🌍 China’s economy trips

Plus: Don’t even get started on inflation.

Good morning, Quartz readers!

Here’s what you need to know

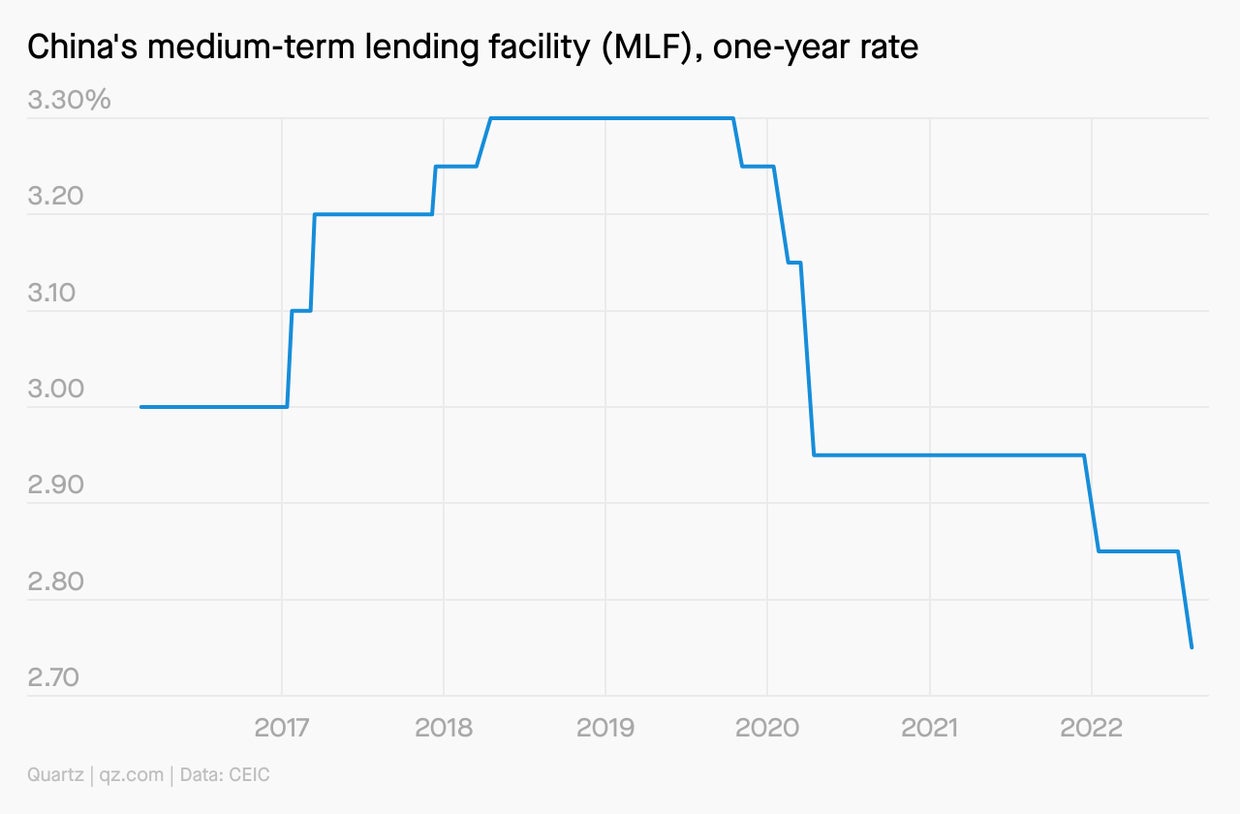

China’s central bank cut a key lending rate by 10 basis points. It hadn’t signaled any immediate plans for rate cuts, and oil prices plunged on the news of the country’s slowing economy. (See more below).

Walmart and Paramount+ struck a streaming deal. The entertainment company’s content will be a perk for Walmart’s subscribers in what’s largely seen as a challenge to Amazon. (More on Walmart’s upcoming earnings below).

Narendra Modi pledged to turn India into a developed country in 25 years. On the 75th anniversary of India’s independence from British rule, the prime minister said the world’s view of India is changing.

William Ruto narrowly won Kenya’s presidential election. Despite the votes being uploaded online for the first time ever, the delay in announcement of the election outcome came amid hacking fears.

China’s airlines could exit US stock markets. The possible departure added skepticism that both countries can reach an agreement on disclosure rules.

Thailand said it’ll invest 2.2 trillion baht ($62 billion) in industry over the next five years. The investments will target electric vehicles and medical technology as the country aims to boost economic growth.

Vladimir Putin offered to expand relations with North Korea’s Kim Jong Un. The Russian president’s message to North Korea comes as the Kremlin looks to increase weapon supply for its war in Ukraine.

The Taliban has ruled in Afghanistan for a year. Women continue to be denied their basic rights, including access to higher education, and tens of thousands of Afghans looking to leave remain in limbo.

What to watch for

Walmart and Target report earnings today and tomorrow, respectively. The US retail giants are considered to be bellwethers not just of the state of their industry, but overall American spending habits.

Both Walmart and Target have issued profit warnings as excess inventory forced a reduction in the prices of goods like apparel, which the retailers had stocked up on to avoid supply disruptions. Walmart, the largest private employer in the US, also cut about 200 corporate roles this month.

Analysts expect Walmart to report a higher revenue but lower earnings on a year-over-year basis. A similar scenario is expected for Target. A closer look at the retailers’ areas of growth can show how customers’ habits are adapting to inflation. While US inflation didn’t grow in July, food prices were still rising—which should boost Walmart and Target’s revenue in the grocery aisle, but might do little to lower those other inventory piles.

China can’t afford to worry about inflation

The about-face China’s central bank did on rate cuts caught markets and analysts off guard. It’s a strategy shift that indicates just how challenging an economic situation Beijing faces as it battles covid flare-ups, imposes pandemic lockdowns, and contends with a real estate meltdown.

As inflation rocks economies globally, for China’s central bank, recovery is still its top priority. Any worries banking authorities have about inflation will have to take a backseat to the more urgent task of trying to rev up the country’s economic engine.

Redbox’s wild ride ends quite predictably

Redbox, one of the strangest meme stocks of the retail-trading era, came to its utterly unsurprising, yet somehow still inexplicable, conclusion last week when it sold to Chicken Soup for the Soul Entertainment for $370 million.

While Redbox—the money-losing DVD vending machine company—may have been one of the dumbest meme stocks, there’s no denying it had many of the typical ingredients that have made companies like GameStop and Blackberry meme stalwarts. Redbox’s stock was cheap; it had some customer-facing nostalgia; and there was a lot of short-selling going on.

✦ Love following the quirks of the global economy? Our member support helps keep Quartz stories free and accessible to all. Become a member and take 40% off when you sign up today!

Quartz’s most popular

📈 Nigeria’s inflation rose for the sixth consecutive month to reach a 17-year high

Surprising discoveries

San Francisco thought $20,000 trash cans would help keep sidewalks clean. Yes, the bins have already been vandalized.

A drought allowed a Swiss artist’s annual river sculpture to sprawl into a castle complex... But the artist has mixed feelings: He wants the river to run, but is sad at the thought of his clay world disappearing.

…while extreme heat has unveiled shipwrecks, ghost villages, and ancient cities. For instance, a town covered by water in the early 1990s has re-emerged in Galicia, Spain.

Mattel filed a trademark lawsuit over Nicki Minaj-fronted “Barbie-Que” chips. The doll maker will be furious to learn Australians’ word for BBQ.

Instant noodles may become less cheap. Makers of the packaged noodles want to raise prices, which have stayed the same for 14 years in Thailand.

Our best wishes for a productive day. Send any news, comments, $20,000 trash cans, and shrimp on the barbie to [email protected]. Reader support makes Quartz available to all—become a member. Today’s Daily Brief was brought to you by Sofia Lotto Persio, Mary Hui, Michelle Cheng, and Morgan Haefner.