🌍 Shrinking GDP and expanding inflation

Plus: What’s going on with the yen?

Good morning, Quartz readers!

Here’s what you need to know

Hong Kong’s third-quarter GDP shrank 4.5%. The business hub’s economy contracted for the third consecutive quarter, recording its worst performance since 2020.

EU inflation hit a record high. October consumer prices rose 10.7% year on year as the bloc continues to face soaring food and energy costs.

Brazilian president Jair Bolsonaro didn’t promptly concede his election defeat. The incumbent leader’s silence has raised fears that he may contest Luiz Inácio “Lula” da Silva’s victory.

Chinese companies are formalizing their ties to the CCP. Over two thirds of Chinese-listed companies that can be traded by foreign investors in Hong Kong have incorporated the role of “Xi thought” in their businesses, according to a Nikkei Asia analysis.

Russia intensified attacks on key infrastructure in Ukraine. Missile and drone strikes have taken out water supplies for 80% of Kyiv residents following Russia’s suspension of the UN-brokered grain deal.

Germany postponed its decision on transport emissions to 2023. Political parties have disagreed over imposing a universal speed limit to curb greenhouse gas emissions.

India’s police arrested nine people following a bridge collapse. At least 140 people died after the cables snapped on a British-era suspension bridge in Morbi, Gujarat.

What to watch for

Today (Nov. 1) marks a symbolic moment in Lebanon’s three-year financial crisis—it’s the deadline set for a change in the value of the Lebanese pound that, for the past 25 years, has been pegged to the dollar at an exchange rate of $1 to 1,507.5 LBP, but is now due to skyrocket to $1 to 15,000 LBP.

The change is one of the conditions the IMF has imposed on a $3 billion loan, in a bid to unify Lebanon’s multiple, unofficial exchange rates, although it remains far below the black market rate, which is more than double.

Whether Lebanon will implement this and other IMF demands—some of which target a banking sector that has prioritized a wealthy elite—remains to be seen. The country is in dire need of political leadership to enact long-delayed reforms, but that kind of human capital can be even harder to come by than funds from global financial institutions.

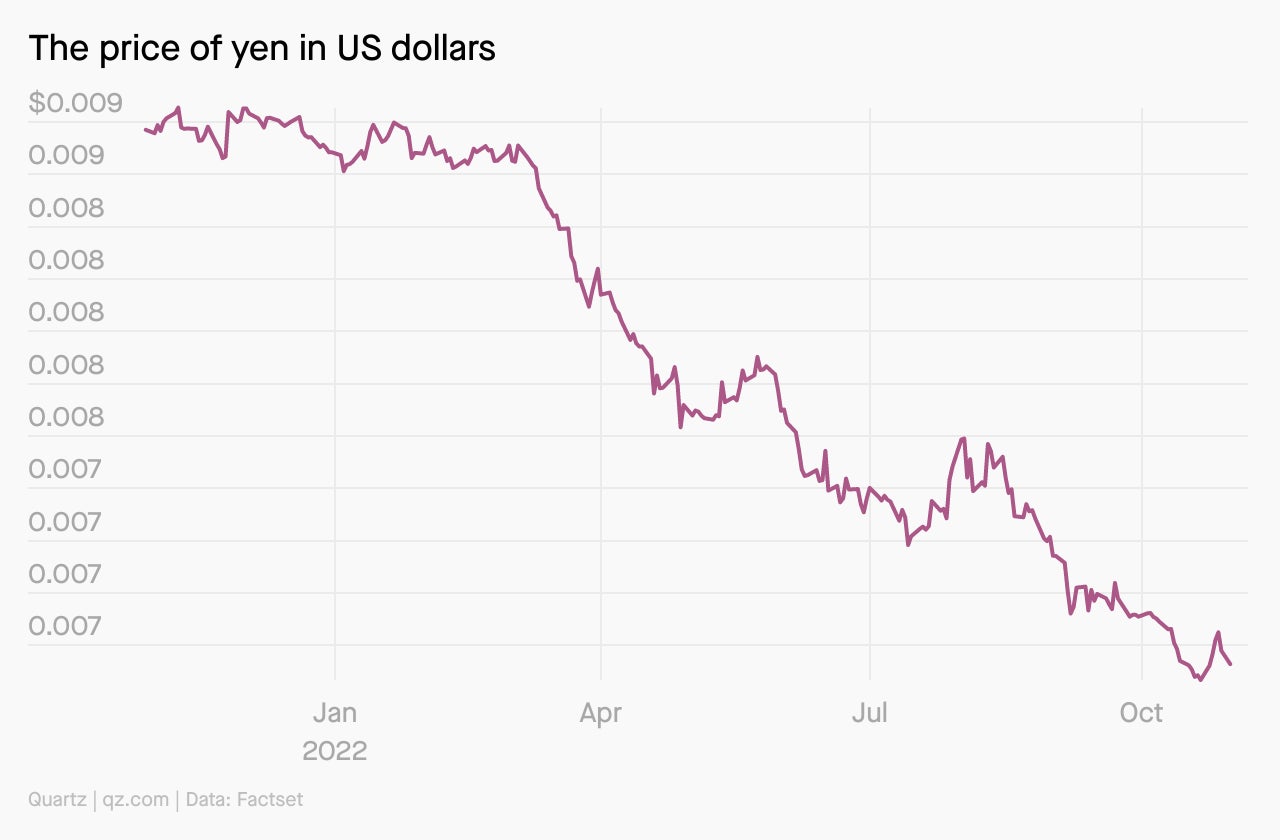

In other currency news…

Japan intervenes in currency markets by buying yen with foreign currency to prevent it from trading in a volatile way and raising import prices even more.

The intervention saves the Japanese central bank from having to raise rates in an already weak economy, but it can’t last forever. At the end of September, Japan had $1.2 trillion in foreign currency reserves.

If the Bank of Japan does raise rates, Japan’s already low-growth economy could be slowed, and it would mean one of the last central banks anchoring global interest rates would be helping all the other central banks raise the cost of borrowing.

A blue checkmark isn’t just a status symbol

Let’s say you’re browsing Twitter and see a tweet from @ScottNover of @qz. Maybe you’ve never heard of Scott or Quartz, but the blue ticks in their profiles make you think: “This is probably legit.”

Verified accounts help communicate to users that someone’s identity is real and that they work for a reputable news organization. But according to The Verge, Musk wants to start charging users $240 annually for verification. While the policy hasn’t yet been announced, it shows that Musk fundamentally misunderstands the point.

Many journalists may not be able to afford the fee, meaning the free news engine of Twitter could easily get snarled up with reports from deceptive or unaccountable actors that have money to spare. Advertisers will surely take notice. @ScottNover explains how easily this could all go down.

✦ Like reading smart, incisive analysis at the intersection of global business and policy? Sign up for a Quartz membership (it’s 60% off!), to support our work.

Surprising discoveries

The biggest plane flew some really fast vehicles. That’s the simplest way to put that Stratolaunch’s Roc successfully carried air-launch hypersonic vehicles for the first time.

A tiny bird flew a lot farther, though. One tagged bar-tailed godwit flew from Alaska to Australia, setting a migratory record.

The Swiss have further improved chocolate. Chocolatier Barry Callebaut spent 20 years working on a chocolate bar that requires half the amount of sugar to make it taste good.

NASA released an image of the sun’s terrifying smile. The coronal holes may have made the ball of gas look like a harmless emoji to some, but to us, the whole picture is cursed.

A horror video game looked too much like IKEA. The furniture chain didn’t take kindly to the resemblance.

Our best wishes for a productive day. Send any news, comments, lost in IKEA stories, and groundbreaking chocolate bars to [email protected]. Reader support makes Quartz available to all—become a member. Today’s Daily Brief was brought to you by Ananya Bhattacharya, Nate DiCamillo, Sofia Lotto Persio, Julia Malleck, Morgan Haefner, and Susan Howson.