Coronavirus: Farm to unstable

Hello Quartz readers,

Hello Quartz readers,

Consider the humble peanut. Since the start of this year, the global price of peanuts is up 12% as shoppers under lockdown turn to shelf-stable goods. No other crop (not even rice) has seen comparable growth.

But as it turns out, the relative success of peanuts may actually wind up hurting the global clothing market. Farmers, mostly in the southern US, often decide between planting cotton or peanuts each year, depending on the current value of each crop and the balance of supply and demand. Recently, cotton prices have taken a hit around the world.

Few things illustrate the interlacings of a global economy like the food supply chain. Today we’re going to look at how coronavirus is impacting several key links, and why quick pivots are harder than they seem. Thanks to Pat for suggesting the topic; if there’s a subject you’re interested in learning more about, ✉️ let us know. (Past rabbit holes include immunity, contact tracing, bailout architects, and masks.)

Okay, let’s get started.

Meat redress

The conventional meat industry is in a tailspin. As of last week, 15 meatpacking plants in the US were closed because of workers infected with Covid-19. On May 4, daily slaughter of cattle was down 36% compared with a year earlier, and daily slaughter of pigs was down 37%. The plant closures impact some 25% of US meat production, and prompted the chairman of Tyson Foods to take out a full-page ad in national newspapers warning that “millions of pounds of meat” would not make it to market, and that “the food supply chain is breaking.”

In the past several years, plant-based meat companies, including Beyond Meat and Impossible Foods, have experienced a meteoric rise as fast-food chains, high-end restaurants, and grocery stores started selling their products. But neither company has ever weathered a recession—or a pandemic. In the event of meat shortages, will consumers still have an appetite for meat alternatives?

Early data suggests yes. US sales of plant-based meat substitutes increased 200% in the week ending April 18, compared with the same period a year ago. US sales of conventional meat increased by 30% during that same period. Impossible Foods CFO David Lee has said his company’s supply chain is uninterrupted by the virus.

Wall Street is less optimistic. In an April 27 report, analysts at UBS slashed their price target for Beyond Meat’s stock from $90 to $73. They acknowledged that the company is performing well in retail—where it aimed its early resources—but warned that it wouldn’t come close to making up for the loss of restaurant and food-service business. UBS also noted the rising US unemployment rate and potential recession. “Our concern is that many of Beyond’s independent customers may disproportionately struggle,” the report says, “and that traffic to national chain customers may not snap back as quickly as investors anticipate.”

While that might be the case in the US, in Hong Kong and China, demand for plant-based meat has increased since the coronavirus outbreak began, according to the World Economic Forum. Suppliers say shoppers are worried about links between animal meat and Covid-19. In China, Starbucks will soon roll out a plant-based lunch menu.

Resetting the farm

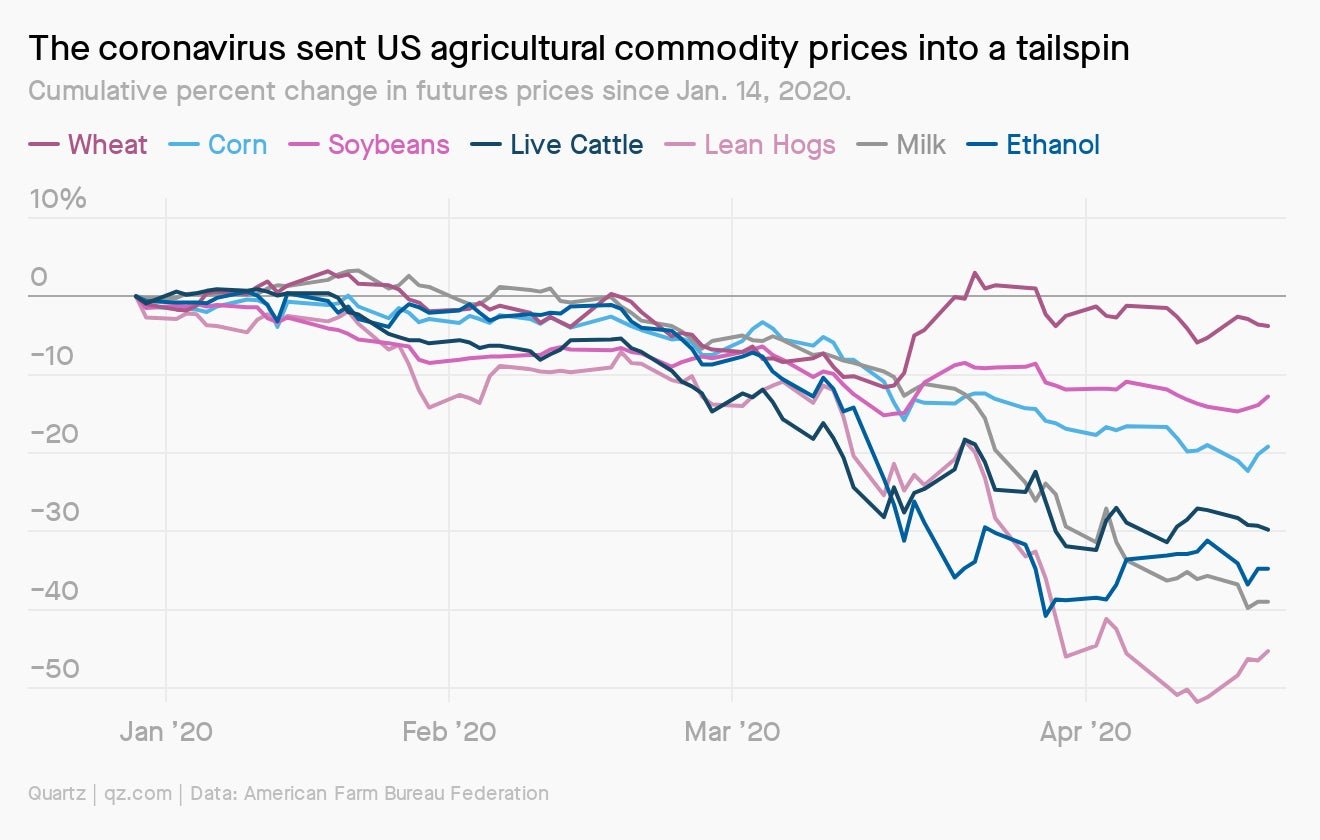

The coronavirus pandemic is destabilizing US agricultural commodity prices. Between Jan. 14 and April 23, the price of corn plummeted by 19%, live cattle by 30%, and lean hogs by 45%, according to the American Farm Bureau Federation. Under normal circumstances, these fluctuations would hover in the single digits.

That chaos can be connected to circumstances created by coronavirus. There’s a glut of milk because the restaurant and food services industries are at a standstill. Hog and beef prices dropped because supplies are backing up as meatpacking plants close due to worker illnesses. Corn prices have fallen to some of the lowest levels in a decade, in part, because there’s less demand for the ethanol that’s mixed into gasoline.

Every commodity has multiple end-users. One potato farmer might typically sell all of their goods to McDonald’s for french fries, another might only sell directly to Whole Foods, and a third might typically sell to local restaurants. Each requires certain types of packaging and preparation. When the economy shuts down—in this case requiring food service, restaurants, and some food production plants to shutter—it forces farmers to scramble to figure out what to do with their products.

“Farmers are pretty agile, but to completely pivot a supply chain like that when you’ve dedicated resources for a specific end user is difficult,” says Shelby Myers, an economist at the American Farm Bureau Federation.

Farm health, at least in the US, was already in a rough spot. If prices don’t stabilize, it could put the global food system in uncharted territory.

Help wanted

The spread of Covid-19 is revealing a vulnerable link in the food supply chain: the immigrant populations that make up a large part of the agricultural workforce. The global food system as it operates today relies on immigrant labor to run smoothly, and the pandemic is emphasizing the risk of undervaluing that work.

- 50%: Percentage of the US agricultural workforce that consists of undocument immigrants.

- 70,000-80,000: Shortage of harvesters in the UK due to a lack of migrant workers.

- 85%: Share of harvesters who have migrated to work in regions of Spain such as Aragon, Catalonia, Murcia, and Extremadura, where cherries, nectarines, peaches, and apricots are grown.

- 16,000: Number of seasonal workers who would have usually arrived in Spain’s Huelva region by this time of year to pick fruit. Less than half have made it.

Supermarket sweep

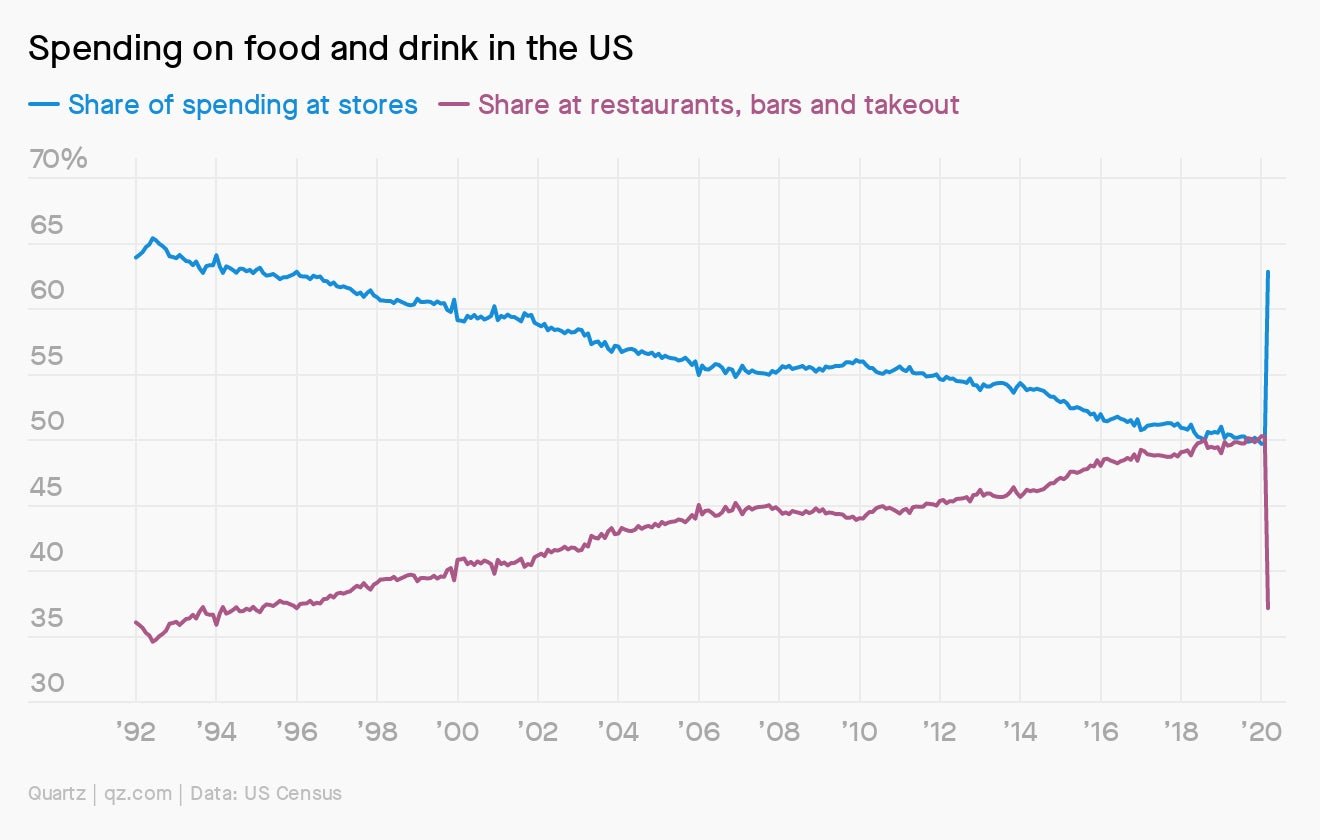

Covid-19 has Americans shopping at grocery stores like it was the 1990s. In March 2020, almost 63% of food and drink bought by US consumers was purchased at stores. This was the highest share since January 1996, according to data from the US Census.

The share of food spending at restaurants and bars (including takeout) has been slowly rising for over half a century. The Great Recession slowed down the move to eating out from 2008 to 2012, but only a pandemic could truly reverse the trend.

Essential reading

- The latest 🌏 figures: 3,628,824 confirmed cases; 1,184,499 classified as “recovered.”

- Stockholm syndrome: Sweden is taking a very different approach to Covid-19.

- The fault in our starts: US businesses want immunity from coronavirus lawsuits.

- There goes the neighborhood: “Travel bubbles” are how the world will get moving again.

- The new ball game: Bereft baseball fans are turning to pro teams in Taiwan and South Korea.

Our best wishes for a healthy day. Get in touch with us at [email protected], and live your best Quartz life by downloading our app and becoming a member. Today’s newsletter was brought to you by Chase Purdy, Katie Palmer, Dan Kopf, and Kira Bindrim.