This week in membership: The next bubble

{{section_end}} {{section_start}}

{{section_end}} {{section_start}}

🤔Here’s Why

1️⃣ Research suggests testosterone could be exacerbating booms and busts. 2️⃣ And governments have been stoking stock-market booms for centuries. 3️⃣ Investors have a long history of getting carried away by stories. 4️⃣ The resulting retail trading boom is rooted in a business model invented by Bernie Madoff. 5️⃣ We should be vigilant, as government debt burdens soar and interest rates fall.

📝 The Details

1️⃣ Research suggests testosterone could be exacerbating booms and busts.

In China, regular people are packing into brokerage houses to buy shares. Americans from coast to coast are feverishly refreshing their Robinhood and TD Ameritrade brokerage app. Newbie traders in India are enamored with penny stocks. A growing number of Brits have taken a fancy to shares. There are several factors contributing to the outbreak in retail fervor, from how easily slick smartphone brokerage apps make it to buy and sell securities, to low interest rates and zero commission charges. And then there’s our biology.

One trader-turned-scientist believes the testosterone-fueled highs and cortisol-inspired lows that accompany trading could amplify market swings. Hormones “may build up in the bodies of traders investors during bull and bear markets to such an extent that they shift risk preferences,” writes John Coates, a former derivatives trader and now neuroscientist. “Under the influence of pathologically elevated hormones, the trading community at the peak of a bubble in the pit of a crash may effectively become a clinical population.”

2️⃣ Governments have been stoking stock-market booms for centuries.

Coates thinks testosterone can amplify bubbles. Others think government policy is usually the culprit. Take China, for example. As ground zero for the coronavirus pandemic, its economy shrank in the first quarter for the first time since 1989. Oh, and the old world order that bound China’s economy to the West is rapidly decoupling.

But for China’s armchair traders, what matters is that the government has said, essentially, go for it. After state media gave China’s army of retail stock traders the all clear, a benchmark of shares listed in Shenzhen and Shanghai took off like a bullet. The China CSI 300 index is now trading at levels last seen in five years ago—when China’s last stock market bubble deflated.

3️⃣ Investors have a long history of getting carried away by stories.

Bubbles can spring from the stories we tell each other. And technology and the companies that harness it have a way of amping up excitement, by promising a “new era.” Yale economist Robert Shiller, the author of the seminal book Irrational Exuberance and a Nobel prize winner for his work analyzing bubbles, has focused a lot of his research on the narratives that spread virally. “Big things happen if someone invents the right story and promulgates it,” he told Quartz in 2017.

One of the stories going around today is that the Covid-19 pandemic has caused a “new era.” The US stock market roughly tripled in value between 2009 and 2014, and people who were shellshocked by the financial crisis missed out on that rally. As the saying goes, there’s nothing more agonizing than watching your neighbors get rich.

4️⃣ Ponzi mastermind Bernie Madoff pioneered the business model for modern retail trading.

Madoff’s firm was an important advocate of payment for order flow, which has become a critical money maker for brokerages like Robinhood and Charles Schwab. Brokerages get paid for their customers’ orders from market makers—contemporary versions of what Madoff’s trading company was. In his heyday, Madoff portrayed himself as someone who democratized finance for the little guy—a renegade who went up against NYSE. These days the players have changed, but the sales pitch is remarkably similar. Now it’s Robinhood that touts itself as a brokerage that will “democratize finance for all.”

5️⃣ We should be vigilant, as government debt burdens soar and interest rates fall.

US Treasury yields fell to a 150-year low this year, signaling that the risks of easy credit are present and growing. The pandemic has resulted in eye-popping levels of government debt, which will spur officials to look for an easy way out. The spread of Covid-19, if anything, has increased the tech company hype. The barriers to trading are lower than ever, with apps putting a brokerage in every person’s pocket. It’s too soon to call what’s happening now an outright bubble—a confounding surge in prices before the crash—but research suggests we should be on our guard, and look to the history of financial bubbles to prepare for what’s next. We can learn from centuries of booms and busts, and hit the brakes before it’s too late.

📚Read the field guide

Inside the hormones, politics, and technology fueling a global stock market bubble

📣 Sound off

Are you obsessed with our Obsessions? Our newsroom is driven by the topics of greatest importance to today’s global economy. Now’s your chance to tell us what you think about Obsessions so that we can create the best experience for you—take our two-minute survey to tell us what you think.

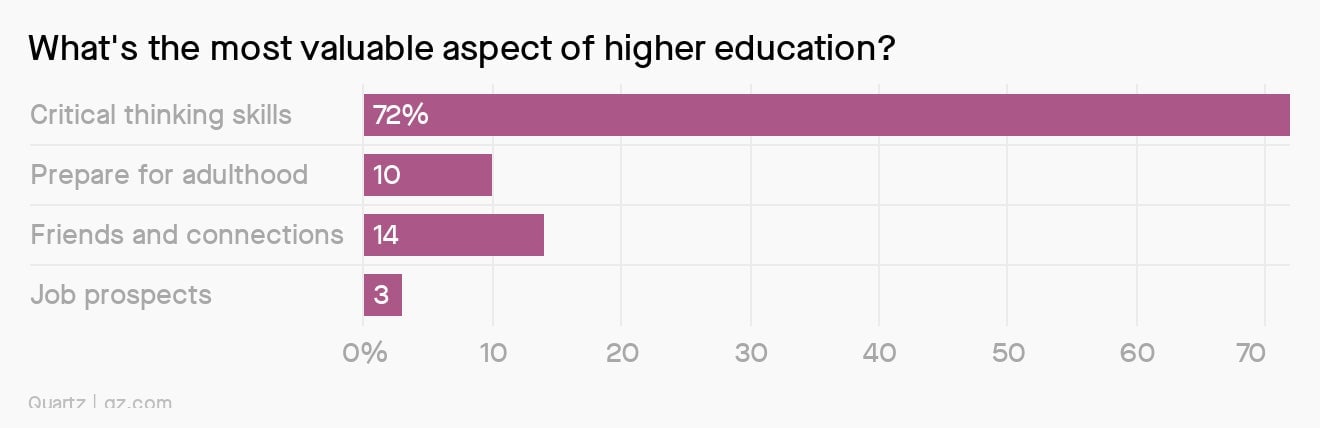

Last week we asked you what you thought was the most valuable aspect of college, as part of our guide to higher ed going remote. Here’s what you said: