“Miles to go before I sleep.” Yes, you can take that quote literally. In the world of air travel, there is a category of people that is all about the miles it earns. In 1999, an engineer in the US bought over 12,000 cups of pudding at 0.25 cents each, to amass over a million miles under a promotion. Since then, there have been many attempts to score as many miles as possible by the people who believe in their power. Why go crazy after them, you ask? Airmiles have been known to make possible trips at a fraction of the cost it takes to buy a ticket after all.

I have travelled back from the US, along with my wife, on Etihad Airways A380 in its First Apartments class for 90,000 airmiles and just $5 per head. Those who know the potential of these airmiles would never want to pay the $15,000 it would have cost for this trip, which involves a full bed, a deep sinking chair with adjustable levels of firmness, a 32-inch flat TV (with live television), a shower at 40,000 feet, and customised meals by a chef on board. Rinse, repeat. I took the same Etihad Apartments to Australia and back for just 60,000 miles per head the following year to bring in the New Year in Sydney.

Miles have also taken me on board Singapore Airlines’ first class, Jet Airways’ first and business class, Etihad’s business class, British Airways’ first Class and business class, and Cathay Pacific’s first class, amongst others. Most recently, I was on board the Lufthansa first class for a fraction of the cost it takes to buy the tickets on retail prices.

Loyalty is rewarding

Airmiles, or frequent flyer miles as they are more commonly known, are part of the marketing machinery called loyalty programmes that US-based airlines first established in 1980. Airlines wanted to ensure that the customer would keep coming back to them for repeat business, rather than fly a different airline every time. American Airlines launched AAdvantage, and other airlines quickly followed suit.

The basic premise of the loyalty programmes at that time was simple. You were awarded the number of miles that you flew. So, a Los Angeles to New York JFK direct flight got you 2,464 miles. But flying Los Angeles-Seattle-Chicago-Florida-New York got you 4,925 award miles in your account for flying to the same place. So, for those who understood the system, it quickly became a thing to find the most convoluted route to fly so that they could amass the greatest number of award miles for the same destination.

The hunt for frequent flyer status also made sure people flew more. Airline status traditionally is counted on the number of flights you flew with the airline in a year, or the number of miles you flew with them. As you fly more, you would progress to milestones such as silver, gold, platinum, diamond, or other precious materials.

The higher you go, the greater number of miles you get for the same trip (for instance, an airline may offer you a 100% award miles bonus as a platinum member flying with them). Also, you would get privileges such as expedited check-in, boarding, lounge access, upgrades, and other similar perks. The airline would count the number of status miles you flew, a phantom counter that would reset every year, to decide which status to grant you.

You could use the award miles amassed by you to get free seats on the plane. Airlines would keep seats aside for their frequent flyer members to redeem tickets. These seats would usually be the unsold seats on a flight, and typically be dead inventory when the it flew empty. So airlines used them to offer members an opportunity to use miles from their mileage balance and then travel on these instead. Not surprisingly, loyalty programmes have been one of the biggest hits in the past decades for all sorts of travel companies to gain repeat customers.

Why collect airmiles?

It is my personal advice to everyone that every time they fly, they should earn airmiles if the airline given them that opportunity. Airmiles are a sort of pass back that airlines give you for flying them. But the ability to earn airmiles has now moved beyond just flying. Credit cards are a way to earn airmiles on daily spends. Banks tie-up with mileage programmes to buy airmiles and reward their customers for spends. Other ways include, but are not limited to, magazine subscriptions, shopping, renting a car, and countless other such things. For instance, signing up for The Economist magazine’s subscription could earn you a boatload of miles.

First and foremost, the more airmiles you have, the more ability for you to travel for a fraction of the cost. For instance, you could defray the cost of your vacation or work tickets. So, you get more money in your hands to spend on your stay and experiences rather than spend that money on air tickets.

You can also choose to travel more comfortably, for less. For instance, you might want to travel from India to the United States. A 16-hour flight would be crazy in economy, so how about a flat bed in business class with better food and drinks as well?

When you want to buy a business class ticket in cash, the prices tend to move four to five times higher than economy class. But when flying on a redemption ticket, you would usually just pay double the number of miles of economy for a business class flight. Hence, you would be able to get a more comfortable experience for a fraction of the price.

Sometimes, you need to fly last minute and ticket prices may have gone through the roof. How about redeeming some miles? Take, for instance, a last-minute Mumbai-Goa flight on a long weekend. While the cash price may go up to over Rs10,000 one way per person on Vistara, they are available for 4,000 miles.

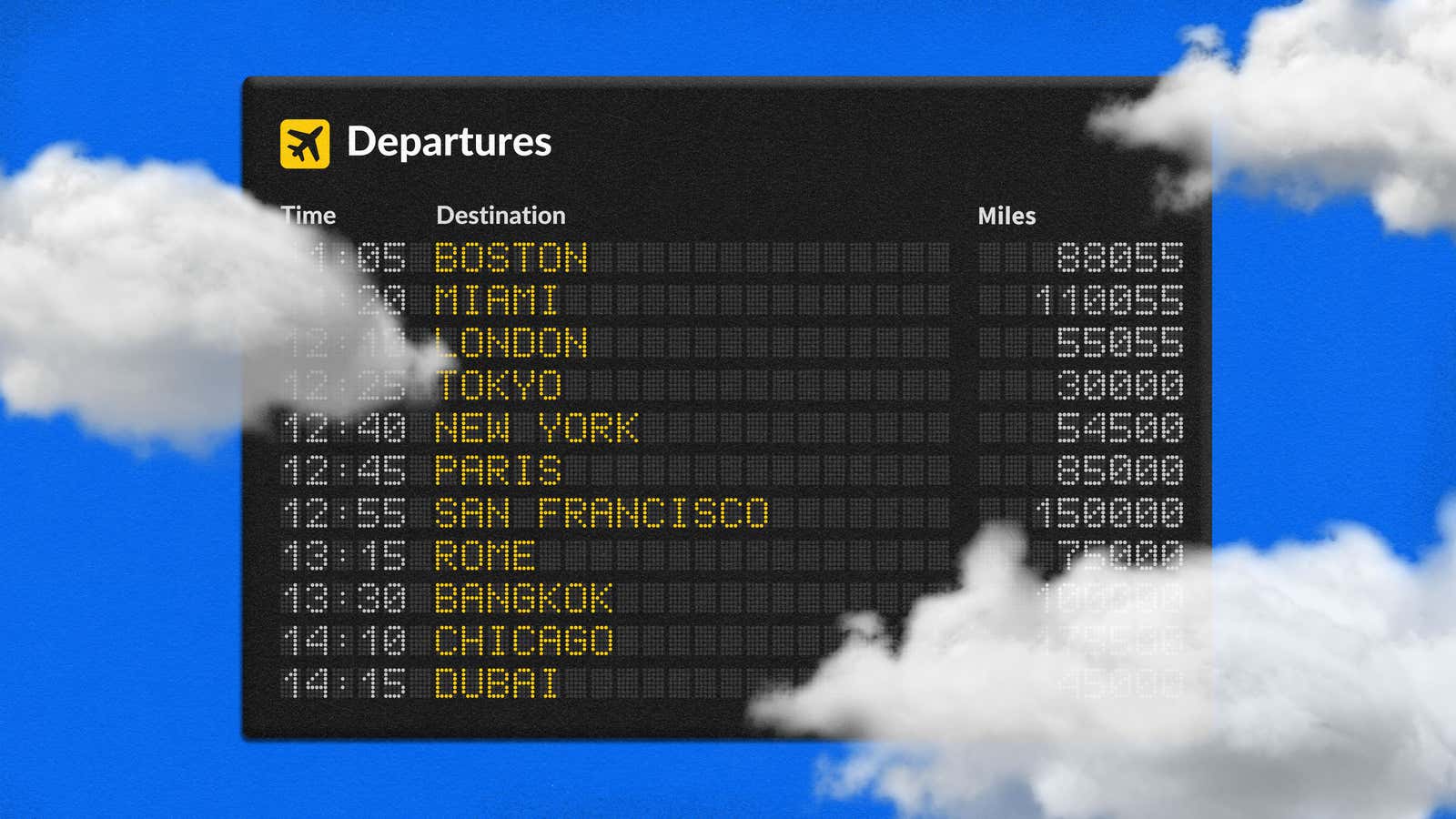

What airmiles to collect in India and why?

There are many options when it comes to collecting air miles in India, but not all are born equal. A question I receive a lot is which one to go for. It largely is a lot about how easy they make it to earn and redeem miles, and if they offer a good value. For instance, for an economy class ticket between New York and Washington DC, for the same flight, British Airways offers it to you for 7,500 miles and American Airlines offers it to you for 12,500 miles. So, you need to study the programmes and check out which one works for you.

If you are largely a domestic flyer around India, the most sensible options are be the home carriers. The biggest airline loyalty programme in India was JetPrivilege, but with the closure of Jet Airways, it is seeking to reinvent itself. Currently Air India has the Flying Returns frequent flyer programme, and Vistara offers the Club Vistara frequent flyer programme.

Air India’s Flying Returns: So much potential

Air India’s Flying Returns programme is a mixed bag, so join at your own risk. Air India joined the Star Alliance in 2014, which means you can now fly Air India or any other of the 27 airlines of Star Alliance across the world, deposit your miles on Flying Returns, and then redeem them for Star Alliance or Air India flights. Star Alliance has some of the biggest and best airlines in the world as members, such as United, Singapore Airlines, Lufthansa, Thai, ANA, Air Canada, and others.

But Air India has structural flaws in their loyalty programme, which do not allow you to benefit from it if you do not fly a lot of international business class. Air India offers as low as 25% of the flown miles on their cheapest tickets.

To become an Air India Golden Edge Club member, which would allow you to get benefits such as lounge access and business class check-in on Air India and other Star Alliance airlines, you need to accumulate at least 50,000 Air India status miles. If you are a frequent Delhi-Mumbai flyer then, you need to do 300+ flights on the cheapest tickets to be able to make it to that status. Air India is also not very generous when it comes to redemptions. It has progressively become harder to find any redemption seats on their international flights.

Let’s say you want to fly from India to the United States on United, or Singapore Airlines. You can still use your Air India miles, but be ready to pay 100,000 Air India miles for an economy class ticket (one way). This is 25% more expensive than Air India’s own flights, which cost just 80,000 miles one-way. This trend reflects across the board when you want to make a Star Alliance redemption with Air India.

To earn more Air India miles, you can sign up for the Air India SBI Signature Credit Card, which earns you 4 miles per Rs100 spent on the card. You even get 30 miles per Rs100 spent if you book Air India tickets for yourself on their website. Not just that, you get up to 90,000 miles bonus for your spending on the card.

Club Vistara: Young and restless

Club Vistara took a different approach to loyalty than the others. They don’t award you miles for the number of miles you fly, but rather they award you Club Vistara points for the fare you pay them for the ticket. You can earn 8 Club Vistara miles per Rs100 spent on the ticket (apart from the taxes and airport fees). You need at least 2,000 Club Vistara points to get a redemption ticket in Economy class.

In terms of status, Vistara’s is far easier to get than Air India. Vistara requires you to only fly 30 flights or earn 25,000 tier points to get Club Vistara Gold status, which earns you lounge access, business class check-in, and boarding and baggage handling priority, among other facilities. And since Vistara has Singapore Airlines as one of their parents, you also get to access Singapore Airline’s lounges with your Vistara Gold/Platinum status when travelling abroad on Singapore Airlines.

You can also become Vistara Gold just by signing up for their top-end co-branded card with Axis Bank, which costs Rs10,000 per annum. You get a free business class ticket on paying the fee, and three more tickets through the year, as you spend up to Rs7.5 lakh during the year on the card. HDFC Bank Diners Club and IndusInd Bank cards can also be used to convert to Vistara points.

What international programmes are good for Indians?

But, being in India does not limit you to just earning miles on Indian airlines. Some of the best loyalty programmes are abroad, and you could sign up for them as well. Here are some that you should definitely look at from the perspective of each airline alliance.

Star Alliance: Avianca LifeMiles and Asiana Diamond Club. LifeMiles is a South American Star Alliance programme, which requires a low number of miles to get redemption flights. For instance, India-Europe business class flights just cost 35,000 miles across Star Alliance airlines when using LifeMiles instead of Air India’s Flying Returns. However, if you are a frequent international traveller in economy and want to quickly unlock the Star Alliance privileges, look at Asiana’s Diamond Club. You need to accumulate 40,000 status miles over a 24-month period, and once you get your Star Alliance Gold status, it lasts for 24 months.

Oneworld: Oneworld is a small but important alliance for Indians because half the alliance member airlines fly to India, such as British Airways, Cathay Pacific, Japan Airlines, Malaysia Airlines, Qatar Airways, Sri Lankan. Out of all of these, British Airways makes the most sense for Indians, given you can generate miles by flying, but also by transferring them from various credit cards. But if you are flying to the US even a few times a year, then the best choice is American Airlines AAdvantage to accrue miles. That is because you can use those miles to redeem on Oneworld airlines as well as Etihad, among other carriers.

However, if you like flying Emirates, you should look at crediting your Emirates flights to Alaska Airlines’ Mileage Plan. Just 82,500 Alaska Miles get you a business class ticket between India and the USA on Emirates, while on Emirates’ own programme, it takes at least 1,10,000 miles to redeem the same ticket.

There also exists a short cut to becoming Star Alliance Gold in just three flights. Shangri-La Hotels have a tie-up with Singapore Airlines called Infinite Journeys. When you become a Jade Member with Shangri-La Hotels, for just three flights on Singapore Airlines in any class, you would become a Singapore Airlines KrisFlyer Gold. This would usually require 50,000 miles of flying. The best part is, Shangri-La Jade status comes free for members of American Express Platinum Card in India.

Credit card points make your choices more widespread

Co-branded credit cards make you captive to an airline, which is both good and bad. For instance, the Vistara co-branded cards give you benefits when you are flying Vistara only. In such a case, it also helps to get some credit cards, which are, in flying parlance, airline-agnostic. These credit cards have points that can be used for good value on many airlines.

Here are some of the popular credit card programmes.

Citi PremierMiles: Citi’s entry-level travel credit card gets you 10,000 PremierMiles when you pay the fee of Rs3,000 in the first year. You earn four PremierMiles per Rs100 spent. But when you spend on airfare using the airline website or PremierMiles.co.in, a portal owned by Citibank, you get 10 PremierMiles per 100 spent. Each PremierMile is worth Rs0.45 and can be redeemed for air tickets or hotel bookings. Alternatively, you can transfer to 12 airline loyalty programmes in the ratio of 2 PremierMiles = 1 airmile. These include major airlines such as Qantas, Cathay Pacific, British Airways, Singapore Airlines, and others.

HDFC Bank Diners ClubMiles: HDFC Bank offers this as a middle-tier card. You can earn four points per Rs150 spent on this card. A long-running promotion of HDFC Bank called Smartbuy allows you to earn 10 times the usual points when you buy air tickets from a captive website, each point being equal to one mile of Vistara, British Airways or Singapore Airlines. Otherwise you can spend it for Rs0.50 in cash value for buying tickets on any airline using the same Smartbuy portal.

Citi Prestige: One of the top-end cards from Citibank, it costs Rs20,000 per annum in fees. But you get Rs10,000 worth of hotel vouchers at Taj/ITC Hotels and 10,000 airmiles in return for your fee every year. Plus, you earn one point per Rs100 for domestic spends and two points per Rs100 on international spends, golf benefits, airport transfers in Asia Pacific twice a year, and unlimited lounge access for you and the family. One point equals four airmiles on 12 major loyalty programmes.

American Express Platinum Charge card: The top-end card from American Express, Amex Platinum is a metal card, that earns you two and a half membership rewards points per Rs100 spent domestically, and three times that equation if you spend in foreign currency. Two membership rewards points convert to one air mile in nine airline loyalty programmes, such as Emirates, British Airways, and Singapore Airlines. You can also transfer to some hotel programmes such as Hilton and Marriott. Besides, you get unlimited access to lounges across the world, including American Express’ proprietary lounges in Mumbai and Delhi.

HDFC Bank Infinia/Diners Club Black: The top-end cards from HDFC Bank offer you a frequent 10X promotion, where you can shop via the Smartbuy website to get 10 times the usual number of points for your purchases on Flipkart, Amazon, and air tickets. Each point is worth Re1 when spending on airfare using the same portal, or you can also transfer them to some airlines. They come with unlimited airport lounge access.

Getting one or many of the above credit cards will essentially cover you a lot of ground in terms of getting access to miles that can be used across many airlines. Additionally, when you redeem the miles from portals such as that of Citi and HDFC, you also earn miles on the airline itself, so that is a sweet double dipping right there. Some of them are expensive, but all the cards make it a point to give you welcome gifts that make good for most of the fee you pay.

So, the next time you hear “miles are useless,” do not believe the naysayers. Once you start using them, they save you money like nothing else does. So, where will your next redemption flight take you?

The author is the founder of livefromalounge.com, India’s leading loyalty programme and credit card analyst website. You can follow him on @Livefromalounge on various social media for all the updates from his life at 40,000 feet.