Hi Quartz members,

For people with money in crypto, it’s been a rough two weeks. Losses have topped $400 billion. The selloff, as you’ve probably heard, was triggered by the epic failure of stablecoin Terra and its crypto peg Luna, whose investors alone are short $60 billion.

Crypto veterans are taking all of this in stride. As they scan the carnage, some even see signs for optimism. It’s reassuring, they say, that the whole system didn’t break, given the scale of the Terra/Luna debacle, though there might be still more fallout to come. And for now, there is little sign of spillover into the non-crypto world.

For crypto’s staunchest backers, this is just the latest turn in the crypto ecosystem’s natural boom-and-bust cycle. They will rebuild, and they’re sure the market will bounce back.

If history is any guide, they are right. After past crashes, the industry has come back stronger and bolder. And each time around, the group of people lured in by the boom—and burnt by the bust—grows bigger.

Among the latest batch of investors to buy in after the last crypto winter, in 2018, are pension funds, big hedge funds, cities, and El Salvador’s National Treasury. Last month, Fidelity, which manages more than 20 million 401Ks, said it will start dabbling in bitcoin. At this pace, the crypto industry might someday require its own government bailout to prevent a financial system meltdown.

Crypto backers may be allergic to government intervention, arguing the prospect of being saved transfers risk from gung-ho investors to the taxpayer. But they, too, are operating with a safety net: the legions of new recruits that erase old-timers’ losses every time crypto is on the way up.

The trouble with Terra

If anything is supposed to be shielded from the volatility of crypto, it’s the stablecoins. They are like poker chips in a casino—when they work, they’re a safe store of cash that you can use to easily trade without interacting with fiat currency. Tether, the largest, has been around since 2014.

Stablecoins are pegged to a government-backed currency like the US dollar or a commodity like gold. But while most stablecoins hold traditional financial assets—cash, Treasury bills, commercial paper—to assure customers of their liquidity, others do not.

That brings us to algorithmic stablecoins, which rely on computer code to maintain their value. TerraUSD (UST) is one such coin, maintaining its $1 peg through a symbiotic supply-and-demand relationship with the cryptocurrency LUNA.

But now UST and LUNA look more like a house of cards than a responsible—let alone stable—store of cash. After someone sold a large amount of UST a few weeks ago, a mass sell-off ensued, plummeting LUNA close to $0 (down from $116 in early April) and sending UST, which is always supposed to be $1, to $0.17. (Financial organizations Citadel Securities and Blackrock denied rumors that they played a role in UST’s collapse.)

The Terra disaster has sent shockwaves through the crypto industry, sent bitcoin to a 16-month low, and dashed confidence in algorithmic stablecoins. If investors can’t rely on stable coins, what can they trust?

A regular ol’ asset?

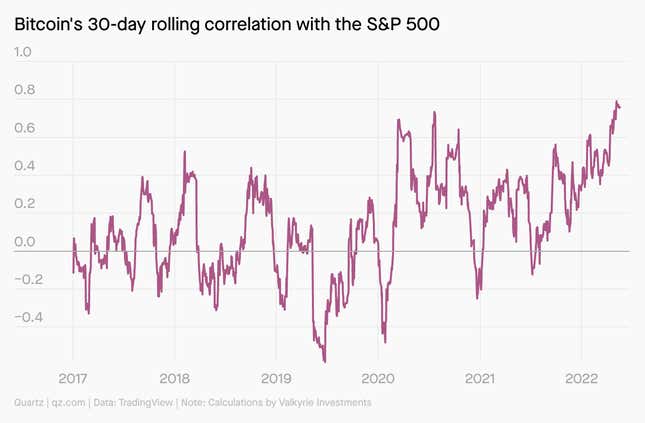

Crypto evangelizers have peddled bitcoin, the flagship cryptocurrency, as a hedge against inflation and drops in the value of traditional assets. That’s not working out. Just like regular stocks, bitcoin prices have been falling since November, when the US Fed started rolling back its bond purchases.

This can be partly explained by the influx of institutional money into digital assets. These are not the buy-the-dip kind of investors. When they sell tech stocks, crypto goes out too.

But Jeff Dorman, chief investment officer at digital-asset management firm ARCA, sees this link as only temporary. “I’ve written about [digital assets’] correlation to equities to gold to the Chinese yuan to the dollar to avocados,” he said. “These correlations are often spurious and change quickly.”

While bitcoin might continue bobbing up and down with the stock market, he believes other tokens will eventually break away, fulfilling their promise as alternatives. We shall see.

Is crypto really like the internet of the late 1990s?

Some investors and economists watching the crypto crash are sharing a refrain that might reassure hodlers: We’ve been around this… block.

The burst of the first dot-com bubble in the early 2000s was expected to be an extinction-level event, too, the argument goes. Instead, it became a kind of post-hype reset, Kevin Depew, deputy chief economist at the RSM consulting firm, recently suggested on Twitter. In 2000, “as all the internet stocks collapsed, many going away permanently, we really buckled down and figured out how to use the internet,” he writes. Predictions about what web technology would do for us seemed crazy, he adds, but “ultimately seem pretty obvious in hindsight…which brings us to crypto today.”

Billionaire Mark Cuban made a similar comparison this month, tweeting that crypto is going through a “lull” just as the internet did. Like the early web, crypto is now rife with chains “copying” others, jumping into NFTs and DeFi bandwagon-style, he asserts, when what crypto needs is “Smart Contract apps replacing SAAS apps.”

Not everyone feels as prepared to identify tomorrow’s killer crypto apps, which would be key to navigating the bust. Bloomberg columnist Lionel Laurent writes that the “tech-adoption narrative requires the ability to differentiate between crypto’s Googles and Pets.coms, and to determine whether Bitcoin is itself vulnerable to disruption by public or private-sector rivals.”

Developing such divination skills could take years.

🔮 Predictions

Coming soon: Regulations. The US federal government has been threatening to regulate digital assets for a while, but the Terra/Luna collapse will likely speed up its timeline. Stablecoin rules, which the US has already been looking into, are likely to come first. The European Commission, meanwhile, is reportedly considering restricting stablecoins.

Institutional investors take a breather… “They were sitting on the edge of the pool, with their feet in the water, ready to jump in,” says ARCA’s Dorman. “Now maybe they backed up a little way, and are back at the deck chairs.” They’ll eventually dive in, he adds, though it’s unclear whether that’s in months or years.

… and so do VCs. Venture capital, a big contributor to the crypto froth, will likely retreat. Reports of start-up deals falling apart and founders getting ghosted are starting to pop up.

The crypto crowd braces for another crypto winter. Coinbase has already slowed hiring, and recently said customers would lose access to their crypto assets if the exchange goes bankrupt. Robinhood, which had become increasingly reliant on crypto, said it’s laying off 9% of its staff.

Keep learning

- What is the point of a stablecoin? (Quartz)

- Why Washington Worries About Stablecoins (New York Times)

- An argument for letting Terra Die (CoinDesk)

- Lessons from Miami’s dashed crypto dreams

- An analysis of crypto’s boom-and-bust cycle from one of its biggest boosters

- Why crypto investors should study the history of financial advice

Sound off

What do you think of crypto’s long-term prospects?

It’ll just keep dropping from here

In last week’s poll about smart cities, 36% of respondents said they were most excited about sensors on everything. Your utopian city is one driven by data, and we’re here for it.

Have a great weekend,

—Ana Campoy, deputy economics and finance editor (had her first crypto-related dream this week, but couldn’t remember the plot after waking up)

—Scott Nover, emerging industries reporter (less stable than TerraUSD)

—Lila MacLellan, senior reporter (looks forward to getting the chorus from “Crypto Boy” out of her head)

—Nate DiCamillo, economics reporter (begging the masses to not invest more in crypto than they can stand to lose)

One 🎙️ Thing

It’s open season for poking fun at crypto bros and their HODL-mentality, and this TikTok breakup song does it well.

The video recaps the latest next-big-things in crypto, from NFT marketplace OpenSea to ether-wallet Metamask. “So ether one you choose your wallet or me,” it goes. “Well better hope you’re getting laid on web3”