Coal is taking a hit in India.

The amount of the fossil fuel consumed by the country’s power generators, most of them coal-fired, during the ongoing financial year that began in April is on track to fall for the first time in over a decade. The reason for this decline is a combination of factors, including the rise in electricity generation from other sources and the overall slowdown in the country’s economy.

From April to October this year, coal consumption by thermal power plants declined by 2.3 million tonnes compared to the corresponding period last year, according to an analysis of official data by Charles Worringham, a contributing researcher at the Institute for Energy Economics and Financial Analysis, a non-profit based in Australia.

Rise in hydro and nuclear

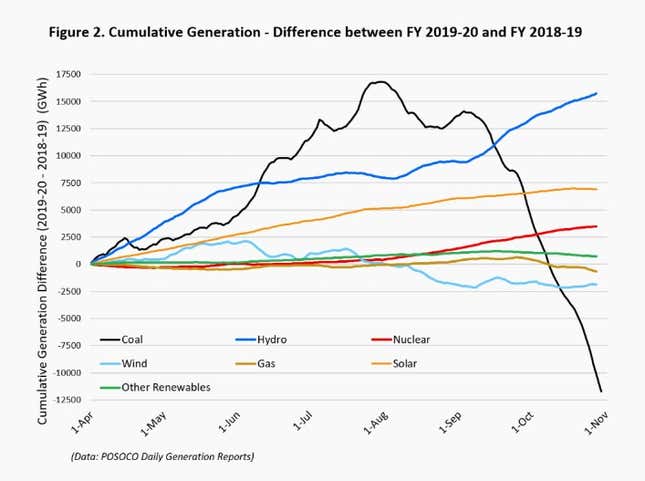

The fall in India’s coal consumption by the electricity generation industry began in August, and worsened over the next two months.

This can be attributed to the unexpected rise in generation from hydro and nuclear power projects this year, said Ashish Nainan, an analyst at Care Ratings.

This season’s monsoon rains in India have been the heaviest in 25 years. As a result, hydro projects generated about 96 terawatt-hours (TWh) of electricity in the first half of this financial year, 9.8% more than what the central electricity authority (CEA), the government’s planning arm on electricity systems, had estimated earlier.

In the same period, nuclear power stations generated 24 TWh of electricity, 11.45% more than the CEA’s estimates. India’s nuclear plants are running at 80.69% of their overall capacity, an improvement of nearly 20% over “last year when two nuclear plants had been under maintenance for around four months,” Nainan said.

Moreover, India’s ongoing economic slowdown has also hit power demand, which may have otherwise absorbed the rise in hydro and nuclear generation. “When economies stumble, slackening electricity demand is a very common symptom,” Worringham said.

Production of both hydro and nuclear projects is trickier to ramp down than coal power plants, Nainan added. During September, India’s coal plants ran at merely 51.16% of their total capacity.

The slowdown in the economy has also impacted coal demand from India’s steel plants, the second biggest consumers of the fuel in the country which are facing a deceleration in production growth.

Blip or omen?

India is often viewed as a safe harbour for coal, which is fast being abandoned by developed countries in the wake of climate change.

Apart from China, the world’s largest consumer of the fuel, growth in coal demand comes largely from India. Long-term forecasts suggest that the country’s coal consumption will steadily rise over the next decade, and perhaps even beyond. In 2018, growth in India’s coal demand had far outpaced that of other energy sources, according to data from the International Energy Agency (IEA).

State-owned miner Coal India, which produces more than 60% of all the coal consumed in the country, has for years been under pressure from the government to ramp up production to reduce dependence on coal imports and complaints of coal shortages at power stations.

But in the first half of this financial year, the firm mined 241 million tonnes of coal, 6% less than its production in the corresponding period last financial year.

A shortfall in Coal India’s production should have led to a rise in imports to meet the domestic demand. But imports have also been falling since September, suggesting that, at least for now, India’s appetite for the fuel is not growing as fast as expected.