Space Business: Rampant SPACulation

Dear readers,

Dear readers,

Welcome to Quartz’s newsletter on the economic possibilities of the extraterrestrial sphere. Please forward widely, and let me know what you think. This week: Stonks, rocket dilemmas, and satellite lasers. We’re skipping next week’s edition, but will be back in your inbox on Feb. 11.

🚀 🚀 🚀

It’s no surprise that the world of meme-driven stock speculation and “new space” business has some significant overlaps.

Market watchers have been transfixed by the surging share price of GameStop, a brick-and-mortar video game retailer that has seen its value increase more than twelvefold thanks to the wild intersection of an activist investor promising to transform the company for the digital era, massive bets against GameStop by short-selling hedge funds, a flood of retail investors coordinating on Reddit to make counter bets on the stock’s rise, and trading algorithms getting frenzied in response. Bloomberg’s newsletter god Matt Levine has a fuller explanation of the dynamics.

But we’re here to think about how finance can accelerate space activity, and there are implications. Elon Musk, a pioneer in social media finance and accidental (?) stock promoter himself, got in on the GME trade. And so did Chamath Palihapitiya, the venture investor who took space tourism company Virgin Galactic public in 2019 by purchasing it with a publicly-traded blank check company, or special purpose acquisition vehicle (SPAC).

And today that stock, SPCE, is surging. Virgin’s latest news was an aborted test flight in Dec. 2020, and it has yet to say publicly why the motor on its rocket plane failed to ignite. Since that test, SPCE’s stock price has gained more than 50%.

Is this logical? Sure, in the sense that the best-performing investments in our pandemic and social media age seem to be high tech things with fun narratives—Tesla’s electric cars, cryptocurrency and bitcoin, tech giants amid remote work, and… stocks that seem similar to things that Elon Musk tweets about. It’s a great time to bring a sexy high tech thing to market, like a suborbital rocket plane, without having to think too hard about cash flow.

Consider Momentus, the venture-backed company developing an Orbital Transfer Vehicle, which is being taken public by a SPAC backed by Stable Road Capital, trading as SRAC. After the news, Quartz reported that Momentus’ Russian founder and CEO was the subject of a federal investigation into his access to restricted technologies; he resigned this week. The price of Stable Road’s publicly-traded SPAC fell on the news—but remains twice as as high as before the merger announcement.

The market, as John Maynard Keynes explained to value investors almost a century ago, can stay irrational longer than you can stay solvent. (Or, as Tracy Alloway puts it in this context, “flows before pros.”) The funds behind SPACs are unlikely to fret too much—for example, as a sponsorship fee, Stable Road paid $25,000—$0.006 per share—for a chunk of Momentus stock that would be worth about $87 million if the transaction closed at today’s share prices. Other investors may not have that fall-back.

When it comes to space, SPACs are kicking the tires on more than one start-up. But several VC-backed entrepreneurs I speak to warn that if newly public space firms disappoint, it could be harder for other businesses in the sector to enter public markets, either to cash out investors and employees or raise working capital.

“Until you get the company to a point where you have a very stable revenue year by year, in my opinion it’s wrong to go public, because the public expects to be investing in companies that are growing every year, year after year,” Payam Banazadeh, the CEO of space radar firm Capella, told me in Dec. 2020. “If that SPAC is going to be unsuccessful, it’s going to have some implications and reputation damage for the industry as a whole.”

It might well be that these valuations persist, the companies start earning money, and everyone muddles through. Or the post-vaccine world may lure internet stock enthusiasts away from their trading apps while the SEC imposes new regulations on retail stock options, and they collapse. Or maybe the whole market collapses and we remember these days like Joe Kennedy did the shoeshine boy.

On the other hand, Elon Musk has been adamant about not taking SpaceX public, at least until regular service to Mars is under way. He cites a hatred of short sellers, developed during bruising years at Tesla, and SpaceX’s embrace of risk, which might lead public investors to back away at inopportune times. But if armies of small investors mobilized by internet luminaries can squeeze the shorts effectively, perhaps he’ll consider making the whole firm, not just its internet network, publicly tradable.

🌘 🌘 🌘

IMAGERY INTERLUDE

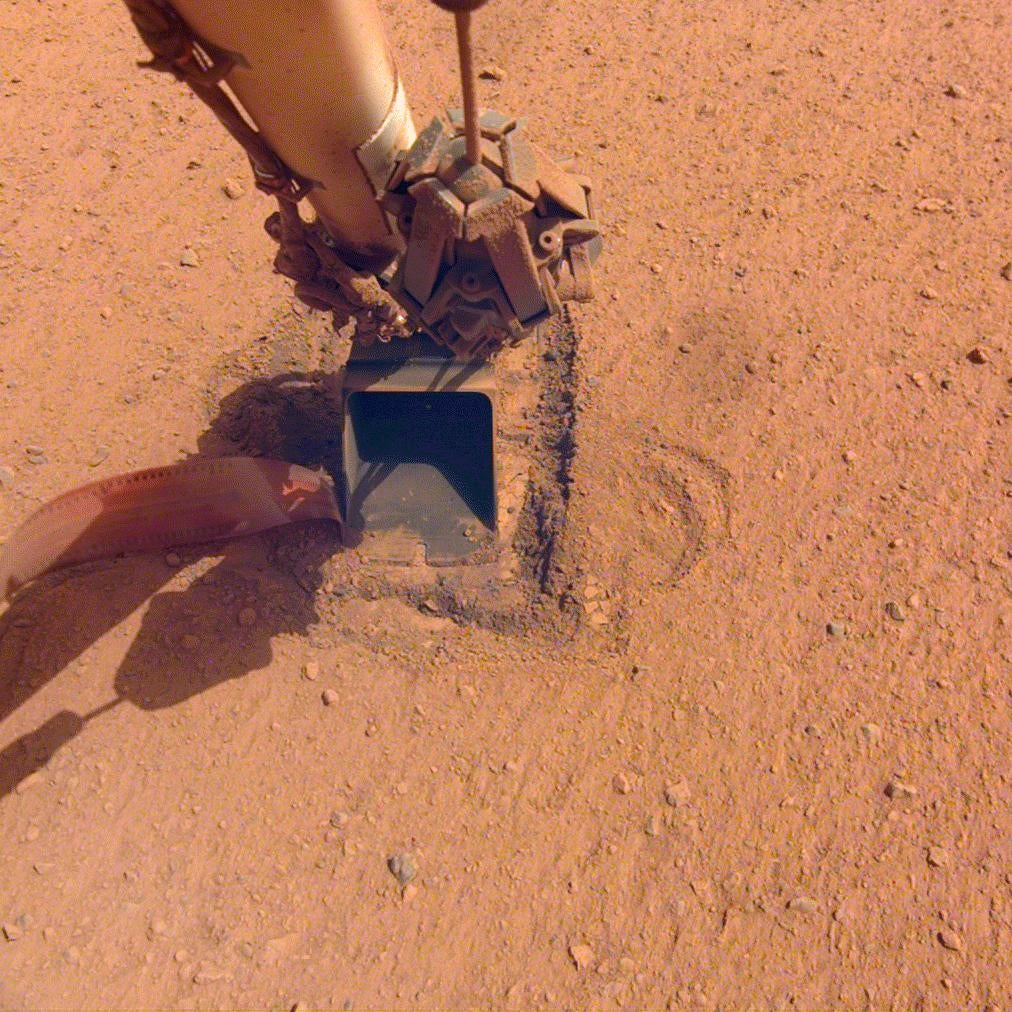

In the weeks ahead, the fleet of spacecraft Earthlings launched to Mars last year will begin to arrive and attempt to begin scientific exploration. The last lander to arrive, NASA’s Mars Insight, is still plugging away on the Red Planet, although researchers have now given up on a plan to burrow a “mole” into the planet’s surface to perform seismic measurements. Here’s a shot of the mole and a shovel arm that attempted to bop it deeper into the ground:

At least we’ve learned more about the composition of Martian soil. You can check out an animated image here for a better perspective.

👀 Read this 👀

Is solar power a space business? We may have to postpone answering that question, but there’s a simpler query to consider: Should you put a solar panel on your house? Whether solar is “worth it” depends on the roof’s orientation, size, and other physical factors. The more sun-friendly the roof, the more power the panels can produce, and the better chance the system has of meeting the most important criteria: Whether the monthly cost can beat your typical utility electric bill. Read more about the factors you should consider in our field guide to a happier home.

🛰🛰🛰

SPACE DEBRIS

Billionaires fight over public infrastructure. SpaceX and Amazon are both developing multi-billion dollar networks of satellites to offer internet service to folks down below. This requires using publicly regulated airwaves and orbital space, and the two firms (alongside other rivals) are duking it out at the Federal Communication Commission for the right to use optimal territory. This week, Elon Musk called out Amazon for trying to “hamstring” his Starlink constellation, noting that Amazon’s Kuiper is years away from coming into service. Different issues, but this reminds me of the fight between SpaceX and Bezos’ Blue Origin over who would lease a historic launchpad at Cape Canaveral in 2013. SpaceX won, with Musk saying that unicorns were more likely to be found at the pad than Blue Origin’s orbital rocket to be launched within five years. Eight years later, we’re still waiting.

Fricking lasers. Speaking of Starlink, the latest batch of internet satellites includes lasers—for communication.

Are you down with OTV? Among the 143 spacecraft launched on SpaceX’s latest rideshare mission was an Orbital Transfer Vehicle, called Sherpa, developed by Spaceflight. These vehicles help solve the “last mile problem” facing satellite operators who want to save money on a ride to space but still ultimately get dropped off at the perfect spot to do their job. Building a business around them, however, won’t be easy.

It’s an SLS Dilemma. What will the Biden administration do about the huge, over-budget Space Launch System (SLS) rocket that we need, or don’t need, to go to the moon, or not, which will be ready this year, or later? Eric Berger explores the options facing the Biden administration and the factors that will influence their choice. One related note—at the behest of lawmakers, NASA will hold a competition to choose the rocket that will carry a scientific mission to Jupiter’s moon Europa. This mission was earmarked for the SLS alone, but now SpaceX and perhaps other commercial rocket makers will throw their hats in the ring.

I know, I know, it’s serious. Sirius, the satellite radio company, reported significant problems with a new satellite just launched last year. SXM-7 was built by Maxar and launched by SpaceX, but the specific problem with the satellite thus far has not been identified. Sirius says that it is still able to communicate with and control the $225 million spacecraft.

Moon rocks in the Oval Office? Moon rocks in the Oval Office.

Your pal,

Tim

This was issue 82 of our newsletter. Hope your week is out of this world! Please send sophisticated takes on space finance, Martian sandbox imagery, tips, and informed opinions to [email protected].