Hi Quartz members,

US companies got a new homework assignment from federal regulators this week, which should ultimately reward those curbing their contributions to climate change. Big accounting firms are sharpening their pencils to help. But the biggest gold rush could be for an emerging group of startups that specialize in tallying corporate carbon footprints.

Over the next few fiscal years, the Securities and Exchange Commission will require (pdf) public companies to publish information annually about their greenhouse gas emissions and exposure to climate change risk. The disclosures are meant as a resource for investors, who will be able to compare companies’ climate plans—and either call out laggards or divest from them.

Just like traditional financial disclosures, these assessments will need to be fact-checked by auditors, which means a business opportunity for “Big Four” firms like Ernst & Young. But climate disclosures are a young and feisty beast, and require far more data about a company’s operations and potential vulnerabilities than your average 10-K. In November 2021, a coalition of major investors warned the Big Four that they weren’t adequately prepared for this kind of audit.

Fortunately for companies rushing to comply, the SEC’s proposal allows that some disclosure-checking need not be done by traditional accountants. That’s where carbon accounting firms come in: They have narrower but deeper expertise, and are already on the rise as more investors demand this data. Kristina Wyatt, a former SEC lawyer who helped develop the rules and is now deputy general counsel for Persefoni, a carbon accounting software firm, said that since the SEC proposal dropped they’ve been flooded with inquiries: “I think the demand for our product is really going to explode, to be honest.”

The backstory

The SEC’s proposal has been cooking since US president Joe Biden took office, and responds to the growing global consensus that fixing climate change means publishing more detail about the risk it poses to companies and the economy.

- The carbon bubble needs popping. The underlying rationale for climate disclosures is that investors have a right to understand how the value of shares they hold might be affected by climate damage to the company’s physical assets, or changes in regulations and consumer demand for the company’s products (fossil fuels in particular).

- There are some early adopters. At least 13,000 companies globally have voluntarily published climate data through the nonprofit Carbon Disclosure Project. But the list doesn’t include most major oil and gas companies, which have not been forthcoming about climate risk in their traditional financial disclosures. The US is also late to the game—the European Union and Japan already rolled out climate disclosure rules.

- Biden’s climate agenda is on thin ice. The SEC rules could end up being one of the few major climate policy measures to emerge from Biden’s first term, given that his spending bill is stalled in Congress, the Supreme Court is poised to impede direct greenhouse gas restrictions, and the Russia-Ukraine war has the White House begging oil companies to drill more.

The scope(s) of the problem

Among other things, the SEC rules will require companies to provide annual snapshots of current emissions. Economists divide corporate emissions into three categories, or “scopes”:

🚗 Scope 1: Emissions from direct operations, primarily referring to fossil fuels burned in company-owned vehicles or facilities.

⚡ Scope 2: Emissions from purchased energy, primarily referring to emissions from the power plant you buy electricity from.

🕸️ Scope 3: Emissions from a company’s suppliers and customers, as well as from business travel. This is where things get tricky, because comprehensive data isn’t always available (the SEC rules do provide some legal protection here). But for fossil fuel companies and other top emitters, scope 3 is by the far the biggest share, because it counts customers burning those fuels. The SEC rule only requires large companies to disclose scope 3 emissions if they are “material” to investors; what exactly that means is sure to be the subject of disagreement.

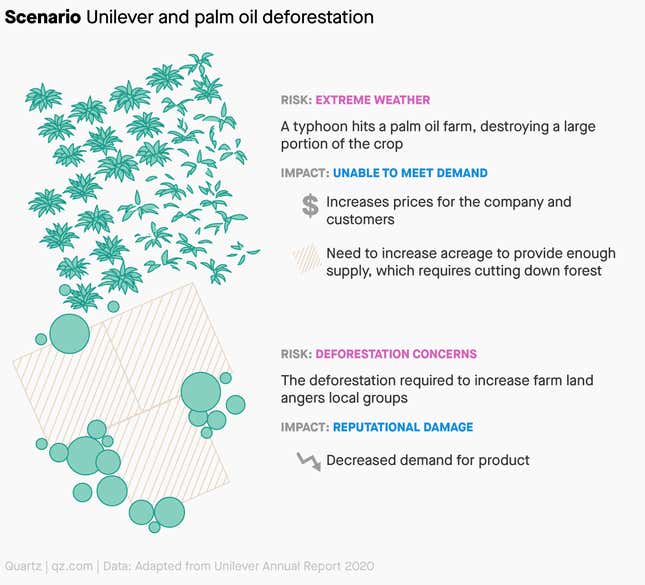

So how do these scopes impact a bottom line? We can tell by looking at the case studies shared by companies that already make climate disclosures. Here’s how Unilever—one of the largest buyers of palm oil in the world—demonstrates the potential impact of an extreme weather event on production.

What to watch for next

- Litigation. The SEC rules won’t be finalized until they go through a months-long public comment period, after which they are likely to face lawsuits from industry trade groups arguing that the requirements are too onerous, expensive, or immaterial.

- Squabbling for ESG talent. Accounting firms of all sizes will join asset managers and investment banks in a hiring frenzy for eco-savvy number-crunchers to scope out scopes and read the tea leaves of long-term climate forecasts. One possible shortcut: Merge with or acquire existing carbon accounting shops.

- When greenwashing becomes a crime. All this data will make it harder for companies to hide behind vague or greenwashy marketing statements, and could expose them to criminal fraud prosecution if their deeds don’t match up to their promises.

- Will investors revolt? The whole idea here is to give shareholders ammunition for climate accountability. But it’s up to them to actually use it, by either working with companies to lessen risk or punishing them with higher costs of capital.

Quartz stories to spark conversation

🇨🇳 Like oil and war. As recently as last year, Russia seemed like a good hedge in China’s attempt to diversify oil imports. But the Ukraine conflict has made clear that relying on Russia isn’t foolproof. One economist characterizes oil as “the soft underbelly of China’s energy security.”

🤰 On the internet, nobody knows you’re pregnant. Remote work is allowing women to wait longer before informing their employer of a pregnancy. But delaying disclosure also risks forfeiting crucial rights. Says one lawyer, “If you under-perform due to pregnancy symptoms but your employer doesn’t know you are pregnant, you can be legally terminated.”

🔌 A charged moment. With US gas prices soaring, it’s now three times more expensive to fill the gas tank for a combustion engine than it is to charge an EV at home. “It’s not only that electric vehicles are cheaper to operate,” says Ben Prochazka, executive director of the Electrification Coalition. “Electricity costs are also much more consistent than gas prices.”

😷 What did you just call me? China’s stringent covid strategy has been largely successful, but it’s also facing growing frustration from citizens, who coined the term “pandemic prevention enthusiast” to describe anyone irrationally enthusiastic about covid-zero, or for whom covid restrictions aren’t a hindrance to earning an income.

🥡 Hungry like the wolf. What if an algorithm could predict takeout demand, match customers to kitchens, and instantly assign delivery drivers? That’s the promise from India’s Zomato, whose “Zomato Instant” offers food in just 10 minutes. But all that convenience could come at the expense of drivers, who fear being penalized for delivery circumstances beyond their control.

😞 The coming mental health crisis. What if the Great Resignation is not a solution, but a symptom? A look back at the influenza pandemic of 1918 shows an increase in depression in the years that followed. Post-pandemic blues were “so constant that [they] ought to be regarded as part of the disease,” medical journal The Lancet wrote in a 1919 omen for today’s covid trauma.

🤩 Young, Famous & African. Netflix has its first original African reality show, which follows the lives of some of the continent’s biggest celebrities. “One of my favorite quotes is ‘Until the lion learns how to write, the story will always glorify the hunter,’” says co-creator Peace Hyde of showcasing a more cosmopolitan African than Western depictions often present.

Survival of the fittest

The streaming wars ushered in a new era of on-demand entertainment, and with it a tsunami of original, high-quality programming. But being a TV lover these days is an expensive, decentralized mess. So which streaming services have the best chance of survival as things shake out? We asked some of the leading television industry analysts:

- Ross Benes, Insider Intelligence: “Netflix, Disney+, Prime Video.”

- Geetha Ranganathan, Bloomberg Intelligence: “Disney+ and Netflix at the top, followed by the Discovery/HBO combination and Amazon Prime as the top-tier players.”

- Mike Proulx, Forrester: “The most popular streaming services that are used at least monthly in the US are Netflix (59%), Amazon Prime Video (43%), Disney+ (29%), and Hulu (26%). However, other platforms like HBO Max are making gains because of strong intellectual property. Relatively speaking, the streaming space is still very nascent and it’s anyone’s and everyone’s game right now.”

Learn more about the future of streaming—and what’s ahead for everything from live events to robotics—by checking out our series on the next 10 years of innovation.

6 great stories from elsewhere

🚗 Afghanistan’s finance minister drives an Uber now (Washington Post)

😷 People decide when a pandemic is over (Scientific American)

😟 Ethereum’s founder is worried about crypto’s future (Time)

☕ What happened to progressive Starbucks? (Fast Company)

🙈 There’s something off about ApeCoin (Platformer)

✊ The current thing (Stratechery)

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Best wishes for a transparent weekend,

—Tim McDonnell, climate and energy reporter

—Kira Bindrim, executive editor