Louis Armstrong was unknowingly coopted into the US’s Cold War strategy in the newly independent Republic of the Congo.

An oil trader turns on his co-conspirators. For Bloomberg, Christian Berthelsen, Javier Blas, and Bob Van Voris write that for 12 years, Anthony Stimler, the head of Glencore’s West African oil trading desk, paid millions of dollars in bribes to African officials and intermediaries, and is now helping the US investigate the company and his former colleagues.

ICYMI

Spotlighting African entertainment. In an Invest Africa webinar, industry experts will discuss the recent performance of the African entertainment economy, how the sector has used technology, and the future directors and potential challenges. (Sept. 27)

Partnering with the AfDB. The African Development Bank’s Virtual Business Opportunities Seminar will offer individual and consulting firms, civil contractors, manufacturers, suppliers, and diplomatic commercial attachés an opportunity to learn more about providing goods and services in collaboration with the institution. (Oct. 12 and 13)

🎵 This brief was produced while listening to “Shake Your Head” by Musketeers and Azaria (Namibia)

Our best wishes for a productive and ideas-filled week ahead. Please send any news, comments, suggestions, ideas, classic jazz tracks, and palm oil to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.