The end of Google traffic is coming faster than expected

Google's new AI tools are gutting publisher traffic. If the content dries up, even the best search engine could run out of answers

Google's new AI tools are gutting publisher traffic. If the content dries up, even the best search engine could run out of answers

Generative AI is breaking the dynamic that built the digital-publishing business.

Since the mid-aughts, the link economy has defined how traffic moves across the internet. Publishers created search-optimized content, and Google (GOOGL), in its turn, sent traffic to their sites. This search traffic sharply increased readership, augmenting dedicated daily visitors with a steady pipeline of more random seekers that publishers aimed to turn into regular readers.

But now, with Google’s rollout of AI Overviews and its even more recent introduction of AI Mode — which competes with ChatGPT by providing synthesized answers to complex questions, heading off the need for links – publishers are cut out of the loop. That’s despite the fact that Google continues to feed on their content, mining articles and digests for its agent-style answers.

All of this means publishers are seeing a tremendous drop in eyeballs, clicks, and readers. Traffic to sites like HuffPost (BZFD), the Washington Post, and Business Insider has dropped by more than 50% in three years, per Similarweb.

Layoffs have followed. Business Insider just cut 21% of staff, making headlines. Meanwhile, over the last years, 1 out of every 10 editors and journalists have lost their jobs according to Bureau of Labor statistics data — a timeline that directly overlaps with the traffic drop.

In response, publishers are racing to build more direct relationships with readers through newsletters and events, a set of plays and pivots that have arguably already been in the works longer than generative AI has been available to everyday internet users.

“We have to develop new strategies,” Nicholas Thompson, CEO of The Atlantic, told the Wall Street Journal. The Atlantic is operating on the assumption that search traffic will go to zero.

Whether or not every internet publication can become a conference business or be sustained by its newsletter portfolio is an open question. One thing is sure: a cost structure that obtains content without incurring the cost of content has a tough-to-beat advantage.

As newsletter writer Byrne Hobart recently put it, search “remains the best business in history” — a high-margin cash machine that employs user behavior to improve itself, monetize intent, and reinforce its dominance over both creators and consumers. Everyone from SEO consultants to local restaurants has learned to speak its language. So it’s no wonder Google stock is up some 7,000% since its 2004 IPO, a trajectory that has seen its valuation climb from about $20 billion to well over $2 trillion.

But will Google’s advantage disappear if content producers themselves die off? It might.

Eventually, even the best search engine needs something to search. AI-generated answers still require fresh, high-quality inputs, much of which continue to be created by publishers, the same ones now being squeezed so hard. If Google traffic keeps falling, publishers may have stronger incentive to lock down their content, erect paywalls, or block scrapers entirely. Some already are. That makes the current moment look less like a shift in traffic patterns and more like a complete reorientation of the internet’s most basic business workings. As search evolves into something more agent-like, it risks cannibalizing the very ecosystem that made it powerful.

Buried beneath the surface-level disappointment was a quieter announcement that could prove far more consequential for Apple's AI ambitions

Wall Street isn't impressed with Apple this week. As the tech giant holds its annual Worldwide Developers Conference (WWDC), one analyst called the event "a yawner". Shares fell more than 1% Monday before inching back a bit Tuesday as investors were disappointed by AI announcements another analyst called "incremental at best."

Apple's annual developer showcase failed to deliver the splashy announcements that have defined previous WWDCs — no Vision Pro-style hardware debut, no Apple Intelligence reveal.

Instead, Apple spent most of its keynote unveiling "Liquid Glass," a new design language that makes iOS look, well, more glass-like. As with many Apple announcements, reactions spanned from really liking it to calling it a “bad” copy of the Windows Vista aesthetic from 2007.

But buried beneath the surface-level disappointment was a quieter announcement that could prove far more consequential for Apple's AI ambitions: the Foundation Models framework.

For the first time, Apple is giving third-party developers direct access to the on-device large language models that power Apple Intelligence — with as little as three lines of code. This represents a fundamental shift for a company that has historically guarded its core technologies like state secrets.

The framework enables developers to build AI features that run entirely offline, protecting user privacy while eliminating the cloud API costs that can make AI prohibitively expensive for smaller developers. Examples showcased included the quiz platform Kahoot creating personalized study questions from user notes and the hiking app AllTrails suggesting routes based on natural language descriptions — all without an internet connection.

What makes this significant isn't the current capabilities of Apple's 3 billion parameter model, which pales compared to frontier models like GPT-4 which is rumored to be more than a trillion. It's the strategic positioning.

Apple has never been first to market with transformative technologies. The company didn't invent smartphones, tablets, or smartwatches — it perfected them. The Foundation Models framework suggests Apple is applying this same playbook to AI.

Consider the math: Apple has over 1 billion active iPhone users and millions of developers in its App Store ecosystem. Even if Apple's current AI models are inferior to OpenAI's or Google's, enabling millions of developers to experiment with free, on-device AI could generate the breakthrough applications that Apple hasn't been able to create internally.

By enabling millions of developers to build on Apple's AI foundation, the company could leverage its ecosystem advantages rather than trying to out-innovate OpenAI or Google directly. As tech analyst Ben Thompson noted, Apple's initial success with the Apple II was because of third-party developers, and developers were critical to making the iPhone a sustainable success with the App Store.

"Trusting developers and relying on partners may be a retreat from Apple's increasing insistence on doing everything itself, but it is very much a welcome one," Thompson wrote.

While competitors like Google and OpenAI race to build ever-larger cloud-based models, Apple is trying a different approach: making decent AI universally accessible across its device ecosystem. What's more, it's doubling down on local processing — something other companies have largely abandoned in their rush to the cloud.

This strategy aligns with Apple's broader positioning around privacy. In an era when AI companies are scraping the internet for training data and users are increasingly concerned about data privacy, Apple's on-device approach could prove prescient.

None of this guarantees success. Apple delayed its promised "more personal" Siri features in March and provided no update on timing during Monday's keynote. The company's AI credibility remains damaged from over-promising and under-delivering on Apple Intelligence.

But if Monday's start to WWDC was indeed a "retreat," as Thompson characterized it, it might be a strategic one. Rather than continuing to overextend in a battle it is unlikely to win, Apple can return to focusing on its unique advantages while making a bet that empowering developers and partners will pay off like it has before.

The Foundation Models framework might not generate headlines like ChatGPT or Gemini. But in Apple's typical fashion, it could prove more important than the flashier announcements from its competitors. The question is whether developers can build something compelling enough with Apple's tools to keep the company in the AI race.

Even if Google wins its antitrust case, it could still lose the future of search — thanks to a shift toward AI

When Vineet Jain, the CEO of cloud management company Egnyte, decided to spend four days without using Google Search, he was “blown away” by how clean and simple AI interfaces were: no clutter at the top of his screen, no ads, just the answers. Shortly after, his 15-year-old son told him, “We don’t use Google anymore. We do everything with ChatGPT.”

That shift in user behavior comes as the U.S. Department of Justice gears up for a defining ruling in its long-running antitrust case against Google. In a decision expected by August, Judge Amit Mehta will decide whether Google must unwind its lucrative default-search deals and spin off its Chrome browser.

“If you remember the Samson and Delilah story where Samson’s power was in his hair, [Google’s] ‘hair’ is going to be search,” Jain said. And that search business may very well be on the chopping block — even if the DOJ doesn’t win its case.

In the first quarter of 2025, Google’s advertising revenue reached $66.9 billion, with $50.7 billion coming from Google Search — thanks largely to its iron-clad position as the default on browsers and devices. That default status is the quiet engine behind its dominance: In 2022, Google paid Apple over $20 billion to be the preset search engine on Safari, locking in the company’s share of mobile eyeballs. Chrome, Google’s browser, adds even more gravitational pull.

For years, regulators have circled Google over its dominance in search — and the advertising empire built on it. But what if the real existential risk isn’t legal at all? What if it’s behavioral?

Search is no longer analogous to Google. ChatGPT and other AI-native tools are starting to pull traffic and attention away from traditional search engines by answering questions directly, skipping the blue links, and ignoring the ad slots altogether. According to a recent report from Mary Meeker, ChatGPT hit a billion searches a day in less than two years; Google needed 11 years to reach that mark.

Jain said Mehta’s ruling could be a “watershed moment” for Google “in terms of how they regulate their platform power. Because they have become a behemoth — in search, display, advertising, everything related to it.”

As AI search starts to capture a larger share of the search market, Jain said the argument Google could make is, “‘Hey, we are not a monopoly anymore. We’re not as dominant as you’re making us out to be.’”

But whether the company wins or loses the antitrust case, the deeper problem remains: Google is built around an advertising model that depends on search volume, attention, and high-intent queries. Unlike pure AI chatbots, which can deliver answers free of sponsorship, Google can’t simply declutter its interface without cutting off the revenue stream that fuels its empire.

And while Google has begun integrating AI into its products — from AI overviews to Gemini — it’s trying to have it both ways: serve direct answers while keeping users scrolling and clicking long enough to monetize their attention. That’s a far harder trick than it sounds, especially as users come to expect stripped-down, ad-free experiences from tools such as ChatGPT, Perplexity, or Claude.

And the scale of the business makes any change feel like trying to turn an ocean liner. “Google Search, in terms of its contribution to the overall Google pie, is so disproportionately large it’s almost like a massive, massive, ten-times-the-size-of-the-Titanic that you’re trying to move,” Jain said. “So it’ll take time.”

How Google adjusts to the changing market is the “$10-plus-billion question,” he said.

Google’s dominance in search was never just about having the best engine. It’s also about placement — and payments. That strategy is what’s on trial. Mehta is weighing whether these default arrangements violate antitrust law by unfairly shutting out competition. A ruling that forces Google to unwind its “default” approach could dramatically shake up how users access search — and open the door for competitors to gain ground.

“Over time, given the size and heft [Google has], there will be a gradual atrophy in the search traffic going to them,” Jain said.

He said he expects some regulatory response regardless of the outcome. “There’ll be some action. I can predict. There’ll be some action,” he said. “I don’t know what it’s gonna be, and I hope the Chrome divestiture, if it happens, it’s done in a favorable way” — where it’s not bought by a competitor, such as OpenAI, which has expressed interest.

Any erosion to Google’s core business may not grab headlines like a courtroom ruling, but it could be as consequential. Just as Microsoft missed the mobile revolution while defending its Windows monopoly, Google risks clinging to its current business model while the next paradigm quietly passes it by. This isn’t the first time Google has faced a potential disruption — mobile search, voice assistants, and vertical platforms like Amazon and TikTok have all chipped away at its dominance.

But generative AI is different. It doesn’t just offer an alternative to search — it threatens the idea of search itself.

The irony is that Google has long known this moment was coming. In 2011, then-CEO Eric Schmidt warned that “the next Google” wouldn’t look like a search engine — “we’re trying to move from answers that are link-based to answers that are algorithmically based, where we can actually compute the right answer,” he said. That future is here, but Google’s own business incentives are pulling it in the opposite direction. The company can’t become a pure-answer engine without undercutting the ad clicks that make up the bulk of its revenue.

And that tension will only grow more painful as AI-native tools accelerate. Jain predicts search will remain Google’s biggest revenue contributor “for at least the next five to seven years,” but beyond that, the fundamentals begin to wobble.

Still, he’s not betting against the company. “People underestimate Google and the intellectual horsepower they bring to the table. And they are no slouches,” Jain said. “I would not bet against Google at this point.”

But even the smartest players can miss the moment if they’re too busy protecting the past. So while Google isn’t going anywhere — traditional search might be.

The self-driving robotaxis were set ablaze during anti-ICE protests in Los Angeles on Sunday

Waymo (GOOGL) cars were torched over the weekend during anti-ICE protests in Los Angeles — and the company is looking for someone to clean up the proverbial mess.

The robotaxi company currently has a job opening for a Community & Public Affairs Specialist based in Los Angeles, a role it probably wishes it had filled before its cars were set ablaze.

Footage captured of the events showed Waymo vehicles that had been vandalized and set on fire.

Waymo says the job opening has been up for months and wasn’t posted in the aftermath of the arson. Whoever gets the job would be “implementing advocacy, grassroots, and grasstops campaigns to drive acceptance and adoption of our life-saving technology,” according to the posting.

The role also includes developing and sustaining relationships with community organizations, working with leaders to build trust, helping with social media content about Waymo’s public affairs work, and advocating for the company’s values in the LA community. It comes with a generous salary between $125,000 and $157,000.

Waymo told Quartz that “we are in touch with law enforcement about recent events.” The Alphabet-owned company had to temporarily suspend service in parts of Los Angeles on Sunday following the incidents.

Waymo currently operates its driverless robotaxis in San Francisco, Los Angeles, Phoenix, and Austin. It is expanding to more cities soon, and announced in May that it is preparing to scale up its manufacturing facility in the Phoenix suburb of Mesa, Arizona. At the new plant, Waymo is transforming 2,000 Jaguar I-PACEs into robotaxis equipped with the cameras and sensors that allow it to operate without a driver.

Americans in these states bring him the most cash across all income levels

It’s no secret that where you live can have a massive impact on how much money you make given that average salaries vary widely from state-to-state.

WalletHub set out to find the states where people make the most money, looking at the the average annual income of the top 5%, the median income for all residents, and the average income of the bottom 20%.

“The highest-earning 10% of individuals in the United States earn over 12 times more than those in the lowest-earning 10%,” said WalletHub analyst Chip Lupo. “By measuring the income of various percentiles against a state’s median income, we can better identify where income disparities are more prevalent, which could help us better understand why residents of certain states struggle more to make ends meet.”

Continue reading to see which 10 states have the highest earners. All numbers are adjusted for the cost of living index.

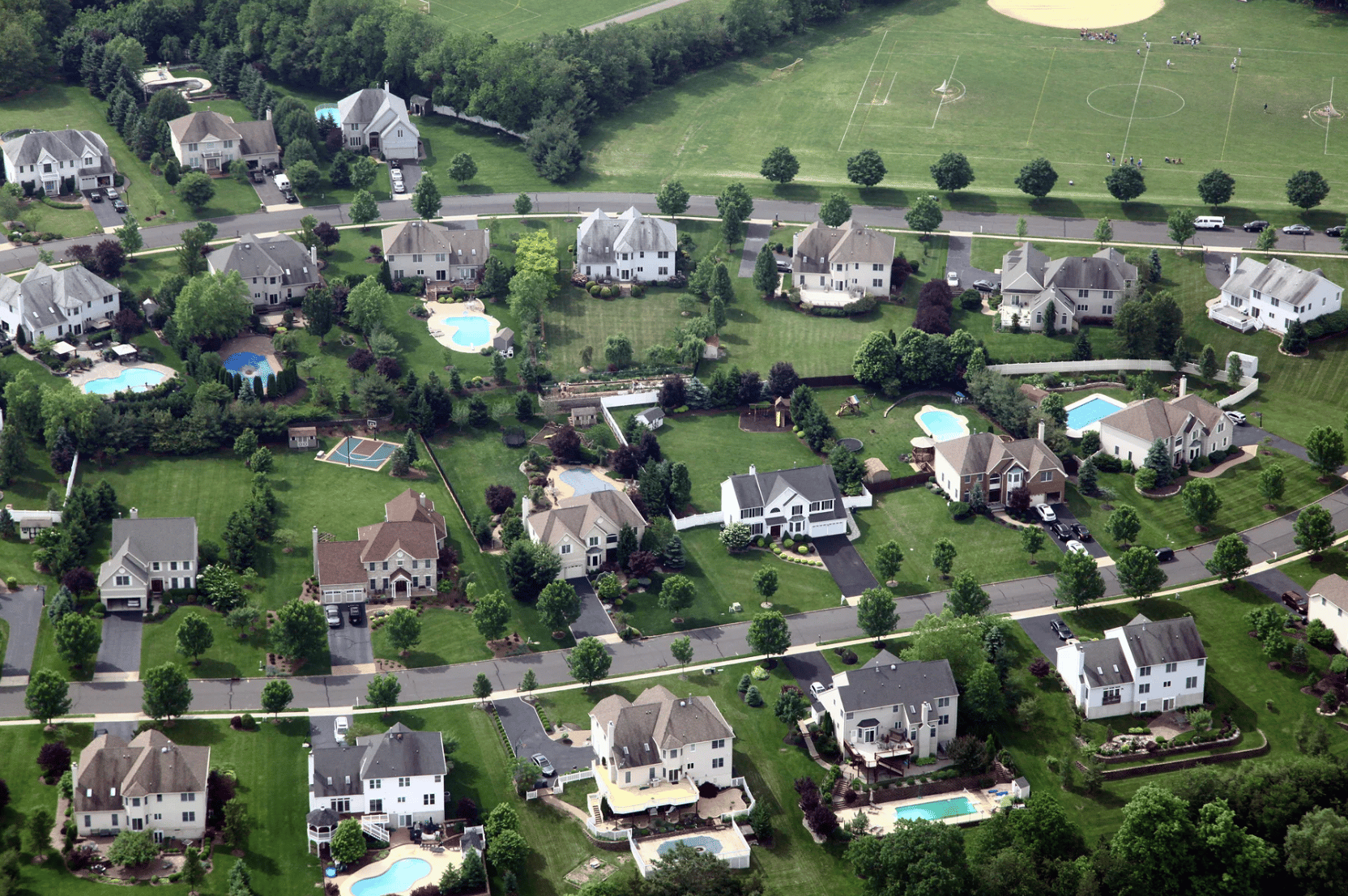

Atlantide Phototravel / Getty Images

Allan Baxter / Getty Images

Deb Snelson / Getty Images

Grant Faint / Getty Images

Sean Pavone / Getty Images

Carmen Martínez Torrón / Getty Images

DenisTangneyJr / Getty Images

Barry Winiker / Getty Images

DougSchneiderPhoto / Getty Images

L. Toshio Kishiyama / Getty Images

New forecast warns 2025 will bring the weakest non-recessionary growth since 2008, with the U.S. and emerging economies hit hardest

The World Bank has slashed its global growth forecast, warning that President Donald Trump’s tariffs and the resulting political uncertainty are dragging the world economy to its weakest non-recessionary pace since 2008.

In a detailed report released Tuesday, the Bank projected global GDP growth will slow to just 2.3% in 2025, a sharp downgrade from January’s 2.7% estimate. That suggests the ongoing trade wars are exerting a 20% drag on the global economy.

The outlook is especially bleak for emerging markets and developing economies (EMDEs), with the Bank suggesting that income gaps with richer nations will widen further. Already, foreign direct investment into these economies has fallen to less than half its 2008 peak, with little sign of recovery.

“Downside risks to the outlook predominate,” as a summary of the report dryly puts it. Trade barriers appear to be becoming more entrenched and intractable, not less, all while policy direction remains uncertain and the economic damage racks up.

Released as U.S.-China trade talks enter their second day in London, the World Bank’s report reflects an urgent hope that these global powers can contain and negotiate their economic conflicts.

“If trade restrictions escalate or policy uncertainty persists,” the authors warn, “global growth could be even weaker.”

The World Bank also flagged risks from extreme weather and inflation, especially for countries already dealing with debt distress and weakened or fragile institutions.

Regional downgrades – that is, revisions to the Bank’s growth forecasts – were broad-based and sweeping. Growth is expected to slow across East Asia, South Asia, Europe, and Latin America. However, the report singles out the U.S. as the most negatively affected economy in terms of slowing growth, echoing OECD projections released last week.

In response, the Bank is urging coordinated, multilateral action to create greater policy certainty and boost investment in human capital, labor markets, and the quality of national and international institutions. “On the upside, uncertainty and trade barriers could diminish if major economies reach lasting agreements that address trade tensions,” according to the report.

But today, with the London talks so far inconclusive, it’s unclear if the World’s Bank call will be heeded – no matter how urgent it may be.

A new lawsuit came after Regeneron Pharmaceuticals said it would buy the failing genetic testing company for $256 million

Twenty-seven states and Washington, D.C. are suing to stop 23andMe (ME) from selling customers’ personal information without their consent.

The lawsuit filed in a Missouri bankruptcy court Monday was brought by a bipartisan coalition of attorneys general who fear that the genetic testing company will auction off people’s private information to the highest bidder without regard for their privacy.

“This isn’t just data – it’s your DNA. It’s personal, permanent, and deeply private,” Oregon Attorney General Dan Rayfield said in a statement. “People did not submit their personal data to 23andMe thinking their genetic blueprint would later be sold off... We’re standing up in court to make sure Oregonians – and millions of others – keep the right to control their own genetic information.”

The suit comes after 23andMe, which had a $6 billion valuation at the time of its 2021 IPO, declared bankruptcy in late March. The company then announced in May that it was being purchased by Regeneron Pharmaceuticals for $256 million, in a deal expected to finalized in the third quarter of 2025.

After 23andMe declared bankruptcy, there were myriad concerns about users’ privacy, especially after a 2023 data breach affecting 6.9 million people. Its stock tumbled by 98% from 2021 to November 2024. It then halted work on new therapies, laid off hundreds of employees and agreed to a $30 million settlement related to the breach. This April, the company was subjected to a Congressional investigation into the fate of its users’ sensitive information.

The coalition of states suing to stop the sale of information say that should be able to control the fate of their own genetic data, which Rayfield said “cannot be sold like ordinary property.” In their complaint, the states say the information is too personal and sensitive to be auctioned off.

In the meantime, the attorneys general are encouraging those who used the service to delete their genetic information.

A spokesperson for 23andMe told Quartz in a statement that it believes the suit is “without merit” and it will address the allegations at its sale hearing. “We required any bidder to adopt our policies and comply with applicable law as a condition to participating in our sales process,” the company said. “Customers will continue to have the same rights and protections in the hands of the winning bidder.”

—Michael Barclay contributed to this article.

Improving sales expectations contributed most to the overall increase

Small U.S. businesses are feeling slightly more confident, according to a Tuesday report.

The NFIB Small Business Optimism Index increased by 3 points in May to 98.8, slightly above the 51-year average of 98. It’s the first improvement in sentiment since December, with eight of the ten components that make up the index rising from April’s levels.

Improving sales expectations contributed most to the overall increase. Owners expecting to see a rise in sales was up 11 points, to a (seasonally adjusted) net of 10%. The second-largest rise was from owners who expect the economy to improve, rising by 10 points to a net 25%—a historically high reading.

While there were green shots of optimism, owners’ attitudes toward the the overall outlook of their businesses remained relatively unchanged from April. As part of the report, respondents were also asked to provide a rating for the health of their businesses: 14% reported “excellent” (up one point); 55% reported “good” (down one point); 28% reported “fair” (up one point); 4% reported “poor” (unchanged).

“Although optimism recovered slightly in May, uncertainty is still high among small business owners. While the economy will continue to stumble along until the major sources of uncertainty are resolved, owners reported more positive expectations on business conditions and sales growth,” NFIB Chief Economist Bill Dunkelberg said in a statement.

There were two index components which trended down in May.

Those reporting positive profit trends were five points lower than in April. Meanwhile, owners planning to create new jobs in the next three months dropped 1 point, to a net 12% of owners.

There were early clues that President Donald Trump’s sweeping tariffs on imports into the U.S. could be stifling the supply of goods to small businesses. Those who viewed their inventory stocks as “too low” in May, was up 7 points from April. While that’s just a net of 1%, it’s the highest reading since August 2022, and the largest monthly increase for this component in the survey’s history.

This diminished supply of goods could become inflationary if persistent. It coincides with a stubbornly overheated labor market, which may also be keeping the U.S. inflation rate hovering around 2.3%, which is higher than the Federal Reserve’s 2% target. The NFIB’s May jobs report, published last week, found that about one-third of small business owners had job openings that they could not fill for the second consecutive month. Moreover, of the owners that were hiring, 86% reported few or no qualified applicants for the positions.

As the company has fallen short of AI expectations, CEO Mark Zuckerberg is personally recruiting top talent to join Meta's venture

Mark Zuckerberg doesn’t just want Meta (META) to be smart — he wants it to be super smart. The CEO is reportedly creating an AI lab to pursue “superintelligence” as Meta jockeys for position at the forefront of an ever-crowded AI field.

Zuckerberg is largely focused on achieving artificial general intelligence (AGI) — a currently theoretical humanlike level of intelligence where a machine can perform any task a person can. Meta could then weave that AGI across its product suite — chatbots, augmented reality glasses, and more.

According to Bloomberg, Zuckerberg has been personally recruiting top AI talent and has been prioritizing the staffing and development of this new team, which is being referred to internally as a “superintelligence group,” according to people familiar with the matter. The Meta CEO is reportedly looking to hire 50 people for the team, which he hopes will make his company a leader in AI.

Meta is reportedly in talks for a $10 billion-plus investment in Scale AI — a data platform company that helps companies train models — and the company will likely play a big role in Zuckerberg’s plans. Alexandr Wang, the company’s founder and CEO (and former housemate of OpenAI’s Sam Altman), has been tapped to join Meta’s venture, and the investment deal is poised to bring other Scale AI employees to Meta. Other researchers from Meta’s rivals have reportedly been offered seven- to nine-figure deals to jump ship.

Sources told The New York Times that the superintelligence lab is part of a larger reorganization effort and comes at a time when Zuckerberg has been frustrated by failing product releases, such as Llama 4, which has been questioned both internally and externally by developers. Despite Zuckerberg’s claims that Meta’s Llama model worked as well as (or better than) models from industry leaders, researchers largely decided that Meta’s model was designed to look more advanced than it actually was.

As a a result, the company delayed plans to release its next iteration, “Behemoth,” with the Wall Street Journal reporting that Meta’s brass was worried the model didn’t sufficiently improve on previous models. Sources told Bloomberg that these missteps have led Zuckerberg to get more involved in the company’s AI dealings. The CEO has reportedly created a WhatsApp group with top execs called “Recruiting Party” to find talent it will try to hire away to help with Meta’s efforts.

While Meta has invested billions in AI, it still lags behind others in the field. OpenAI’s ChatGPT continues to rake in money — and has increased its paid user base by 50% in three months. Microsoft (MSFT) has invested more than $13 billion in OpenAI, and its stock has soared as investors see that the company’s aggressive moves are paying off. Amazon (AMZN) has poured more than $8 billion into startup Anthropic — and is continuing to make big investments to expand its data services. And Google (GOOGL) has continued to develop its AI research lab, DeepMind, which Google parent Alphabet bought in 2014.

So Zuckerberg needs Meta’s AI lab to be super — in more ways than one.

The U.S. and China are seeking an off-ramp from trade restrictions crippling their supply chains

U.S. trade negotiations with China entered their second day on Tuesday, as U.S. officials expressed optimism on the direction of the talks aimed at ending a trade war between the two biggest global economies.

Commerce Secretary Howard Lutnick spoke to reporters outside London’s Lancaster House, the site of high-stakes negotiations with Beijing. The American negotiating team is spearheaded by Lutnick, Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer.

“We’ve been [talking] all day yesterday and we expect to go all day today. The talks are going well, we’re spending lots of time together,” he said.

Trade tensions between the U.S. and Beijing spiked in recent weeks. Both countries have accused each other of reneging on an interim accord struck last month in Geneva that scaled back triple-digit tariffs in the ongoing trade war.

However, Trump and other administration officials were hopeful about defusing tensions and securing a deal. “China’s not easy,” Trump said Monday after the first day of talks concluded. He added: “I’m only getting good reports.”

“The purpose of the meeting today is to make sure that they’re serious, and to get handshakes from our three lead trade negotiators and get this thing behind us,” White House National Economic Council Director Kevin Hassett told CNBC on Monday.

Trade tensions have crippled supply chains at critical points in the U.S. and China. American companies are reeling from Chinese export restrictions on rare earth magnets that are key components in autos, as well as energy and the defense sectors. China is grappling with a U.S. pause in shipments of chemicals and semiconductor chips, among other key components.