Lyft rolls out new payment measures to gain more drivers

Lyft has increased its employee perks as the company aims to attract more drivers to its platform

Lyft has increased its employee perks as the company aims to attract more drivers to its platform

Lyft says it plans to attract more drivers to its ride-hailing platform by unveiling new payment measures for longer-than-estimated rides. These measures from the company come as Lyft (LYFT) is looking to entice new drivers and retain current drivers on its platform.

Drivers’ pay will be adjusted if there’s an unexpected inconvenience — like traffic or a detour, which will make the ride longer than estimated. The company said in February that in its earnings commitment, which rolled out nationwide in May, drivers will earn 70% of their riders’ payments at the end of each week. If drivers do not reach 70%, they will be paid the difference.

The rideshare company’s “preferred drivers” status is a program for drivers who have met the safe driving and reliability metrics and will get rewarded with a bonus or additional ride requests depending on the region, a Lyft spokesperson told Quartz.

Lyft also said that drivers who conclude rides in a particular area where they aren’t eligible to receive riders are “less likely” to get a trip on the way back and will receive additional pay on top of their upfront fare, per Fast Company.

“If you are obsessed with drivers as customers and provide a platform that will make their experience coming to the platform, whether they’re a mom or a dad or an immigrant or entrepreneur or caregiver coming to the platform, if we can make that work for them, they’ll drive more. There’ll be better reliability for riders. Riders will come back more,” said Jeremy Bird, Lyft’s EVP of Driver Experiences, to Fast Company.

Additionally, the company announced that it has partnered with Merit America to provide drivers with courses and with access to affordable health insurance with Stride Health.

Good morning, Quartz readers!

Tensions down, forecast up. Goldman Sachs analysts say the probability of a recession is shrinking as the trade war between the U.S. and China cools.

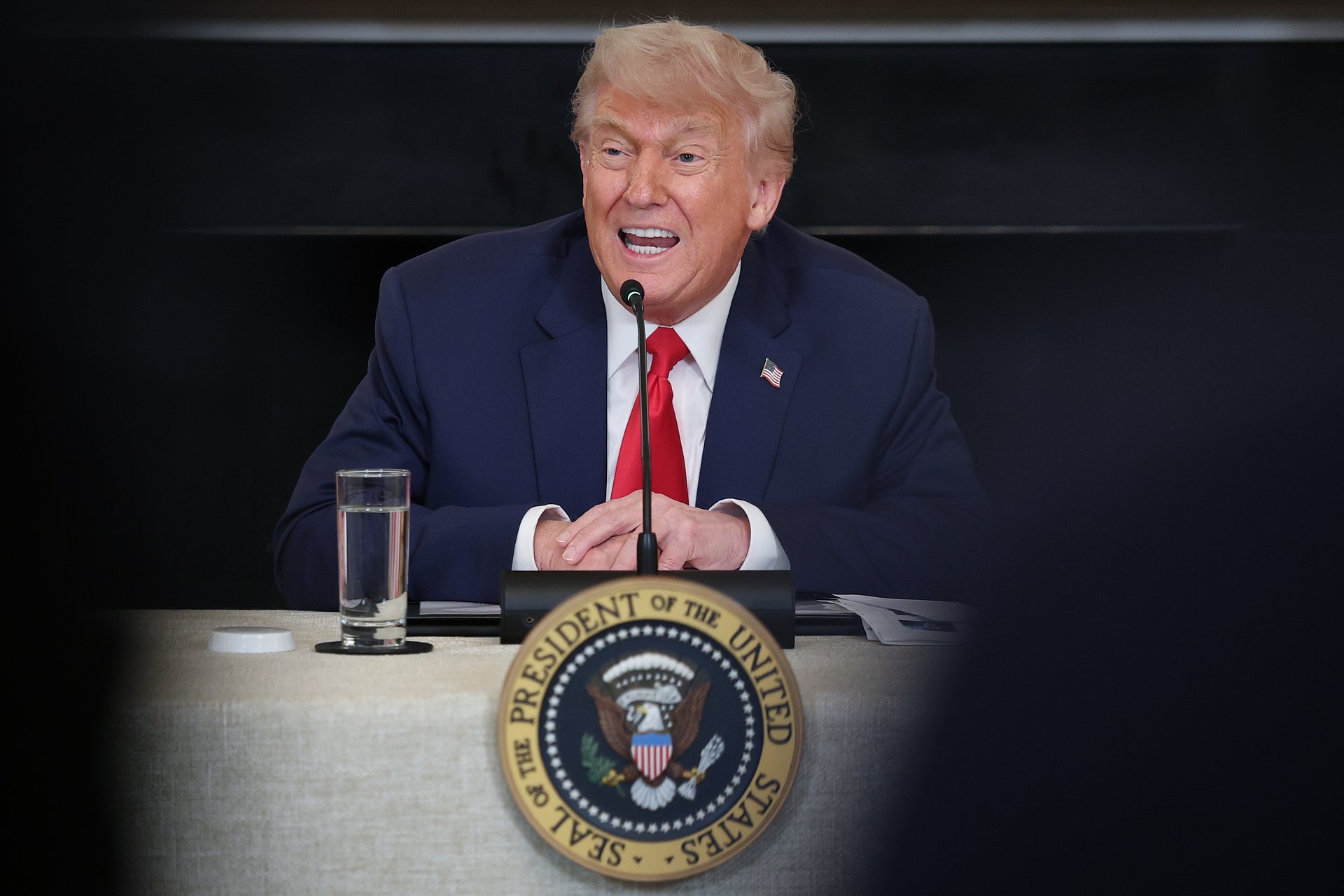

American express route. President Donald Trump’s $5 million “Trump Card,” which he says will fast-track U.S. citizenship and offer permanent resident status, has gone live.

Grounded in controversy. Boeing has found itself under scrutiny after a fatal Air India crash on Thursday morning involved one of the company’s 787-8 Dreamliner aircraft.

Caught red-handed? Tesla is suing a former engineer in its robotics department, alleging that the ex-employee stole designs for the Optimus robots’ best-in-class hands.

Not in the game plan. GameStop’s stock tanked almost 23% at one point on Thursday as investors indicated they weren’t on board with the company’s plans to stockpile Bitcoin.

Amazon wants shelf control. Per an internal memo, it’s bringing Whole Foods more closely under its purview to cut out duplicate efforts with a corporate reorganization.

The mall is dead. Long live the algorithm.

Remember when shopping meant going to a mall, trying things on under fluorescent lights, and pretending you might “circle back” on that top? How quaint. In the AI-powered future of retail, your closet won’t just be a closet — it’ll be a searchable database, a digital moodboard, and a semi-judgmental best friend rolled into one.

Now, two startups, Phia and New Gen, are rewriting retail for the generation that treats its search bar like a stylist.

Phia’s browser extension works behind the scenes, scanning 40,000-plus sites for better deals, secondhand finds, and “I can’t believe that’s under $200” moments. New Gen, meanwhile, is building for the AI-first shopper who doesn’t just browse — they query. It’s reimagining storefronts for the future of shopping with a pitch for AI-native retail domains where clean data meets curated vibes, so when you type “perfect bike shorts under $100,” the answers are instant, tailored, and algorithmically confident.

This isn’t just tech for tech’s sake. Gen Z shoppers expect speed, personalization, sustainability, and vibes. They don’t browse; they brief. And they’re turning shopping from an activity into an interface. Zoom out and the trend is obvious: Shopping is shifting from slow scroll to smart assist.

Retail isn’t dying — it’s just debugging itself. Quartz’s Shannon Carroll has more on the next upgrade to your wardrobe: AI.

Once the exclusive obsession of bond traders and guys who voluntarily read CBO reports, U.S. Treasury auctions may have found an unlikely second act: financial thriller. On Wednesday, the government sold $39 billion worth of 10-year bonds. Thursday? Another $22 billion in 30-year paper. And while the sales went off without a hitch, everyone’s asking the same thing: What happens when the bidders stop bidding?

These auctions are normally sleepy affairs. But with the U.S. deficit swelling, interest payments ballooning, and Trump floating another round of tax cuts, even a routine bond sale now feels like a stress test for the country’s fiscal reputation. If buyers start pulling back, yields could spike, markets could wobble, and confidence in Uncle Sam’s credit card could start to fray.

This week’s auctions weren’t panic-worthy, but nerves are showing.

Thirty-year yields are creeping back toward 5%, a level investors treat like a cursed mile marker. One wrong move and suddenly the world’s most boring financial instrument becomes the spark for global market jitters. Meanwhile, across the Pacific, Japan’s bond market is already cracking. Poorly received auctions there have sent yields on 30- and 40-year debt soaring to multi-decade highs — triggering big paper losses for insurance giants and forcing Tokyo to consider buying back its own bonds just to keep things under control.

The U.S. isn’t Japan (yet). But if Treasury auctions keep flirting with chaos, we might all be learning a lot more about fixed income than we ever planned. Quartz’s Catherine Baab has more on how a sleepy market got loud real fast.

☕ Howard Schultz is a fan of the “Back to Starbucks” plan

❌ Meta has sued an AI-powered deep-fake “nudify” app

Our best wishes on a safe start to the day. Send any news, comments, and more to [email protected].

Tesla claimed in its lawsuit that the former employee launched a rival firm using stolen robotic hand designs

The future of robotics may be humanoid — but Tesla says this move was all too human. The EV giant is suing a former engineer for allegedly stealing trade secrets from its Optimus program and founding a rival AI robotics firm days later.

As Bloomberg reported, Tesla has filed suit against Zhongjie “Jay” Li, a former engineer on its Optimus humanoid robot program, accusing him of stealing proprietary designs and launching a rival startup in the heart of Silicon Valley. According to Tesla, Li didn’t just walk away with company secrets — he allegedly copied some of the robot’s most complex components and recreated them under a new name: Proception Inc.

The suit, filed Wednesday in federal court in San Francisco, paints a picture of quiet defection and stealth data siphoning.

Tesla claims Li downloaded sensitive files — specifically those related to robotic hand sensors — onto personal devices in the weeks leading up to his September 2024 departure. Just six days later, Proception was incorporated. Within five months, Proception was demoing a five-fingered “ProHand” that Tesla calls a dead ringer for its design — or, “hands that bear a striking resemblance to the designs Li worked on at Tesla,” according to the complaint.

Now, Tesla wants damages and an injunction blocking Li from using what it has called the most sophisticated hand ever made. Tesla’s Optimus program, still in early development, is aimed at creating general-purpose robots capable of factory labor, household tasks, and even child care. CEO Elon Musk said in May that the robot will be “the biggest product of all time.”

The humanoid robot industry, long stuck in the uncanny valley, is heating up as AI and sensor tech finally catch up to sci-fi ambition.

Several companies, including Figure AI (which just landed investment from Amazon and OpenAI), 1X Technologies, and Apptronik, are racing to deliver general-purpose bots. But making a truly dexterous robotic hand — one capable of gripping, pinching, and manipulating small objects — is one of the field’s holy grails.

That’s the very capability Li allegedly reproduced at Proception.

He was “entrusted with some of the most sensitive technical data in the program,” Tesla’s lawyers said in the filing, and Li's “conduct is not only unlawful trade misappropriation — it also constitutes a calculated effort to exploit Tesla’s investments, insights, and intellectual property for their own commercial gain.”

If Tesla’s allegations hold, the event would reprise a familiar plotline. The company has sued at least three former employees since 2020 for hauling data off to Zoox, XPeng, and most recently, Rivian; all those cases were settled before trial.

On the company’s earnings call in April, Musk said that he expects the scale-up of the Optimus robots to be faster than any of the company’s other products — a million units per year in less than five years. Musk claimed that there would be thousands of the robots working in Tesla factories by the end of the year and promised that the Optimus robots would help produce a time of “sustainable abundance for all.”

The timing is awkward for Musk, who has been pounding the table about Optimus for months, predicting “thousands of Optimus robots working in Tesla factories by the end of this year” and, eventually, “millions per year.” Last week, Optimus’ head of engineering, Milan Kovac, abruptly quit “to spend more time with family abroad,” forcing Autopilot chief Ashok Elluswamy to take the reins.

Losing a top lieutenant while fending off alleged intellectual-property leaks underscores how critical — and fragile — Tesla’s robotics push has become.

Thousands of CrushAI-related ads reportedly evaded Meta's moderation efforts in early January

Meta is suing a company that reportedly ran thousands of ads on its network to promote a so-called "nudify" app. The lawsuit was filed against Joy Timeline HK Ltd., the Hong Kong-based entity behind the app CrushAI, which enables users to generate fake and non-consensual sexually explicit images of other people.

The legal action follows multiple attempts by Joy Timeline to bypass Meta’s ad-review process, after the developer's ads were repeatedly removed for breaking the rules, Facebook's owner said in a statement Thursday.

The lawsuit also follows a letter sent by Sen. Dick Durbin, D-Ill., in February to Mark Zuckerberg, urging the CEO to address his company’s role in letting Joy Timeline run ads that violate Meta’s policies.

Durbin cited a report by tech news outlet 404 Media and research by Cornell Tech’s Alexios Mantzarlis that found that at least 8,010 CrushAI-related ads ran on Meta’s apps during the first two weeks of January.

Meta updated its policies regarding non-consensual intimate imagery over a year ago, to make it “even clearer” that promoting nudify apps is prohibited.

“We remove ads, Facebook Pages and Instagram accounts promoting these services when we become aware of them, block links to websites hosting them so they can’t be accessed from Meta platforms,” the company said in Thursday’s statement. It also restricts search terms like "nudify," "undress," and "delete clothing" on Facebook and Instagram.

The problem is larger than Meta and CrushAI, however.

A Bellingcat investigation published last year uncovered how sites like CrushAI promote themselves on mainstream platforms.

The investigation described a loosely affiliated network of similar platforms, which include Clothoff, Nudify, Undress, and DrawNudes. The apps have “manipulated financial and online service providers” by disguising their activities to evade crackdowns, Bellingcat reported.

For instance, it found that accounts on G2A, one of the world’s largest online video game marketplaces, were being used to collect payments for Clothoff. The site disguised the sales as if they were for downloadable gaming content.

The network has also tried to exploit payment services and marketplaces such as Coinbase, Patreon, PayPal, Shopify, Steam, and Stripe, in order to receive payments.

In a leaked memo, Whole Foods CEO Jason Buechel outlined plans to cut down on duplicative efforts and create a leadership team.

When Amazon acquired Whole Foods for $13.7 billion in 2017, the upscale grocer was largely allowed to operate with a surprising level of independence. But that era seems to be over. In a sweeping reorganization, Amazon is integrating Whole Foods more deeply into its broader grocery operations — bringing corporate staff under Amazon’s systems for pay, benefits, and performance, and centralizing leadership across its food businesses under one chain of command.

The effort is being led by Jason Buechel, who has run Whole Foods since 2022 and was promoted in January to oversee all of Amazon’s grocery ventures, including Amazon Fresh and Amazon Go. In a leaked internal memo obtained by Business Insider, Buechel called out “duplicative efforts” and missed opportunities, signaling a move toward what he described as “working smarter across teams.”

A new leadership team will now coordinate seven core functions, from tech and operations to real estate and logistics, spanning all Amazon grocery brands. While Whole Foods will retain its quality and ingredient standards, the goal is clear: unify systems, share resources, and accelerate growth in a category where Amazon has yet to gain serious traction.

“To make it even easier to collaborate and innovate on behalf of our customers, we’re continuing to unify teams across our grocery brands,” Lauren Snyder, an Amazon spokesperson, said in an emailed statement. “These changes reflect our long-term commitment to making grocery shopping easier, faster, and more affordable for customers.”

Despite years of experimentation, from cashierless stores to Prime-linked perks, Amazon remains a small player in the $1.5 trillion U.S. grocery market — commanding just a sliver of market share (1.4-1.6%) compared with giants such as Walmart (21.2%) and Kroger (8.6%), even with its network of roughly 530 Whole Foods stores and 60 Amazon Fresh locations. Analysts have long pointed to the fragmented nature of Amazon’s grocery efforts as a key barrier to growth. Whole Foods and Amazon Fresh often operated in parallel silos, with limited coordination between teams working on similar problems.

This reorganization aims to break down those silos — and follows a pattern set by Amazon CEO Andy Jassy, who has pushed for tighter integration across adjacent businesses such as Audible and One Medical.

“Too frequently we are duplicating efforts and missing easy opportunities for efficiency,” Buechel wrote in the memo. “We have a big opportunity to work smarter across teams and simplify how we approach shared needs.”

Amazon has slowly been blurring the lines between its grocery arms — leveraging Whole Foods as fulfillment hubs, piloting “Amazon Grocery” micro-stores, experimenting with combined delivery from Fresh centers, and launching budget-friendly private labels. Now, with deeper integration, the company is hoping for sharper rollout of local microcenters, cross-brand pricing discipline, unified inventory systems, and more.

The changes won’t affect frontline workers in stores or warehouses, but they do mark a cultural shift. Whole Foods’ corporate employees will now be measured — and rewarded — according to Amazon's corporate norms. That raises questions about whether the company can preserve the grocer’s identity while subjecting it to Big Tech’s metrics and machinelike efficiency. Meanwhile, external threats loom: Cyberattacks on key distributor UNFI could disrupt grocer pipelines.

Still, for Amazon, the logic is clear. As grocery continues to resist full e-commerce penetration, owning the supply chain and store network is a long game. This time, Whole Foods isn’t just an asset on the balance sheet — it’s a core part of the strategy.

As the U.S. and China cool down their trade war, the investment bank sees an economic downturn as less likely

Goldman Sachs thinks a U.S. recession is looking less likely.

The investment bank on Thursday cut the probability of a downturn, from 35% to 30%."Three recent developments point to a somewhat smaller effect of tariffs on the economy," Goldman analysts wrote in a note to investors.

First, President Donald Trump's tariffs seems to be having "a slightly smaller impact on consumer prices and therefore on real income and consumer spending" s0 far, Goldman said. The current annual U.S. inflation rate is 2.4%. While that's higher than the Federal Reserve's 2% target, it remains unchanged since September 2024.

Second, "broad financial conditions have now eased back to roughly pre-tariff levels," the Goldman analysts said. This is presumably a reference to the stabilizing stock market. Following April 2, when Trump announced the sweeping reciprocal tariffs on goods imported into the U.S., otherwise known as "Liberation Day," chaos ensued on Wall Street. The S&P 500 dropped more than 12% in one week. The index has since returned to February levels. Similarly, the tariffs triggered chaos in the bond market: 10-year Treasury yields soared more than 12% in one week, ultimately causing the president to issue a 90-day pause on the levies. Yields remain high but have since stabilized.

Third, "measures of trade policy uncertainty have moderated a bit following steps toward de-escalation," Goldman said. In recent weeks, the Trump administration has announced multiple deals with trade partners, which have quelled fears of a worst-case scenario, while offering businesses some clarity on supply chains. This "de-escalation" is likely in reference to the US-China trade talks, which culminated yesterday in London.

Treasury Secretary Scott Bessent led the American delegation in the talks with Chinese Vice Premier He Lifeng. As part of the deal, Chinese goods imported into the U.S. are still subject to a 55% tariff, however this is down from a peak of 145%. Meanwhile, China will keep a 10% levy on U.S. goods.

Both sides also agreed to concessions. Beijing has agreed to resume approving rare-earth mineral licenses for U.S. companies, which are critical for automakers and manufacturers. In return, Washington has agreed to lift export controls on jet engines and related parts, plus ethane, a chemical required for producing plastics. Trump said in a Truth Social post on Wednesday: “Our deal with China is done" — but the president added that the agreement remains "subject to final approval."

Despite a slightly more optimistic outlook for economy, Goldman's forecast for interest rates remains unchanged. The bank doesn't foresee the next cut until December, followed by two more in 2026, reaching a terminal rate of 3.5-3.75%.

The former Starbucks CEO said in a surprise appearance that he's never been more optimistic about the future of the company than he is now

When Starbucks’ former leader Howard Schultz first heard about the “Back to Starbucks” plan, he “did a cartwheel in [his] living room.” At least, that’s what he told CEO Brian Niccol in front of about 14,000 others at this year’s Starbucks Leadership Experience in Las Vegas.

Schultz, who remains closely associated with the company despite stepping down after another stint as CEO and leaving the board in 2023, said he’s optimistic about Starbucks’ future — despite some worrying outside signs that have included disappointing quarterly earnings, falling sales, and protests.

“I’ve never been more optimistic about the future of the company than I have been today,” he said in a surprise appearance at the conference.

Niccol has focused on making Starbucks feel like a coffee company again.

His ambitious “Back to Starbucks” plan includes updates to make stores feel more like a “third place” (comfier furniture, a no-loitering policy), a sequencing algorithm to get drinks in customers’ hands more efficiently and quickly; a dress code update; requiring patrons’ names to be handwritten on cups; mobile order scheduling; restoring the condiment bar; and a simplified menu. Starbucks recently announced that it’s partnering with Microsoft Azure to get AI help for its baristas.

“[The “Back to Starbucks” plan is] short, it’s to the point, and it’s exactly the tip of the spear of who we should be, and who we are,” Schultz said. “And we are, above all else, a coffee company.”

Niccol took the reins in September after being lured away from his role as Chipotle’s CEO to take over the struggling coffee chain — after the board ousted Schultz’s hand-picked successor, Laxman Narasimhan. (Schultz, for his part, reacted to the news of Narasimhan’s firing by saying Niccol was exactly the leader Starbucks needed.) And investors seem to be reacting well to Niccol’s plans; the company’s stock is up almost 11% in the last month and almost 20% in the last year.

The current CEO has particularly prioritized making Starbucks that “third place” — somewhere outside of home and work where people can gather and spend time. Being a “third place” was the first thing Niccol and Schultz talked about; Schultz said that at a time of global anxiety and uncertainty, giving people a place to come where they can feel anchored by community is more important than ever.

“The third place is not something we need to reinvent — it’s who we are,” Schultz said. “People all over the world are longing for human connection. … We are a company that is steeped in humanity. We are steeped in human connection, because of all of you and the people you represent.”

While Schultz has stepped back from Starbucks, he remains a key company figure because of his role in its growth and success. So what he says carries plenty of weight on Wall Street.

He said Wednesday that Starbucks had struggled recently because “the culture was not understood. The culture wasn’t valued. The culture wasn’t being upheld."

But Schultz seems to be on board with Niccol’s plans for a company turnaround.

“Our success is not an entitlement – it must be earned,” Schultz told conference attendees. “Be true to the coffee. Be true to your partners. Let’s surprise the world again.”

Trump wants wealthy foreigners to invest in the U.S. and help pay off the swelling national debt. Details on the program remain scarce

The Trump administration launched a new website on Thursday aimed at attracting foreign nationals to apply for a fast-track to U.S. citizenship — if they have gobs of cash.

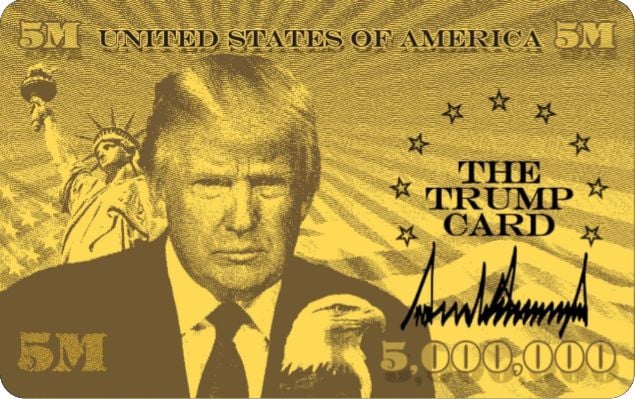

The website for the "gold card" included a portal for interested applicants to submit their name, region of origin, email, and family status. There's an image of a gold card with President Donald Trump's stern face on it, flanked by the Statue of Liberty and a bald eagle.

Trump has expressed enthusiasm for wealthy foreigners to invest in the U.S. and help pay off the swelling national debt.

He has said it would provide permanent residency status, similar to a green card.

"Wealthy people will be coming into our country by buying this card," Trump said in February. "They'll be wealthy and they'll be successful and they'll be spending a lot of money and paying a lot of taxes and employing a lot of people. And we think it's going to be extremely successful."

The Trump Card

Commerce Secretary Howard Lutnick said at the time the program was intended to replace the EB-5 visa, a similar route to citizenship for foreign investors who invest at least $500,000 and generate at least 10 jobs . Eliminating that visa program might require Congress to sign off on it since it was renewed in 2022.

Details of the so-called gold card program remain scarce, and it still may face legal challenges.

GameStop wants to raise $1.75 billion to help fund the purchase of Bitcoin

Investors aren’t sold on GameStop’s strategy to stockpile Bitcoin.

The ailing video game retailer unveiled plans on Wednesday to raise $1.75 billion via convertible notes to help fund the purchase of the cryptocurrency. Shares in GameStop were down more than almost 18% on Thursday morning.

The proceeds from the offering will go toward general corporate purchases, including “making investments in a manner consistent with GameStop’s Investment Policy and potential acquisitions.”

While the statement made no explicit reference to cryptocurrencies, it’s assumed this is where some of the funds will be allocated. That's because GameStop bought 4,710 Bitcoin last month, worth more than half a billion dollars at current market prices. Moreover, the move aligns with a recent trend: several publicly traded firms have been tapping investors for billions via convertible notes in order to put Bitcoin on their balance sheets.

This includes Trump Media & Technology Group. Last month, it raised $2.5 billion to fund a cryptocurrency reserve. Shares in TMTG dropped almost 14% following the announcement.

There are currently 30 companies with Bitcoin reserves listed on the Nasdaq, with treasuries worth a combined total of more than $85 billion — about 2% of the coin’s total market cap.

The token has had staggering returns — up 60% in the past year, thereby boosting balance sheets for many companies. Meanwhile, the pitch for investors in the stock market is that treasuries provide exposure to crypto’s steep gains without needing to hold the assets.

Business intelligence company Strategy, formerly known as MicroStrategy (MSTR), is considered the blueprint. Its CEO Michael Saylor has spearheaded using stock sales and debt financing to build a Bitcoin war chest worth over $40 billion, a move that has made the firm the 40th largest on the Nasdaq 100 index.

GameStop’s attempt to cash in on the frenzy is just one of many efforts to find new revenue streams. The rise of online shopping and streaming services has plunged its brick-and-mortar business into relative obsolescence over the the past decade. Its shares declined 95% between 2013 and 2020.

In light of this demise, GameStop became a “meme stock” in 2021, a term for shares in ailing businesses that gain popularity among retail investors through social media. This all makes GameStop’s recent foray into crypto unsurprising. The appeal of meme stocks — volatility, anti-establishment, viral — is analogous to meme coins. Traders thus typically also trade crypto tokens, and GameStop has a cult-like status among the community.

The fatal crash, which killed at least 200 people, is the first for Boeing’s 787 Dreamliner

Boeing stock was down some 6% Thursday morning after a fatal crash involving one of its 787-8 Dreamliner aircraft.

The plane, operated by Air India, tragically crashed just minutes after takeoff from Ahmedabad, killing many of the people onboard and causing additional casualties on the ground, according to Indian officials. It's not yet clear if there are survivors from the flight itself.

The plane was bound for London’s Gatwick Airport when it went down in a densely populated area, hitting residential buildings, a medical college, and offices near the airport. The cause of the crash has not yet been determined.

The event marks the first fatal crash involving a 787 Dreamliner since the aircraft entered service in 2011. In addition to the human toll, it delivers a devastating blow to what’s been thought of as one of Boeing’s most modern jets. While the Dreamliner faced some battery-related groundings early in its history, it has, until now, avoided the kind of tragedies that plagued Boeing’s 737 MAX program, which saw two deadly crashes in 2018 and 2019, and additional issues in 2024.

Spokespeople for Boeing have said the company is in contact with Air India and assisting investigators.

Just days ago, a raft of articles speculated about whether or not Boeing's turnaround might finally be turning. Now the crash revives old concerns and surfaces new ones just as recently-installed CEO Kelly Orthberg was attempting to restore public confidence.

Shares of key Boeing suppliers, including Spirit AeroSystems and GE Aerospace, also dropped approximately 2% each. Some analysts described the stock moves as knee-jerk reactions as fears about Boeing’s safety issues take hold once more.

As emergency responders remain on the scene in India, aviation specialists now turn to black box data for signs of whether this is an isolated incident or the start of another painful chapter.

Boeing’s response will be closely watched, too.