Hi Quartz members,

It’s been a decade since Marc Andreessen’s “Software is eating the world” op-ed, which crystallized the thesis underlying Silicon Valley’s current boom. His venture fund, co-founded in 2009 with longtime business partner Ben Horowitz, has shattered venture capital norms with its lavish checks and speedy deals.

Twelve years in, Andreessen Horowitz (better known as a16z) has grown large enough to amass billion-dollar funds, hire a policy team that’s lobbying Washington for more favorable crypto regulation, jumpstart a separate media arm, and inspire numerous copycats across the industry.

Here’s how a16z got its start and how it transformed VC.

By the digits

$19 billion: a16z’s assets under management

1,200+: Number of investments a16z has made, including follow-on rounds

295: Total exits of a16z’s portfolio companies

438: Number of a16z’s active portfolio companies

20: Number of venture capital funds a16z has run

$160 billion: How much venture capital was infused in startups in Q3 2021, a record

A rose by any other name?

The a16z moniker came about when the founders realized the firm’s name would be difficult to spell: 16 is the number of characters between the first and last letters of “Andreessen Horowitz.”

Both of the firm’s eponymous founders made their names as entrepreneurs, a fact that became the cornerstone of the firm’s philosophy.

Marc Andreessen first rose to fame when he helped develop Mosaic, one of the first web browsers, in 1993. Mosaic evolved into Netscape, which was snapped up by AOL in 1999.

Ben Horowitz co-founded the infrastructure-as-a-service startup Opsware (then known as Loudcloud) with Andreessen in 1999. HP acquired Opsware in 2007. Before that, Horowitz served as vice president of AOL’s e-commerce division and helped run Netscape.

Breaking free

A16z was established on a personal belief: That founders are the best leaders of their companies.

The duo behind a16z had seen traditional VC methods up close and weren’t always fans. In 1999, one of Horowitz’s investors asked him, then founding CEO of Loudcloud, when the company would get a “real CEO,” i.e., someone who had run large organizations in the past. Though Horowitz remained as CEO after that interaction, the question continued to “torture” him for months, he wrote in a blog post. This question spawned numerous conversations with his business partner, Andreessen, about the quality of founding vs. professional CEOs—which turned into motivation to start a16z.

In 2009, Andreessen told the Associated Press:

“We tend to be pro-megalomania. We are big fans of an inexperienced person who has great technology and wants to build a company while staying on as CEO.”

The fund began with $300 million to invest in tech startups. Three years in, a16z had raised $2.7 billion.

A16z did more than promise to keep founders in charge of their companies: they offered specialized services to help them succeed. The fund hired a slew of specialists to help with everything from recruiting to marketing to sales—functions that small startups often can’t afford.

The famed firm shook up the industry again in 2019 by shedding its venture capital status and becoming a registered investment advisor (RIA). Traditional VC funds are largely constrained to cutting checks in exchange for equity in private startups; just 20 percent of their capital can be allotted to liquid securities.

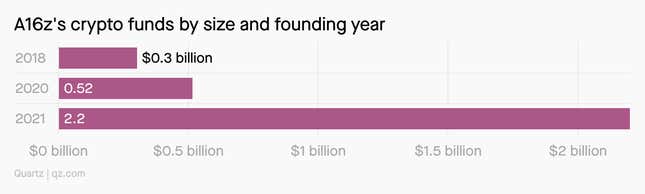

Amid a market flush with cash, transitioning to RIA status allowed a16z to invest in secondary offerings, public shares, other funds—and most importantly, to double down on crypto. In June, it announced a new $2.2 billion fund earmarked for crypto—a first among the largest VCs.

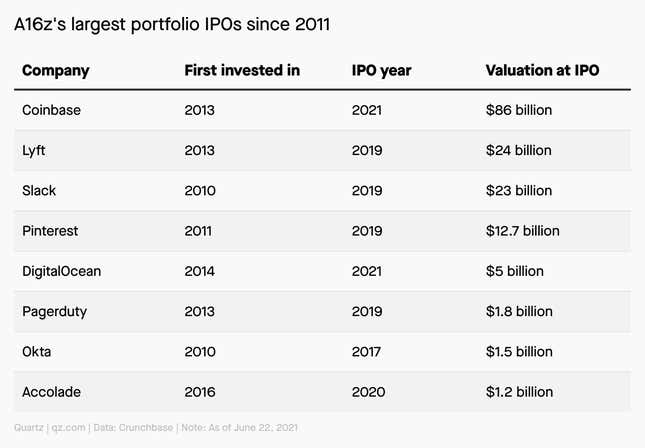

Home runs

A16z vets thousands of startups each year in hopes of finding the rare unicorn (or, these days, decacorn). Here are some of its biggest payoffs so far, per Crunchbase.

The push for crypto

Crypto is now a core part of a16z’s business. Though it’s been bullish on crypto since its 2013 bet on Coinbase, the firm has been pouring money into the sector by the bucket. Overall, it boasts a mammoth $3.1 billion under management across three crypto funds, which invest in both crypto startups and cryptocurrency itself. In the past few years, a16z has funded at least 55 crypto startups.

In October, a16z launched a major lobbying effort for more favorable crypto regulation in the US. It assembled a new team of experts—including a former Biden aide, an ex-Justice Department crypto prosecutor, and a recent Commodity Futures Trading Commission (CFTC) commissioner—to meet with regulators and economic aides, while publishing a letter for the Senate advocating for crypto tax policy in the infrastructure bill, a stablecoin policy framework, and four legislative proposals for the Senate Banking Committee. While a16z claims that its proposals help democratize the internet, outsiders have criticized the policies for being self-interested, leaving tax loopholes or evading regulation that protects consumers.

Keep learning

- Andreessen Horowitz’s Plan to Dominate Crypto (New York Times)

- Andreessen Horowitz Is Blowing Up The Venture Capital Model (Again) (Forbes)

- The Mind of Marc Andreessen (The New Yorker)

- The Unauthorized Story of Andreessen Horowitz (Newcomer)

- Under The Hood: A Decade After ‘Software Is Eating The World,’ Andreessen Horowitz Has Its Best Exit Year Yet (Crunchbase)

Have an enriching end to your week,

—Jasmine Teng, associate membership editor (also 👀 for the next unicorn)

One 📖 thing

In 2015, tech analyst Benedict Evans described a16z as a “media company that monetises through venture capital.” (He worked there at the time.) The firm has a burgeoning network of podcasts, newsletters, op-eds, and launched a publication called Future this year.

Andreessen is no stranger to the direct marketing approach—he’s long blogged about startups and venture capital at pmarca and is credited as the “father of the tweetstorm.” Horowitz has written two books about startups: The Hard Thing About Hard Things and What You Do Is Who You Are.

“[Twitter]’s like a tube and I have loudspeakers installed in every reporting cubicle around the world,” Andreessen told the New Yorker in 2015. But it hasn’t been the smoothest ride: he’s posted insensitive remarks he later apologized for, mass-blocked people, and quit the app.