Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

Last week I got an email from Clive Mira-Smith, who says he’s a Revolut customer originally from Britain whose accounts with the fintech have been frozen. He’s a retired anthropologist now living in France, and he regularly uses Revolut to swap from money from pounds to euros. Mira-Smith says he hasn’t been able to access his business and personal accounts for weeks, and that he relies on these funds to go about his daily life.

Frozen bank accounts have been in the news in the UK lately. Monzo was investigated by BBC Watchdog, which said the number of cases it had heard about raised questions about whether the upstart bank “is getting it wrong when it comes to freezing accounts.” The BBC suggested that Monzo had grown quickly and that its compliance procedures weren’t keeping up. Monzo says it seldom blocks accounts and most customers don’t even know it happened.

There are a number of complaints on Trustpilot and social media about blocked accounts at Revolut, which has been dinged in the past for compliance concerns. A spokesperson for Revolut said the company is working to improve its customer service operations. “This year alone we have opened a new global customer service office in Porto and made over 500 hires in customer support roles, bringing our global total to over 800 people,” the company said. “By the end of the year we’ll have quadrupled the size of our team that checks and unlocks accounts to make this process as efficient as possible while fully adhering to our regulatory obligations.”

This is a customer-relations nightmare for banks—not just the new digital ones. (It goes without saying that it’s annoying for customers, too.) Once a bank has made, or is planning to make, a Suspicious Activity Report (SAR), the financial institution is required to avoid “tipping off” the customer about the investigation, according to Nick Brett, a partner at law firm Brett Wilson. “The banks go into lockdown and obviously customers get extremely frustrated because it happens a lot,” Brett said. Some “99% of those to whom it happens are entirely innocent people,” he added.

Brett said most major problems with frozen accounts, in his experience, come from two or three banks that have been around for a long time. He suspected that newer institutions, with simpler and more streamlined back offices and compliance functions, could actually be more adept at handling these breakdowns. But this all assumes that fast-growing startups invest in enough customer support to keep up with the problem.

Venkatesh Varadarajan, a partner in financial services at Infosys Consulting, also said there’s probably not much difference between neobanks and traditional banks when it comes to frozen accounts. Arguably, the bank that takes the toughest line on guarding against money laundering is also going to end up freezing the most accounts, many of them unnecessarily, causing anger and serious problems for their customers. “It all depends on a bank’s approach to risk and compliance,” Varadarajan said.

Despite the seriousness of this issue, nobody knows how many accounts each bank has frozen in the UK. The National Crime Agency publishes SAR data, but that information doesn’t indicate whether Revolut and Monzo act any differently from other institutions. If there’s a bank that consumers should avoid for its account-freezing practices, there’s little way to know. This is a surprising oversight given the hardship that a frozen account causes.

In the meantime, the number of blocked accounts is likely increasing as governments try to clamp down on money laundering. Cross-border transactions—like a large sum sent to buy a house or pay for a wedding—can trigger an algorithmic alert that results in an account freeze. “It’s becoming a much more frequent problem,” Brett said.

Mira-Smith, the retired anthropologist who is still waiting to access his money, says he understands the regulations and that there’s a limit to what banks can tell him. He said he has never had an account frozen before, and now it has happened multiple times in a short span. He says his frustration is with unhelpful automated responses from Revolut, and hours spent on chat lines waiting for some kind of answer. “I think others should be warned of the difficult situation which they could totally unexpectedly find themselves in,” he wrote.

This week’s top stories

1️⃣ Civil rights groups have been pressuring Facebook for years about its ad targeting tools. Quartz took a deep dive into the company’s “Lookalike Audience” algorithm, and the risk of this tool making bank and other financial-service ads invisible to people because of their age, gender, or race, which is forbidden by US federal law.

2️⃣ Banks are lobbying against Big Tech, according to Politico. Trade groups want to block industrial loan charters that technology companies could use to offer credit.

3️⃣ Gretchen Howard left one of Silicon Valley’s most high-profile venture jobs to work at Robinhood. She tells CNBC that working at the fintech is similar to working at Google a decade ago.

4️⃣ Digital financial services will generate at least $38 billion of annual revenue in Southeast Asia by 2025, according to Bain, Google, and Temasek Holdings. Online lending will make up about half of that amount, as payments offer a gateway to other services.

5️⃣ Machine trading is putting pressure on the financial terminal business, the Financial Times (paywall) reports. Companies like FactSet are looking for new markets.

The future of finance on Quartz

Nubank’s app has been downloaded more times in the past year than Revolut, Monzo, and N26 combined. The Brazilian company’s rapid growth shows the promise of mobile banking upstarts in markets that lack adequate financial services.

Zimbabwe is getting another new national currency. The country has become reliant on mobile money and its economy is suffering from cash shortages.

Stock trading fees are falling fast. The same can’t be said for crypto, in which expenses, or “convenience fees,” are sky high.

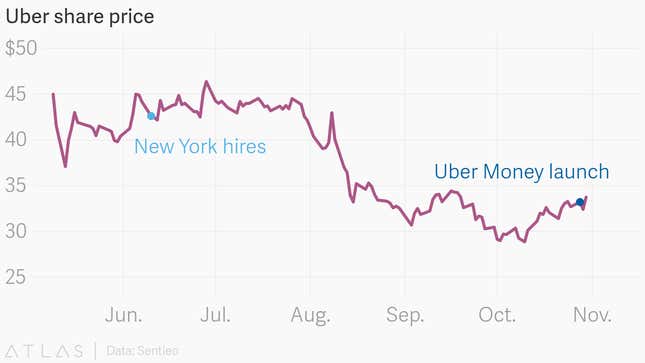

Investors aren’t impressed by Uber’s drive into fintech, known as Uber Money. Even so, one investor I interviewed thinks the company’s gig workers could be attracted to services like cheap remittances.

See you next week?

I’ll be at Web Summit in Lisbon on November 5th and will moderate two panels the next day. I’ll be talking about fintech and unicorns with Plaid, OakNorth, Airwallex, and Deposit Solutions. If you’re around on the evening of the 5th or 6th, hit me up!

Always be closing

- Irish peer-to-peer lender Flender got a €75 million ($83 million) funding line.

- Freetrade, a UK commission-free stock investing app, raised a €13.4 million.

- US home insurance platform Young Alfred got $10 million in funding from the likes of Gradient Ventures.

- GP Bullhound led a $10 million investment in RavenPack, an analytics provider for hedge funds and banks.

- TrueLayer, an API platform, has a strategic partnership with Visa.

- Mortgage comparison company Own Up raised $8.5 million.

- British consumer credit-reports startup TotallyMoney got £5 million ($6.5 million) in debt funding from Silicon Valley Bank.

- UK fintech lender Koyo raised £3.8 million in debt and equity funding.

- Trade Ledger, platform that automates commercial lending, raised £1.5 million.

- Greensill bought early-salary payment company Freeup.

- RBS, Mastercard, Motive Partners, and EFM Asset Management invested in Pollinate, a merchant acquiring and services startup.

I hope your week has been a profitable one (pick your own metric). Please send any complaints, tips, and other ideas to jd@qz.com.