Hi Quartz members,

Singles Day is a big deal in China. The holiday, which falls every year on Nov. 11, celebrates those not in relationships and has become one of the biggest shopping days of the year. In the US, Black Friday and Cyber Monday saw $17 billion in sales in 2020. By comparison, Alibaba and JD.com, the two largest e-commerce companies in China, combined for $115 billion in sales last Singles Day.

But unlike Black Friday and Cyber Monday, Singles Day depends heavily on sales from livestreams on platforms like Alibaba’s Taobao Live. Brands and influencers sell products to hungry customers, like an online QVC, the American TV shopping pioneer. In the first 30 minutes of Alibaba’s 2020 Singles Day pre-sales stream on its Taobao Live platform, the company did a whopping $7.5 billion in sales.

In the US, shopping on social media is still embryonic—and livestream shopping is just getting started. But there is reason to believe that social commerce is the future of shopping, and soon Americans will be buying everything from clothes to hot meals from online broadcasts.

IT’S BIG IN CHINA

Livestream shopping is big business in China, becoming a popular way to shop in the past five years. What was only a $3 billion industry in 2017 has quickly ballooned, expected to take in $423 billion by 2022 in the country.

When users see that an influencer or brand is livestreaming, they can click to watch the stream. As people on the stream introduce products, those products populate with pricing information and checkout links for users. Through a picture-in-picture display, a user can buy the product without disrupting the stream that they are watching. While television shopping programs like those seen on QVC are one-way and often pre-recorded, livestream shopping is interactive and, well, live.

The livestream model is appealing for brands selling stuff because it puts their products in front of an audience that’s already in the mood to buy, especially if they’re tapping into an influencer’s captive audience. The livestream is entertaining, the interface is easy, there’s community in the comments, and shopping during screentime seems perfectly suited to our multitasking age.

The platforms hosting the livestream take a small cut of any transaction.

In China, the path to livestream shopping was simpler because social media, e-commerce marketplaces, and payment options are often integrated in the same app. If Facebook, Amazon, and PayPal were all in the same app, Americans might already be shopping on livestreams.

Here’s a rundown of the most popular apps and platforms for livestream shopping in China:

- Taobao, Tmall, and Taobao Live (Alibaba’s e-commerce platforms)

- JD.com (Alibaba’s main competitor)

- Douyin (ByteDance’s sister app to TikTok in China)

- Kuaishou (Douyin’s main competitor)

- Mogu (a leading fashion platform)

- WeChat (Tencent’s mega app has some livestream shopping capabilities)

INTENT VERSUS DISCOVERY

Shopping isn’t really social in the US: The e-commerce sector is dominated by Amazon and Walmart, among others. The technology to make livestream shopping happen is still pretty new in the US, but mainly the consumer habit isn’t there as most Americans aren’t used to shopping while they scroll—yet.

It’s important to distinguish e-commerce from social commerce, the act of shopping on a social media platform, because the user behavior is different. The market research firm eMarketer puts it this way: “While most traditional e-commerce purchases start with a product search—which requires intent—social media’s sweet spot lies in discovery.” Here’s the difference: Currently, you might see leggings on TikTok, decide you want them, find them on Amazon, and then complete the transaction. But in the future, you could see the leggings and buy them without even leaving the video you are watching.

That’s only just starting to happen. eMarketer predicts that social commerce in the US will amount to $36 billion in 2021, about a tenth of the $352 billion market in China.

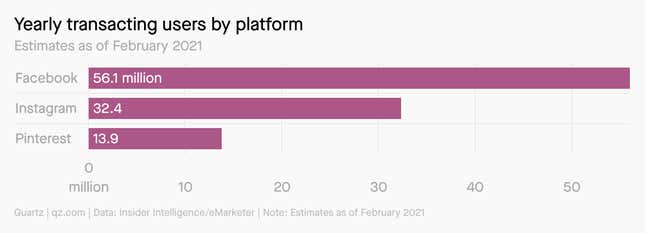

So what are the biggest US platforms for social commerce right now? The two biggest are Facebook with an estimated 56 million buyers globally this year, and Facebook-owned Instagram with 32 million. Pinterest ranked third with nearly 14 million people buying products through the site. But TikTok, Snapchat, and Twitter have all added shopping features and could become major players in this burgeoning space.

THE US PLAYERS

A handful of major US companies have started testing livestream shopping on their websites and apps.

Amazon: Amazon launched Amazon Live in 2019, which features original QVC-like programming, highlighting deals and new products on the site. Amazon is not a social media platform, but Amazon Live mirrors what we could see on social: a shoppable livestream. Plus, Amazon could add similar functionality to Twitch, which it owns, in the future.

Facebook: Facebook lets brands and creators use live shopping features using its Commerce Manager. Facebook also debuted Live Shopping Fridays, a weekly series, with brands like Petco and Abercrombie & Fitch in spring 2021.

Instagram: Like Facebook, Instagram lets brands and creators “go live” and tag products so they appear—and can be purchased—as users watch. It’s also running holiday-themed shopping events in the coming months.

Pinterest: Pinterest announced Pinterest TV, a series of “live, original, shoppable” shows featuring creators like Olympic diver Tom Daley and comedian Robyn Schall.

TikTok: TikTok tested livestream shopping with Walmart last year, but has not rolled out the functionality widely to brands or creators.

YouTube: YouTube is testing livestream shopping this holiday season. The Google-owned video platform has planned an event called “YouTube Holiday Stream and Shop” featuring brands and YouTube creators starting Nov. 15.

KEEP LEARNING

- The future of social media looks a lot like QVC (Quartz)

- It’s showtime! How live commerce is transforming the shopping experience (McKinsey)

- Live-Streaming Craze Turns Into a Lifeline for China’s Stores (WSJ)

- Social Commerce Forecast 2021 (eMarketer)

Have a great week,

—Scott Nover, emerging industries reporter (already spends too much money online)

ONE 🛒 THING

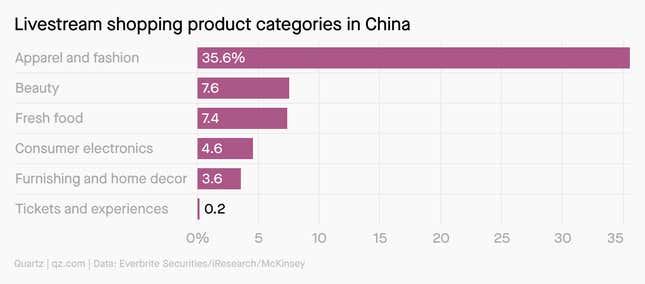

In China, livestream shopping isn’t just for beauty and apparel, though those are among the most popular segments. About 7% of shoppable livestreams in China focus on fresh food—that includes groceries and hot meals.

Here’s what livestreamers in China are selling: