Coronavirus: A tale of new cities

Hello Quartz readers,

Hello Quartz readers,

A debate erupted in our newsroom last week…to the extent that something can “erupt” over video chat. Once the worst of this is over, we asked ourselves, will people reconsider living in cities?

One camp said: Duh—urban population density is now a risk factor. And if lockdowns become more routine, what’s the appeal of a city where everything is closed?

The other side wasn’t convinced: Cities will find new ways to ensure safety and culture, they said. Plus, not every city has the density (or skyscraper prevalence) of a Manhattan or Tokyo.

We want to know what you think. Will cities hold less appeal?

By the way, special thanks to Vince and Richard, both of whom pointed out that our subject line last week should have been “One datum at a time,” as datum is the singular of data. We regret this error, love our readers, and will always take feedback on a pun.

Okay, let’s get started.

Mouse, trapped

At the start of the year, Disney was on top of the world, coming off a record-breaking 2019. Its films accounted for nearly 40% of the US box office, and its global theme parks were flourishing. The company was arguably the single most important arbiter of culture, and its biggest concern was a decrease in cable TV subscribers as more Americans cut the cord.

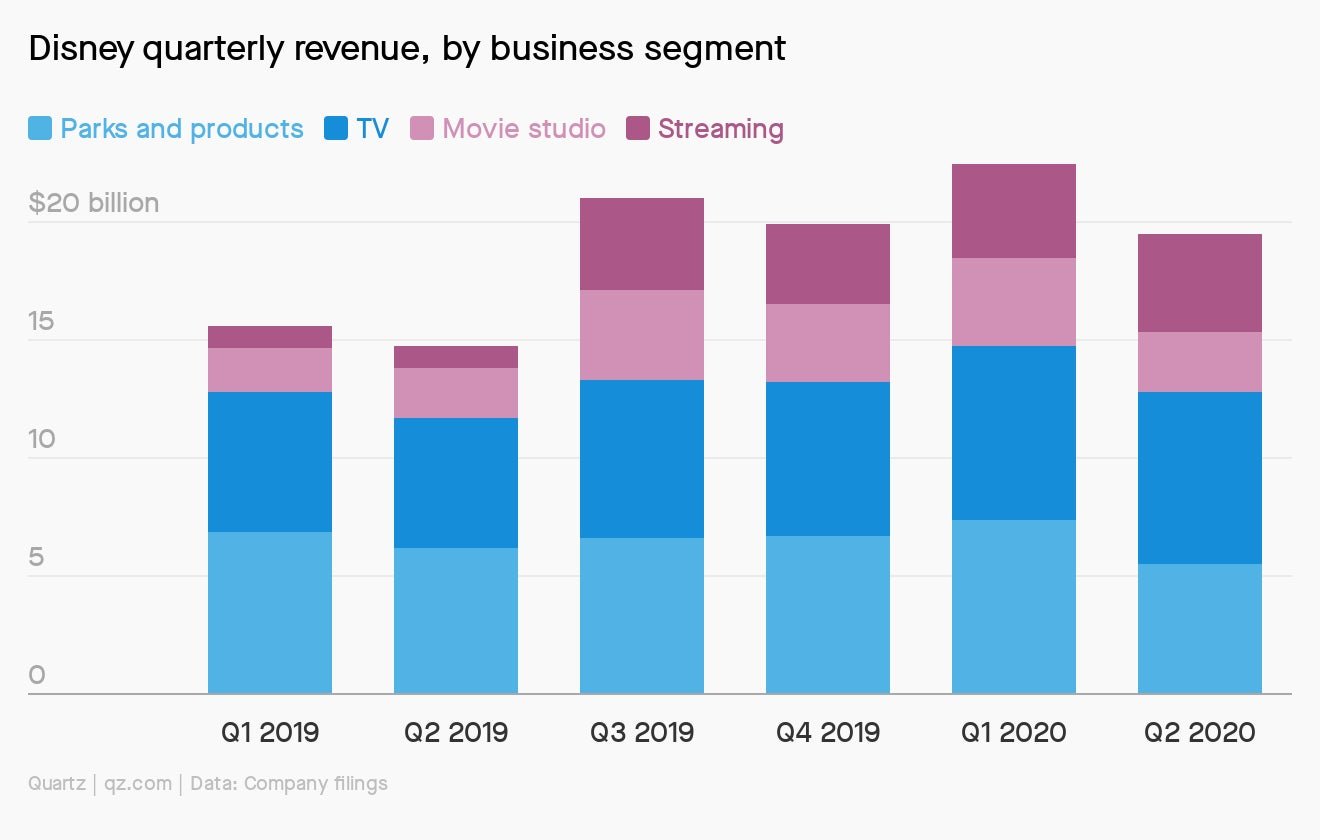

Today, Disney is reeling. Over the past month and half, the company has relied almost entirely on its cable, broadcast, and streaming TV businesses to stay afloat as coronavirus forces the closure of most in-person experiences like parks and movie theaters. Netflix, which doesn’t have parks or movie theaters to worry about, surpassed Disney in market capitalization last month for only the second time ever, and hasn’t looked back. Netflix’s stock is up 33% this year, while Disney’s is down 28%.

Revenue from the parks business fell to $5.5 billion in the last financial quarter, down 10% from the same period last year. But the real damage won’t be known until Disney’s next quarterly earnings report in August, which covers the period from April through June.

Disney says its resiliency and brand affinity will carry it through the crisis, but analysts aren’t convinced. Last week, Michael Nathanson of MoffettNathanson downgraded Disney’s stock, arguing the effects of the pandemic on its core businesses will last longer than many believe. He forecasted the company’s parks and movies segments will drop 33% and 20% in revenue this year, respectively. Even soft park reopens, like that of the Shanghai Disney Resort on May 11, are serving smaller crowds with fewer open attractions.

Disney has already furloughed 100,000 workers without pay (representing roughly half of its employees), and said it would forgo the semi-annual dividend it pays investors. The company has also entered into agreements with banks that give it access to $13 billion in loans to increase its cash on hand.

Disney’s only silver lining right now is the success of its nascent streaming service, Disney+, which the company said has 54.5 million global subscribers and made $4 billion in revenue last quarter. Most analysts expect the service to have between 60 and 80 million global subscribers by the end of 2021, putting it three years ahead of Disney’s own goal. Disney+ is set to launch in dozens more countries in Europe and South America by the end of the year, and global subscription revenue should help offset a portion of the losses from its theatrical business. But the longer theaters remain closed, the more the Mouse bleeds cash.

In good company

☝️That little apéritif came from this week’s lineup of Quartz member exclusives, in which we’re looking at the pandemic’s impact on different companies. Here’s what else we know:

- J. Crew’s Chapter 11 may be the first big bankruptcy of the coronavirus era, but it has more to do with debt than disease.

- Tesla is poised to weather a moribund global auto market, perhaps cementing its lead in the global race for electric vehicles.

- Paging Boeing and Airbus: The wide-body plane may be another casualty of coronavirus, as air travel goes smaller, leaner, and more efficient.

Remember, you too can become a Quartz member. We’ll even throw in a 40% discount.

Wuhan wisdom

As China’s cities start to reopen, some people are considering what they learned during lockdown. The appropriate phrase in Chinese is 前车之鉴: lessons to be heeded from the overturned cart in the path. That 20/20 hindsight can be helpful for those of us still stuck at home.

- Make the best of this moment. “Enjoy the novel bliss of togetherness, because it could never happen again like this,” says Alicia Cheng, a Wuhan native. “Now that this is seemingly over for us, we realize that we may never have that time of simplicity and closeness ever again in our lives.”

- Create routines. It’s not too late, especially if you’ll be housebound for a while longer. Says Cheng, “The predictability of my 8:30am breakfast with my mom, my hour of reading after lunch, and my exercise after dinner created a feeling of safety I couldn’t find anywhere else.”

- Don’t stay angry. Constant physical closeness creates friction. Even if you don’t have a touchy-feely family, wind down a fight with a hug. And in general, don’t hesitate to over-communicate your affection for people. Everyone can use it.

- Get lost in the mundane. While Cheng was obsessing over every corona update, her mom took a 佛系, which loosely translates to a “Buddhist approach.” That means she only focused on what she could control—wear a mask, wash your hands, don’t go out. “While I was freaking out, she was playing online mahjong with her friends, texting the family recipes, and reading,” says Cheng. “And you know what? My freaking out and her ‘Buddhist’ approach both led to the same result: We were still stuck at home.”

Eating our feelings

US cannabis sales skyrocketed in the days leading up to stay-at-home orders. Now, cannabis analysts have found that an unusually high proportion of those sales can be attributed to edibles.

A new report from the market research firm Headset shows that during the week beginning March 9, when the WHO deemed the coronavirus a pandemic, the edibles category saw a 10.6% increase in its portion of the cannabis sales mix from the prior week in Colorado, Washington, California, and Nevada, the four states Headset covers. Roy Bingham, the co-founder and CEO of cannabis market research firm BDSA, says about half of the edibles market is made of gummies.

Essential reading

- The latest 🌏 figures: 4,229,074 confirmed cases; 1,479,508 classified as “recovered.

- Backsliding: Ethiopia’s once-promising economy is hitting a wall.

- Manspreading: Young men break social-distancing rules more than young women.

- New calculus: Parents, it’s time to get over your math anxiety

- All aboard: Tens of thousands are still stuck on cruise ships.

Our best wishes for a healthy day. Get in touch with us at [email protected], and live your best Quartz life by downloading our app and becoming a member. Today’s newsletter was brought to you by Adam Epstein, Zak Dychtwald, Jenni Avins, and Kira Bindrim.