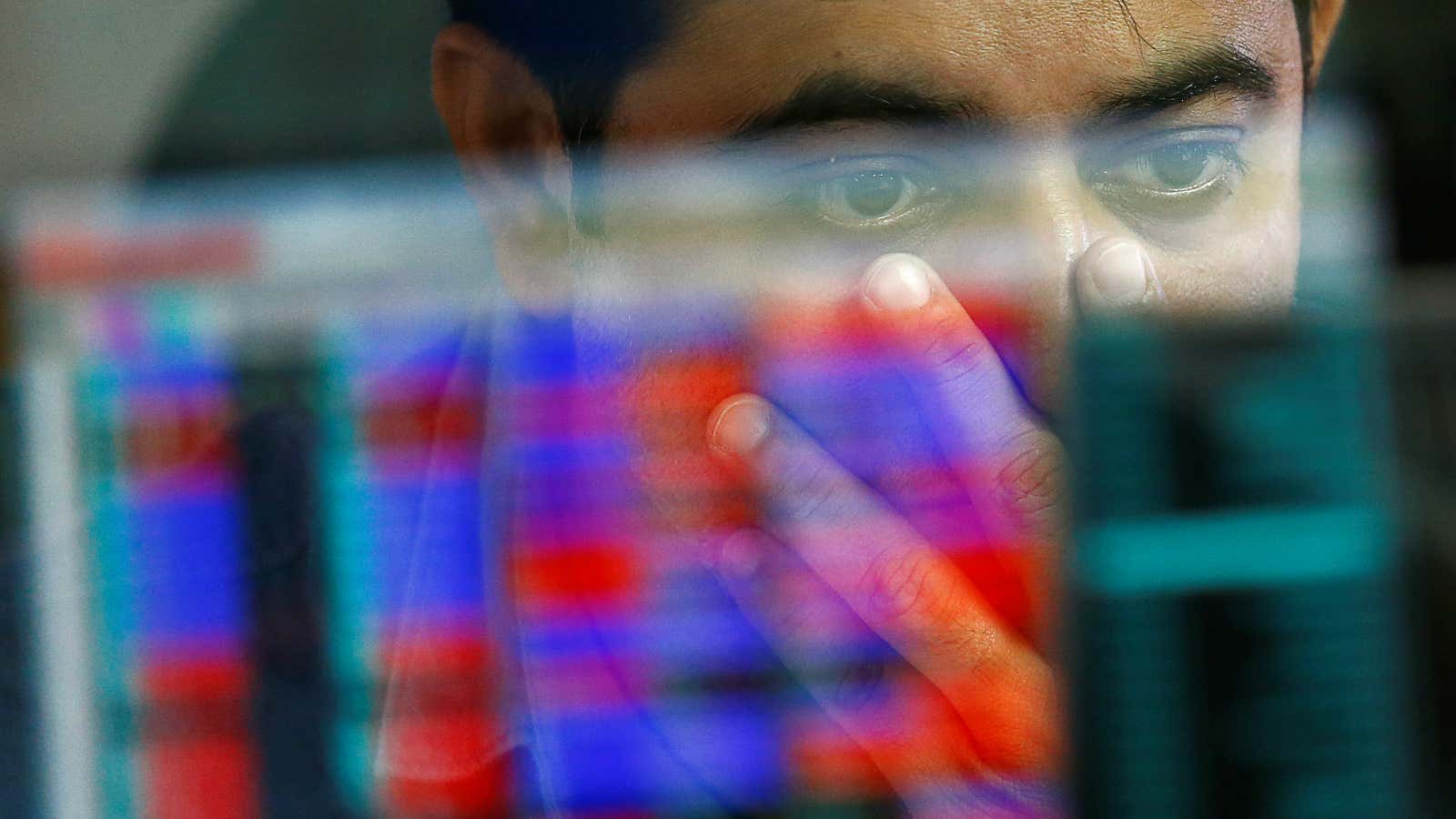

Don’t let the recent rally in the Indian stock market sweep you off your feet, for the party may be ending soon.

At least, that’s what Goldman Sachs seems to think.

For the first time since March 2014, the investment firm has for multiple reasons downgraded Indian equities from “overweight” to “market-weight.”

“The risk-reward for Indian equities is less favourable at current levels. The key reasons for our less optimistic view include, among others, stretched valuations, multiple macro headwinds in the near term and election event risk,” a Goldman Sachs analyst said. “We expect markets to consolidate heading into the elections and the Nifty to reach our 12-month target of 12,000 [points] as political uncertainty wanes and earnings accrue.”

The Goldman Sachs downgrade comes at a time when India’s benchmark stock indices Nifty and Sensex have had a stellar year. In 2018 alone, the BSE Sensex registered 22 record highs. In January it hit a record 34,382 points; by August it had breached 38,000 points, driven by the inflow of foreign funds and domestic institutional investors. This has made the Sensex among the most expensive equity markets in Asia.

However, Goldman Sachs has plenty of reasons to believe the exuberant phase may be ending. These include higher crude prices, a weakening rupee, and sluggish domestic institutional investment flows.

Given the rupee’s slide, things are unlikely to improve in the short term. So far in 2018, the Indian currency has already lost 11% of its value against the dollar. This has made the rupee one of Asia’s worst-performing currencies. Higher crude oil prices and India’s widening current account deficit have prompted this slip.

It could take a lot of work to get investor faith back in Indian equities.