Hi Quartz members,

Rising prices and the Fed’s efforts to combat them have put the economy in a tight spot. A recession looms if the global economy doesn’t catch some breaks in the form of unclogging supply chains, extra production of oil and gas, or a deal to let Ukraine export more wheat.

Like most problems, inflation is easier to solve in advance. The causes of today’s rising prices aren’t necessarily avoidable, but it is possible, even easy, to imagine the US economy being in a better position to deal with this pressure. When historians assess US economic policy in the 2010s, they’ll see a decade of missed opportunity.

For example, if gas prices are the main pain point today, wouldn’t it be better if the US had moved to decarbonize its economy more quickly? If rent is a major contributor to inflation, wouldn’t more houses help drive it down? If the supply chain is snarled, would deeper ports and better airports smooth things out?

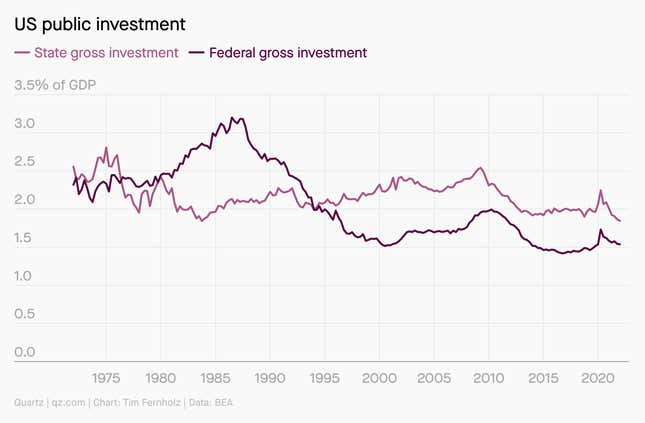

Looking back at the policy debates of the last decade, it’s increasingly clear that the decision to let public investment fall to the lowest levels since World War II between 2014 and 2020 was a major mistake. The “jobless recovery” from the 2008 financial crisis left the Federal Reserve holding interest rates at near zero for five years before slow hiking began. Those low interest rates made public investment even more attractive than it might otherwise be.

To be clear, the idea of a missed opportunity shouldn’t suggest that now isn’t a good time to invest in infrastructure. It would be better to build now than not to build at all, but it would have been better still to have started building five years ago.

The backstory

- After the crash. When the mortgage bubble popped in 2008, the US government responded with a stimulus package that included a little over $100 billion in infrastructure investment. Environmentalists, executives, urbanists, and farmers could all come up with reasons to back spending on transportation, energy, communications, even health and educational infrastructure. An additional $300 billion package was passed in 2015, which everyone agrees fell short.

- “Secular stagnation.” The budget fights of the 2010s (remember the Tea Party?) led to caps on government spending. Economists started fretting about “secular stagnation”—a fear that globalization, slowing population growth, and advanced technology would lead to permanently lower investment. The Fed’s inability to hit its price target raised fears of deflation. Bipartisan desire for an “infrastructure week” became an ever-present joke during the Trump administration, but nothing happened.

- It’s pandemic time. The coronavirus pandemic upended the global economy, and unprecedented US relief spending helped get people through it—but the booming recovery has resulted in the highest inflation in 40 years. Now, the rising cost of living has the Fed raising rates, but chair Jay Powell frets that the current drivers of inflation are beyond his control. Wouldn’t it be nice if the US economy had just a little more transportation capacity, green energy and living space to help take the pressure off?

📈 interlude

The US government isn’t investing as much as it once did–especially at the federal level.

What to watch for next

- Budget wars are back. The cost of public spending will be more visible at a time of high inflation and interest rates, but even if they weren’t, a Democratic president and the Republican Congress pollsters forecast in the fall will mean fights over taxes, spending, and—God help us all—the debt ceiling.

- How high will rates go? The Federal Funds rate, at 1.58% today, isn’t that tight by historical standards, but the Fed expects it to hit 3.8%, last seen in 2005, by next year. But as we saw with this month’s surprise hike of 0.75 percentage points instead of 0.5, the central bank could respond to signs of continued price increases with bigger hikes.

- How low will rates go? Financial conditions are tightening and companies are preparing for a recession with cost-cutting. If the Fed pauses rate hikes due to a recession and slowing price increases, the trends that push down the neutral interest rate in the long run could take back over: An aging population, technological progress, and globalization (probably!)

- There is some investment happening now. The US Congress did enact a $550 billion infrastructure bill in 2021, and bully for them. While the bill is missing important climate policies and includes some boondoggles, its successes and failures will influence future investment choices. One bad sign: Inflation is already eroding how far the money can stretch.

- The supply-side agenda. There’s plenty of talk of building more, “supply-side progressivism” and an “abundance agenda”. Will it lead to more production of the goods and services needed to lower the cost of living and fight climate change, or is it just a passing fad?

One 🚗 case study

One great case study in the power of timely public investment? The US government virtually saved Tesla with a $456 million loan after the 2008 crisis, a move decried by conservatives as government picking winners. Everybody won: Tesla went public, paid back the loan early, and became a leading EV maker, spurring other carmakers to up their commitments to green vehicles. Experts say a similar trick could help lead to innovation in other aspects of green energy, batteries and carbon removal projects. Meanwhile, EVs are approaching 9% of the global market share, which is small—but it’s still less competition at the pump, and fewer emissions in the future.

Quartz stories to spark conversation

👀 Bitcoin’s crash is good for the climate

😞 Are Russian diamonds now conflict diamonds? Depends on who you ask

🚀 Why JetBlue is so desperate to buy Spirit

🤔 Everything you need to know about meme stocks

🤖 These three companies exemplify China’s future economy

🍿 How to interpret the new round of Netflix layoffs

🏘️ Airbnb is giving homeowners $100,000 to build wacky rentals

5 great stories from elsewhere

🌲 Spirit of the pine. North Korea has an approach to environmental protection that diverges from Western-led multilateral governance—and it may be more effective and resilient. So argues Dylan Levi King in a Palladium essay that covers the history of North Korea’s mythology and spiritual ties to its natural world, a kind of “eco-theology,” that ideologically embeds the motivation to preserve the environment.

💔 Ups and downs. The first 10 minutes of Pixar’s Up (2009) has reduced many a moviegoer to tears. The Ringer goes into the story behind the film’s prologue, which lays out the life of Carl, the movie’s main character, and the love of his life Ellie, as they go from children with dreams of adventure to adults facing the sobering realities of life. Over a decade later, this sequence in the Oscar award-winning movie continues to deeply move viewers.

📉 Chip slip. America is a global leader in the semiconductor industry, but it’s starting to lose its lead. With a skilled worker shortage and investment in startups and R&D on the decline, the US will need to take swift policy action if it wants to keep a technological edge. Dylan Patel, author of SemiAnalysis, details what’s going wrong and what can be done to ensure this critical piece of technology receives government support.

🥩 Nothing biting. There was big hype for the meatless meat market last year, with millions of dollars pouring in to fund new ventures. But enthusiasm seems to be fizzling out, Forbes writes, as sales stagnate in an overcrowded market. Having yet to land on a formula that brings back customers for more, some companies will likely be meeting chopping block, and others consolidating, to keep the meat-free dream alive.

🌐 Web3-ism? There are parallels one can draw between Web3 and multi-level marketing (MLM), according to crypto-writer Lars Doucet. In a guest post on Noahopinion, Doucet gives his take on blockchain believers, and their similarities to members of “Amway,” a billion-dollar MLM scheme that consumed his own family in the 90s. From lack of articulation about how the system works, to dogged belief in its potential, a strong liberatarian throughline, and cult-like tendencies, the two have more in common than one might think.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Don’t waste your weekend,

—Tim Fernholz, senior reporter