Hi Quartz members,

The Forecast is now on Sundays. That way you can enjoy the deep dive over the weekend.

And, in case you missed it, we dropped our paywall! Quartz is on a mission to make the global economy more equitable, sustainable, and inclusive. That goal is best realized with journalism that’s accessible to everyone, and thanks to your support as a Quartz member we’re able to make that happen. Continue to enjoy our member-exclusive Weekend Brief and Forecast emails by renewing today for 50% off.

What would it take for global commerce to bypass the US financial system? Maybe the shock of Russia’s invasion of Ukraine.

It goes something like this, according to Zoltan Pozsar, a bond market strategist at Credit Suisse. Post-pandemic supply chains are tangled, powerful sanctions have cut off key exporters like Russia from the world economy, and commodity prices are rising against the background of elevated inflation. In that world, producers of key commodities simply have more bargaining power, and will be able to demand payment in their own domestic currencies—or the Chinese yuan, so they can buy more goods from the world’s largest exporter.

“It used to be as simple as ‘our currency, your problem.’ Now it’s ‘our commodity, your problem,'” Pozsar wrote in March. As countries focus on obtaining stockpiles of key commodities, demand for dollars and dollar debt will fall, and offshore yuan will start to dominate global commerce.

It’s a compelling picture—but in the near-term, an unlikely one. Thus far, neither Russia nor China has succeeded in changing payment terms for commodities. And a global monetary system based on hard goods rather than a global currency would be more volatile than most investors like. As analyst Joseph Politano writes, “there’s a reason why no major country uses the gold standard anymore.”

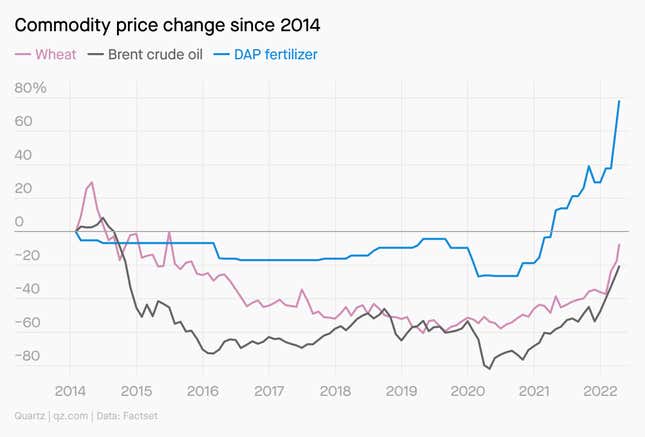

Then again, nobody eats gold, or makes electricity with it. Pozsar’s thesis is that scarcity of oil and wheat will change the dynamic. But oil and wheat remain cheaper than they were at the height of the last commodities boom, though fertilizer prices signal more concern. The dollar (and high-tech American exports) may prove more resilient than expected.

Charted

A brief history of threats to dollar dominance

Since before World War II, the US dollar has been the dominant global trading currency, even after the Bretton Woods system was abandoned in favor of free-floating exchange rates. The prices of most goods and services traded between countries (and their banking systems) are assessed in dollars, and investors of all stripes accumulate dollar-based financial assets, often US debt, to ensure they have foreign exchange on hand.

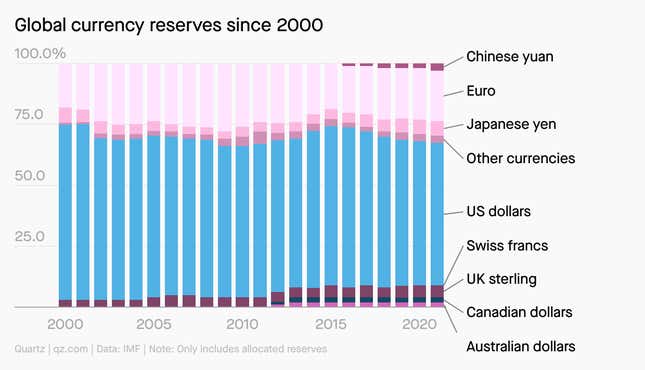

At the turn of the century, the creation of the European Union and China’s entry into the global economy pushed forward the euro and the yuan as potential successors. When these rival economies grow larger than the US, the thinking goes, their financial gravity will usurp the role of the American financial system. By and large, that hasn’t happened: In 2021, the dollar made up 59% of global foreign reserves, while US GDP represented about 20% of global production.

Recent research shows that most of the currencies supplanting the dollar are from countries close to the US, like Canada, Australia, and South Korea, with central banks that benefit from the US Federal Reserve’s international dollar swap lines.

The euro and the yuan have their drawbacks, according to Federal Reserve economists: The former still sits uncomfortably on top of a confederation of independent states, not a single fiscally-integrated government—with unpredictable results, as Brexit showed. China, meanwhile, does not allow its currency to trade freely or be independently managed.

Even if Beijing took necessary steps to make the yuan broadly attractive to investors, like opening its capital account, it would still be an autocratic government with all the risks that that entails. The uncertainty around the fate of a troubled company like Evergrande would not do well applied to a currency regime.

What about electronic money?

Bitcoin, ethereum, and other cryptography-based digital tokens are popular candidates to rival the dollar (at least among people who have a lot of money invested in crypto). Aside from slow transactions and dubious security, the big problem is simply liquidity: There’s not enough of it to support global trade.

At press time, all the cryptocurrency in the world is worth about $1.8 trillion. That’s a lot of money… but in 2021, foreign investors alone held $7 trillion in marketable Treasury securities, just one third of the total issuance. That suggests there will need to be a lot more assets denominated in crypto before it will play a serious role in trade. On the other hand, there is $25 billion in Swiss francs held as foreign reserves, so perhaps the right cryptocurrency could end up in international portfolios.

But central banks might get ahead of decentralized projects. Efforts to develop government-backed digital currency, like the US e-dollar and China’s e-CNY, could overcome the hurdles facing private digital money.

🔮 Prediction

There’s little question that the extraordinary dominance of the dollar is likely to fade. But investors have expectations from a reserve currency: stability, security, value, and liquidity. Until another currency can offer all four, it’s hard to see the dollar being supplanted. The question is which alternative can do that, or perhaps more realistically, which of multiple trading currencies will fill the gap together.

Some observers, like Poszar, have confidence that China will continue liberalizing its financial institutions to truly internationalize the yuan, or that a new Cold War dynamic will force countries to choose. Others believe that some combination of inertia and American institutions doing enough to respond to changing economic trends will keep the dollar at the forefront of world trade. Ultimately, the fate of the dollar will be decided by politics.

Keep learning

- Credit Suisse’s Zoltan Pozsar explains his vision of “Bretton Woods III” (Bloomberg’s Odd Lots podcast)

- Economist Barry Eichengreen, the authority on reserve currencies, on the future of the dollar (Quartz)

- The history of dollar trade hegemony (Adam Tooze, Foreign Policy)

- Former Federal Reserve chair Ben Bernanke argues that the dollar’s hegemony on trade isn’t much of a benefit to the US (Brookings)

📣 Sound off

What will replace the dollar?

Have a great week,

—Tim Fernholz, senior reporter (who is dominated by the dollar)

One 💵 thing

Why do we value the dollar? Forget the full faith and credit of the US government—sometimes the bills just look cool. The Del Monte $20, so dubbed because a banana sticker somehow stuck to the paper during printing, was discovered in an ATM in 2004 and auctioned off for nearly $400,000 in 2021.

That’s nothing compared to the “Grand Watermelon” $1,000 Treasury note, printed in 1890, which collectors adore for its rarity and the enormous stylized zeroes that look like watermelons. One such bill sold for $3.3 million at a 2014 auction.