Hi Quartz members,

Whether it’s on Twitter or from your college roommate who won’t stop talking about crypto, you might have crossed paths with the term “DeFi” recently.

DeFi—decentralized finance—is a new breed of financial services that is built on a blockchain and capable of stripping out traditional banks. A user with a crypto wallet can trade digital assets, get loans, or take out insurance, among many other things.

And just three years since the term came into existence, it’s already big business; more than $90 billion of collateral is locked up in these services, and more than 10 million people have downloaded MetaMask, one of the most popular digital wallets used to open up access to these networks.

Proponents insist that a financial future banking on DeFi is more inclusive. But as DeFi tips into the mainstream, some have begun to question how the community grows from here.

Explain it like I’m 5!

DeFi is an amalgam of cryptography, finance, and software development, and it tends to be shrouded with its own lexicon and jargon. Let’s break it down.

Decentralization: Decentralized exchanges and lending systems use blockchains like the Ethereum network. Think of Ethereum as a decentralized computer that software developers can make applications (dApps) for. The Ethereum network is hard to shut down or corrupt—anyone with an internet connection can access it.

Governance: The decision making, or governance, at DeFi organizations—from the fees they charge users to the products they offer—is often meant to be decentralized. A single person or a small group of people might be driving a decentralized application at inception, but they often seek to step away as the project gains momentum, handing control to the community that uses it.

Peer-to-peer: Users have the ability to swap crypto tokens on a DeFi exchange without the intervention from a third party that could charge a fee or censor the transaction.

Pros/cons

- Decentralization makes DeFi difficult to censor or stamp out, but it requires some heavy-duty computing. Maintaining a database and records across a network of many computers slows things down and can make transactions more expensive. Ethereum is the most popular blockchain for DeFi applications, but the sheer amount of computing now taking place is driving up fees and bogging down the network. As Ethereum developers try to find ways to make it more scalable, other chains like Solana and Avalanche are picking up momentum. “It’s genuinely hard to get performance out of blockchains,” says Emin Gün Sirer, a computer scientist at Cornell University and an advisor to Avalanche.

- DeFi strips out intermediaries like custody banks, which are expected to keep assets (usually digital tokens) safe. That means you don’t have to worry about a financial institution failing and taking your holdings with it—or a government seizing your tokens and confiscating them. On the other hand, the only thing keeping your holdings safe is you and your passcode. In crypto’s purest form, if you lose that passcode (or someone steals it), your assets are gone for good.

- The DeFi upstarts often purport to be available to anyone. You may be able to get a loan or trade virtual coins without traditional financial credentials like identification or a credit score. That freedom promises to extend financial services to parts of the world that haven’t always had them, or where the services are expensive or prone to fraud or confiscation. But you can easily see the downside: If there’s no entity keeping track of who is using a service or where they are located, the systems could be used by criminals or run counter to sanctions. The regulatory crackdown has already begun.

- Blockchains have proven pretty tough to crack—but the smart contracts and apps that run on top of those chains are only as smart as the people who designed them. The code is typically open-source, which means it’s there for everyone to see and to innovate with, but that also makes it easier for hackers to attack. Much more programming code these days is audited for bugs and vulnerabilities, and a growing number of people understand the need for formal verification (a process that uses algorithms to analyze other algorithms for glitches), but plenty of money is still going into code that hasn’t been shored up in that way, Cornell’s Sirer said.

All in the family

It’s not just DeFi—blockchain has enabled a series of digital gold rushes since it was invented 13 years ago.

ICOs: ICOs are a type of crowdfunding, and they’re often used to raise money for open-source software projects. In exchange for capital, ICO investors get a unique token that might give them access to the software’s special features… or might not give them access to much at all.

NFTs: NFTs are kind of like a limited-edition trading card—only online. Just as blockchain enables users to prove ownership of their bitcoin holdings, so too does it enable people to make unique digital assets like collectibles and art.

DAOs: DAOs are flat organizations underpinned by blockchain technology. Their functions vary widely, including developer collectives, venture funds (The LAO), gaming guilds (Yield Guild Games), or social communities (FWB). What they have in common is that they are typically meant to be member driven, not top-down or hierarchical.

🔮Prediction

Right now, most decentralized apps (dapps) run on Ethereum. Could that change?

It might, and that’s because the Ethereum network is becoming congested—partly because NFTs have become so popular—driving up fees and slowing down the system. The average cost of a transaction on the Ethereum network jumped to $24 on Sept. 27, up from around $4 a few days earlier.

Insiders say there are two ways this can go. Ethereum 2.0 could finally take off, which is basically an Ethereum upgrade that is faster, requires less energy, and is more scalable. This long-awaited enhancement has been talked about for years, and not everyone has kept their faith that it will finally happen.

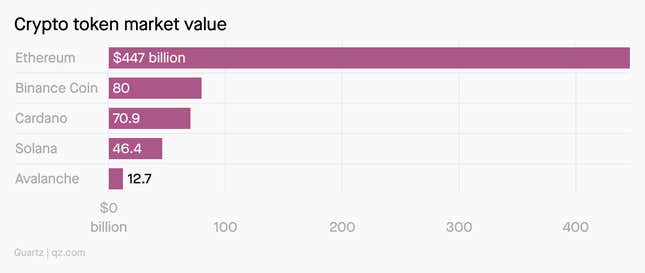

The other possibility is that slow, expensive transactions on Ethereum will give newer rival blockchains a chance to take market share. And that’s what happened, with Ethereum competitors like Binance Coin, Cardano, Solana, and Avalanche ballooning in market value.

If recent history is any guide, newer blockchains are going to gain momentum if Ethereum 2.0 doesn’t take off soon.

Sound off

Are you ready to give DeFi a try?

Maybe once it’s better established

No thanks, I need more convincing

In last week’s poll about tech’s new hometown(s), 38% of respondents said they’d start a company totally remotely, while 26% said they’d stick to a major city.

Have a great week,

—John Detrixhe, senior reporter, future of finance

One 💡 Thing

The term “decentralized finance” came from a group of software developers and entrepreneurs in a Telegram chat in 2018.