The Race to Zero Emissions: Why isn’t there a universal charger for EVs?

Remember travel? That was nice.

Remember travel? That was nice.

Someday, if the world reopens its borders and you get the chance to go abroad, you’ll of course need to dust off your trusty electric plug converter, that essential gadget for connecting your devices to the world’s dizzying array of mismatched prongs and sockets.

Plug incompatibility is a well-known headache for any globetrotter, a relic of the early, less globalized days of electrification. Now, as my colleague Michael Coren reports, the same problem is coming for electric vehicles.

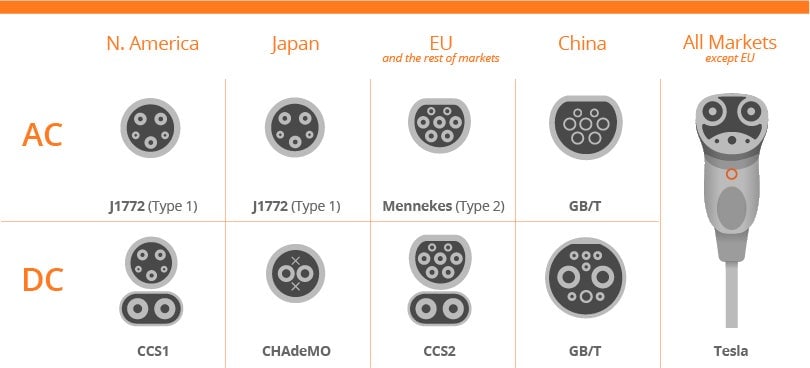

There are at least nine different, incompatible versions of EV plugs in use worldwide, each with strengths and weaknesses (charging speed, for example). Most of the time, this wouldn’t seem like a problem, since the outlet EV users use most often is the one at their own home.

But for the estimated 20% of EV recharges that happen at an office, gas station, or elsewhere on the road, drivers could have to take a gamble that they won’t be stranded on low-batt. That risk could pull the plug on some EV purchases, analysts said.

On the other hand, at this early stage of the EV market’s evolution, the lack of a universal design leaves room for innovation.

Policymakers and manufacturers in Europe, China, and the US are duking it out over whose design will end up as the defacto global standard. The world already blew its chance to get on the same current with electronics plugs. Whoever comes out on top of this “VHS-Betamax rivalry,” as one source called it, I think all EV drivers would be glad to have one less doo-hickey in their glovebox.

✦ A universal EV plug could even be a sticking point for the renewable-based grid. You can read more by signing up for a Quartz membership. ✦

Here’s what happened over the past week that helped or harmed the world’s chances of cutting greenhouse-gas emissions to zero:

Decreases emissions

1️⃣ The total global capacity of coal-fired power plants fell for the first time on record in the first half of 2020, as plant shutdowns in the US and Europe outpaced new openings in China and elsewhere.

2️⃣ Bangladesh, which has one of the world’s largest portfolios of planned coal-fired power plants, may be about to scrap almost all of them. That would be a blow for Chinese energy infrastructure companies and financiers, which are behind most of those projects.

3️⃣ A controversial natural gas export terminal planned for the US west coast looks likely to be cancelled, the latest casualty of a broader global contraction in natural gas trade.

And now for your regularly scheduled earnings

After everything the global oil market has been through during the pandemic, no one expected the big oil and gas companies to post rosy results for the second quarter. And boy, didn’t they. Exxon reported its first consecutive quarterly loss in 36 years. Chevron lost $8.3 billion and warned that Q3 might not be much better. Shell and Total managed to eke out a few hundred million in profits, largely because they have robust oil trading operations that could take advantage of market volatility.

Net-zero (for now)

1️⃣ China is expected to more than triple its wind power installations by 2029, despite the looming phase-out of subsidies. But the industry faces stiff internal competition from solar, which is also booming and set to overtake the total capacity of wind power in China this year.

2️⃣ In the last month most of the big tech companies, including Apple, Facebook, and Google, announced new initiatives to reduce their carbon footprints. Now Microsoft is beginning to report on its progress, starting with a data center powered by hydrogen fuel cells.

3️⃣ Steel manufacturing requires a lot of intense heat, and is notoriously carbon intensive. Some companies are experimenting with zero-carbon electric smelters—but executives say they need renewable energy to get a lot cheaper to provide the amount of power they need.

Looking ahead this week

A closer look at last week’s earnings shows the pandemic hasn’t changed the fundamental divide between US and European companies (✦) over the future of fossil fuels. Shell and Total, citing the approaching arrival of peak oil demand and the global transition to clean energy, wrote down the value of their assets by a combined $25 billion. US companies, meanwhile, trust that a boom will inevitably follow this bust: Exxon took no write-downs and Chevron only $1.8 billion, which it attributed solely to the pandemic. We’ll see if the trend continues this week, as BP and others roll out their earnings.

🔼 Increases emissions

1️⃣ The Trump administration is rolling back reporting requirements for oil and gas drillers on federal land. Activists say the move could allow companies to fudge what they owe the public in royalties.

2️⃣ The oil taps are opening up. Members of the international oil cartel OPEC are beginning to ease off cuts put in place during the pandemic shutdown. That could send the oil price tipping down, potentially catastrophic news for US producers.

3️⃣ China is looking to fuel its post-pandemic economic recovery with coal—and now a record amount of it is coming from Australia, after trade and travel restrictions cut off a key supplier, Mongolia.

Stats to remember

As of Aug. 2, the concentration of carbon dioxide in the atmosphere was 413.37 ppm. A year ago, the level was 410.41 ppm.

Have a great week ahead. Please send feedback and tips to [email protected] and [email protected].