Hi Quartz members,

When natural disasters strike, insurance companies are often there to bail out homeowners and businesses. But as climate change dramatically increases the severity and cost of catastrophes, insurance companies need to get bailed out, too. Enter reinsurance, the global economy’s last backstop for the costs of climate chaos. In many cases, those costs fall to Swiss Re.

As the world’s second largest reinsurer by value of premiums written (No. 1 is Munich Re), Swiss Re paid out $1.7 billion in natural catastrophe claims in 2020 (down from $2 billion in 2019). Thanks to the pandemic, it also posted its first annual loss in a decade. Along with pandemic-related hits, S&P Global Ratings cited climate change as a factor in downgrading the company’s outlook from “stable” to “negative” last year, making it one of only two reinsurers in the top 10 with that outlook.

Yet Swiss Re sees opportunity in crisis. It increased the natural catastrophe exposure of its portfolio by 7% in 2020, part of a strategy to recalibrate premiums and reap a payoff as people, governments, and organizations seek more protection from disaster. Martin Bertogg, Swiss Re’s head of catastrophe perils, warned in April that the reinsurance industry overall is too reliant on history to inform its projections for an unprecedented climate. Swiss Re now has dozens of people working to change that.

“It is not our aim to reduce natural catastrophe risks in our portfolio,” Bertogg said. “For Swiss Re, natural catastrophe reinsurance has been a very profitable business segment over the past decade. Growing risk levels in this risk pool can present an opportunity for us, as long as premiums are adequate with assumed risk.”

So far, they are not: Although reinsurance rates are rising globally, a September S&P analysis found that reinsurers are likely underestimating climate risk by 33-50%—a miscalculation that would wipe out most of the industry’s capital reserves in the event of a particularly bad disaster year. Can Swiss Re and its peers cover their bases?

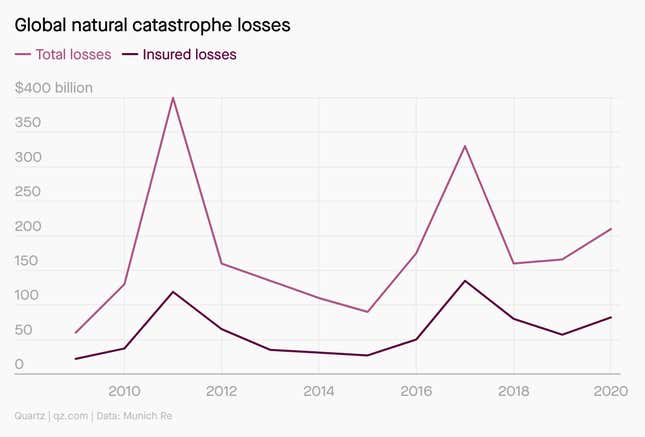

It’s your loss

Global losses from natural disasters are rising, and most remain uninsured.

By the digits

-$878 million: Swiss Re’s net income in 2020, down from a peak of $4.6 billion in 2015

-90%: Change in Swiss Re’s net income between 2016 and 2017, thanks to the most expensive Atlantic hurricane season on record

66%: Share of average annual global losses from natural disasters that aren’t covered by insurance

$155 billion: What Swiss Re estimates it could gain by expanding its coverage of property damage from catastrophes (pdf)

5,600: Wind and solar farms insured by Swiss Re (pdf)

40: In-house scientists working for Swiss Re to project risks from natural disasters

How to climate-proof reinsurance

For companies like Swiss Re, the entire business model is about anticipating risk. But today, many reinsurers still assume that the future will echo the past. Here are a few steps forward for Swiss Re and its peers:

⏩ Be more forward-looking. The industry still relies heavily on historic weather and climate risk data, Bertogg wrote in April, which “is creating a blurry picture of current risk.” Reinsurance companies should be clear that climate risks are here today, not just in the long term.

🏗️ Invest in mitigating risk. By expanding coverage for climate resilience projects—sea walls, say, or building upgrades—reinsurers can help their clients reduce exposure to climate risks, thus managing their own exposure (while profiting). “More risk isn’t an opportunity,” says Paula Jarzabkowski, professor of strategic management at City University of London. “More well-managed risk is an opportunity.”

📝 Push for more disclosure. Reinsurers should ask clients to be forthcoming with data about their risk exposure, and practice the same transparency with their own portfolios.

💰 Adjust rates and maybe walk away. Reinsurers should explicitly account for climate risks in their rates, so that sufficient capital is on hand when disasters strike. They may need to be prepared to walk away from the highest-risk properties, or work with governments to provide subsidized rates.

A brief history

1863: Swiss Re is founded in a two-room Zurich apartment by a coalition of Swiss banks to handle disaster risks following a catastrophic fire that destroyed most of the town of Glarus in 1861.

1906: Swiss Re loses 44% of its equity to losses from the San Francisco earthquake, and subsequently works with other reinsurers on the first global guidelines for reinsurance liability.

1938: Swiss Re becomes the world’s top reinsurer, with premiums worth $929 million in today’s dollars.

1940s: The company expands from Europe and the US to new markets in Asia and Australia.

1979: The company publishes its first report on sustainability.

1995: Swiss Re creates a climate and environment steering committee.

2003: The company commits to eliminate emissions from its own operations, and reaches net zero in 2013 with the help of carbon offsets.

2007: Swiss Re modifies its natural catastrophe risk model for the first time to explicitly include climate change.

2018: Swiss Re commits to end reinsurance coverage for companies with a significant stake in coal mining or coal-fired power plants.

2020: The company is powered by 100% renewable energy.

2023: Swiss Re’s target date to end reinsurance coverage for the most carbon-intensive oil and gas production operations.

2050: The company’s target date to reach net-zero emissions across its entire portfolio.

“Do our best, remove the rest”

That’s Swiss Re’s motto for reaching net-zero emissions, says Mischa Repmann, the company’s senior environmental management specialist. Swiss Re made a major gamble on that strategy in September, when it inked a $10 million contract to buy carbon offset credits from Climeworks, a Swiss engineering startup. That deal gave Climeworks the boost it needed to switch on the world’s largest machine that sucks CO2 directly from the atmosphere, in Iceland.

The machine is still barely a drop in the global CO2 bucket—annually, it will offset the emissions of about 870 cars. Energy analysts are in wide agreement that such technology will soon be needed at a much larger scale to counteract emissions from aviation and other hard-to-abate sectors.

At around several hundred dollars per ton (Swiss Re didn’t disclose a specific cost), these are some of the most expensive carbon offsets on the market, but compared to cheaper offsets from reforestation projects and other sometimes-scammy methods, they’re much easier to validate. Swiss Re sees them as a strategic early investment in technology that will be indispensable for the company’s 2050 net-zero target.

“Supporting technological [carbon] removal today is more expensive for Swiss Re now,” Repmann says, “but makes it cheaper for the world to achieve net-zero eventually.”

Keep learning

- The world’s biggest carbon-sucking machine is switching on in Iceland (Quartz)

- Global reinsurers grapple with climate change risks (S&P)

- Global reinsurance experts urge investment in open-source risk models (City University of London)

- Carbon offsets are going primetime and they’re not ready (Quartz)

- 2021 was “no outlier” for European catastrophe losses (Reinsurance News)

- The $5 trillion insurance industry faces a reckoning. Blame climate change. (Vox)

- German reinsurers eye higher prices after flood-hit year (Market Watch)

- Climate change is forcing the insurance industry to recalculate (Wall Street Journal)

- Paying for climate change: a reinsurance industry view (KCET)

Have a forward-looking end to your week,

—Tim McDonnell, climate reporter (and strategic risk-taker)

One ⌛ thing

Pick an iconic catastrophe in history, and chances are Swiss Re had some exposure to it. Over the past 130 years, the company has: insured travelers heading to the 1893 Chicago World’s Fair; covered losses from the 1912 sinking of the Titanic; suffered losses in the 1929 stock market crash; shared in the losses of 1966’s Hurricane Betsy (pictured), which cost the insurance industry $700 million in the southeast US; and survived payouts from 1984’s deadly summer hailstorm in Munich.