Hi Quartz members,

For months, a tricky IPO has been giving bankers and government officials in India sleepless nights. Nope, it’s not an e-commerce site, fintech player, or food-delivery platform. In fact, it’s not even a startup. It is, however, a household name—the first financial investment for many Indians.

Some 280 million Indians own a life insurance policy from the Life Insurance Corporation of India, a 65-year-old behemoth that dominates the market. Its planned IPO is the latest effort by India to divest from its state-run conglomerates—its crown jewels—to help plug ballooning deficits. It follows a 2019 IPO for Indian Railways (the country’s largest employer), and the 2021 sale of Air India to the Tata conglomerate. If all goes to plan, India hopes to raise more than $8 billion from the sale of a 5% stake in LIC, according to a Feb. 13 prospectus (pdf) filed with the country’s markets regulator.

But the scale and peculiarities of India’s life insurance giant dwarf those other privatization efforts. For starters, LIC is governed under a special 1956 act, and not the corporate rules that apply to other companies, or insurers. This in itself makes the listing a perilous task. The government also had to revise investment rules to allow foreign investors to participate in the offer.

On top of that, the timing couldn’t be more challenging. India had hoped to complete the sale by the end of its current financial year in March, but in recent months foreign funds have been pulling out of Indian markets, with the pace of selling only picking up since Russia’s Feb. 24 invasion of Ukraine. Soaring oil prices could also challenge India’s economic recovery and further deter investors.

Even if not quite on the level of Saudi Arabia’s $29.4 billion listing of a 1.5% stake in its oil giant Aramco in 2019, LIC’s debut will test the depth of the country’s capital markets and the global appetite for the insurance baron. Considering all the hurdles, India has been steeling itself for the gargantuan task for two years. It may end up taking a little while longer.

By the digits

64%: LIC’s market share in India

1.3 million: LIC sales agents

282 million: LIC policies in force (pdf, p. 193)

$2.14 billion: LIC’s net profit for nine months ended December 2021

$526 billion: LIC’s assets under management as of September 2021

$34 billion: The insurer’s investment income in the year ended March 31, 2021

$2.4 billion: The size of fintech company Paytm’s IPO, India’s largest yet

A brief history

In 1818, the Oriental Life Insurance Company was set up to sell policies to Europeans in Calcutta (now Kolkata), then the capital of British-ruled India. Other companies soon followed, but these insurance companies only provided services to the European community, not Indians. It was through the efforts of the richest businessman in Kolkata, Babu Mutty Lal Seal, also known as the “Rothschild of Calcutta,” that foreign life insurance companies started insuring Indian lives.

Still, no legislation regulated these companies or how they came up with their premiums. Indians were often discriminated against, and charged far higher premiums than European customers. In 1870, the Bombay Mutual Life Assurance Society heralded the birth of the first Indian life insurance company, and covered Indian lives at normal rates.

In 1912, following calls to nationalize the life insurance business, the Indian Life Assurance Companies Act was passed, making it necessary for an actuary to certify premium rate tables and periodic valuations of companies. LIC in its modern form came into existence a decade after Indian independence: In 1956, the Indian parliament passed the LIC Act, which absorbed 154 insurance companies, 16 non-Indian insurers, and 75 provident societies into one entity.

How to value LIC

For the LIC IPO to be deemed a success, it needs to be priced just right: too low and the government will be accused of leaving public money on the table; too expensive and it could deter investors. In November, India’s largest unicorn, payments provider Paytm, saw its IPO flop after investors deemed its valuation too high for a loss-making business.

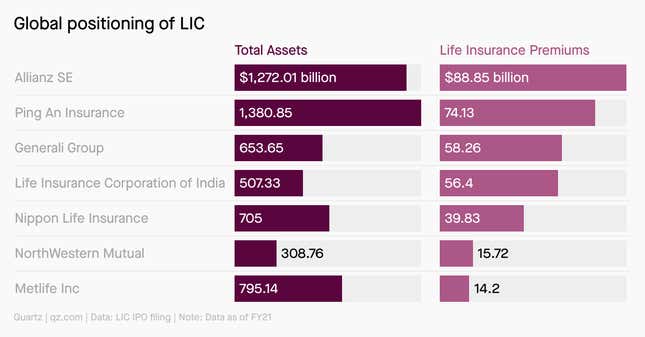

LIC is the only Indian player among the top 10 global insurers, ranking fifth globally in terms of the value of life insurance premiums. The company’s embedded value, a key metric for life insurers that combines the current value of future profits with the net value of assets, is pegged at $72 billion by actuarial and consulting firm Milliman. In India, the market value of other private life insurers ranges from three to six times the embedded value. By that calculation, LIC’s market cap could be mammoth.

But some analysts argue that the insurer’s market value should be significantly lower owing to expenses from its large agent base, its investment holdings in other public entities, and differences in its product mix and those of private insurers.

Timing the market

In 2021, dozens of tech startups went public amid a surge of interest from both domestic retail investors and foreign investors spooked by China’s tech crackdown. LIC’s listing, Indian officials hoped, would ride this wave and set a new benchmark for IPOs in India. But they may have missed the moment.

📉 Since October last year, foreign investors have been scaling back their portfolio funds from India in the face of looming interest rate increases in the US and a war in Europe. This year alone, foreign funds have sold a net $14.8 billion of Indian equities, according to official securities data.

💰 Foreign investors may also not love the role LIC has often played when it comes to other state-run firms, using its deep pockets to help bail out public-sector companies. Fifty of the 280 companies LIC owns stakes in are state-owned, including blue-chip behemoths such as Oil and Natural Gas Corporation and Indian Oil Corporation, but also debt-laden firms like telecom MTNL and IDBI Bank.

🤑 That means the success of the IPO might well hinge on domestic retail investors who have been flocking to the stock market during the pandemic—and in particular LIC’s millions of policyholders who have been promised a chance to own a piece of the company at a discount.

LIC expects at least 7.5 million retail investors to subscribe to the IPO, which could be the largest non-institutional participation in the history of Indian capital markets. “The valuation demanded by the government and discount provided to retail investors will define the success and performance of the offer,” said Vinod Nair, head of research at Geojit Financial Services.

Keep learning

- IPO of India’s most valuable firm is a delicate business (Bloomberg)

- India has a stretch goal for the IPO valuation of its state insurance giant (Quartz)

- Cabinet approves up to 20% FDI in IPO bound LIC (The Economic Times)

- LIC plans digital platform to take on private peers (Mint)

Have an insured end to your week,

—Mimansa Verma, Quartz India reporter (one of India’s 280 million LIC policyholders)

One 😋 thing

LIC has had a track record of employing sales agents from all levels of Indian society, and of all ages. Famous Bollywood actors Abhishek Bachchan and Amrish Puri also worked as LIC agents before entering movies. The age difference between Bachchan and Puri was 43 years before Puri passed away in 2005.