For Quartz members—The merger mercenaries

Hi Quartz member,

Hi Quartz member,

Hundreds of economists at leading universities live a double life: By day, they conduct research, teach classes, and rub padded elbows at academic conferences. But by night, they moonlight as analytic mercenaries, helping to tear down—or defend—the world’s biggest monopolies. These academics work for economic consulting firms, and few firms are as feared and revered as 44-year-old Compass Lexecon.

How consultants sway monopoly cases

In legal jurisdictions from the US to the EU to China, the outcome of anti-monopoly lawsuits and merger reviews hinges on hard-to-answer economic questions: How much of the relevant market does a company control? What is the relevant market, anyway? If two companies combine, will their customers wind up paying higher prices?

Private businesses and government regulators hire Compass Lexecon to answer those questions. The firm has scores of top-flight economists on hand who can create economic models to prove whichever version of reality its clients need to prove. (“They can testify that the world is flat or round,” former US Federal Trade Commission chairman William Kovacic says of economic consultants in general.) Sometimes, consulting firms work for both sides of a legal dispute, presenting opposite arguments for each client. The economists also serve as expert witnesses, breaking down complicated economic ideas for judges and juries during antitrust trials.

Compass Lexecon says on its website that it “has evaluated thousands of proposed mergers and acquisitions across virtually every industry on behalf of both private parties and government agencies,” in addition to weighing in on four decades of antitrust lawsuits. Over the years, the firm has consulted for tech giants like Huawei, Motorola, IBM, and NVIDIA, telecom giants like Sprint, AT&T, and Verizon, automakers like GM and Fiat Chrysler, airlines like American and Southwest, pharmaceutical giants like Pfizer and GSK, publishers like Hearst, insurers like Anthem, and dozens of regulatory bodies that target dominant companies like these.

Ironically, economic consultancies present problems for antitrust enforcement. Their high fees drive up the costs of bringing cases to trial, and over time they’ve convinced lawyers, judges, and regulators to consider ever more complicated economic models as evidence.

“They have pushed the system in the direction of more complex analysis,” says Kovacic. “As you make the system more complex you tend to favor defendants—especially big defendants.” Dominant companies, after all, can afford the consulting fees, while cash-strapped enforcement agencies have to make triage decisions about which cases to prioritize.

Brief history

1977: Consulting firm “Lexecon” is founded by University of Chicago law professor Richard Posner and two colleagues. Posner is one of the leading figures in the “Chicago School” of legal thought, which pushed American courts to consider antitrust cases narrowly, on the basis of the impact to consumer prices. “Lexecon” is a mashup of lex, the Latin word for law, and “econ.”

1978: Lexecon gets its first big break: AT&T hires Posner to consult on its defense in a federal antitrust lawsuit that ends in the court-ordered breakup of AT&T.

1981: US president Ronald Reagan appoints William Baxter, a prominent “Chicago School” law professor, as attorney general. He helps usher in a new era of antitrust enforcement. Business begins to boom for economic consultants who build models (for the prosecution or defense) that quantify the impact dominant companies have on consumer prices.

1998: Nextera Enterprises, a company owned by “junk bond king” Michael Milken, acquires Lexecon for $60 million.

2003: FTI Consulting acquires Lexecon for $130 million.

2006: FTI Consulting acquires another antitrust consultant firm, Competition Policy Associates, and merges it with Lexecon to form Compass Lexecon.

Compass Lexecon’s army

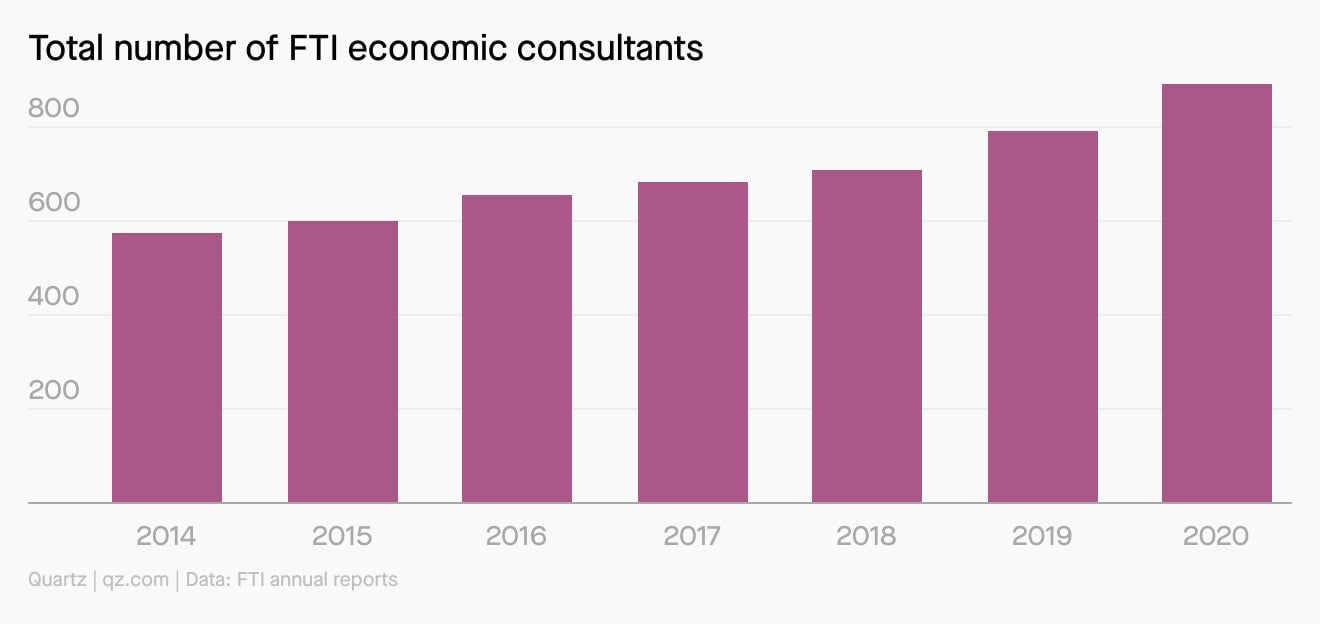

FTI keeps growing the number of economic consultants in its eponymous division, which is dominated by Compass Lexecon.

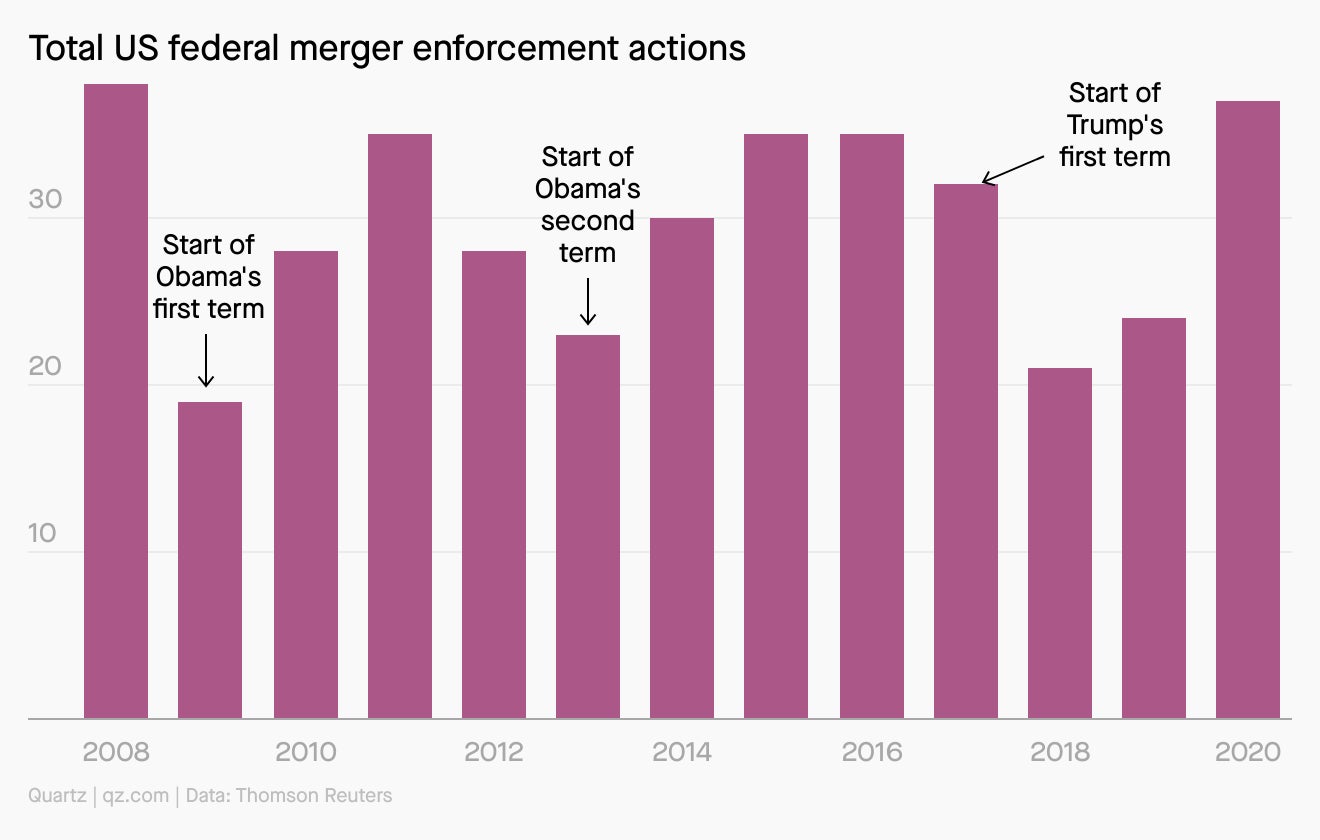

Even so, US merger enforcement has remained relatively flat over the past decade: New presidential administrations tend to take it easy in year one, and ramp up by the end of each term.

175: PhD-credentialed consultants employed by Compass Lexecon

2: Nobel prize winners working for Compass Lexecon (University of Chicago economist James Heckman and New York University economist Robert Engle)

$494: Average hourly fee for a Compass Lexecon consultant (though top experts charge as much as $1,350 per hour)

84: Fortune 100 companies that have hired Compass Lexecon

23: Compass Lexecon offices, in 14 countries

It’s a small world

The industry of antitrust consultants is itself highly concentrated: About half a dozen firms control the lion’s share of the market for expert witnesses and economic reports in antitrust cases and merger reviews.

- Charles River Associates: Often listed alongside Compass Lexecon as the world’s top antitrust consulting firm, CRA has a similar reach, operating 22 offices in 10 countries.

- National Economic Research Associates: Founded in 1961, NERA is the oldest consulting firm that specializes in using economic models to support antitrust litigation.

- Bates White: With one office in Washington DC, Bates White focuses primarily on US antitrust cases, but has an international network of consultants spread across the globe.

- Analysis Group: This Boston-based firm has offices in North America, Europe, and Asia, and in the past year has represented firms like Qualcomm and GSK in antitrust cases.

- Cornerstone Research: Based in San Francisco, Cornerstone most memorably consulted on the mega-merger between Sprint and T-Mobile.

- Berkeley Research Group: The youngest entrant on the list, BRG was founded in 2010 but has quickly ballooned to 45 offices in 17 countries.

Quotable

“It’s a pretty rare skill set to be able to have both very good qualifications substantively in economics…and also to have the skills to sit in the stand and testify and explain it in plain English. Not everybody can do that. And the people that can do it can charge pretty good fees.” —Janelle Wrigley, former FTC prosecutor

It takes a particular person to become a $1,000-an-hour economic consultant. And it helps if you look and act the part of a pointy-headed, tweed-bound professor.

ProPublica describes Dennis Carlton, a University of Chicago economist and leading Compass Lexecon consultant—who has raked in about $100 million in fees over the course of his career—as being self-effacing, with small, bespectacled eyes, a habit of speaking in a slow, nasal voice, and an overall demeanor that’s about “as intimidating as a high school guidance counselor.” And yet, “his calm, unassuming demeanor, even under intense cross-examination, makes him the perfect champion for his corporate clients.”

Keep learning:

- These professors make more than a thousand bucks an hour peddling mega-mergers (ProPublica)

- How consultants will sway the outcome of the Epic v. Apple case (Quartz)

- Understanding the extremely high stakes of Big Tech’s antitrust battle (Quartz)

- Europe’s new antitrust rules will annoy, not topple, Big Tech (Quartz)

- Big companies are starting to swallow the world (The New York Times)

Thanks for reading! And don’t hesitate to reach out with comments, questions, or companies you want to know more about.

Best wishes for a mercenary end to your week,