Show US the money

Hello Quartz readers,

Hello Quartz readers,

Over the weekend, the US granted emergency-use authorization to Johnson & Johnson’s Covid-19 vaccine, which requires just one shot and can be refrigerated normally. It’s the third vaccine to be approved in the US, which is expecting 100 million forthcoming J&J doses to bolster a vaccination effort that got off to a rocky start.

Any questions? This is your last chance to register for our virtual Q&A on vaccines, which goes down tomorrow (March 3) at 11am US Eastern time. Quartz health reporter Katherine Foley will be joined by Panagis Galiatsatos, a pulmonologist at Johns Hopkins Bayview Medical Center, to field a bounty of reader-submitted queries. Register now to join in.

Okay, let’s get started.

Hey big spender

The US government has spent lavishly to boost the economy during the pandemic, and Americans like it—so much, in fact, that history suggests high levels of public expenditure will continue to be a norm for a long time to come.

“People come to benefit from it and then to expect it,” says Price Fishback, a professor of economics at the University of Arizona. “That makes it harder to go back to a time of low spending.”

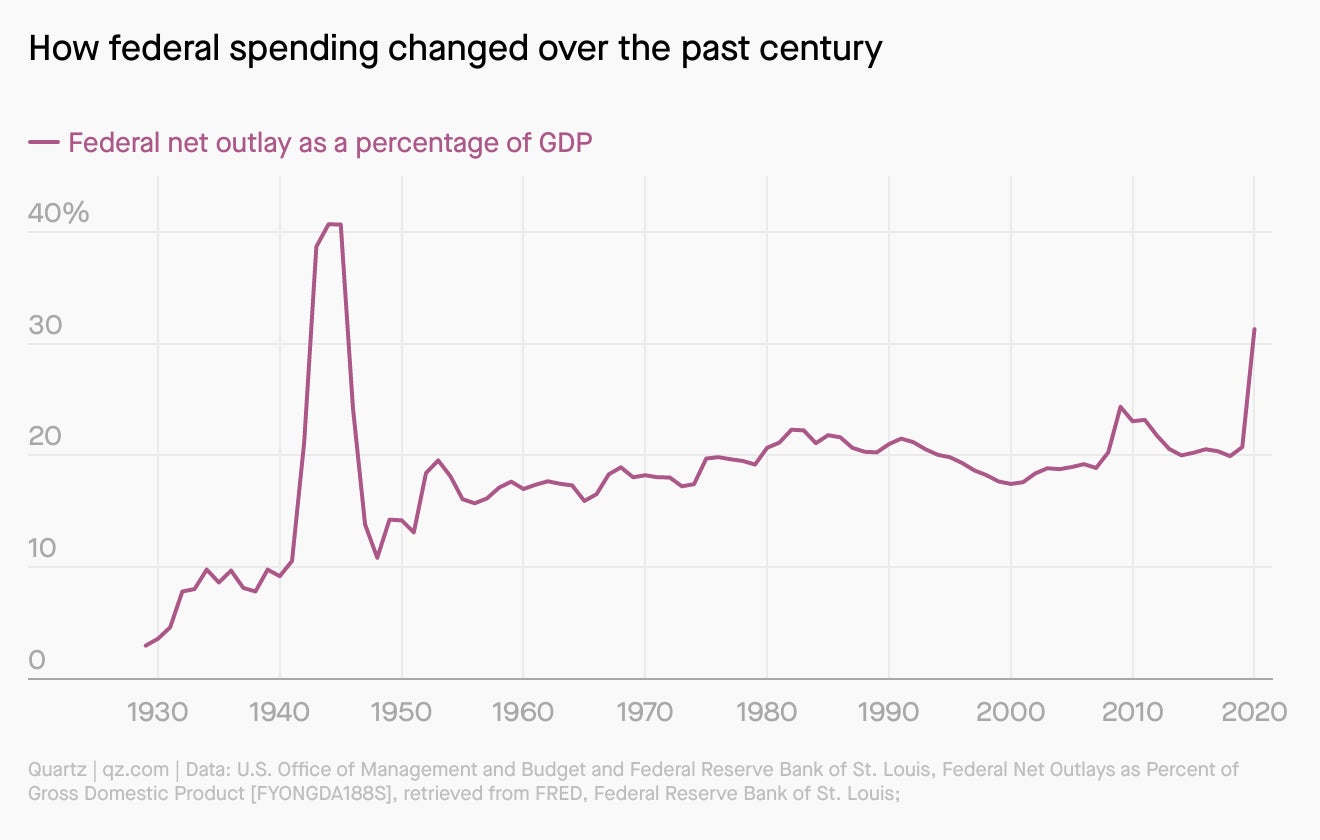

Fishback’s principal area of research is the political economy of the New Deal, a period of intense public expenditure during the Great Depression that gave way to the even greater spending of World War II. “Federal net outlay, as a share of GDP, went from 3% to 9% by the end of 1933, and then to nearly 10% by the end of the 1930s,” Fishback says. “The war comes in, everything explodes, and it’s 41% by 1944.” It wasn’t just that the government spent on infrastructure or welfare or the military; it imposed more regulation and taxes as well. The state grew bigger in nearly every way.

It never permanently came back down. Just after 1945, the government stopped spending on fighting the war, so a sharp dip ensued, but then spending began to climb again. By the time Ronald Reagan became president, net outlay was still around 20% of GDP. And while there were plenty of things that needed government money—defense, Medicare and Medicaid, the GI Bill—Fishback says people were also “just willing to expect more government.”

The largest peacetime spike in US spending (until the pandemic) came just after the 2008 recession, when federal net outlay touched 24%. Since Covid-19, the figure has hit 36%, before factoring in another $1.9 trillion stimulus plan.

“Chief among the enduring legacies of emergency governmental programs has been ideological change,” the economist Robert Higgs wrote in his book Crisis and Leviathan, “in particular a profound transformation of the typical American’s beliefs about the appropriate role of the federal government in economic affairs.”

It isn’t just the public that comes to prize such expenditure, Fishback says: Political opposition to it also falls off. No US president since Dwight Eisenhower has overseen a decline in federal spending as a proportion of GDP—and Eisenhower himself only brought spending down from 20.4% to 18.4%. —Samanth Subramanian

Five dinner-table conversations

👵 US nursing homes are in trouble. A recent industry survey found that 34% of the country’s more than 15,000 nursing homes believe they will need to close within a year. That’s in part because nursing homes subsidize care for long-term residents with payouts from short-term ones, of which there have been few during the pandemic. Fixing this broken system will require a major overhaul.

🧶 Etsy is turning mask-only buyers into repeat customers. In its fourth-quarter earnings (which clobbered analyst expectations), the online craft-good store said that nearly half of the 3 million customers who only bought masks on the site in the third quarter came back to buy other items in the fourth. CFO Rachel Glaser called it “a great signal” for the company’s ability to retain buyers as well as its future growth.

💉 The US vaccine rollout is under-serving Latinos. Distrust in the federal government, poor vaccine messaging, and a tight-knit community culture that prizes information from peers is leading many US Latinos to side-eye their shots: One January poll found that about 20% of Latinos were likely not or definitely not going to get the vaccine. The only way forward is building better trust between healthcare providers and Latino communities.

📈 Don’t panic about US inflation. Is inflation set to increase this year? The likely answer is yes—but only by a healthy amount, and in the short term, because of how activity will resume as the pandemic subsides. There is a sign the markets anticipate this dynamic: Normally, investors expect more inflation over 10 years than over five. But in recent weeks, their calculus has changed. They now expect inflation to be higher in the next five years than over the next 10.

🍿 Movies are back, baby. Theaters in New York City, the biggest film market in the US after Los Angeles, will reopen March 5 at 25% capacity. No US Covid-19 outbreaks have been traced to movie theaters, which are currently open in 49 of 50 states—New Mexico being the lone holdout—and generally operating between 25% and 50% capacity. Still audience averse? Try taking advantage of an A+ pandemic innovation: the private theater rental.

Prime directive

Who said this?

Jeff Bezos famously set out to make Amazon “customer obsessed.” The customer wants everything as cheaply and quickly as possible. The customer may not even want to get out of bed. The customer is comfortably unaware of Amazon’s exploitative labor practices or tax-avoidance schemes. The customer doesn’t know that Amazon is intentionally losing money on deeply discounted bestsellers to make it impossible for independent bookstores to compete, to gain market share at all costs… Sometimes what we think we want and what is good for us are two different things.

🇦 Andy Hunter, founder and CEO of Bookshop.org

🇧 Kara Swisher, longtime tech journalist

🇨 Alison Taylor, executive director of Ethical Systems at the NYU Stern School of Business

🇩 James Bessen, executive director of the Technology & Policy Research Initiative at Boston University School of Law

Did you guess A? Ding ding ding! After a stellar 2020 performance bolstered by the pandemic’s impact on online shopping, Amazon founder Jeff Bezos will in a few months step down as CEO of his empire. How will Bezos be remembered? For Quartz members this week, we asked 11 thoughtful experts from business, academia, labor, and policy (including everyone listed above) to assess his legacy, and Bookshop.org founder Andy Hunter wasn’t the only one to bring some 🔥.

To enjoy the full guide to Bezos’s legacy, try Quartz membership for seven days free.

Just give me a Second Life

“Unfortunately we live in a world where we’re shown these beautiful, expensive things. That kind of lifestyle is very inexpensive in virtual life. Maybe it’s just about getting a necklace you can’t otherwise afford—it’s just as gratifying to wear one on your avatar.” —a Second Life player

As the real-world economy floundered last year, there was an economic boom on Second Life, the online world where people have lived parallel existences through their avatars since 2003. “We are seeing a 30-40% increase in overall in-game GDP,” Ebbe Altberg, CEO of Linden Lab, the company that runs Second Life, told Quartz.

How does it work? Once avatars earn Linden Dollars in the game, through the goods and services they offer, their players can cash them out into US dollars. Last year, players earned and cashed out $73 million, up from $65 million in 2019. Samanth Subramanian looked at this pandemic-fueled boom in the virtual economy.

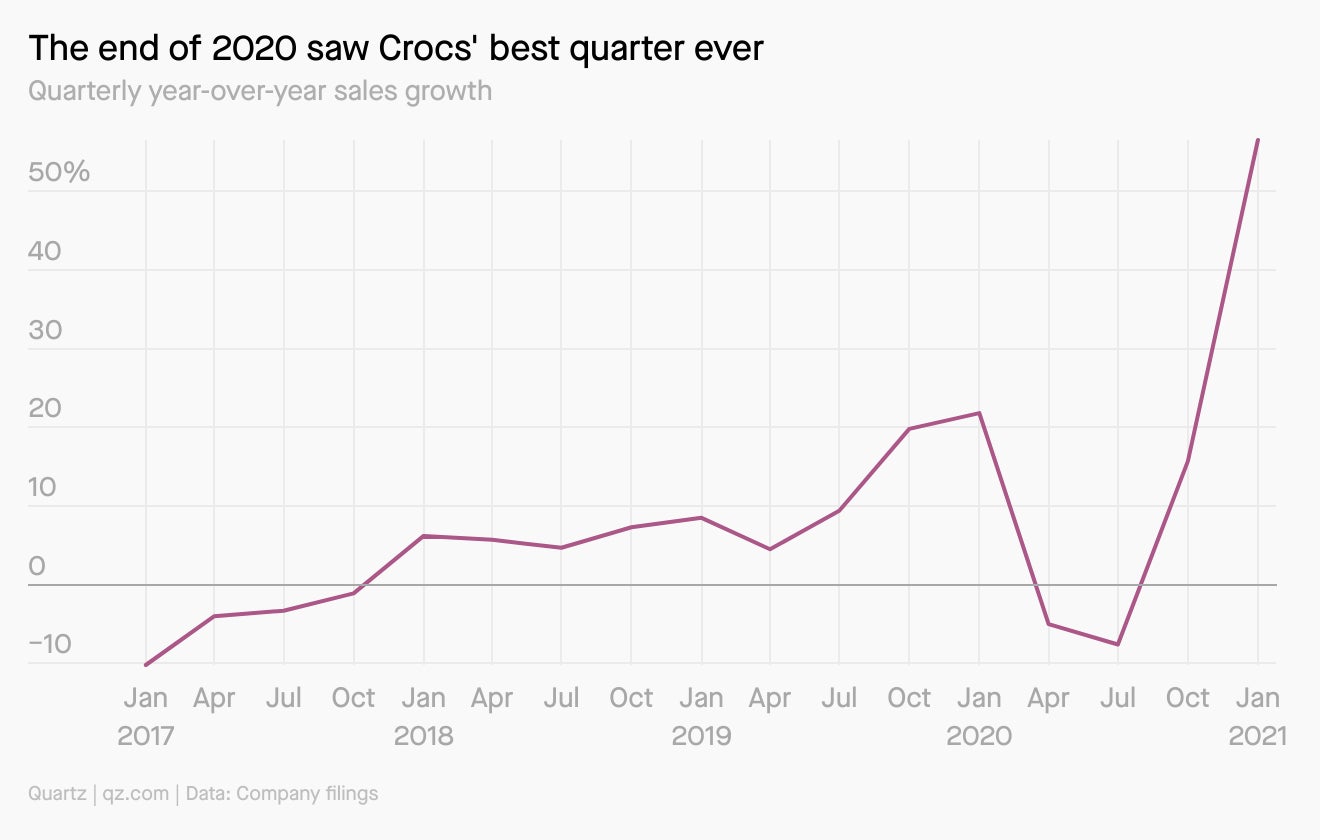

A “shoe,” in

As Covid-19 raged, Crocs became the footwear of choice for millions of workers and students prioritizing comfort while homebound. Consequently, the company closed out 2020 with the best quarter in its history. Sales of its clogs, sandals, and accessories—but mostly clogs—spiked to $411.5 million, up 56.5% over the same period last year.

Essential reading

- The latest 🌏 figures: 114.5 million confirmed cases; 64.7 million classified as “recovered;” 245 million vaccine doses administered.

- Insecure: Hackers have a whole new set of vulnerable businesses to go after in India.

- This is America: The economic rationale for whether you deserve a stimulus check.

- Real talk: Tanzania has finally acknowledged the presence of Covid-19 in the country.

- What gives? India’s vaccine committee has been mercurial in its approval processes.

- Shots not fired: Syringe shortages are causing Pfizer vaccine bottlenecks.

Our best wishes for a healthy day. Get in touch with us at [email protected], and live your best Quartz life by downloading our iOS app and becoming a member. Today’s newsletter was brought to you by Samanth Subramanian, Lila MacLellan, Karen Ho, Tim Fernholz, Katherine Foley, Adam Epstein, Marc Bain, and Kira Bindrim.