SPACs: Where are they now?

A look back at the SPAC

A look back at the SPAC

Suggested Reading

For a brief, shining moment, there was nothing sexier to be involved with on Wall Street than a special purpose acquisition company. SPACs, as they’re better known, attracted investments in 2020 and 2021 from boldfaced names like retired baseball star Alex Rodriguez and former US speaker of the House Paul Ryan. Richard Branson joined up his Virgin Galactic space venture with a SPAC. Serena Williams joined the board of a SPAC. Even Channing Tatum’s manscaping company got in on the trend and merged with a SPAC.

Related Content

SPACs operated in relative obscurity for years until the pandemic, for reasons we’ll explain, made them a wildly popular way of taking private companies public. But every boom has its bust. And SPACs, which go public as blank-check companies in search of private companies to merge with, are no exception.

SPAC activity remains busier than it was pre-pandemic, however, and the array of folks getting caught in the SPAC market’s comeuppance (famed investor Bill Ackman, Facebook billionaire Chamath Palihapitiya, and former US president Donald Trump among them) ensure that the headlines about SPACs will stay interesting for some time.

Let’s go target hunting.

Explain it like I’m 5!

A SPAC is formed by a sponsor who raises money from investors in an initial public offering (IPO). The SPAC then typically has 24 months to a) find a business to buy, and b) complete the merger, also known as a de-SPAC, which transforms the private acquisition target into a public company. If the SPAC can’t de-SPAC in time, it dissolves.

Why would anyone do this?

Though the payoff is far from certain, SPAC sponsors get big stakes—typically 20%—in the blank-check companies they’ve formed.

That’s a lot of dilution for investors. But in exchange, they get to vote on the merger proposed by the SPAC. If they walk away from the deal, they get back the money they invested, plus interest. Usually, they can also keep any stock warrants offered as a sweetener during the fundraising process, allowing them to buy shares at a certain price on a later date.

For private companies interested in going public, merging with a SPAC takes about half the time as a regular IPO. And the company’s valuation requires agreement with just one party—the SPAC’s management—as opposed to being influenced by any number of market forces.

But SPACs and de-SPACs pose plenty of risks for everyone involved.

Take me down this 🐰 hole

SPACs were invented in 1993 by two old friends—one an investment banker, the other a lawyer—who simply wanted to give private companies a new way to reach regular investors.

For most of the next three decades, SPAC activity plodded along quietly, largely overshadowed by IPOs and direct listings. But when the markets dried up at the start of the covid pandemic, SPACs that had not yet spent their shopping money became a rare, new source of capital. Suddenly, a lot more companies were interested in merging with SPACs, which increased the quality of the available acquisition targets, which increased the pool of prospective SPAC sponsors.

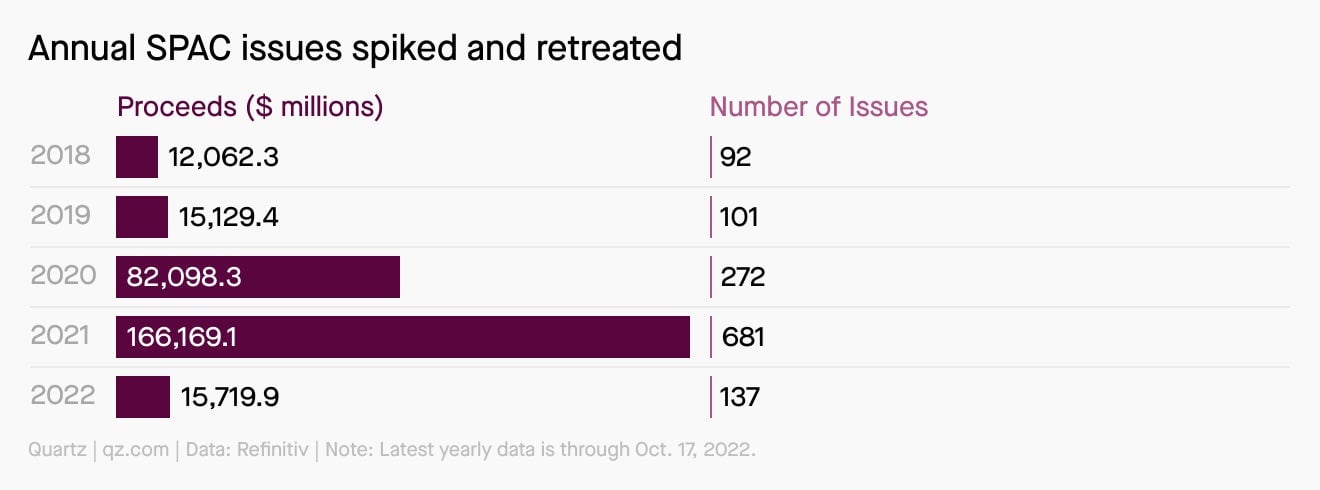

But poor returns on de-SPACs, rising inflation and macroeconomic risks, and heightened US regulatory scrutiny of SPACs have all taken a toll. This year through mid-October, the number of new SPAC listings was down 74% from the same period in 2021, and the number of mergers they completed was off by more than a third, according to data tracked by Refinitiv.

By the digits

$390 million: Average value of a SPAC merger in 2019

$2 billion+: Average value of a SPAC merger in 2021

$39.6 billion: Amount that Altimeter Growth Corp.’s SPAC paid for Grab Holdings, the Singapore-based ride-hailing and food delivery company, in 2021

681: Number of new SPAC listings in 2021

137: Number of new SPAC listings year-to-date in 2022, according to data from Refinitiv

1%: Rate of a new US excise tax that could apply to SPAC redemptions

81%: Average SPAC redemption rate in the first eight months of 2022

$10: The price investors in a pre-acquisition SPAC usually pay for a share of stock

Pop quiz

Which of the following companies to go public via acquisition by SPAC was backed by rapper Jay-Z?

A. Jamba Juice (smoothies)

B. DraftKings (sports betting)

C. The Parent Company (cannabis)

D. Immunovant (biotech)

Find the answer at the bottom.

Fun fact

Way ahead of the latest SPAC craze, satellite telecom company Iridium merged with a blank-check company in 2006, and traded below the $10 SPAC IPO price for the next seven years. But as the commercial space business caught on—with SpaceX’s reusable rockets giving Iridium a new way to launch its constellation of satellites—the stock pulled out of its rut. As of this writing, Iridium trades at more than $50 a share.

Put that in your PIPE

Heavy redemptions by SPAC investors are never a good look, but they’re only truly problematic when there’s no other capital to fill the void. That’s why a SPAC might look to a PIPE, a private investment in public equity.

However, for many of the same reasons the SPAC market has slowed in general, PIPE investors are no longer as reliable a source of backup funds. If they’re willing to invest in a SPAC at all, they’re often demanding deal sweeteners, like convertible debt or preferred shares, which are senior to the $10 common shares held by the SPAC’s regular investor base.

Lawyers at Skadden, Arps, Slate, Meagher & Flom recently noted “a rise in ‘insider only’ PIPEs—where the PIPE investors consist solely of SPAC sponsors, target insiders and their respective ‘friends and family’—and in ‘strategic’ PIPEs, in which the investors have a business or commercial relationship with the target, all resulting from the lack of interested third-party financial PIPE investors.”

Poll

Is a SPAC investment in your future?

Look into your crystal ball, and tell us what you see.

💬 Let’s talk!

In our last poll about the Day of the Dead, over 65% of you said “¿porque no los dos?” when asked if you’d prefer to celebrate Halloween or Día de Muertos. 27% of you are strictly Day of the Dead observers, while only about 8% of you threw a candy in the hat for Halloween.

Today’s email was written by Heather Landy (will probably never go out of style) and edited by Susan Howson (definitely did a long time ago) and produced by Julia Malleck (has never gone out with Styles).

The answer to the quiz is C. The Parent Company. Jay-Z is “chief visionary officer” of the cannabis grower, packager, and distributor, which merged in 2021 in a SPAC deal with Subversive Capital Acquisition Corp.