The Covid-19 pandemic has given a booster shot to digital transactions in India, but cash is still king.

After breaching the 2-billion mark for the first time ever, the number of transactions on India’s partly state-owned digital payment platform Unified Payment Interface (UPI) stood at 2.2 billion in October. Despite this rise in digital payments, Indians are also holding cash at record levels, according to the data released by the Reserve Bank of India (RBI). “With a nationwide lockdown and people mostly remaining indoors, amidst fear and uncertainty, the usage of cash witnessed an abnormal rise,” the RBI said in its annual report (pdf), released on Aug. 25.

This contradicting trend has also emerged because Indians still prefer making day-to-day low-value transactions in cash, “however, there has been a gradual shift towards electronic payments in recent times though, supported by government’s push for digital payment, rising merchant acceptance and increasing consumer awareness,” said Ravi Sharma, project manager at data analytics firm GlobalData.

UPI transactions continue to grow

The central bank monitored UPI platform, with its ease of transaction, has been one of the biggest factors contributing to the spurt in digital transactions in India.

“In the past couple of years, we have seen a sharp rise in mobile payments; within that, UPI payments have far exceeded payments using wallet mode,” said Deepali Seth Chhabria, an analyst at S&P Global Ratings.

The number of mobile money accounts in India rose from 73 per 1,000 adults in 2015 to 1,265 in 2019, according to the International Monetary Fund’s (IMF) financial access survey.

The strong growth in customer base has been supported by intense competition among domestic and international players. As of now, there are around 200 live members (banks and fintech firms) on the UPI platform. India’s digital payment space currently is dominated by big global names such as Google, Walmart (through PhonePe), and Amazon. The latest entrant into the sector is Facebook, which launched UPI-based payments on WhatsApp last month.

While intense competition is beneficial for customers, it doesn’t bode well for fintech firms. Experts believe digital payment companies need to diversify if they want to survive. “They will have to enter into thick margin businesses like lending and insurance. Digital payments alone won’t be enough. It hasn’t worked for even bigger players like Paytm. The web of other services is essential from the revenue point of view,” said Arnav Gupta, analyst at Forrester Research.

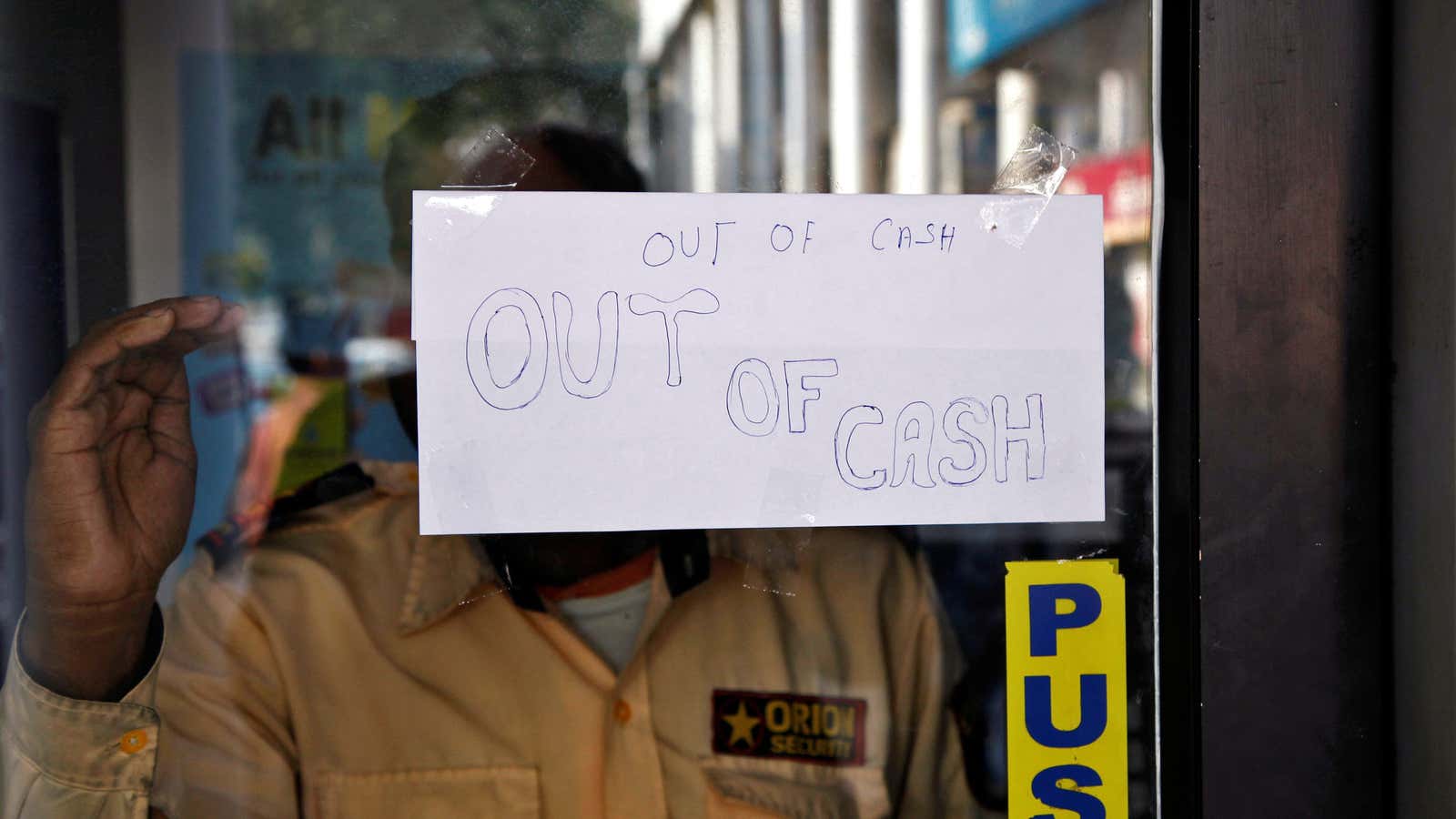

But despite all its success, digital payments haven’t yet managed to displace the use of cash.

Cash in circulation rises

Throughout the pandemic, usage of cash was on the rise.

As of November 2020, Indians held Rs26.74 lakh crore ($356 billion) in physical cash. That’s the highest this number has ever been.

This trend raises serious questions over the Narendra Modi government’s 2016 decision to demonetise Rs500 and Rs1,000 notes. One of the reasons, which the government had cited at the time for the purging of old notes, was to nudge people towards digital payments.

But after the initial euphoria, cash is once again emerging as king. In fact, in August itself, the currency circulation was at pre-demonetisation levels. “In the case of India, cash is still a highly preferred mode of payment, as demonstrated by the relatively higher proportion of currency in circulation as a percentage of GDP. Currency in circulation as a percentage of GDP is higher in India than some other Asian peers, such as China, Indonesia, and Korea, although it is lower than places like Hong Kong and Japan,” said Chhabria. In fact, even in developed countries, where technology adoption is much higher than in India, cash is still very much a part of day-to-day transactions.