Hey Quartz members,

If you were awake and following along late at night on Wednesday (Sept. 14), you may have heard that ethereum completed its “merge”. It’s not a phase, and it isn’t a union with another cryptocurrency. It’s actually a fundamental change in how the community decides what transactions are legitimate and should be recorded in a new block on a digital chain.

This sort of consensus mechanism is what makes it possible for cryptocurrencies—and, for that matter, modern finance—to exist. Most folks park their money in a bank in part because they know the bank isn’t going to lose their funds and because they can pay other companies with their bank account. The bank’s ledger, where transactions are recorded, is maintained by bank employees. Blockchains, similarly, consist of a bunch of individuals following a mechanism that keeps a ledger of all transactions in cryptocurrencies.

For most cryptocurrencies, the original consensus mechanism was “proof-of-work.” In this model, anyone who wants to participate in maintaining the ledger has to have a computer that solves cryptographic equations, which add new blocks to the chain. But the mechanism that ethereum switched to last week through the merge is called “proof-of-stake.” Instead of devoting computing power, individuals now pony up ETH—ether, the native cryptocurrency of ethereum—to participate in the process of confirming transactions.

The merge has something for everyone. For developers, it was one of the largest open-source projects in history. For environmentalists, it’s like Finland turned off its power grid overnight. And for the crypto skeptics, it’s a way to make ethereum’s supply deflate over time.

THE BACKGROUND

Since 2014, Vitalik Buterin, the co-founder of ethereum, has recognized that the blockchain may require a different kind of consensus mechanism.

Ethereum aims to do a lot more than bitcoin’s blockchain, because ethereum enables smart contracts: automated tools that execute transactions as soon as specified conditions are met. The computer scientist Nick Szabo, who first described the idea of a smart contract in 1993, likened it to a digital vending machine: You put a dollar in, you got a snack back, all without needing a centralized entity to approve it.

The smart contracts feature has allowed several decentralized finance protocols—peer-to-peer finance, involving no intermediaries or central institutions—to emerge on ethereum. This has created a system with daily transaction volumes that are multiples higher than that on the bitcoin blockchain. Remarkably, this is true even though one bitcoin is worth a lot more than one ether.

Given ethereum’s popularity, these transactions were always only going to multiply in coming years. To sustain them, ethereum had to find another consensus mechanism that didn’t require waiting for computers to churn through cryptographic equations. The merge is a solution engineered to meet that inevitable need. The sharp drop in energy use is, in a way, a byproduct—but a very happy one for the planet.

THE LONG HISTORY OF THE MERGE

2014: Vitalik Buterin writes in the introductory ethereum white paper that, in the future, blockchain will likely have to switch from proof-of-work to some other mechanism.

2015: Ethereum is created. The first block mined around 72 million coins of ether. Buterin got 553,000 of these ether.

October 2020: Ethereum introduces a beacon chain deposit contract to test people’s appetite for proof-of-stake. If you staked 32 ether, ethereum promises, you would become a validator of ethereum transactions when the merge was completed.

November 2020: The beacon chain reaches a threshold of 524,288 ether staked on it—the minimum that ethereum decides it needs for the chain to be considered a viable mechanism.

December 2020: The beacon chain is launched seven days after it meets the staking threshold. This kicks off the process of coding and testing the chain to ensure that it can handle the full volume of ethereum transactions.

September 2022: The merge successfully completes.

GOING GREEN

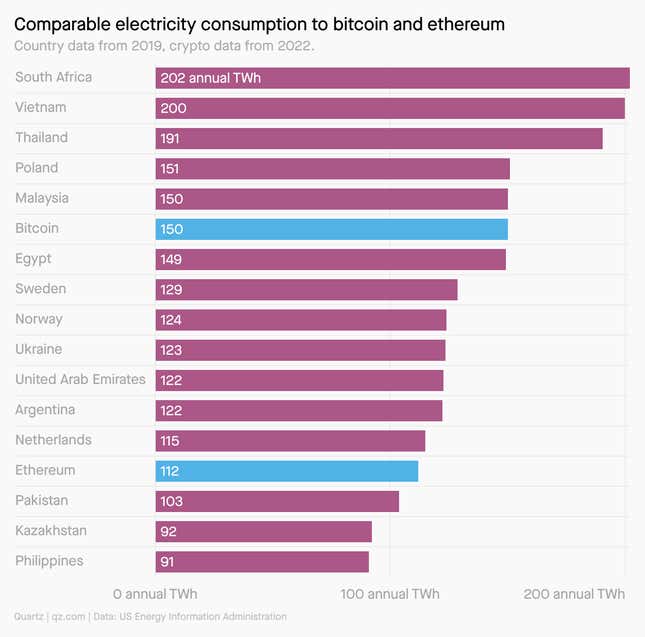

The ethereum merge is inarguably the most important environmental upgrade in the history of crypto. Ether is the second largest cryptocurrency by market capitalization, behind bitcoin, and uses about 112 Terawatt-hours of energy per year, according to the Ethereum Foundation. That’s about the same power consumption as all of the Netherlands.

The merge, which eliminates the energy-intensive proof-of-work system, will cut emissions by an estimated 99.95%, the foundation says. The transition should not only make ethereum greener, but will also reduce the stigma surrounding crypto among many climate-conscious investors.

“Most institutional investors don’t understand [crypto] technology, but they do understand the sound bites,” Larry Newhook, CEO of the asset management firm Alpha Innovations, told Quartz’s Tim McDonnell. “They use ‘proof-of-work’ as another reason to say no to crypto. When ether moves to proof-of-stake, there will be one less reason for institutional investors to say no.”

But others are still skeptical about crypto in general. What’s the point? they wonder. “We haven’t identified what we think is a viable use case,” said Jon Quealy, chief investment officer at Trillium Asset Management. “We’re not there, and we won’t be there for some time.”

ONE 💵 THING

Even though the merge appears to have gone smoothly, it hasn’t really helped ether’s value. In fact, the price of ether fell more than 9% in the first 24 hours after the merge was deemed complete. The blockchain intelligence firm Glassnode may have called it right in August when it predicted that investors would “buy the rumor, and sell the news.”

Ether’s price topped $4,600 a coin in November 2021, but it has since dropped to about $1,400 amid a broader “crypto winter,” the industry’s term for a bear market.

QUARTZ STORIES TO SPARK CONVERSATION

- New documents show Big Oil knows its climate plans are bogus

- Patagonia say it’s owned by the Earth now. Here’s what that looks like.

- How Fred Franzia kept “Two Buck Chuck” wine so cheap

- How much will the Queen’s funeral cost?

- Gorbachev’s free press legacy can survive Putin

- Covid explains the mystery of a hot US labor market in rocky economic time

5 GREAT STORIES FROM ELSEWHERE

⛓️ Web3 philosophy. In a piece for Dirt, self-proclaimed crypto “participant-observer” Joy Howard delves into the five ideological underpinnings of ethereum collectivism—a movement she sees as a response, in part, to bitcoin libertarians. The nascent subculture brings together communitarians, feminists, and environmentalists, united in the belief that blockchain technology can be a force for positive social transformation.

🐈 Nine lives. Cats, acrobats that they are, can fall from feverish heights and still live to meow about it. The physics behind their survival is still not fully understood, although scientists surmise that their super-bendy spines might play a role. The Atlantic investigates why felines have nine lives, and the possibility that they can stick any landing, regardless of whether they’re falling from 50 feet or 50 stories.

🤫 A spy on trial. Xu Yanjun, a Chinese intelligence officer, was extradited to the US in 2018 for espionage. His trial, last fall, provided an unprecedented look into China’s robust industrial espionage apparatus, from its hierarchy to politics, training to methods. A report from Bloomberg lays out how Xu and his collaborators worked to secure trade secrets from some of America’s largest aerospace companies.

🎒 Ye school. Kanye West has founded a record label, a clothing line, and even a fast food LLC—but few know about his private school, Donda Academy. The Christian prep school located in Simi Valley, California reportedly requires parents to sign a non-disclosure agreement and aims to raise the “next generation of leaders.” Rolling Stone reports that West eventually plans to open schools across the US, including a university, but many details remain a mystery.

🌐 Grid international. The age of transnational super grids is nigh, energy experts are saying. One project, the Green Grids Initiative, envisions building an electricity network that will connect over 120 countries around the globe, allowing for more efficient energy harvesting and distribution. The Wall Street Journal explains that while ambitious projects like these have failed in the past, growing political will to shift to renewables may make them a reality.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Have a proof-of-no-work weekend,

— Scott Nover, emerging industries reporter, and Nate DiCamillo, economics reporter

Additional contributions by Alex Citrin-Safadi, Tim McDonnell, Julia Malleck, and Samanth Subramanian