Last week, news emerged that China wanted to break up Alipay, a digital payments app with over 1 billion users. It’s the most recent blow to Ant Group, Alipay’s parent company, whose attempted public listing was quashed in Nov. 2020.

Ant Group is one of several private Chinese companies that are among the most valuable in the world. In fact, for the past few years China has been home to an outsized number of unicorns—a private company valued at more than $1 billion.

But amid an increased distrust of the private sphere, China is creating new guardrails and rules for these firms, and the tech sector as a whole. That has a direct impact on these companies, and on the global market—Wall Street executives met with Chinese regulators last week to discuss the recent crackdown. Beijing’s far-reaching moves look set to alter the startup ecosystem that allowed China’s first generations of unicorns to develop in the first place.

Quartz is seeking small businesses on a big mission. Sponsored by T-Mobile for Business, this new competition gives purpose-driven companies the chance to broadcast their mission across our platform with free ads plus $10k in cash. Register to enter.

By the digits

227: Chinese unicorns, according to a 2020 ranking, just a tiny bit behind the US’s 233

23%: Unicorns worldwide that hail from China

16%: World’s unicorns operating out of Beijing per a 2020 report, the most of any global city

$37 billion: The amount Ant Group hoped to raise in its IPO before Chinese authorities stepped in

~$80 billion: Funds raised by Chinese companies in US IPOs from 2010 through June 30, according to Refinitiv

Line of defense

Billion-dollar companies don’t just appear. Many of China’s tech unicorns emerged in the first decade of the 21st century at a unique moment in the country. As the population was becoming increasingly wealthy and digitally connected, cutting-edge companies gained millions of users, which fostered a surge in venture capital investment. The Chinese government allowed these companies to take advantage of regulatory loopholes, even to do business abroad.

That permissive era seems to have ended. Data security, monopolistic behavior, inconsistent pricing, difficult workplace practices—the Chinese government now has a number of rationales it can use to kneecap the operations of any business within its borders.

But why would China want to crack down, anyway? Here are some of experts’ best guesses:

- To keep closer control of consumer and government data

- To stop personal debt from getting out of control

- To reassert its authority over the private sector

- To help smaller startups rise

- To humble its growing ranks of tech billionaires

- To limit its financial risks

Some fear that the government’s crackdown will have a chilling effect on founders and investors alike. In which case, the state may start trying to fund more tech investment itself. If that happens, the genuinely private Chinese unicorn could become an endangered species.

Taming unicorns

Here’s how China’s biggest tech companies, all of which are still or used to be unicorns, went public, and how Beijing is using regulations to tame their “savage growth.”

- Where listed: Hong Kong

- When listed: June 2004

- Raised in IPO: US$180 million

- Regulation: Despite the regulator’s fines of the gaming giant over some of its past deals, Tencent hasn’t seen too much scrutiny from Beijing. Some say this is because its CEO Pony Ma keeps a low profile that helps it to stay under the radar of authorities. But more recently, regulators blocked a merger of two gaming streaming websites, which are similar to Twitch, both backed by Tencent, signaling the government’s determination to enhance its oversight in this space.

- Where listed: US and Hong Kong

- When listed: Sept 2014 and Nov 2019

- Raised in IPO: $21.8 billion

- Regulation: In April 2021, regulators fined the e-commerce company $2.8 billion for monopolistic conduct. Before that, the company had already been at the center of China’s antitrust storm, triggered by a bold speech by its founder Jack Ma last year.

- Where to be listed: Hong Kong and Shanghai

- Anticipated IPO date: Nov 2020

- Expected to raise in IPO: $37 billion

- Regulation: A few days before the firm’s listing, Chinese regulators summoned Jack Ma, the major stakeholder of Ant, and several other of the company’s executives. At the time this was seen as a potential warning in response to Ma’s speech in October, in which the tech mogul heavily criticized fintech regulation. Probably very few expected to see the regulator suspend the IPO abruptly only two days before its scheduled date, which was a decision reportedly made by Chinese president Xi Jinping. Later the firm was ordered to restructure and hew more closely to rules that apply to traditional banks.

- Where to be listed: Hong Kong and Shanghai

- Anticipated IPO date: TBD

- Expected to raise in IPO: n/a

- Regulation: There hasn’t been that much scrutiny of the company yet, and it appears to be proactively taking action to avoid meeting the same fate as Ant or Didi. The company is said to have been working on ensuring compliance with Beijing’s data security rules, and has been proceeding cautiously with its listing plan. Its founder and CEO Zhang Yiming will also step down from his role by the end of the year, a move many see as his attempt to avoid drawing the ire of Beijing for becoming too influential.

- Where listed: US

- When listed: June 30, 2021

- Expected to raise in IPO: $4.4 billion

- Regulation: Mere days after the company’s US IPO, the Cyberspace Administration of China opened a cybersecurity investigation into Didi, citing “risks related to national data security,” opening a new front in China’s war against big tech. Soon, the watchdog ordered all app stores in China to remove Didi’s app, saying the company had violated rules on collecting and using personal information.

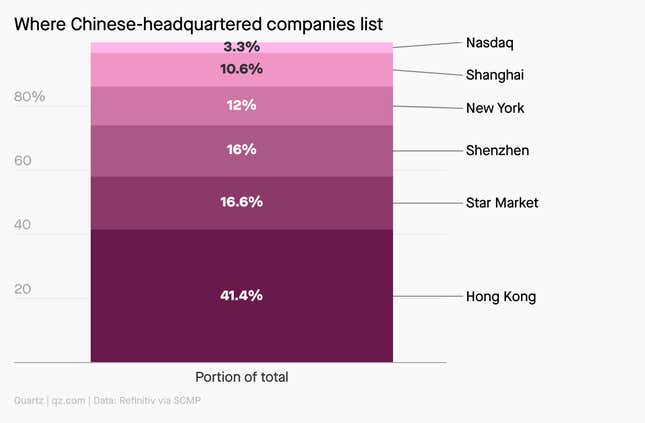

Where to list

For years, Chinese companies have found it appealing to go public in the US because of the market size and corresponding liquidity. Since the early 1990s, they’ve used loopholes such as registering holding companies in the Cayman Islands, and using the variable interest entity (VIE) corporate structure to create complex ties between their overseas and Chinese firms.

Hong Kong, meanwhile, has started replacing the US to become a new listing destination for Chinese tech darlings due to the rising tensions between China and the US. Beijing’s increasingly sprawling crackdown on tech is also giving Chinese companies a further hint that they should consider Hong Kong, or mainland exchanges, for listings.

It all comes down to 0s and 1s

Some speculate this tech crackdown is China’s attempt to keep control of one of its most valuable assets: consumer data.

For years, China has been exploring ways to harness and also secure the power of the vast troves of data held by companies such as Alipay and Didi. A recent cybersecurity probe into ride-hailing giant Didi Chuxing, along with new regulations governing data privacy and security paint a much clearer picture of Beijing’s vision for private data: to govern it as a key national asset within its borders, while trying to further unlock data’s potential, seen by Beijing as a business of similar importance as land and capital.

“The hope from Beijing’s perspective is to unleash the data potential of 1.4 billion consumers, producers, and innovators, plus the mountain of industrial data that the country produces and see it yield economic fruit,” Jacob Gunter, senior analyst with German think tank MERICS, told Quartz.

🔮 Prediction

Right now, it’s hard to know what effect the government crackdown will have even in the near future. Some reports say foreign investment is still flowing into China, while others say the crackdown is shifted some funding to India.

Even less clear is what that spells for the longer term. Even so, here are some of experts’ best guesses:

Chinese companies will keep listing in the US as long as they’re able:

“If somehow the listing rules are changed and the doors are closed on Friday, you’ll probably see a Chinese IPO on Thursday.”

—Drew Bernstein, co-chairman of accounting firm Marcum Bernstein & Pinchuk LLP, in WSJ

Fewer US IPOs for Chinese companies:

“The Chinese are leaning on companies like Didi not to go public. Didi was a warning to other companies.”

“The Didi situation reinforces the fact that China is annoyed by the flood of US IPOs by Chinese tech companies, and is attempting to slow the reception of these IPOs in the West. While Chinese names look like better value, they will suffer from this overhang for some time.”

—Hans Albrecht, portfolio manager at Horizons ETFs Management Canada Inc., in Bloomberg

Foreign investment in Chinese companies will dwindle:

“The Chinese government could have stopped the IPOs from happening, like how they did with Ant. Instead, they allowed global investors to take pain, and consequently have broken trust with a lot of foreign investors. While we did not participate in any of these listings, we would imagine that several funds would consider exiting.”

—Sharif Farha, portfolio manager at Safehouse Global Consumer Fund, to Bloomberg

Homegrown companies will continue to fund burgeoning startups:

“Big tech companies used to be making later-stage investments into our portfolio companies; now they are starting to come in earlier. Also, there is comparatively less M&A in China, so minority investments give them the access they want to up-and-coming start-ups.”

—Charles Zhang, venture capital firm Lightspeed China, to FT

There will be more unicorns, but in consumer industries instead of tech:

“The next decade will be the golden age for the rise of Chinese brands. The rise of Generation Z reshapes the industry.”

—Frank Wei, co-head of Warburg Pincus China, in Bloomberg

Unicorns will be responsibly reined in:

“Tech companies will see their previous ‘wild growth’ curtailed under such scrutiny, but they can still continue their normal operations to serve users.”

—Shen Meng, a director at boutique investment bank Chanson & Co in Beijing, in Quartz

Sound off

Do you think we’ll see as many Chinese unicorns in the next decade as we did in the last?

We’ll see fewer, particularly on US exchanges

No, investment will drop off and there will be fewer overall

In last week’s poll about extreme weather, just 17% of respondents said their city’s safeguards are holding up well, while 46% said they could be improved. I hope your mayor appreciates your growth mindset!

Have a great week,

—Jane Li, reporter

—Alex Ossola, membership editor

One 🔨 thing

It’s not just the tech giants China seems to be cracking down on at the moment: casinos, companies doing business in the Democratic Republic of Congo, the super rich, the private education industry, and kids’ video game habits have all come under scrutiny in the past month.