Tanzania’s press lockdown, corrupt Kenya, Africa’s trees vs Africa’s chocolate

Hi Quartz Africa readers! [insertSponsor]

Hi Quartz Africa readers! [insertSponsor]

Vultures no more

Arguably, the turning point in the 2012 US presidential elections between incumbent president Barack Obama and Mitt Romney was the leaking of a recording of the former Utah governor’s infamous “47%” comment.

The comment was a reference to a certain segment of US society being freeloaders while everyone else paid their way. It was leapt on by the Obama campaign to build on Romney’s characterization as the evil private-equity man who became a billionaire by stripping businesses of assets and firing thousands of people.

That image of private-equity investors in the US and Europe, as “vultures” or “locusts,” is one that’s useful for politicians and union leaders. But in Africa, it’s often turned on its head. Increasingly, progressive and ambitious governments are hungry to attract investors with the sizable pools of capital needed to solve big problems, from infrastructure deficits to power generation.

That was evident from a Quartz interview with Côte d’Ivoire’s vice president Daniel Kablan Duncan at this year’s African Private Equity and Venture Capital (AVCA) conference. He pointed out that many of the country’s new toll roads, power generation, and water distribution projects were backed by private investors, not government. “We welcome investors,” Duncan stressed.

But the Ivorian government is also focused on creating jobs and opportunities for young Ivorians. Typically, focusing on job creation and social development would be at odds with private equity’s world view. But in fact, the selfish unerring focus on long-term returns for investors in their funds means they’re aligned with the development targets of governments, like Cote d’Ivoire’s.

Private-equity players invested $3.8 billion in 145 deals across Africa last year within a range of businesses from agriculture and energy to healthcare and financial sectors. That was up more than 50% from $2.5 billion in 2015, according to AVCA data.

Several of the biggest private-equity players in Africa point out that “social good,” or a development dividend, generates an even bigger return as you invest in better road networks, electricity distributors, or agri-processing for example.

But it’s important to note private-equity firms never lose sight of their fiduciary responsibility to investors who have not asked them be impact investors or concentrate on social good, says Hurley Doddy, co-founder of Emerging Capital Partners. Yet, this is what ends up happening.

“By fulfilling these needs, they can make money because you’re helping to grow the economy and transform society,” says Doddy, whose firm has raised nearly $3 billion for investment over 15 years in Africa. “It’s a side benefit.”

Yinka Adegoke, Quartz Africa editor

Stories from this week

John Magufuli’s Tanzania keeps hurting press freedom. Since coming to power in Nov. 2015, Tanzania’s president has threatened to shut down media houses, fired his information minister, and detained a rapper for releasing a song critical of his administration. As Joshua Masinde reports, this worrying trend of criminalizing free speech continues to use up the goodwill Tanzanians originally had in their president.

The lives of 20 million starving Africans and Yemenis are worth $43 each. The United Nations says it needs $4.4 billion to help mitigate the looming famine in South Sudan, Nigeria, Yemen, and Somalia. But at a time of falling support for foreign aid in Western countries, the UN has received about 20% of what it needs, writes Max de Haldevang.

The world’s taste for chocolate and coffee is damaging African forests. Across Africa, illegal logging has depleted vast woodlands creating social and environmental disasters. But as a new study shows, the increased global demand for cash crops like cocoa, coffee, and palm oil are threatening to deplete the Congo Basin, Africa’s largest rainforest.

Africa’s next generation of business leaders may be even more corrupt. In a recent survey, 77% of global board directors were willing to bribe to win or retain new business. In Kenya, almost two thirds of those between the ages of 25 and 34 believed that unethical behavior was justified to maintain or boost business interests, writes Lily Kuo.

The economic promise of post-apartheid South Africa is fading. This week, ratings firm Moody’s joined S&P in downgrading South Africa’s government bonds, placing it two notches above junk. The credit downgrade was precipitated by the firing of finance minister Pravin Gordhan, which has also sparked protests. But as Lynsey Chutel reports, it will take the country a while before it is able to put forward a clear strategy and rehabilitate its image globally.

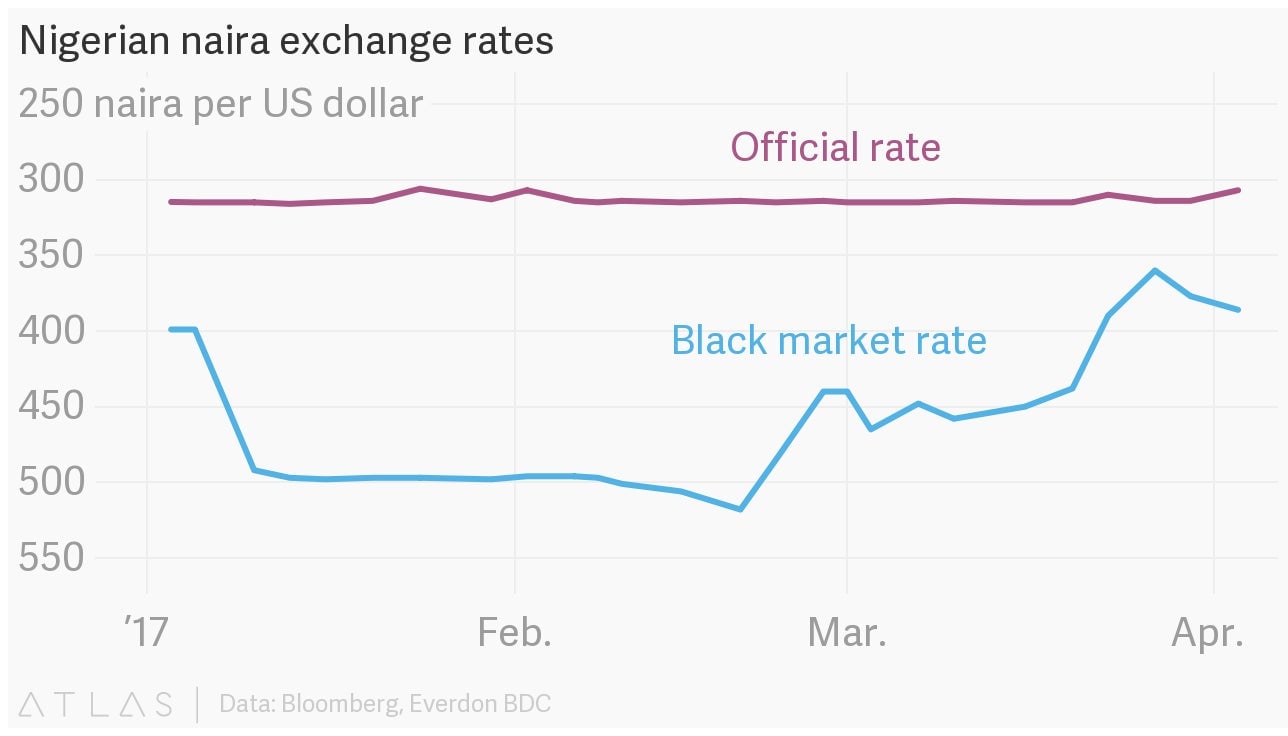

CHART OF THE WEEK

Nigeria is no longer running short on dollars—for now. When the Central Bank of Nigeria adopted a more flexible exchange-rate policy or “managed float” determined by market forces last year, the naira’s value plummeted, leading to a dollar shortage. But as Yomi Kazeem explains, the Bank’s recent efforts to pump dollars into the marketplace has helped narrow the gap between the official and black market rates. The question remains though, is this sustainable?

Other Things We Liked

The journey of a trafficked girl along ancient slave trade routes. As African migrants journey towards the Mediterranean in search of a better life in Europe, they unknowingly follow ancient trans-Saharan slave routes. As Ben Taub reports in The New Yorker, tens of thousands of men and women find themselves trafficked and traded in these routes, with the majority of the females coming from around one city in southern Nigeria.

What does it mean to be poor, gifted and black in South Africa? In South Africa, students of color still struggle with the long-lasting effects of apartheid, because education, like society, still confers advantage on white people. More than two decades after the end of apartheid, Monica Mark of BuzzFeed goes to meet students and teachers who have spent the past year protesting for the right to a free and fair education.

Brazil wants to know if you’re really black or not. For decades, Brazilian intellectuals and political leaders claimed the country was a “racial democracy,” contrasting favorably with US Jim Crow-era segregation. Black activists have succeeded in bursting that myth by showing extreme inequality, such as the absence of black Brazilians in higher education. But in a country with as much mixed-race heritage as Brazil, Foreign Policy’s Cleuci de Oliveira finds affirmative action policies are being exploited by some white citizens who have African heritage.

Keep an eye on

East Africa Islamic Economy Summit (Apr. 10–11). The second edition of the annual summit will take place in Nairobi, Kenya, with key stakeholders discussing opportunities to improve Islamic finance and banking, besides the halal economy.

South Africa employment statistics (Apr. 11). As the protests against president Jacob Zuma to step down intensify, Statistics South Africa will release the quarterly employment statistics. The agency will also release retail and wholesale trade sales on April 13 and 14 respectively.

Our best wishes for a productive and thought-filled week ahead. Please send any news, comments, suggestions and CVs of honest African directors to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week.