Debates on startups and their eye-popping losses aren’t new in India.

The question of growth versus profitability has been pondered over for years. On Feb. 11, however, two celebrated Indian entrepreneurs began an exchange on the subject, uncharacteristically, on Twitter. And like it often happens on the micro-blogging site, they were joined by all and sundry.

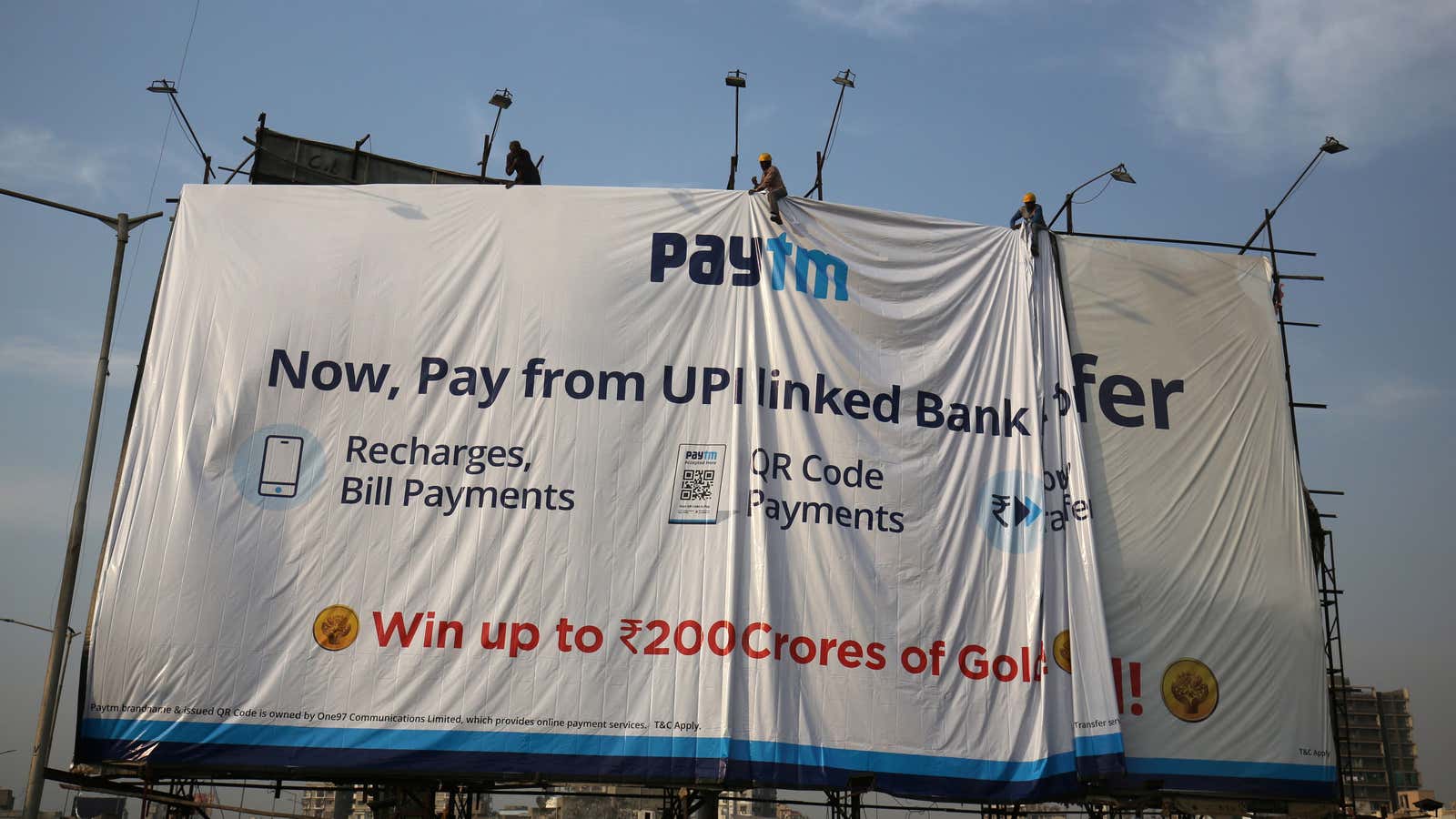

Ronnie Screwvala, who’s tasted financial success in several of his ventures, criticised India’s largest digital payments venture, Paytm, about the “mad mad” way the business was being run. He said such firms will remain popular only until they offer perks to consumers.

Vijay Shekhar Sharma, founder and CEO of Paytm, replied in good humour.

However, the discussion rolled onto a more serious note. After all, Screwvala’s concerns are not without reason.

Mad mad, indeed?

One97 Communications, the parent company of the nine-year-old Paytm, has raised over $2.8 billion (around Rs19,000 crore) from some marquee global investors such as Japan’s Softbank and China’s Alibaba. And while the company has built a huge user base, it’s mostly been through hefty discounts and cashback offers. The company has not pocketed any profit until now.

In March 2018, transactions on Paytm reportedly crossed $20 billion. But in financial year 2018, One97 Communications’ losses widened by 70% to Rs1,490 crore even as revenue jumped four-fold to Rs3,314 crore.

And Paytm is not alone.

Most Indian unicorns (startups valued at over $1 billion) are booking massive losses even as their valuations shoot up and they attract more users.

The counter argument

Despite these glaring losses, entrepreneurs have remained hopeful that one day their services will become a habit for users who will remain loyal even when the discounts are pulled out.

“…not everyone who came to (the) party will be a long term friend! That said, a question for you as a communication person: What should be on counter message/ offering that makes customer pull out (their) phone and try the product once. Cashback does work, what else is possible,” Paytm’s Sharma asked.

Several users of Paytm defended Sharma in reply to Screwvala, saying the app offers convenience that could make other modes of payment like credit and debit cards obsolete.

While it’s still anybody’s guess if users will stick around after the perks are gone, it does raise a key question: For how long can companies keep splurging this way?

Wait and watch

It’s impossible to convert a customer who is lured by cashback to a paying user, according to Screwvala, currently chairman and co-founder of online education platform UpGrad.

Indeed, there’s no denying investor pressure to make profits, and it’s showing in the fact that several Indian entrepreneurs have lately begun talking about it.

In June 2018, education tech unicorn Byju’s said it had turned profitable while its monthly revenue crossed Rs100 crore. In July 2018, Bhavish Aggarwal, co-founder and CEO of ride-hailing unicorn Ola, said the company was operationally profitable and would soon become cash flow positive.