It’s easier to be an entrepreneur in India than an investor, says a 35-year-old startup industry veteran who has tried his hand at both over the past decade.

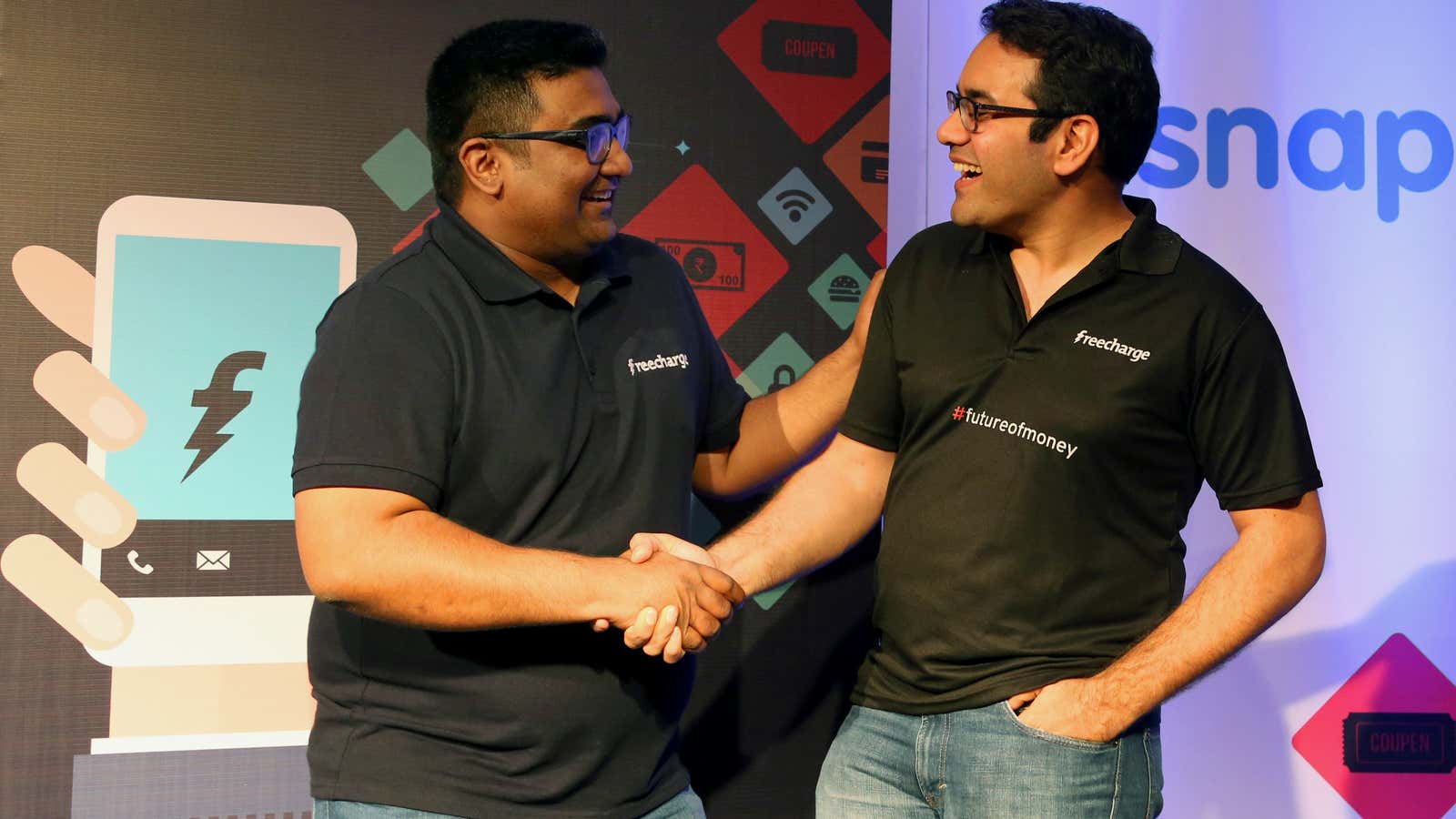

Three years after he sold his second venture, online recharge platform Freecharge, for $400 million to Snapdeal, Kunal Shah is back with a new startup: a rewards platform, Cred. (Snapdeal sold Freecharge to Axis Bank in 2017 for $60 million.)

Cred, which goes live today (Nov. 26), rewards users who pay their bills on time and are financially disciplined. Users who pay their credit card bills through Cred earn points, which can then be redeemed to purchase movie tickets, gym memberships and so on. The startup has already tied up with around 30 brands till now, including BookMyShow, Urban Ladder, Ixigo, CureFit, Furlenco, and FreshMenu, among others.

“Our financial system doesn’t reward people with good financial behaviour,” Shah told Quartz. “In the US, if you are a bad driver your car insurance premium and interest will be higher. Here, your home loan is not drastically cheaper because you have a good score.”

Cred has already secured $25 million in a funding round led by Sequoia Capital and Ribbit Capital, along with a bunch of other investors.

Shah spoke to Quartz about his anxiety around Cred after a successful stint with Freecharge and after being a prudent angel investor in startups such as Spinny, Zepo, Unacademy, and Bharat Bazaar, among others. Edited excerpts:

What made you return to entrepreneurship and launch Cred?

In a world where capital is freely available, it is very hard to be an investor. It’s better to be an entrepreneur because you can take advantage of that.

I have been dabbling with ideas for some time now. My biggest learning from Freecharge was how poor financial knowledge is in India. Moreover, our financial system doesn’t really incentivise good financial behaviour.

So we saw a pressing need to create a product that will tackle these problems. My goal here is to create this platform of trustworthy people and reward them.

You took some time to return to entrepreneurship. What kept you occupied?

I have been busy with my startup investments and advising investors such as Sequoia. But I tried angel investment with a view to learning. Call it my research, which I believe is important because I have seen several startups fail due to a lack of it. The founders might think of something as a great product, but users wouldn’t buy it.

How is it to be a second-time entrepreneur in India?

I don’t think the odds of success improve as a second-time entrepreneur, but chances of failure do reduce because you have the knowledge of all the ways things can go wrong. We can avoid fatal mistakes.

Moreover, the reputation and access to right kind of people help you accelerate the process of starting up.

It’s is also less of an emotional affair. There is experience backing you, so you can train and guide the younger members of the team.

How do you think the industry views a second-time entrepreneur?

In the US and China, there is a huge amount of support among the founders and failures are celebrated. In India, there is a lot of pressure. I make the smallest mistake and people will find happiness in highlighting it. It’s actually painful to be a second-time/third-time founder in India, while it is absolutely cool in a country like the US.

When I sold Freecharge my family and friends were sad about it because they felt I am selling it in distress. People in India are obsessed with creating an empire.

Do you think you could have done things differently with Freecharge?

When I sold Freecharge we had $100 million in the bank, so it wasn’t a distressed sale. Our goal was to combine the power of both the companies (Freecharage and Snapdeal) and we were promised more capital from the investors. That did not pan out due to other reasons.

When two large companies come together and if you don’t have a healthy financial runway, it can be difficult for both to survive. It would have been a different situation if they had a capital advantage that a lot of other companies had.

What is the future scope of growth for Cred?

The scope is huge. We haven’t even had to try and convince brands much to create unique propositions for our users because they have a proven creditworthiness. For example, we spoke to Zoomcar and told them we don’t want our users to pay the deposit and they agreed. Also, we went to Dunzo and asked for Rs 10,000 credit limit for our users, and they said sure!

This community of creditworthy people can be a base for a plethora of things. We don’t even have to negotiate with banks because they readily accept users with good financial behaviour. We have also approached a few embassies to make visa rules easier for our users based on their merit. So, imagine what all we can do with this.