The past year turned out to be quite constructive for Indian equity. Markets made fresh lifetime highs on the back of improving domestic macros indicators, supportive global equity and expected governance improvement in India after the general elections. The benchmark index, the Sensex, crossed 21,200, a level it had not seen in almost six years. Foreign institutional investors reaffirmed their commitment toward Indian equities with more than $20 billion invested in 2013.

This is our new reality: 2014 will bring a new bull cycle into existence. A strong export sector, revival in investment activity, continued recovery in the US, and a stable euro area are significant positives for equity markets.

Despite the many negatives plaguing the economy, corrective measures by the new government can quickly revive growth. The potential growth rate of the economy is currently around 6%. The growth rebound to those levels can take place quickly by reviving the investment demand. Once that has been achieved, the more arduous path of reclaiming the 8% growth can start.

Macro-economic revival in India will open opportunities to make strong returns in the equity markets in the next few years. The agricultural and services sectors continue to show strong traction and gradually even the manufacturing sector should pick-up as consumer demand revives. A real GDP growth of 6% along with inflation of around 7% should lead to a nominal GDP growth of 13%. Sensex earnings growth has improved from 5% in fiscal year 2013 to about 10% in fiscal year 2014 on the back of the rupee’s depreciation.

If the infrastructure cycle revives quickly, the earnings growth revival can even reach 25% on a compounded basis. A multiple re-rating, or review of valuations by investors, is also possible as cost of equity goes down in the next few years. An earnings growth between 20-25% and multiple re-rating from 15 times to 16-17 times in the next few years can lead to a 25% compounding of Sensex returns, which will take it to 100,000 levels by calendar year 2020.

This won’t be unprecedented

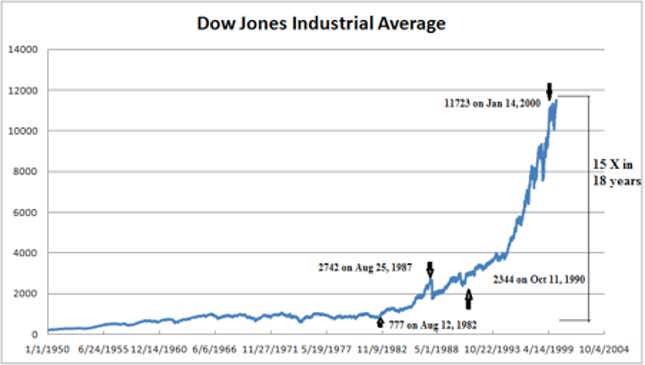

There have been several instances in the past with 20-25% compounding for long periods in other global markets. The Dow Jones Industrial Average experienced its most spectacular rise in history in 1980s. From a meager 777 on August 12, 1982, the index grew more than 1,500% to close at 11,722.98 by January 14, 2000.

The Dow moved from 769 in 1982 to 2,742 in 1987 (3.6 times in a span of 5 years.) This was followed by a very sharp correction in 1987. After a period of consolidation, the rally started again in 1990 from 2,344 all the way to 11,750 in 2000 (five times in a span of 10 years). This period of high returns in the US economy was achieved as the economy revived from a period of stagflation in the 1970s resulting in aggressive monetary tightening by US Federal Reserve chairman Paul Volcker, which broke the back of inflation. It took until 1982 before a new economic recovery was born.

The economic recovery of the 1980s commenced without the industry leaders of the 1970s: agriculture, energy, and mining companies. All of them were still reeling under massive balance sheet defaults. The 1980s recovery in the US also transpired amid a global financial crisis. Notably, the US economy did not grow particularly quickly in the 1980s, but the expansion lasted quite a long time by historical standards. An economic expansion that is prolonged helps consumers and companies heal slowly without stoking inflation and leads to more sustainable wealth creation.

In India too, we are not predicting a very quick economic recovery. The recovery shall be slow and steady with the Reserve Bank of India under Raghuram Rajan keeping a hawk’s eye on inflation, not allowing the economy to overheat. The challenge for the new government is to quickly revive the investment cycle. Big infrastructure projects need to be provided quick access to capital, speedy environmental and forest clearances, and policy support.

We expect that the new government will identify some large infrastructure projects and a concerted push will be given to drive them to completion. The dedicated freight corridor between Mumbai and Delhi is one such project. Quick execution of such projects will provide massive employment, provide quick transportation for goods, lead to productivity gains, and have large trickle-down effects on the adjoining towns and villages leading to revival in consumption demand.

The income and productivity of a large number of Indians will increase and infrastructure generation leads to massive employment opportunities, high efficiency leading to salary gains and higher purchasing power.

The other thing which can lead to an increase in GDP growth is making India a big player in the manufacturing space. The recent rupee depreciation can make Indian manufacturing competitive globally. With clever resource allocation, India can become a global manufacturing hub in sectors such as automobiles and auto components, pharmaceutical, textiles, gems & jewellery, leather goods, IT hardware, and solar power. The special economic zones (SEZ) policy was launched with this very intention. However, policy muddles and land acquisition issues brought this to a complete halt.

There are expectations that under the new government, SEZ policy will be revived and several incentives will be given to the industry to expand in these sectors. A land acquisition bill has already been passed by Lok Sabha. Labour laws also need a complete overhaul so that producers are encouraged to hire more employees. Once labour and land issues are streamlined and cheap finance is available to industry, Indian manufacturing will blossom and will lay the foundation of a virtuous cycle of productivity gains, high salaries, and high growth.

Thus, there is no reason that India can’t see a prolonged economic growth cycle with low inflation. The prolonged economic growth can create similar equity market returns in India as seen in US in the 1980s.