Sub-Saharan Africa has endured a period of economic turbulence for many years. Because most countries lacked the resources to inject billions of dollars into their economies during the Covid pandemic, growth is expected to slow this year, and inflation is high, especially when it comes to staples like maize and wheat. In fact, the IMF estimates that 12% of the region’s population would face acute food insecurity by the end of 2022.

At the same time, more than half of adults in Africa have no access to banking services, according to a recent financial survey by Mastercard. However, what many of them do have is a cell phone — and many more will acquire one in the next few years. Of the nearly 400 million new mobile subscribers expected to sign up globally by 2025, the majority will come from frontier markets like Africa.

With so many of the continent’s citizens going mobile but shut out of traditional banking systems, Sub-Saharan Africa especially primed for fintech: digital financial services that include digital wallets and money transfers, QR codes, and cryptocurrency. Tools like these won’t just allow Sub-Saharan Africans to send and receive money; they also create data footprints that can streamline financial lives, provide access to funding and financing, and introduce predictability.

To gain a greater understanding of fintech’s development potential for the continent, we interviewed Mark Elliott, Mastercard’s President of Sub-Saharan Africa. With a tenure developing and streamlining financial services in diverse markets around the world—including Hong Kong and the United Arab Emirates—he moved to South Africa to serve the Sub-Saharan region in 2014.

Today, Elliott does this work for nearly the entire continent, and he told us that fintech is encouraging crucial economic growth and improving financial solvency for Africa’s consumer bankers. In conversation with Elliott, here are five learnings about fintech’s potential to grow the fiscal landscape of Africa.

Lesson 1: Fintech encourages the most accessible banking to date.

Quartz: Digital payments are flourishing, ecommerce solutions are growing, and fintech innovation is shaping commerce in new ways. How would you describe the state of the fintech landscape in Africa?

Mark Elliott: Fintech has made great inroads in Africa despite economic challenges and a global pandemic. Mastercard has come to the forefront of this disruption by partnering with both end-user fintech companies and fintech enablers.

Together with our fintech partners, we are all looking for the best way to form a new value chain and facilitate new technologies enhancing financial service provision and expansion across Africa. With the use of the internet, blockchain, and algorithms, fintech companies have widened the reach of financial services like loans, insurance, payments, investments, and wealth management.

In an effort to resolve pain points and increase both financial and digital inclusion, many Sub-Saharan African nations are incorporating new payment systems. Kenya, Nigeria, and South Africa are just a few of the countries leading the transition to digital payments, the expansion of infrastructure, and the development of payment solutions for consumers and micro and small merchants. The sector accounted for 27% of the record-high number of deals closed and 61% of the USD $2.7 billion deployed across Africa in 2021.

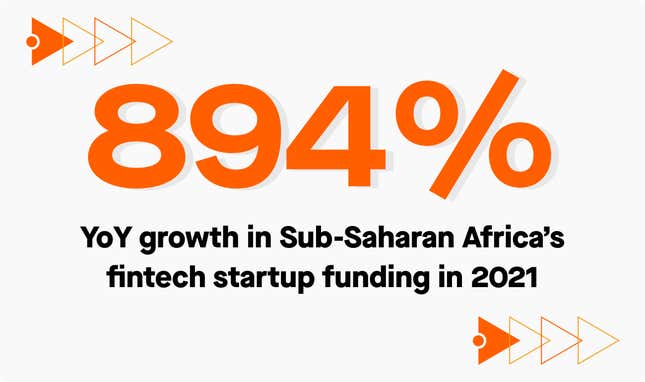

Better yet: the right products and solutions attract funding and investment, leading to great interest and rapid expansion of the fintech sector. Across Sub-Saharan Africa, fintech startups recorded 894% year-on-year growth in funding in 2021 — that’s over $1.5 billion.

Lesson 2: Digital infrastructure is connecting rural Africans to the global economy.

Quartz: Which trends are you observing now and which ones do you anticipate will gather steam to fuel the next growth phase of Africa’s fintech landscape?

Mark Elliott: The most successful fintech innovations will eliminate pain points and reduce friction, bringing effortless convenience to our fingertips. So far in the region, we’ve identified three general societal trends encouraging the development of these innovations.

- First, there are exponentially increasing opportunities to scale in an interconnected global marketplace, which is also seeing an increase in borderless transactions. Fintech investors are finding B2B solutions more attractive, especially in light of rising inflation.

- Second, development in telecom infrastructure will support increasing smartphone adoption, a key driver for fintech growth. Also, the deployment of 5G in markets like South Africa, Nigeria, Kenya, and Botswana — though still in its infancy — bodes well for the continent’s future fintech progress. With 5G almost 100 times faster than 4G, it can deliver superior customer experiences in terms of speed, bandwidth, seamlessness, and immersion.

- Finally, policy-level governance efforts — such as establishing regulation, compliance, and policy frameworks — will loom large in fintech’s future. More than 90% of jurisdictions in Africa have established regulatory frameworks for digital payments, and proactive regulators have been friends of fintech in Africa.

With the understanding that fintech can support market development, it’s critical for regulatory bodies to strike the right balance between enabling financial innovation and addressing the challenges and risks to financial integrity, consumer protection, and financial stability.

At Mastercard, we work closely with regulators and policymakers, as well as partners and innovators, to keep this a safe space during great change.

Lesson 3: More smartphones means more valuable data to report the region’s unique needs.

Quartz: How are emerging technologies impacting the development of payments, fintech solutions, adoption of offerings, and the operations of fintech companies?

Mark Elliott: Emerging technologies are actively driving fintech product development. As a technology company, Mastercard enables, supports, and collaborates with clients to integrate the current digital economy into their new solutions. We are helping to provide the tools fintech innovators need, empowering them to build new products, launch data-driven operational strategies, and grow their target segments.

Throughout the region, new technologies are boosting consumer adoption of emerging payment methods. ‘Buy Now Pay Later,’ in particular, is expected to account for nearly a quarter of all global e-commerce transactions by 2026. Consumers are finding ‘Buy Now Pay Later’ installments to help with budgeting, funding high-ticket purchases, or increasing their spending power.

In addition, biometrics will amplify possibilities for eKYC—a digital identity verification solution standing for “electronic know your customer.” Every day, more consumers are using open banking to accomplish a variety of tasks, including bill payments, credit score optimization, remittances, savings, paying off loans, and financial planning.

“Tap to pay” is an affordable money acceptance solution for merchants, allowing them to avoid the outlay cost of expensive point-of-sale terminals, depending on their phones as effective alternatives.

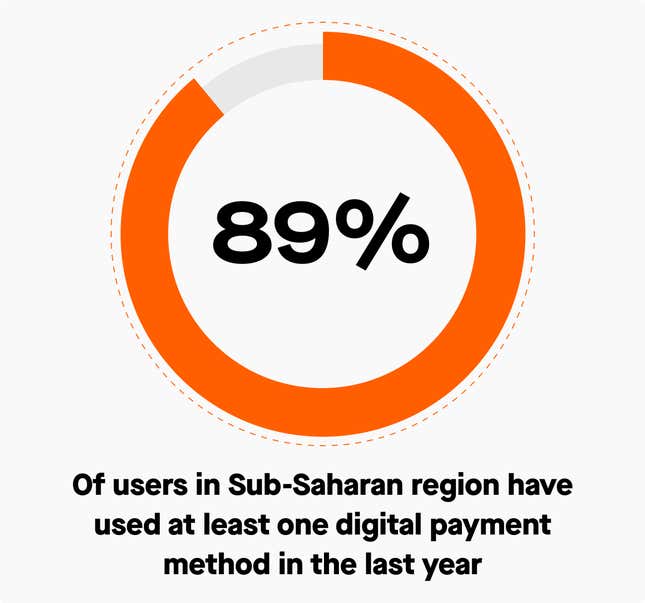

These solutions are incredibly popular in the region. Eighty-nine percent of users in the wider Sub-Saharan region have used at least one digital payment method in the last year.

Lesson 4: Mastercard is hard at work in the region to drive digital and financial inclusion.

Quartz: Which initiatives and programs have you activated to connect fintech innovators and enablers to Mastercard’s capabilities?

Mark Elliott: From our best-in-class APIs and data assets to our trusted ecosystem of partners, Mastercard provides crucial services and tools for fintech innovators to achieve scale at pace to bring more people into the digital economy.

Mastercard Engage is a free global program allowing clients to search for qualified technology partners to help build and deploy solutions for fintech companies, and Mastercard Fintech Express is designed to help both established and emerging companies innovate.

Start Path, our six-month engagement program designed to help stage startups to scale, has supported more than 300 startups to tackle challenges and take advantage of opportunities across Mastercard’s ecosystem.

An example is agritech startup Hello Tractor, which connects tractor owners to smallholder farmers in Nigeria and Kenya, offering easier access to affordable tractor services, so they can plant on time and increase yields. South African-based Karri is a mobile payment app that facilitates fast and easy payments to schools and community organizations, providing parents with a convenient way to manage their child’s money.

These examples speak to the stunning economic growth that certain sectors of the economy are experiencing. Over the past five years, there’s been a 200% Compound Annual Growth rate [a metric demonstrating the long-term appreciation of an asset’s value] in funding attracted by startups in Africa.

Lesson 5: Even in rural communities, domestic e-payments are booming.

Quartz: In a continent where equal access to financial services is a challenge, can fintech move the needle further to transform everyday life for people and entrepreneurs?

Mark Elliott: Connecting Africa’s rural communities to the global digital infrastructure is an opportunity for both commerce and for social impact. In fact, Africa’s domestic e-payments market is projected to see 20% revenue growth per year (compared to 7% globally), reaching around USD 40 billion by 2025.

Fintech is building inclusion in Africa from the ground up, whether it’s encouraging agritech (meaning agricultural technology, or digital tools applied to agriculture), helping small- and medium-sized businesses expand digital commerce, or facilitating peer-to-peer payments. Our partners that are innovating this landscape are important collaborators in Mastercard’s mission to connect one billion people and 50 million SMEs (small-to-medium enterprises) to the digital economy by 2025.

Ultimately, the world thrives when fintech companies have access to the technology they need to reach scale and democratize finances the world over.

In addition to supporting and encouraging the next generation of innovators, we also must enable them. I strongly believe that through partnership, we can close this digital divide, co-create solutions, and innovate for real impact. Together, we can deliver scalable, secure, interoperable, and convenient payment systems that will bring us closer to a cashless world.

Learn how Sub-Saharan Africa is building a more inclusive financial system in Mastercard’s new whitepaper The Future of Fintech: Rapid Growth Attracts Smart Capital.

This post is a sponsored collaboration between Mastercard and G/O Media Studios.