India’s internet economy is booming courtesy video, esports, and music.

The country’s over-the-top (OTT) market is slated to nearly triple in size between now and 2023, growing at a 21.8% compound annual growth rate (CAGR) from Rs4,464 crore ($643 million) in 2018 to Rs11,976 crore, according to a new report by consultancy PricewaterhouseCoopers (PwC).

“The potential of India’s enormous scale will become a reality during the forecast period with its OTT video market overtaking that of South Korea to become the eighth-biggest in the world by 2023,” PwC noted.

A host of foreign and local competitors—Hotstar, Netflix, Amazon, JioTV, ALTBalaji—are all vying for a piece of the growing pie.

Despite posting such strong growth, it remains a small sliver of the overall market. For television still rules.

Even though smartphone penetration and internet access has picked up, much of India is still logging on from feature phones with limited usage. Traditional media such as television, books, and newspapers and magazines, reign in terms of revenues.

OTT, esports, and music still contribute under 5% each.

Unlocking the potential

The newer sectors need time and technology to proliferate.

E-sports, for instance, still posts a small revenue due to “poor online infrastructure, which has historically restricted growth,” PwC said.

However, coupled with improving infrastructure, it “has a strong potential with a calendar of well-supported events and leagues emerging,” the UK-based firm said. India is poised to move into the top 10 global gaming markets by consumer revenue by 2023, the report said.

Other evidence supports the impending boom: By 2021, India’s gaming industry will be worth over $1 billion with 190 million games, a KPMG study estimates. India already houses a tenth of the world’s gamers. The number of game-developing companies has grown tenfold from 25 in 2010 to 250. A fantasy sports startup became a unicorn in April. People are earning money not just from playing in the leagues but also from live-streaming their games.

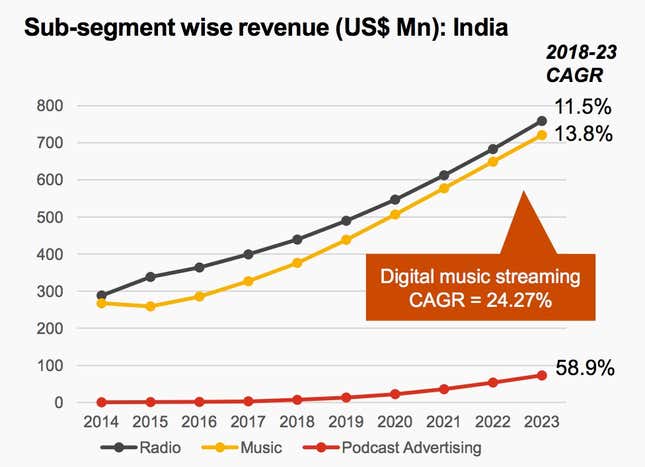

Like esports, the music-radio-podcast segment is also growing at an outsize pace in India compared to world standards. The space is heating up with multiple domestic and international streaming giants like Gaana, YouTube Music, Apple Music, and Spotify, among others, ramping up in the country recently.

A massive 96% of smartphone users use their devices to listen to music—the highest rate in the world—according to the International Federation of the Phonographic Industry (IFPI).

“The growing adoption of smartphones and smart speakers will make all forms of audio increasingly accessible to listeners in the coming years,” PwC said, adding that “ease of voice search” will also boost revenues over the next five years.

But paying for music still doesn’t come easy to price-sensitive citizens. Even those who loosen their purse strings are conservative. That’s why Spotify’s list of freebies is longer in India compared to the rest of the world. Apple Music, already cheaper in India than in the US ($1.69 versus $9.99), slashed prices further in the face of stiff competition.

While Indians still lack awareness about the podcast industry, the ones who discover it tend to get hooked. “…the shows and podcast have niche audiences that are very small in percentage but very sticky in coming back to the platform,” Gaana CEO Prashan Agarwal had told Quartz in 2018. “Our hope is, in about a year or two, these categories will become mainstream as well.”

The podcast industry is already witnessing significant upticks. Monthly listeners—people who listened to at least one podcast in the last month—totalled 40 million at the end of 2018, up a sharp 57.6% from 25.4 million in the year prior.