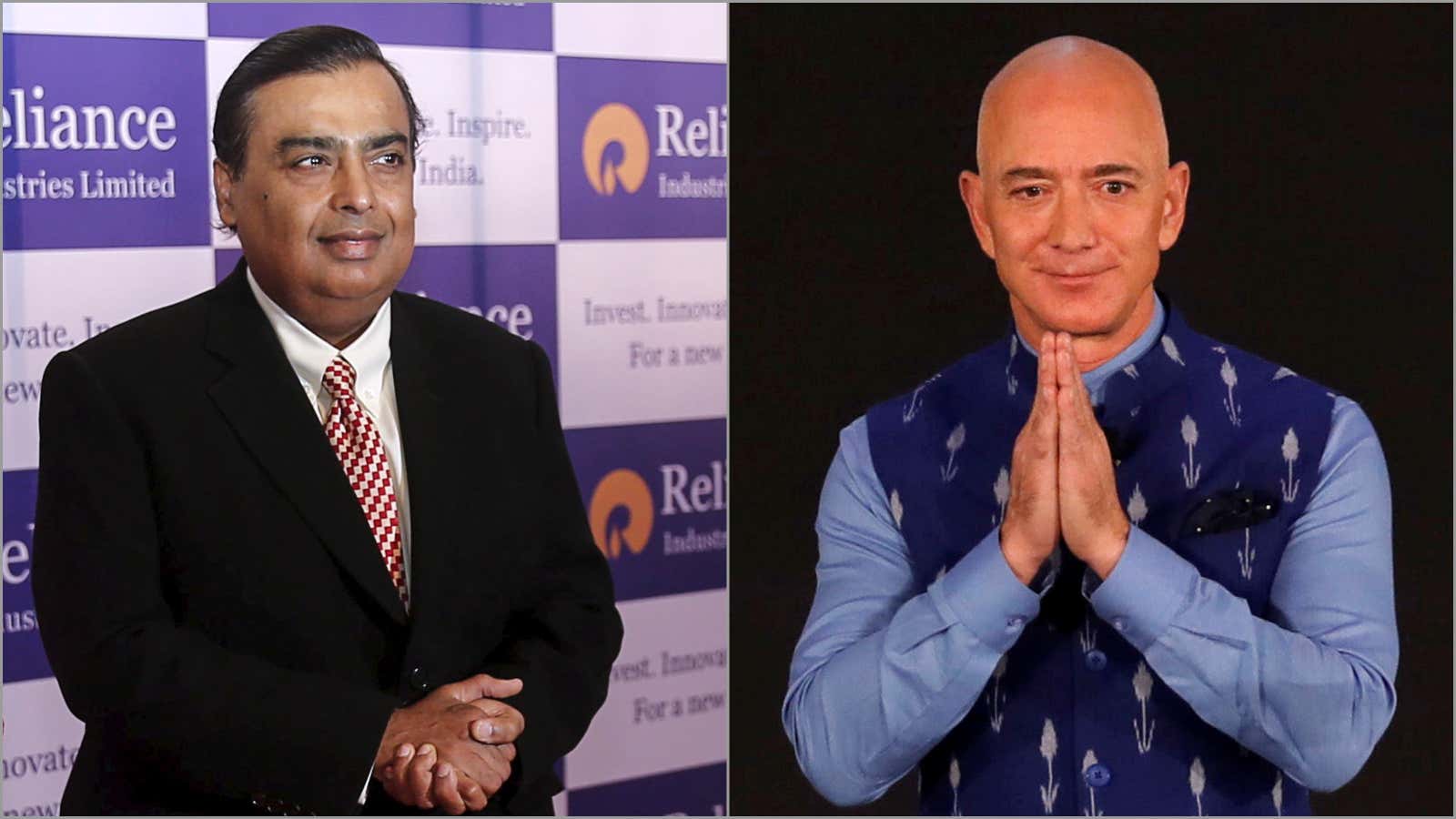

India’s retail industry has become a racetrack for two of the world’s wealthiest men—and one might well be close to the finish line.

On Aug. 29, Reliance Retail Ventures, owned by Asia’s richest man Mukesh Ambani, said it will acquire the retail, wholesale, logistics, and warehousing operations of India’s leading brick-and-mortar retailer Future Group for Rs24,713 crore ($3.4 billion). The deal gives Reliance Retail access to around 1,800 stores of Future Group’s popular brands Big Bazaar, FBB, EasyDay, Central, and Foodhall.

With this deal, Ambani has taken a giant leap in the retail sector, leaving behind all domestic and international rivals, including Amazon, led by the world’s richest man Jeff Bezos.

“Reliance was already much ahead of the competition. This deal has just further strengthened its position in the industry,” said Arvind Singhal, chairman at retail management consultancy firm Technopak Advisors.

Reliance’s retail universe

Reliance Retail, which started operations in 2006, was the country’s largest retailer by number of stores even before the recent deal with Future Group.

The company operates more than 10,000 stores across categories like standalone stores, supermarkets, wholesale cash-and-carry outlets, and speciality stores, across various segments. It also has several e-commerce portals.

In the year ended March 2019, Reliance Retail reported a turnover of Rs1.3 lakh crore.

In recent months, the Reliance group has been actively working to increase its presence in the e-commerce space, too.

In November 2019, the group launched JioMart, an online selling channel for Reliance Retail’s grocery outlets. JioMart was launched with a WhatsApp order-booking service where customers could place orders via the instant messaging app. This gave JioMart the potential to tap into WhatsApp’s massive user base of over 400 million Indians.

More recently, Reliance Industries bought a 15% stake in online lingerie retailer Zivame and paid Rs620 crore for a majority stake in online pharmacy Netmeds. The company is reportedly also in talks to buy stakes in other online retailers such as furniture seller Urban Ladder and grocery delivery app Milkbasket.

While Ambani has been trying to go online, Bezos’ Amazon has been trying to tap offline opportunities.

Amazon in India

India’s retail market is estimated to touch $1.3 trillion by 2025 from $700 billion in 2019. This massive potential has drawn global retailers to the country.

Since its entry into India in 2013, Amazon has invested over $5 billion in its business here. Earlier this year it committed another $1 billion investment over the next five years.

Despite stiff competition from homegrown unicorn Flipkart (now owned by Walmart) and a host of vertical-focused e-commerce firms, Amazon has managed to establish itself as one of the largest players in the segment in India.

However, e-commerce is still a sliver of India’s overall retail. In 2019, online sales accounted for just 1.6% of India’s retail sector.

So, Amazon has been trying to tap into brick-and-mortar retail in India. In 2017, Amazon bought 5% of ownership in department store chain Shoppers Stop for Rs179.25 crore. And in 2018, Amazon invested in Aditya Birla Group’s food and grocery retail chain More.

In January, the Jeff Bezos-led company acquired a 49% stake in Future Coupons, the promoter entity of Future Retail. While Future Coupons’ business is limited to value-added payment solutions such as corporate gift cards, loyalty cards, and reward cards for corporate customers, the deal gave Amazon around a 3.6% share in Future Group.

These acquisitions have benefitted Amazon, but they aren’t enough.

Ambani’s retail focus

Some industry experts have already declared Ambani a winner.

“We cannot say the competition has intensified because for that we need players with similar strength or capability. Foreign retailers such as Amazon and Walmart have a limited reach due to the existing policy restrictions,” said Singhal. “Currently, it’s nothing but an open playing field for Reliance from which it’ll reap benefits.”

In January 2019, Bloomberg’s Andy Mukherjee summed up Ambani’s advantage when it comes to Indian regulations:

Ambani’s ability to influence policies in his home market shouldn’t be underestimated. Just as Reliance gets ready to push ahead, the Indian government has tweaked its e-commerce rules and made them more onerous for Amazon and Walmart-Flipkart. Until now, foreign retailers had found ways around a law that allows them to act only as pure marketplaces that don’t stock their own inventories or offer discounts. Now that the loopholes are being plugged starting next month, Ambani is pitching the idea that Indians’ shopping data should be stored locally.