Hi Quartz members,

What does AMC Entertainment have to do with precious metals? Good question.

On March 15, the movie theater company announced a $27.9 million investment in Hycroft Mining Holding, good for 22% of this obscure Nevada-based gold and silver mine. Hycroft is publicly listed, having ridden the SPAC boom in 2020, but it was trading at just $1.07 at the time of AMC’s investment—barely more than a penny stock—and hadn’t mined or sold anything in months. Buoyed by the infusion of cash and publicity, Hycroft is now priced at $2.16 per share.

If you think about AMC as a movie theater business, which, of course, it is, then this deal makes no sense: Inactive mines are unlikely to provide the expertise or liquidity AMC needs to navigate the evolving landscape of in-person cinema. But if you think of AMC as a meme stock, which, of course, it also is, then… maybe the deal kind of starts to make sense?

“We found a company that was exactly like AMC [was] a year ago,” AMC CEO Adam Aron said in a March 28 interview about the Hycroft deal. “[It] had great assets… but it had a cash squeeze, a liquidity problem.” Within two weeks of AMC’s investment, Hycroft raised $195 million.

The subtext of Aron’s comment is that AMC’s core competencies are no longer limited to selling tickets and popcorn: It’s now in the business of meme-ifying balance sheets, taking debt-ridden companies like itself (last year) and Hycroft (this year) and using its fan club of Reddit-goers to buy stock, inject capital, and provide some runway to succeed. It’s a fixer-upper model of fundraising that could only have been born during the pandemic.

Although GameStop is still riding the wave of a 2021 meme-stock moment, its story could turn out to be a mere trial run. AMC is arguably the first company to fully embrace its meme status, and the first to harness it as an external investment strategy. What could go wrong?

The backstory

- Even pre-pandemic, AMC was struggling. Movie theater attendance was falling, streaming services were investing in feature films, and the company was at war with Moviepass (RIP). By the end of 2020, with most of its theaters out of commission, AMC was staring down filing for bankruptcy as its best option for survival.

- Retail traders kept the company afloat. AMC raised $917 million in January 2021, just a few months before GameStop kicked off the meme-stock craze. Soon after, retail traders glommed onto AMC and sent its stock price soaring. But unlike GameStop, AMC repeatedly issued new shares, fundraising off of the frenzy, while also lowering its stock price.

- Now things are weird. AMC is now 65% owned by retail investors, who—when they band together—control the company’s fate. They even stopped a key vote to allow AMC to issue additional shares in July. Aron has tried to appeal to his meme fanbase, who refer to him affectionately as “Silverback.” AMC announced free popcorn for shareholders plus plans to sell popcorn in grocery stores, and it began accepting crypto for movie tickets. Aron’s hours-long earnings calls also now feature Q&A sessions with retail investors.

Working retail

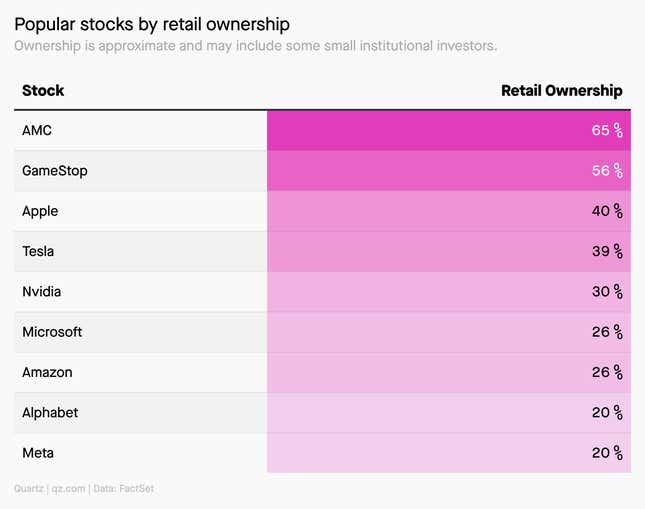

GameStop and AMC are true meme stocks, as evidenced by their ownership breakdown. In each case, institutional investors like mutual funds, hedge funds, and pensions are in the minority, while retail investors are in the majority.

What to watch for next

- More “transformational M&A.” Aron says he has a mandate from shareholders to not only improve the AMC theater business but also do “transformational M&A” deals. “Our shareholder base has given us capital to deploy with the clear expectation that we are… going to do exciting things with the money they entrusted,” Aron told Reuters.

- How AMC stock responds. So far, all the “excitement” has paid off. AMC stock rose from about $14 a share to $25 in the days since the Hycroft deal. But will shareholders love every deal AMC makes regardless of the merits?

- What is going to happen to movie theaters? The theater business is still struggling, especially as theatrical windows shortened during the pandemic. AMC is likely right to diversify revenue, but no one imagined gold and silver mining would be their hedge bet.

- More moves from retail investors. The retail boom is still alive, and even big companies like Amazon, Tesla, and Alphabet are paying attention. Each of those companies announced stock splits recently, a move that will make their share prices more appealing to retail investors. Even GameStop announced a split on March 31.

- Aron’s Twitter account. AMC’s CEO is the “Silverback” for a reason. He speaks directly to retail investors, and in their language. Look for other top brass to learn a thing or two from Aron—and his tweets—as they seek to emulate some elements of AMC’s success.

Quartz stories to spark conversation

📈 Will high inflation lead to bigger pay increases?

🖼️ Ukraine is selling NFTs like war bonds

😬 Business school teaches managers to keep wages low

⚔️ Sanctioning Russia created a financial World War

☢️ Japan’s energy crisis is boosting backing for nuclear power

🏨 How California succeeded at turning hotels into housing

😔 Women are more unhappy than men around the world

😴 Sleep at work is the new work from home in China

5 great stories from elsewhere

🇷🇺 The making of Putin. A New York Times Opinion piece traces the Russian president’s path, from wooing Europe to waging war in Georgia and Ukraine. It describes a version of “Putinism” that blends social conservatism and “imperial glory” with a heaping dose of self-preservation.

🌎 A plastic bag’s 2,000-mile journey. Plastic is notoriously tricky to recycle. So when Tesco claimed it could be easy, Bloomberg reporters put trackers on plastic bags and recycled them at the supermarket chain’s stores in London. Then they sat back and watched the bags’ meandering path.

🤔 Can you tell which studies are right? The social sciences are in the midst of a “replication crisis”—many supposedly high-quality experiments don’t hold up when they’re repeated—and this quiz from Marginal Revolution lets you guess which results replicate and which don’t.

🚗 Where Waymo won’t go. Alphabet’s autonomous vehicle company has been providing rides in the suburbs of Phoenix for five years, and this week announced driverless rides in downtown Phoenix and in San Francisco. But according to Timothy Lee of Full Stack Economics, a map of where Waymo will and won’t drive in San Francisco offers a clue to its current limitations.

📉 Most US cities shrunk in 2021. The majority of urban counties lost population, according to the Economic Innovation Group, while rural counties gained. Remote parts of Oregon and Idaho gained population, as did almost all of Nevada.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Best wishes for a transformational weekend,

—Scott Nover, emerging industries reporter