Quartz Future of Finance: Revolut is tracking you

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

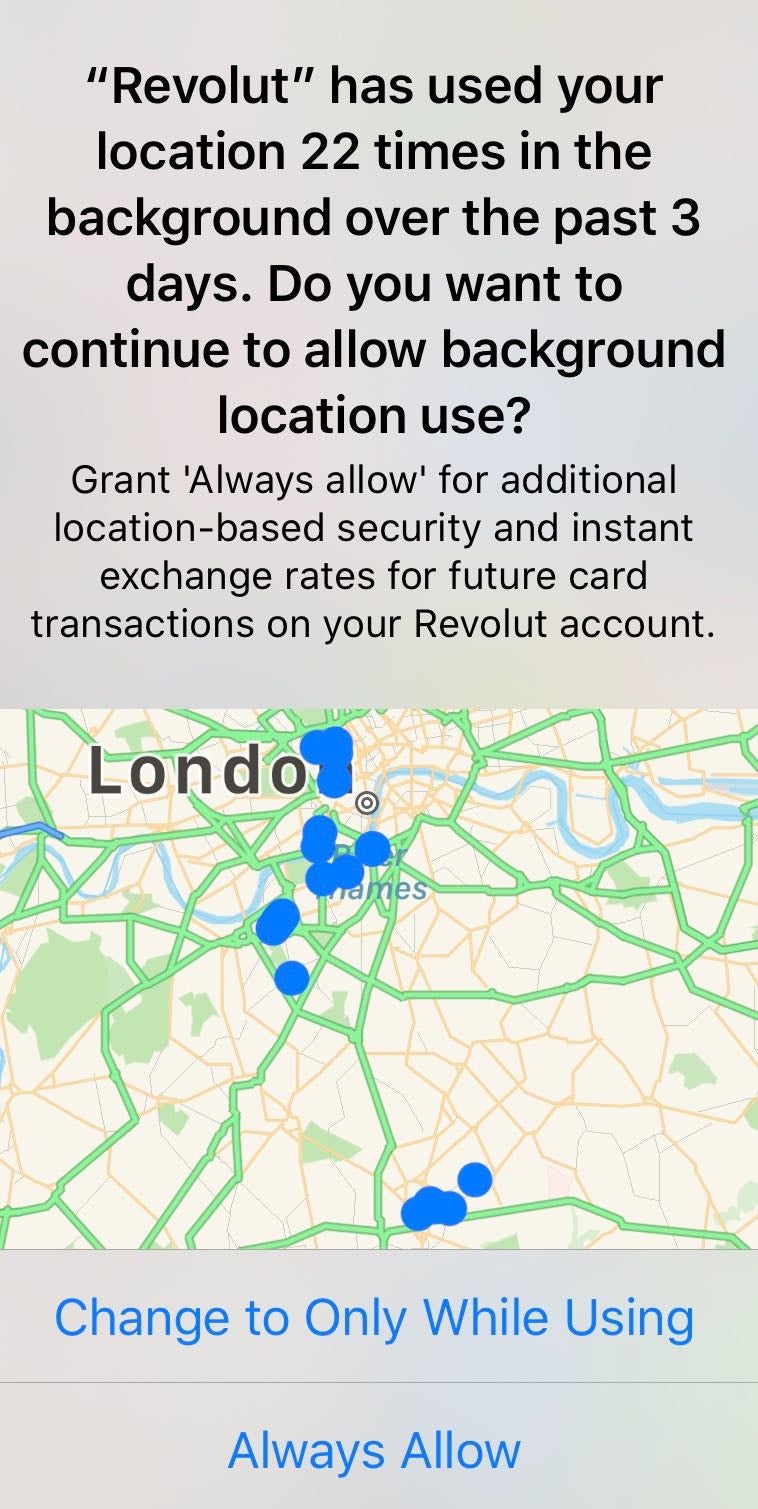

Last weekend I got a surprising alert on my iPhone: it told me that Revolut had been tracking my location in the background. Evidently, it had used my coordinates 22 times over the previous three days, even though my Revolut debit card was frozen. I hadn’t used Revolut since August.

The message popped up because I finally downloaded the latest version of Apple’s mobile operating system, which apparently tattles on other tech companies and their use of location data. Quartz’s Zach Seward wrote about this sort of thing in September: Whereas Revolut checked my location 22 times over three days, Google Maps had apparently used his location data three times in a similar span. Citizen, an app for crowdsourcing crime reports, had used it 32 times.

Beibei Li, an assistant professor at Carnegie Mellon University’s Heinz College, says she has seen even more aggressive location tracking, with some apps collecting coordinates every 15 minutes. “Twenty-two is not that bad,” she said in a phone call.

Revolut was able to access this data because I hadn’t adjusted the the location sharing setting on my phone (it was set to “Always” share, instead of “While Using the App” or “Never”). One way Revolut uses this data is for security, such as making sure that debit-card payments and the location of my phone aren’t suspiciously far apart. A spokesperson from Revolut provided this statement:

“For users that have given permission to share their location, the data is used to enable location-based card security, transactions, near me payments, insurances and airport lounges. We plan to include location tracking to further enhance our security and protect our customers in new global markets. Customers can opt out of sharing their location at any time via the Revolut app or their device’s privacy settings.”

And here’s why my location data was accessed up even though the card was frozen:

“Location-based data is not exclusively used for cards, it is also linked to other features such as insurance. Unless it is disabled it will continue to operate even if a payment card is not in use.”

I had a look at Revolut’s privacy policy to see what other information it collects. In addition to transaction information and location tracking, it can also tap into the phone’s address book, photos, videos, check-ins, and other digital content. “The Revolut app will regularly collect this information in order to stay up to date,” according to the policy.

It makes sense to access photos and videos for, say, know-your-customer (KYC) checks when you open an account. And the app may need access to my address book when I’m sending money to a friend. But it seems odd for a company to have carte blanche access to these things. (Turning off access means users may lose the use of certain features.)

It’s important to note that the company doesn’t sell user data, according to its privacy policy, and a spokesperson said it will never do so. Unlike Facebook, which makes money by harvesting personal data for ad targeting, Revolut operates a freemium model. You get some stuff for free, and if you want additional features you have to pay a recurring fee.

Even so, Revolut appears to have access to an immense amount of user data. Carnegie Mellon’s Li says there’s “huge” value in this kind of information. It can be used to personalize services, as well as cross-sell products. (I’ve gotten popup notifications from Revolut in the past, letting me know about exchange rates when I’m abroad, or advertising insurance when I was on a ski trip.)

Some, like Revolut’s CEO, think the future of finance will feature fully automated digital advisors offering everything in one place, from mortgages to pensions. To get there, companies are going to need vast amount of personal information. Li thinks the costs of storing and processing so much data are manageable, and that security and protection of this data has improved greatly. But these services will only work if customers trust companies enough to share their data with them.

This week’s top stories

1️⃣ Not backing down: The Financial Times (paywall) published documents that it says cast more doubt on Wirecard’s accounting practices. The report follows claims from the German payment company that the FT’s stories about it were inaccurate.

2️⃣ Apple is suffocating competition in payments to give its mobile wallet an edge. Executives in Europe have grumbled to Quartz about the tech company’s grip on the iPhone’s near-field communication tech. Now, mLex reports that Brussels is again probing Apple Pay.

3️⃣ Ant Financial says smaller Chinese companies are handling the country’s economic slowdown just fine. Chairman Eric Jing told Bloomberg that the company still sees strong demand for credit.

4️⃣ Paytm is looking to raise $2 billion from the likes of Softbank and Ant Financial. The Financial Times (paywall) reports that the Indian payment company is looking to fortify itself against competition from Amazon and Walmart.

5️⃣ Goldman Sachs is spending less on humans and more on tech. The bank set aside 35% of revenue for staff benefits and compensation, according to CNBC, the least since at least 2009.

The future of finance on Quartz

As we talked about last week, questions abound about sky-high neobank valuations. Point 72 Ventures thinks investing in neobank-style software makers can be a better bet than neobanks themselves.

Bank branches are closing all over the world. But American community banks in isolated places are doing just fine. They have deep local roots, and their loan and asset growth can exceed bigger national chains.

Government officials should be asking Facebook about WhatsApp Pay, not just Libra. The social network’s cryptocurrency has run into massive skepticism, but its payment ambitions are still going ahead around the world.

The tech unicorn hangover is giving Goldman Sachs a headache. The Wall Street bank’s revenue from investing in equities fell to $662 million during the third quarter, that unit’s worst performance in more than three years.

Always be closing

- Warren Buffett is seeking permission from watchdogs to increased his stake in Bank of America beyond 10%.

- Revolut is looking to raise $1.5 billion in a combination of equity and convertible loans, valuing the company at as much as $10 billion, according to Sky News. The loan will reportedly convert to equity if the company obtains a US banking license.

- Chime is looking to raise money in a deal that could value the US company at more than $5 billion, according to Bloomberg. (It also suffered a service outage this week.)

- Galileo Financial got $77 million in funding from Accel Partners. The company handles backend integrations for financial firms.

- CrossLend, a debt marketplace company in Germany, raised €35 million ($39 million) from investors including Santander.

- Lemon Way raised €25 million. The Paris-based company processes payments for e-commerce.

- Switzerland’s Apiax, which makes regulatory technology, pulled in $6.6 million in funding.

- Sweden’s Klarna has an agreement with Samsung, which will provide more payment options on the tech company’s website.

- Dealroom and Finch Capital published a report about the state of European fintech (pdf), which covers the sector’s funding and exits.

I hope your week has been a profitable one (pick your own metric). Please send any location data, tips, and other ideas to [email protected].