Hi Quartz members,

Today’s web isn’t the “simple, star-spangled, unicorn-sky world” creator Tim Berners-Lee envisioned it to be in the early 1980s.

We’ve shifted into an era of tech monopolies. Digital privacy is all but non-existent. Facebook and Google harvest, hoard, and indirectly sell personal data, incentivized and propped up by advertising-driven business models.

“We demonstrated that the Web had failed instead of served humanity, as it was supposed to have done, and failed in many places,” Berners-Lee told Vanity Fair in 2018.

Regulators have tried to crack down on big tech through a patchwork of laws and fines. But a growing group of techno-utopians, cypherpunks, and software enthusiasts see an answer to the internet’s woes elsewhere. They envision a future internet that is decentralized and underpinned by blockchain technology, and they’re calling it Web3.

WHAT IS WEB3?

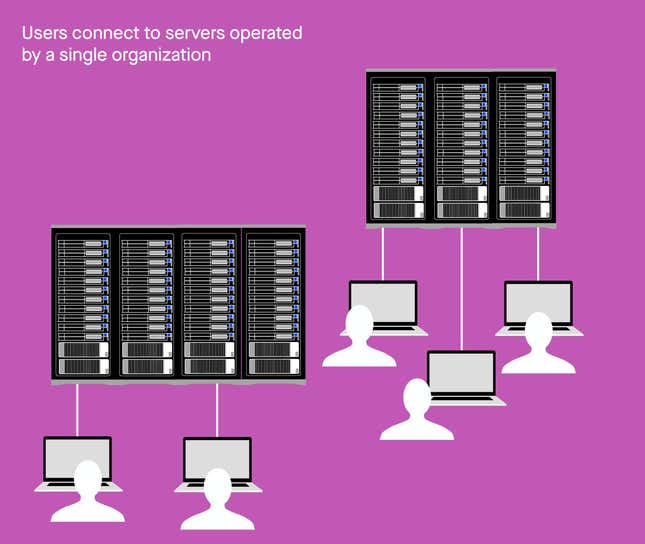

Currently, the web works like this: When you type a URL into your browser, your computer sends a request to a faraway server, and then the server shoots back the information you requested in a HTML format. Any personal information you enter is also stored in the server.

The problem, however, is that these servers are typically centralized and often privately owned. If the server goes down, if the company operating it decides to boot you from its service, or if someone hacks the server to steal your personal data, then you’re out of luck.

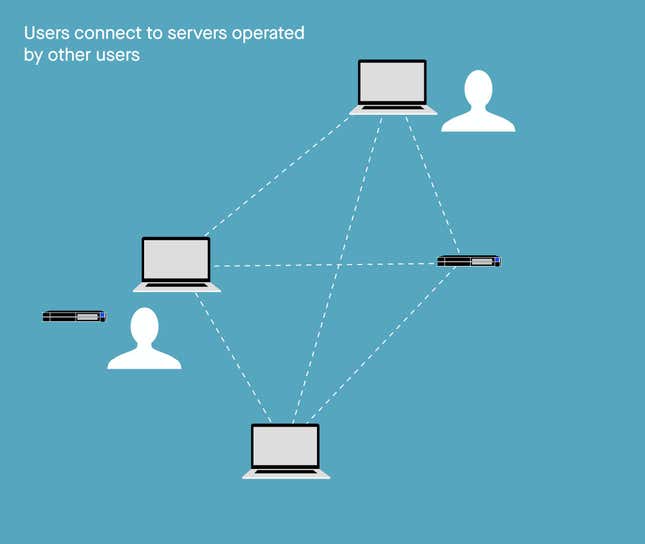

In Web3, blockchain technology replaces these centralized servers. Instead of sending your information to and querying from a Facebook- or Amazon-owned server, for example, all of this data is stored on a peer-to-peer, decentralized database, or a public blockchain. (Blockchains are basically a type of database; there are also private blockchains that can be controlled by single enterprises.)

The Bitcoin blockchain, for example, is basically a giant list of who bought how much bitcoin (its native cryptocurrency) and when.

PROS & CONS OF A DECENTRALIZED INTERNET

PROS

- Users own the data: People are able to control their data directly, rather than having to entrust it to centralized entities. People can carry their information across several decentralized applications (dapps) if they want.

- Transparency: Public blockchains are open, so anyone can view and audit the software.

- Native payments: Public blockchains have cryptocurrencies built into them as an incentive to maintain the ledger. This feature means that payments and other financial transactions don’t necessarily have to go through third parties that take a cut or require personal information.

- Censorship resistant: No central authority can shut down or remove any part of what gets recorded on blockchains. Naturally, this brings up the question of content moderation (pdf); there aren’t true solutions yet, but some projects are experimenting with other ways to moderate that aren’t top-down.

CONS

- Lack of privacy: Blockchain transactions are open and trackable, though pseudonymous, by default.

- Inefficiency: Blockchains have limits to the number of transactions that can be recorded on each block; excess demand can make it difficult to scale. Companies are building “layer 2” solutions to address this, by batching transactions off the main blockchain.

- Lack of regulation: Decentralization makes it difficult for regulators to crack down on or shut down harmful projects or scams.

- Environmental impact: Certain blockchains, like Bitcoin, require miners to use up immense amounts of energy to validate the blocks of information. Others, like Ethereum, are exploring another trust-based mechanism that doesn’t require as much energy.

OPEN QUESTIONS

What will Web3 look like, and how do we make it? Here are some questions that the blockchain developer community and regulators will have to answer.

Infrastructure. How do we make blockchains that are decentralized, scalable, and secure? Currently, technical limitations make it difficult to achieve all three. The general consensus in the community is that there will be multiple systems that exist for different purposes, but which will win out in the end has yet to be seen.

Access and inclusivity. Operating on a blockchain isn’t free. For example, fees to transact on Ethereum (also known as gas fees) have skyrocketed amid record transaction volume, potentially pricing out newcomers. The crypto community also has a diversity and reputation problem: it’s heavily dominated by men; scams are prolific; and participation requires complex technical or financial knowledge that many aren’t interested in researching.

Regulatory uncertainty. Decentralized finance (DeFi) companies are especially feeling the heat. The US Securities and Exchange Commission (SEC) is reportedly investigating decentralized exchange Uniswap; Coinbase canceled its lending product that would allow users to earn 4% interest on their crypto due to regulatory uncertainty; while crypto lender Celsius was slapped with a cease and desist.

“We just don’t have enough investor protection in crypto. Frankly, at this time, it’s more like the Wild West,” SEC chair Gary Gensler said at the Aspen Security Forum in August.

PREDICTION

It’s possible that the shift to Web3 won’t look too radically different for the end user: apps may look similar to the way they do now; it’s just that the underlying architecture would be totally different. The Web3 vision remains amorphous, and there are other competing visions for the web. But here’s what could be coming next:

A year from now: Blockchain development right now resembles early web development, where “people are still interacting directly with primitives,” Mike Garland, a product lead at Alchemy, a blockchain developer platform, said at Mainnet, a crypto conference held last month in New York City. Still, some press on. More companies will experiment with Web3 apps to figure out product-market fit, whether it’s financial applications, NFTs, gaming, or more. “With Web3, we are just crossing from that fairy tale technology phase to something tangible,” Polygon co-founder and chief operations officer Sandeep Nailwal told Quartz.

Five years from now: It will be easier than ever to deploy Web3 apps through the development of better infrastructure. Just like how we can set up websites or apps with drag-and-drop or no-code platforms today, users will also be able to set up decentralized applications without necessarily needing to know how to access the base infrastructure. “You want to be able to serve a super performant application to millions of users as you gain success, without having to worry about the internals of how your infrastructure is working and how that’s going to scale as your product does,” Garland said at Mainnet.

10 years from now: The industry will realize which use cases and applications are truly practical for using blockchain technology. Institutions may also join in on the hype. “Currently, we’re in the parody phase, where we’re copying what’s in traditional finance. Over the next couple of years, we’re going to start to see things that actually take advantage of the unique properties of DeFi that couldn’t exist in traditional finance,” DeFi lending protocol Maple Finance co-founder Sidney Powell told Quartz.

KEEP LEARNING

- When Walmart says it’s on the blockchain, what does it mean? (Quartz)

- Web3 ELIF5: What is Web3? (Messari)

- The Crypto Surge (Quartz)

- Gaby’s Web3 Reading List (Gaby Goldberg)

- Understanding Web 3—A User Controlled Internet | by Emre Tekisalp (Coinbase)

- The Decentralized Web Of Hate (Emmi Bevensee & Rebellious Data, pdf)

SOUND OFF

Is Web3 the future of the internet?

wagmi (we’re all gonna make it)

In last week’s poll about the great resignation, 53% of respondents said life taking precedence over work is the most likely impact.

Have a great week,

—Jasmine Teng, associate membership editor (haunted by crypto)

One 🥴 thing

Twitter is where all the crypto folks congregate. Here’s a quick glossary for all of the ~ fun ~ jargon people use:

- Aping in: To go all in on an asset

- Degen: Short for “degenerate gambler,” now used more fondly by crypto folks to self-describe

- FUD: “Fear, uncertainty, and doubt,” usually used to describe news about cryptocurrencies

- HFSP: “Have fun staying poor,” usually used by crypto holders to denigrate people who don’t own crypto