Gas prices are inching closer to the $3 per gallon mark just ahead of Election Day. The current U.S. average gas price has fallen to $3.13 per gallon from $3.50 a gallon at this time last year, according to AAA, bringing relief to many states.

The Energy Information Administration (EIA) anticipates national gasoline prices to average $3.20 in 2025, down from $3.30 this year. Some key swing states — including Georgia, North Carolina, and Wisconsin — are among the 20 states paying less than $3 at the gas station. While Texas residents pay the lowest in the U.S., at $2.67 a gallon, Californians pay $4.59 a gallon, far above the national average of $3.13.

When it comes to high gas prices, California typically tops the chart, and a big reason is few refineries produce the state’s unique blend of gasoline. Further, the reformulation program is more stringent than the federal government’s program and the tax paid is higher than most states’ gasoline tax.

According to the EIA, gas prices vary across states due to many factors including supply disruptions, retail competition and distance from supply can lead to different costs across states. If supply sources such as refineries, ports, and pipeline terminals are further away, then transportation to the point of sale adds to the total price paid at the pump. Similarly, gas supply can be disrupted by planned or unplanned refinery maintenance or shutdowns due to hurricanes — in which case, EIA notes that retail competition and environmental programs add to the cost of producing, storing, and distributing gasoline.

Lowering household energy costs has been discussed by both major-party presidential nominees. While presidents can adopt policies and regulations through changes in import and export rules, opening up drilling permits or expanding areas to frack, they still have little control over how much consumers pay at the pump.

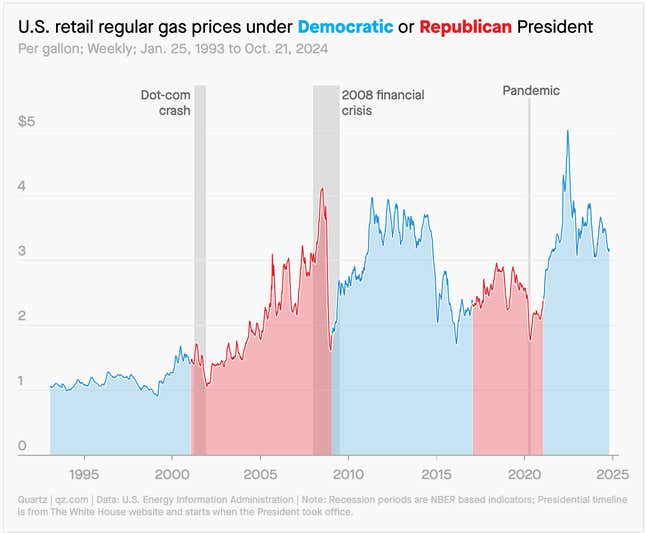

For one, exceptional events like the pandemic can significantly impact demand for gas. Due to lockdowns, the falling demand for gas during COVID-19 pushed gas prices below $2 a gallon. Gas prices first started crossing $2 a gallon in May 2004 and went below $2 for the first time during the 2008 financial crisis and the first quarter of 2016.

Presidents also have little control over gas prices because they are primarily driven by global crude oil prices, which rely on the market fundamentals of supply and demand. An increase in oil supply pushes down oil prices, which lowers gas prices.

Because oil is a global commodity, any impact on its supply and production can spill over to nations relying heavily on oil trade, which can in turn affect gas prices.

Shortly after the European Union and the U.S. imposed economic sanctions on Russia (after it invaded Ukraine), the producer price index (PPI) for gasoline jumped in June 2022, rising 85% above what it was a year earlier. Two years after the invasion, the U.S. gas prices peaked at $5. A big reason for this rise was due to supply concerns since Russia was the world’s third-largest oil producer.

Oil production has been on the rise in non-OPEC countries, including the U.S., which has been producing more crude oil than any leading oil producers including Saudi Arabia and Russia. In December 2023, domestic oil production reached record levels with 13.3 million barrels per day. In contrast, worried by excessive supply and slowing demand in China the Organization of the Petroleum Exporting Countries (OPEC) has been cutting oil demand growth forecasts. Escalating tensions between Israel and Iran and its proxies in the Middle East have also posed risks to infrastructure and oil shipping.

But extremely low prices are not a bragging point, Jeff Lenard, vice president of strategic initiatives at the National Association of Convenience Stores (NACS), a global trade association for advancing convenience and fuel retailing, wrote in his September blog.

“It usually means something really bad happened to the economy because extremely low gas prices are almost always associated with a severe and sudden drop in demand that only happens when the economy crashes,” he wrote.