Quartz Future of Finance: Bitcoin is worth between $20 and $100,000

Hello readers!

Hello readers!

I’m back from hiking in the Dolomites, where I twisted my ankle, chipped a tooth, and got engaged. I couldn’t be happier!

You know who else is happy right now? People who own bitcoin, which has more than doubled in price in the past six months to around $11,000. The bulls remain bullish: Mike Novogratz, founder of Galaxy Investment Partners, thinks it could rise to $20,000 or more this year. Anthony Pompliano, co-founder of Morgan Creek Digital Assets, says there’s a good chance the original crypto asset will soar to $100,000 by the end of next year.

UK financial regulators, however, are wary of even attempting to value bitcoin and its crypto cousins. The Financial Conduct Authority (FCA) is considering banning derivatives linked to cryptocurrencies, in part “because there are no reliable methods to establish a fair value or price for the underlying tokens.”

Unlike other sorts of assets available to speculators, from pork bellies to Japanese yen, crypto coins typically don’t have physical uses, future cash flows, or legal acceptance as money. Instead, crypto prices are “largely driven by speculation,” the regulator wrote in a consultation this week. I couldn’t immediately reach Novogratz for comment, which I sent by email during a US holiday. Pompliano said there wasn’t much to add beyond his explanation here.

To demonstrate how difficult it is to value bitcoin and the like, the FCA showed that analysts using the same bitcoin model came up with wildly different prices, ranging from $20 to more than $8,000. Although bitcoin is a fungible commodity, prices can vary by $3,000 from one exchange to another.

The UK regulator also noted that prices for so-called “utility tokens,” which are supposed to act sort of like coupons in a digital system, tend to be closely correlated with the rest of the crypto market. “This suggests that these markets are not driven by external factors such as usage or technological developments, but instead are driven by speculation, akin to gambling,” the FCA said.

Of course, crypto enthusiasts are far from the only ones making making forecasts for risky assets. Investment banks and hedge funds employ legions of financial analysts who do the same thing, trying to predict everything from sugar prices to Alibaba shares. Forecasts by bulls and bears for Tesla stock, which is plenty volatile, range from $10 to $500. (It is currently trading at around $235.) Even that huge spread pales in comparison to crypto valuations, according to the FCA’s research, to say nothing of traditional currencies, which trade in a tight band.

The UK regulator said it recognized that a crypto derivatives ban could drive people into unregulated tokens—which it says are not appropriate investments for retail consumers—and will continue warning them of the risks in its ScamSmart pages.

The FCA thinks a derivatives ban is the best way forward because retail investors are more influenced by get-rich-quick schemes on the internet than advice from authorities. While a small number hit the jackpot, it estimates retail consumers have lost around £234.3 million ($294.8 million) annually on crypto derivatives. “Many will continue to be influenced by social media and a desire to seek quick, high returns,” the FCA said.

As for Novogratz, he thinks bitcoin is a great investment. He told Bloomberg Television this week that its recent rally was driven by excitement based on “real reasons,” pointing out plans by Facebook and its partners like Uber to launch a cryptocurrency called Libra.

Libra validates the idea that smart people think distributed-ledger technology has promise. But the value of Facebook’s crypto token will be tied to fiat currencies that are deposited in traditional banks within the traditional financial system. Libra’s reliance on government currencies is arguably proof that free-floating crypto tokens are too volatile, and too difficult to value, to become a reliable mechanism for payments.

Still, bitcoin’s longevity signals there’s something going on here. For one thing, its history of rollercoaster price swings makes it one of the most impressive speculative vehicles of all time. Put another way, it could long remain a fun way (for some people) to play the lottery. And perhaps, one day, central banks will borrow bitcoin’s underlying technology for their own purposes. But that doesn’t mean there’s a reliable way to value bitcoin or its spinoffs, or that it will ever join the ranks of reliable assets that form the basis of the financial system.

This week’s top stories

1️⃣ Robinhood execs intentionally didn’t ask permission to launch a checking and savings product, according to Business Insider. While Silicon Valley has sidestepped regulation in other industries, financial watchdogs are keen to stop it from happening in their own sector.

2️⃣ To this end, UK watchdogs are already warning Libra to “get it right the first time round.” The Financial Conduct Authority says it has little patience for any company planning to move fast and break stuff. At the same time, central banks are feeling the competitive heat: they don’t want to become the taxis that were run over by Uber’s disruptive service.

3️⃣ Speaking of Uber, the company is offering debit cards to its drivers in Mexico, as tech companies look for ways to engage the country’s large unbanked population. The ride-hailing company is becoming a hook for bringing people into the financial system.

4️⃣ Installment loans, which have been around since the 1800s, are the new credit cards. As popularized by Max Levchin’s Affirm, digitized installment loans are catching on from Australia to Vietnam.

5️⃣ A retired policeman has patented an app that detects telephone banking scams. The inventor’s 90-year-old father was a victim of such fraud, which targets 80,000 people a year.

Heard on headphones

“It could well be, now that some of these tech companies are moving into the tech-fin area, we will see a great battle of the giants, between all the very large banks and the large tech companies and whether they are going to sort of be at each other’s throats to conquer an interesting market.”—Christine Lagarde, head of the IMF and nominee to be president of the European Central Bank, in a Quartz member exclusive video

The future of finance at Quartz

Alipay is adding beautifying filters to its facial recognition systems. Some 60% of people in a poll said face scans for payments made them feel ugly.

For most people in developed countries with stable currencies, using Libra would introduce added currency risk into their lives. The reserves backed Libra may also reflect a form of active investment management.

Facebook and its partners aren’t the only ones dreaming up a new currency. A regional bloc of West African countries have revived a plan to a start a regional currency next year called the ECO. The dream is alive, but it still appears out of reach.

Bob Collymore, who oversaw the expansion of Kenyan telecoms firm Safaricom, has died. He helped drive the company’s foray into digital services, including the popular mobile-money service M-Pesa.

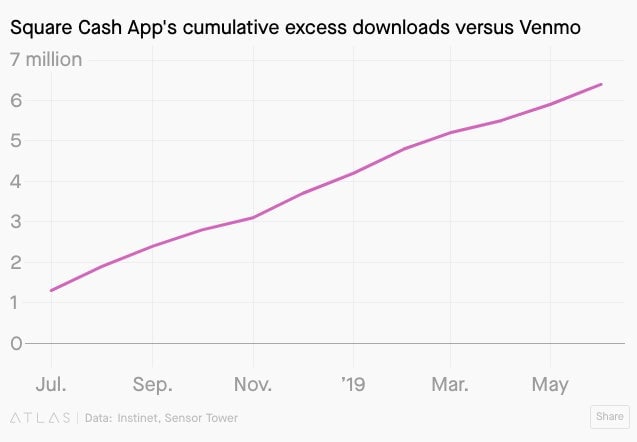

Square’s Cash App downloads are pulling further ahead of Venmo. Lower-income Americans have flocked to Square’s app, suggesting it could disrupt the prepaid card industry that underbanked consumers rely on.

Always be closing

- JPMorgan is reportedly looking to buy a stake in digital banking platform 10X Future Technologies, which was started by ex-Barclays chief Antony Jenkins.

- Online lender Zopa is looking to raise as much as £200 million ($253 million), as it seeks a UK banking license.

- Small business lender Kabbage secured a $200 million revolving credit facility.

- Sensibill raised $31.5 million. The Toronto-based digital receipt startup targets small businesses and freelancers.

- Open, a Bangalore-based neobank for businesses, landed $30 million.

- European exchange Euronext invested €5 million ($5.6 million) in Tokeny, which puts securities on a blockchain.