It’s almost like the Covid-19 lockdown never happened for Flock, an office team communication software firm founded by Indian serial entrepreneur Bhavin Turakhia. During a time when most businesses across the world struggled to cope with shutdowns and lack of demand, Flock’s revenue grew 40% for three consecutive quarters, while it saw a 60% increase in the time users spent on the platform.

Flock mostly benefitted from the need for companies to work remotely during the coronavirus crisis, according to Gaurang Sinha, director of go-to-market strategy at Flock. And Flock is certainly not the only company that has benefitted from this trend.

A host of Indian software startups have had a field day amid the pandemic as their clients’ dependence on technology increased. These startups offer software to support functions such as payroll processing, computer-aided design, accounting, customer relationship management (CRM), management information systems (MIS), invoicing, human resource management, talent acquisition, content management, and geographic information systems (GIS). Using their tools helped companies carry out all these functions remotely.

Most of these software firms work with a “software as a service” (SaaS) model or a licensing and delivery arrangement where their software is used on a subscription basis. The Indian SaaS market is slated to grow to over $20 billion in 2022 from around $6 billion in 2019.

Given the recent trends, it would be no surprise if that estimate is overshot.

Despite coronavirus

Facilion, a Chennai-based internet-of-things (IoT) SaaS startup for property management, clocked as much business in four months during the pandemic as it did in the 12 months prior to the Covid-19 outbreak.

Another SaaS startup, Snapbizz, which provides billing software for goods and services tax (GST), has lately seen unprecedented interest from kirana stores looking to digitise, founder and CEO Prem Kumar told Quartz. Snapbizz, which announced some salary cuts earlier this year, has seen such good business growth that it has reinstated the original pay structure, and even started hiring, Kumar added.

The growth of software firms despite the pandemic has caught the attention of some of the biggest tech firms globally, who are now rushing to enter the market.

“Cash-rich companies are copying the hell out of existing products and moving forward with deploying them,” said Vivek Srinivasan, founder of Startup Squares, a platform that helps budding entrepreneurs grow their businesses.

For instance, India’s richest man Mukesh Ambani’s digital services company Jio Platforms released a copycat version of video-conferencing platform Zoom called JioMeet. After Microsoft Teams launched, Slack accused the Seattle-based behemoth of not just copying its product but also lifting its ads. Google created a rival for the work-tracking tool Airtable.

“Facebook has copied so many apps and incorporated them into Facebook that they have to launch a different app called Campus for students,” Srinivasan said. Campus, launched in September, is not yet available in India.

Even as most SaaS businesses in India thrive, there are challenges that the entire startup ecosystem is facing that these companies cannot escape either.

Funding SaaS startups

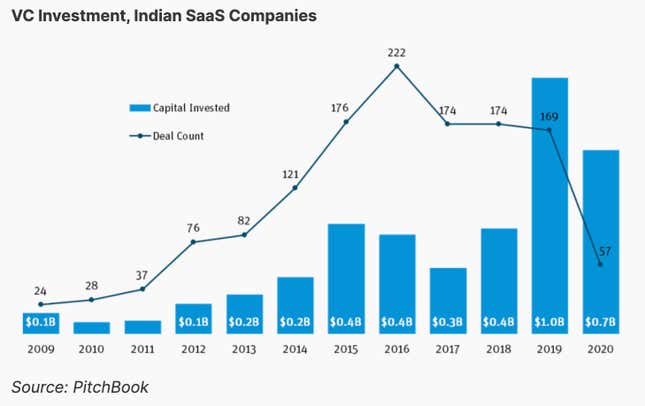

SaaS funding in India crossed $1 billion for the first time in 2019. But this year, investment activity has been stifled due to the coronavirus-related slump. Many investors, for instance, are choosing to put money to help their existing portfolio to tide over the slowdown, rather than backing new firms, several experts told Quartz.

“There were many companies whose expansion plans got stunted as the funding for the successive round were put on hold as a precautionary measure by the investment firms,” said N Shivakumar, managing director at startup consultancy ResourceTree.

But not all hope is lost. In June, San-Francisco and Bengaluru based software startup Postman became a unicorn after raising $150 million. And in September and October, a host of Indian software startups have secured funding:

Experts advise that software startup should consider bootstrapping through this tough year, and rely on their savings and revenue. Startups should also consider “cutting costs—this may include a hiring freeze—and selling company assets or streamlining expenses,” said RS Maan, global chief revenue officer at New Delhi-based IT consulting company Codleo.

Firms could also request credit periods from vendors while reaching out to existing investors or family for support, said Prasad Sreeram, founder and CEO of intra-city logistics platform COGOS.

Then there are ways in which newer startups without an existing rooster of investors can make themselves more attractive.

“They can potentially go the angel investment route, make their offer better in terms of valuation they are asking for and the percentage of equity they are willing to dilute and let the investors own,” said Yugal Joshi, vice president of consultancy Everest Group. “They should also rework their pitch decks to layer in a colour of the pandemic and how it has not meaningfully impacted their business. If it has, they need to admit and be transparent to the investors and use that as an argument for revaluation.”

Fundraising is just one piece of the startup puzzle. The next question is, will investors get the chance to make lucrative exits?

Of mergers, acquisitions, and IPOs

Merging with a larger company should be an option that SaaS startups must explore right now when more funding is hard to come by, and existing investors may be looking at an exit strategy.

Take the case of the three-way merger of Indian hotel technology firms Repup, Hotelogix, and Axisroom in August. Hotelogix is a property management system specialist, AxisRooms is a distribution company, and RepUp handles guest experience. Together, the three can offer hotels a full-stack service.

The other option for raising funds could be an initial public offering (IPOs).

Last year was not a stellar year for IPOs in India as deal numbers and sizes shrunk significantly from a year ago. But a January 2020 survey by the Reserve Bank of India was optimistic that nearly six in 10 Indian startups were eyeing an IPO in the next five years. But Covid may have changed things.

“IPO activity slowed down amidst the pandemic. Companies with plans to go for IPOs are likely to adopt a wait and watch policy,” said Aurojyoti Bose, lead analyst at GlobalData.

In addition, several Indian startups consider IPOs cumbersome given their extensive paperwork and compliance requirements. And managing a company under the public gaze is no easy feat.