Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

This week N26 said it has grown to 5 million customers, a figure that doubled over the course of 2019. The company is aiming to become the world’s first global retail bank, and numbers like this seem pretty impressive. But they also leave a lot to the imagination. It’s like a dating profile with a person’s height and no other information.

There’s obviously wiggle room in what counts as a user and how many continue using the app after downloading it. While bank investors tend to focus on things like assets, deposits, and return on equity, a big customer number tells you little about these factors, not to mention profitability and revenue. I’m going to venture a guess that these more detailed numbers don’t get disclosed because they aren’t as impressive.

That said, N26 should keep doing this as long as they can get press coverage without providing other meaningful numbers. N26 sent me the press release, but when I pressed for daily-active-user and monthly-active-user information, among other things, I didn’t get a response. Why should I? The company’s media strategy is working without having to disclose that stuff (although startup banks have sometimes been forthcoming in the past).

We can make some guesses about N26’s monthly active users. In 2018, London-based financial app Revolut told me it had 2.8 million customers, and some 1.2 million of them were active monthly. If that 43% ratio is roughly accurate for N26, that could put them in the neighborhood of somewhere around 2 million monthly active users.

It’s also debatable how much insight the monthly-active data offers. Stone Atwine, founder of payment and banking wallet Eversend, pointed out that these statistics might be useful for social media companies that sell advertising, but their usefulness for financial startups is less clear. “The thing about fintech is we make revenue or consider people active if they actually make a transaction,” he said. A startup can send a push notification to get users to open the app, but that isn’t necessarily a money-making event for the company.

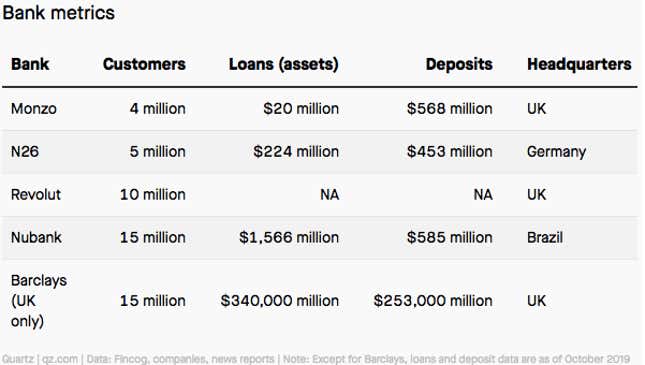

Other types of data, like this deposit and loan data from fintech consultancy Fincog, are available if you know where to look. When you compare the headline customer numbers for startups to an established bank like Barclays, which has roots going back centuries, they seem fairly pretty competitive. But that’s less the case when you look at loans and deposits, which provide the core money-making engine for traditional banks. (This table only looks at Barclays UK, and ignores its large global businesses.)

Of course, some banking upstarts are experimenting with marketplace and freemium models, in which a big overall customer number is a critical stat. Even so, that headline number doesn’t tell you how much business the digital bank does with those clients, such as how many have signed up for a premium subscription.

The hype around big customer numbers could also have some negative consequences. If these press releases succeed in boosting valuations and funding, it stands to reason that a startup could be incentivized to cut corners when it comes to verifying new customers. Berlin-based N26 got dinged by German authorities last year over its anti-money laundering practices. “We take this order very seriously and have already agreed on the implementation of the necessary measures” with the regulator, the company told the Financial Times (paywall). Revolut, the London-based financial app, has been through similar turmoil.

If fintech upstarts want to outgrow their reputation for hype (Quartz member exclusive), it’s going to require them to reveal more than just big customer numbers.

This week’s top stories

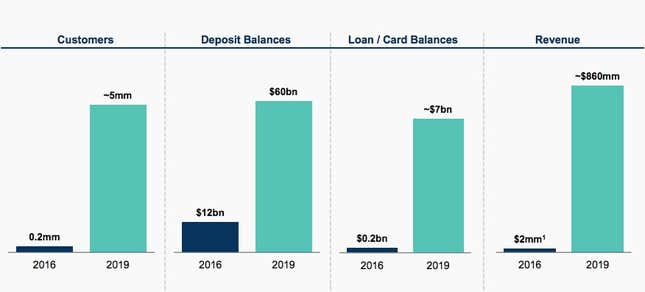

1️⃣ Investors got a close look (pdf) at Goldman Sachs’s future plans. Matt Levine at Bloomberg says the new businesses, like consumer banking and wealth management, are fairly banal compared with its high-finance past. The Financial Times (paywall) wrote that there was little “wow factor,” despite detailed data on the progress of its digital bank:

2️⃣ Mobile money accounts have provided “financial inclusion” in poor countries, but these offerings have opened up opportunities for fraud (paywall), according to The Economist. Predatory lenders and vendors may be using personal data to exploit consumers.

3️⃣ Systematic quantitative analysis will make its way to private markets, according to Bloomberg, in a report that surveyed 16 of the leading quant funds. JPMorgan’s Marko Kolanovic predicts a future recession will show the frailties of passive and quant strategies, leading to the re-introduction of human oversight.

4️⃣ High-frequency trading makes nearly $5 billion a year (paywall) in global stock markets, the Wall Street Journal reports, citing a study from the UK’s financial regulator. An earlier Bank of Canada working paper using bond-futures data found that HFTs “mildly improved” trading costs for institutions.

5️⃣ A group of Revolut customers are threatening to sue the company because they’ve been locked out of their bank accounts, The Telegraph reports. If there’s a bank that consumers should avoid because of its account-freezing practices, there’s little way to know in the UK.

The future of finance on Quartz

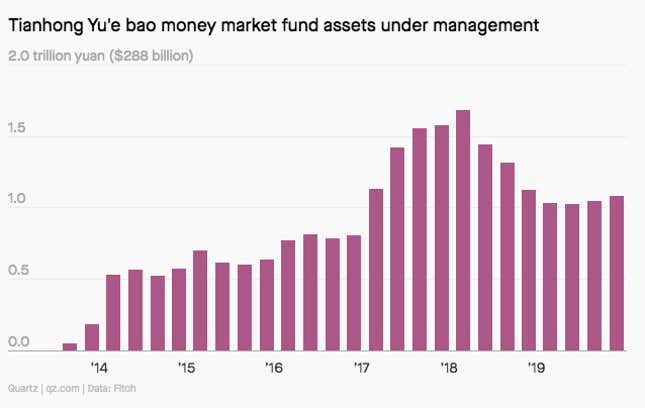

Ant Financial no long runs the world’s biggest money market fund. JPMorgan and Fidelity now occupy the top ranks.

New York’s ban on cashless stores won’t fix its deeper problems. Around 11% of people living there don’t have bank accounts, and laws requiring shops to accept notes and coins won’t fix that.

Elsewhere on Quartz

Fears of a looming recession have followed the world into 2020. “The structure of the global economy has changed in ways we still don’t understand,” reports Quartz’s Gwynn Guilford. This week’s state of play demystifies the risks facing markets in 2020 and tells you what could be behind the next global crisis.

Always be closing

- Klarna raised $200 million from Commonwealth Bank of Australia.

- Policygenius received $100 million in investment. KKR is among the online insurance company’s backers.

- Currencycloud got $80 million in funding. Visa was among the investors in the cross-border payment company.

- Gabi, an automated insurance-shopping company, received $27 million.

- Teller, which makes financial plumbing for fintechs, raised $4 million.

- Monzo has met with SoftBank to discuss raising money, according to The Telegraph.

- It’s Brexit Day: Last year, the UK broke its fintech investment record with $4.9 billion of funding raised.

I hope your week has been a profitable one (pick your own metric). Please send customer statistics, tips, and other ideas to jd@qz.com.