Good morning, Quartz readers!

Here’s what you need to know

Investors await the Fed’s decision on interest rates. A 0.75-percentage-point rate rise is in the cards.

Mortgage rates in the US shot past 6%. As the hot housing market begins to cool down, real estate firms Redfin and Compass announced job cuts.

The euro and the US dollar could be a month away from parity. Wells Fargo predicts the euro, currently worth $1.04, is about to reach $1 for the first time in 20 years.

Coinbase is laying off 18% of its staff. The cryptocurrency exchange platform is cutting about 1,000 jobs as its executives warn of a “crypto winter.”

US tampon manufacturers pledged to ramp up production. Shortages across the country, attributed to supply chain issues and staff shortages, are driving up menstrual product prices.

BTS announced a hiatus, and HYBE stock plunged. Neither the K-pop group’s agency, which lost $1.7 billion, nor its fans were bulletproof to the news.

What to watch for

On Thursday, Russia will release its final GDP figures for the year’s first quarter. Broadly, they will confirm the preliminary data released in May: a 3.5% rise from the previous year.

But the certainty ends there. That first quarter was only partially affected by sanctions and military expenditure. Subsequent quarters will likely reveal a very damaged economy. Russia’s economic ministry expects GDP to shrink by 7.8% in 2022; a World Bank report predicts 8.9%; another economist forecasts a catastrophic 30% contraction.

On June 24, Russia has to make a $159 million bond payment—except that the US Treasury has canceled its license, making such payments harder. If Russian data can be trusted, a better picture of its economy will emerge in August, when second-quarter GDP figures show the full impact of sanctions.

Vaccine inequality is here to stay

Monkeypox hasn’t officially been designated as a health emergency of international concern, but rich countries are already hoarding smallpox vaccines. In the absence of dedicated monkeypox immunization, it can provide protection up to 85%.

Bavarian Nordic, the maker of the most updated vaccine against smallpox, has signed several contracts (mostly in confidential terms) with governments wishing to procure more than enough doses to protect their vulnerable populations.

So far, the US, a key investor in the vaccine’s development, has ordered 500,000 doses on top of the 1.5 million it had in its stockpile. The rush to procure doses echoes the hoarding that led to severe covid vaccine inequality.

The World Health Organization has asked countries to share information on their smallpox vaccine and therapeutics stockpiles, and to be available to share them with countries in need. The call has yet to be answered.

A Sriracha shortage is coming

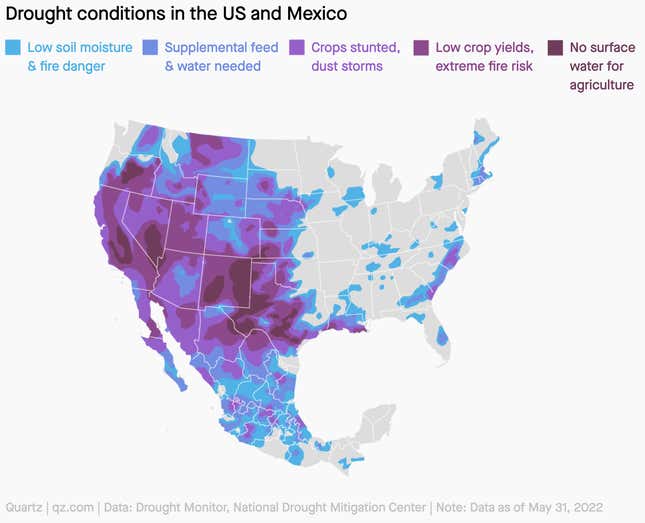

Lovers of Sriracha, Chili Garlic, and Sambal Oelek may have to go without their favorite hot sauces for months. An ongoing chili shortage, stemming from drought and supply chain snafus, have led Huy Fong Foods to halt Sriracha production. The company has told stores that the sauces on their shelves is all they’ll have for a while.

Huy Fong produces 20 million bottles of Sriracha per year, requiring about 100 million pounds of peppers. Where are all those peppers from? They’re usually sourced from Mexico, California, and New Mexico—all of which are experiencing droughts.

✦ Love stories like these? Support our journalism by becoming a Quartz member. Sign up today and take 40% off.

Quartz most popular: Gas vs. electric

📈 Gas prices are so high they’re making governments suspicious…

🤔 …but where in the US are prices the highest?

🔌 Could $5 a gallon gas finally get Americans over EV sticker shock?

🚘 If so, maybe they’d like the Chevy Bolt.

⚔️ In Europe, competition from Chinese EVs is testing the continent’s trade defenses…

🌍 …while the race is on for the world’s first electric air taxi.

Surprising discoveries

Ads still play even after TVs are shut off. Advertisers spend an estimated $1 billion a year to stream while TVs dream.

Armadillos are weekend hippies. Researchers can’t figure out why the armored mammals keep traveling away from where they’re supposed to be in the US.

Need new data on nearly 2 billion Milky Way stars? The European Space Agency has you covered.

Hong Kong’s giant floating restaurant closed. Established in 1976, Jumbo Floating Restaurant was towed away by tugboats after struggling to stay afloat financially.

A mastodon’s tusk can tell you everything about the animal’s life. No need to keep a journal.

🎙 Listen on: Apple Podcasts | Spotify | Google | Stitcher

Our best wishes for a productive day. Send any news, comments, armadillo postcards, and mastodon diaries to hi@qz.com. Reader support makes Quartz available to all—become a member. Today’s Daily Brief was brought to you by Samanth Subramanian, Sofia Lotto Persio, Julia Malleck, Annalisa Merelli, and Morgan Haefner.