At a time when gold prices are losing their sheen, a popular Indian jeweller is hoping for a glittering debut on the stock markets.

Kalyan Jewellers, a jewellery store chain, will launch its initial public offering (IPO) tomorrow (March 16) as it hopes to raise Rs1,175 crore ($169 million) for “working capital requirement and general corporate purpose.”

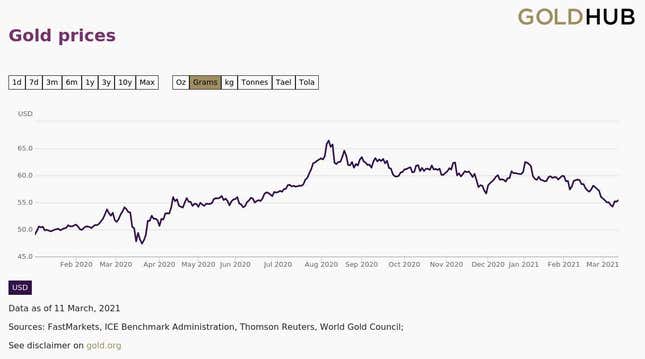

The jeweller—with 107 showrooms across 21 states—gets around 75% of its revenue from gold jewellery sales. Any weakness in gold prices would obviously dent Kalyan Jewellers’ sales. Yet, the company is hitting the stock market at a time when gold prices have fallen nearly 20% from their all-time highs in August 2020.

But experts believe there are reasons why investors will choose to ignore the current weakness in gold prices and welcome the IPO.

Gold prices in India

Gold prices in India shot up by over 30% between January and August 2020 as the Covid-19 pandemic caused economic uncertainty and investors moved their money to the yellow metal, which is considered a relatively safer asset.

However, the optimism over the vaccination drive and subsequent economic revival coupled with the spike in US treasury yields have now sent gold prices on a downward spiral.

Most experts view the recent softness in prices as a temporary blip. After all, India is the second-largest consumer of gold in the world and that is unlikely to change in the immediate future.

A combination of factors including a rebound in gold consumption, rise in inflation, volatility in stock and bond markets (alternative to gold as an asset) and fragile economic recovery are likely to push prices of gold up again. The wedding season in 2020 was subdued because of Covid-19 but is expected to hit the full gear in the second half of 2021, which will lead to a revival in the consumption of gold.

At the same time, a rise in inflation due to soaring oil prices, availability of cheap capital, and slow economic recovery are driving investors towards gold.

“Post the recent correction, we are positive on gold on relative valuation with equities and uncertainties seen in the debt market. We believe, due to the ultra-loose monetary policy of global central banks, an uptick in inflation is likely due to the firming up of commodity prices,” said Chintan Haria, head of product development and strategy at ICICI Prudential Asset Management Company.

India’s IPO Mania

Besides the possibility of a rebound in gold prices, what works in favour of Kalyan Jewellers is the euphoric market sentiment. With investors pouring money into the stock markets, a slew of companies has launched their IPOs in recent months.

Funds raised through IPOs between January and March this year have been the highest since the corresponding weeks in 2008, according to London-based financial market data provider Refinitiv.

In midst of this euphoria, the jewellery retail chain’s IPO offer price of Rs86-87 per share translates to a premium of 84.23 times the price-to-equity ratio. It means for every Rs1 of profit, investors are willing to pay a whopping Rs84.