Good morning, Quartz readers!

This is the last free edition of the Weekend Brief, which starting next Saturday will be exclusive to Quartz members. If you’d like to keep this edition coming, try a year of membership for 50% off. If you can live without the Weekend Brief but not without Quartz, subscribe to show your support. And if you’re already a Quartz member, thanks! We were just talking about you.

Okay, let’s get started.

How to create a cycle

Tell me if you’ve heard this one before.

A new platform pops up on the internet. It shows promise for a niche of creators, so they flock to it; that helps the platform grow and build viable revenue streams. Eventually, the platform gets so big that it finds the niche limiting. Maybe it even has to shed the niche to broaden its appeal, raise capital, or maximize profit. Now the creators who made the platform popular are caught: They can no longer rely on the platform, but they also can’t not rely on it: The platform is where they built a following. For many, it’s how they make a living.

This is the story of OnlyFans, a social media platform that is largely used for pornography. Last year, OnlyFans did $2 billion in sales. But last week, the company said it would ban most porn, citing how hard banks make it for OnlyFans to pay its creators. “JPMorgan Chase is particularly aggressive in closing accounts of sex workers, or any business that supports sex workers,” OnlyFans CEO Tim Stokely told the Financial Times.

Following an outcry, OnlyFans within a week reversed course, saying it had received “assurances” from banks that it could call off the porn ban. But its example is far from isolated: Because this is also the story of what we once called Web 2.0, an era of the internet defined by big tech firms getting rich off user-generated content.

Platforms know they need creators: That’s why they’re establishing “creator funds” to court and incentivize users with large followings. But how much platforms need specific creators is still an open question, and leaves creators with little choice but to avoid relying on any one platform. OnlyFans influencers may have won this round, but the saga is a reminder that tech and finance companies still hold most of the cards.

The backstory

- Financial firms are recurring characters. Before OnlyFans pinpointed banks, some assumed the ban had to do with a new Mastercard policy that will place added restrictions on adult sites taking Mastercard payments.

- OnlyFans is in search of funding. Patreon is valued at $4 billion, Cameo at $1 billion, and Substack around $650 million. But even though OnlyFans is profitable, Axios reports that it’s having a hard time finding investors.

- Porn is a recurring target. Visa, Mastercard, and PayPal have cut ties with website PornHub over allegations that it profits from exploitation, and some venture capital firms have “vice clauses” that prevent them from investing in sex-related companies.

Threat assessment

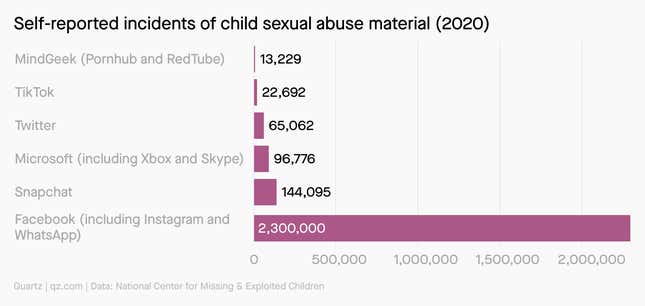

Attacks on the porn industry often cite the spread of child pornography, but social media might be the epicenter of the problem. According to an annual survey by the nonprofit National Center for Missing and Exploited Children (NCMEC), here’s how many incidents major internet companies self-reported last year.

Facebook obviously has the most users (more than 2 billion each month across its apps, compared with 689 million on TikTok and 293 million on Snapchat), and self-reported data could just indicate which companies are being honest. But while porn sites do need strong moderation practices to prevent illegal content, they are far from alone in facing or addressing the problem.

OnlyFans did not disclose annual statistics last year, but in a recent transparency report the company said it reported 14 incidents to NCMEC in July.

What to watch for next

- Preening from OnlyFans competitors. Platforms like AVNStars, ManyVids, JustForFans, and 4MyFans have already rushed in, and some claim to be better alternatives for sex workers. Savvy OnlyFans creators are likely to diversify their revenue streams.

- The next salvo from finance. It’s still unclear what banking policies caused OnlyFans to panic, which means this probably won’t be the last time creators get caught between a platform and its financial considerations.

- More crypto payments for porn. Today, PornHub users can only pay for exclusive content with a direct bank account transaction or via cryptocurrency handled by a third-party provider. Converting crypto to cash may be a hassle for sex workers, but it’s one way to bypass the financial system.

- Platforms putting emphasis on safety. Porn websites need robust trust and safety teams, and content-moderation practices. Those that have them may become more vocal about it, while pressure is likely to continue on those that don’t.

- Gig-economy concerns 2.0. The creator economy can propel online personalities to stardom, but it shares some similarities with tenuous gig work. Venture capitalist Li Jin says that to improve conditions, platforms can offer creators ownership over their subscriber lists, payment information, and interoperability with other platforms.

Take home pay

According to OnlyFans’ investor pitch deck, more than 7 million “fans” are spending money on the platform each month. Around 16,000 creators earn at least $50,000 a year, and more than 300 earn $1 million.

7 Quartz stories to spark conversation

😷 A new study shows the devastating effects of long Covid

📈 What’s behind South Africa’s 34% unemployment?

🚗 Cities that favored pedestrians over cars are reversing course

🇨🇳 A lexicon of China’s tech crackdown jargon

🤝 What would it look like if Facebook and Amazon merged?

👽 The US may have a new top secret space weapon

😶 A guide to taking critical feedback

5 great stories from elsewhere

⚖️ Corporate America made a promise. Following George Floyd’s death, top US businesses dedicated $50 billion to racial equality. The Washington Post asks where it all went.

🎓 International education is a shadowy business. The Walrus looks at higher education’s dependence on international students, who are sometimes set up for failure.

🏡 The bias behind mortgage-approval algorithms. An investigation by The Markup found that loan applicants of color are sometimes 250% more likely to be denied than white applicants.

🚰 Water shortages are brewing wars. Water scarcity affects 40% of the world’s population, and BBC Future predicts the scale of conflicts will grow as demand does.

🥘 Yugoslav cuisine is a paradox. Vittles interrogates what happens to a national cuisine when the nation technically no longer exists.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Best wishes for a creative weekend,

Scott Nover, emerging industries reporter (too old to be a creator)

Kira Bindrim, executive editor (definitely too old to be a creator)