Good morning, Quartz readers!

Here’s what you need to know

Russia said it’s cutting off Poland’s gas supply. The escalation comes after Poland refused to pay for Russian gas in rubles. Meanwhile, Germany said it hopes to find alternatives to Russian oil within just a few days.

Oil prices rose on China’s stimulus plans. The country’s central bank announced plans to support the Chinese economy through covid lockdowns, prompting oil markets to rebound.

Europe warned Elon Musk against skirting new rules. The EU and UK said Twitter will still have to comply with laws regulating harmful content, even with Musk at the helm.

Fears grew that Russia’s war has spilled over to Moldova. The US said it was monitoring reports of explosions in Transnistria, a region of Moldova controlled by pro-Russian separatists that borders Ukraine.

Beijing sought to thwart a covid outbreak. The government ordered about three-quarters of the city’s 22 million residents to get tested for covid in an effort to avoid a lockdown like Shanghai’s.

Delta will pay flight attendants while boarding. Facing a union campaign, the airline said it will pay staff for working while passengers are boarding, as opposed to when the plane’s doors close.

Big tech companies reported quarterly earnings. Microsoft’s earnings rose thanks to continued demand for its cloud services, while Alphabet’s earnings fell short of expectations.

What to watch for

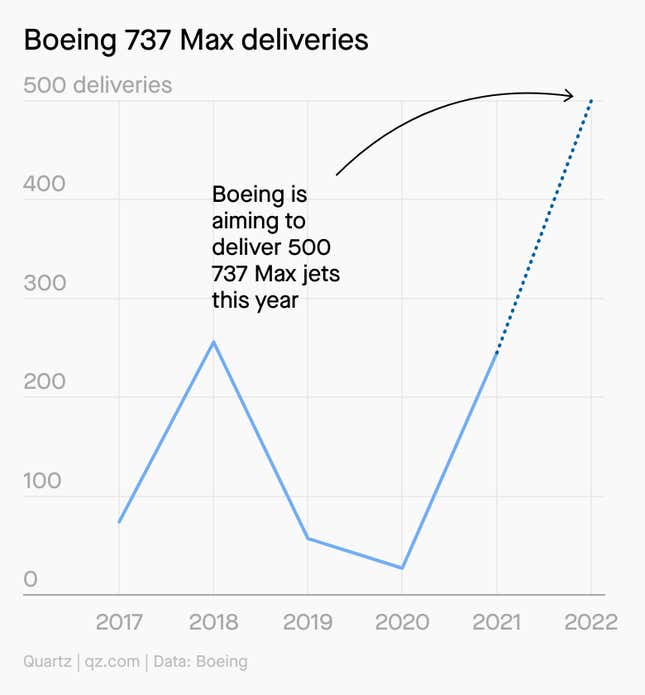

Boeing reports quarterly earnings today. It’s been three years since the airplane maker’s 737 Max jet was grounded worldwide following two fatal crashes, resulting in its first annual loss in more than two decades. The company made a series of changes to the aircraft, and most countries are now allowing the 737 Max to fly again—an uptick in deliveries of the plane is expected to boost Boeing’s earnings.

But the manufacturer is fighting other headwinds. Production of its 787 Dreamliner jet has been stalled since last May and deliveries aren’t expected to resume until the second half of 2022. A Boeing jet flown by China Eastern also crashed on March 21, causing the airline to temporarily ground more than 200 planes.

The black box hasn’t revealed conclusive evidence regarding the cause of the crash, and China Eastern recently started flying the Boeing model, a 737-800, again.

What can kill Twitter?

Though the idea of Elon Musk buying Twitter has certainly gotten hands wringing, it’s unlikely any actions he does in the name of free speech will be what causes Twitter’s demise. Yes, the platform has been working for years on curbing hate speech, and unleashing the trolls will undoubtedly be bad for its bottom line. No matter what business model(s) the network pursues under Musk—advertising, subscription revenue, NFTs—there are financial perils to letting hate speech and misinformation fester. Among them is a potential exodus of users and advertisers.

But that won’t seal the deal. It would have to be a combination of two factors that send it the way of MySpace:

😱 A user experience that gets worse and worse

🤺 A very, very good challenger enters the arena

In a lot of ways, Facebook has been here before, and Twitter would do well to learn from Meta’s mistakes.

Can anything kill a nation’s debt?

Well, the first problem is that many people see national debt in a similar light as personal debt. In reality, it operates completely differently.

Pop quiz: What measure of national debt should we really pay attention to?

- The big (and ever-growing) sum of everything that’s owed

- The debt-to-GDP ratio

- A country’s ability to service the debt, or the cash needed to repay interest and principal on debt that’s owed in a year

Answer: C

🎧 Want to know why? This week’s episode of the Quartz Obsession podcast looks at the world’s complicated relationship with national debt.

Listen on: Apple Podcasts | Spotify | Google | Stitcher

Sponsored by EY

Handpicked Quartz

Our most popular stories this week.

🤑 Fifth on the list, Gautam Adani is coming for the “world’s richest man” title

😬 Indian exports to Russia are costing businesses a fortune

💸 Your “no annual fee” credit card is costing you $700 a year, US retailers say

👗 Nigeria’s $1 billion plus-size market shouldn’t have to fight so hard for inclusivity

🌴 Indonesia’s palm oil export ban could fuel food inflation

✦ Love stories like these? Support our mission by becoming a member—use code MAKEBIZBETTER to take 50% off.

Surprising discoveries

Robotic hamburger helpers are joining the line. Miso Robotics will provide US chain Jack in the Box with “Sippy,” a drink machine, and “Flippy 2,” a burger-flipping bot.

Turns out spider sex is all about the smash and dash. Researchers theorize male spiders catapult off females post-coitus to avoid being cannibalized.

Nike “CryptoKick” NFT sneakers are selling for over $100,000. One pair of these digital shoes is selling for over $500,000 (200 ETH).

In other unwearable footwear news, a 1,700-year-old sandal was found in Norway. A hiker discovered the Roman-style shoe in the Horse Ice Patch mountain pass.

Scientists detected all of DNA’s building blocks on meteorites. Long ago space rocks may have brought these elements for life to Earth. Thanks, space rocks!

Our best wishes for a productive day. Send any news, comments, shoes one can wear, and spiders that aren’t afraid to stick around to hi@qz.com. Get the most out of Quartz by downloading our iOS app and becoming a member. Today’s Daily Brief was brought to you by Julia Malleck, Kira Bindrim, Susan Howson, Courtney Vinopal, and Morgan Haefner.